Banking blockchain: technology value analysis for investment banks

- Transfer

In the context of a constant race to increase profitability, innovations like Blockchain can be a lifeline for investment banks.

Like many other new technologies, Blockchain was greeted by the general public with enthusiasm. Some analysts already give a positive assessment of the increase in efficiency, saving billions of dollars and a significant reduction in risks in the field of Internet technologies that have resulted from the use of technology. Nevertheless, it is impossible not to note the excessive rush that has arisen around such projects.

In this regard, the question arises: “What are the real advantages, savings and business applications does Blockchain offer?”

To answer this question, we have combined our efforts with one of the leading analytical companies in the benchmarking market McLagan, which is part of Aon plc Corporation (a major international provider of risk management, insurance, investment banking), to conduct in-depth analysis and actual assessment of the reduction potential costs and other benefits that can be achieved as a result of technology implementation.

Blockchain, as it is often collectively called all technologies of distributed registries, is a new type of database organization system, allowing a wide group of participants to obtain almost simultaneous sharing of common data, with an unprecedented level of confidentiality.

Today reconciliation and reconciliation of data (reconciliation) is at the core of most business models. However, due to the fact that each company independently maintains the relevance of data in its systems, many processes are slow and inefficient due to the need for continuous two-way data exchange between various parties to solve various tasks. The blockchain can replace multiple and consistent data consistency models by proposing a more efficient and holistic approach, in which reconciliation becomes an integral part of the overall transaction processing process.

Banks are facing a new perspective on transferring the main operating and financial systems, as well as risk assessment systems to the new data processing platform based on Blockchain.

This will allow them to seriously simplify the processes, abandoning a large number of existing processes and elements of the information infrastructure. However, even though such outcomes will take time and will require careful study, the prospects for a significant reduction in costs and efficiency will continue to fuel interest in technology and its financing.

Despite the fact that today some predictions about the potential of the Blockchain are already available to the general public, we believe that the leaders of the capital market need a more detailed analysis of the prospects for implementing the technology to make decisions on their own blockchain cases. Such assessments are especially important for top managers of companies who need to timely assess the potential of emerging technologies on the market and decide on the need to implement them. As a rule, such decisions should take into account both the features of the systems of the previous generation and the requirements of the regulatory bodies. In addition, management should be able to convince all interested parties of the correctness of their choice. How to determine that a bet on the blockchain will provide a competitive advantage, and the end result will not disappoint shareholders?

In order to get a complete picture of how Blockchain can affect the operational activities of banks, our company, together with McLagan, conducted a study. World-class capital markets analyst provider McLagan annually conducts a comprehensive financial assessment of the largest banks. The company uses detailed expenditure data obtained directly from the general books of the participating banks.

In our study, McLagan used the cumulative data on operating expenses of the 8 largest (by income level) investment banks in the world. The information provided was analyzed using the Accenture High Performance Investment Bank proprietary model. This allowed us to gain an understanding of which indicators and operational metrics of investment banks can experience the greatest impact of technology.

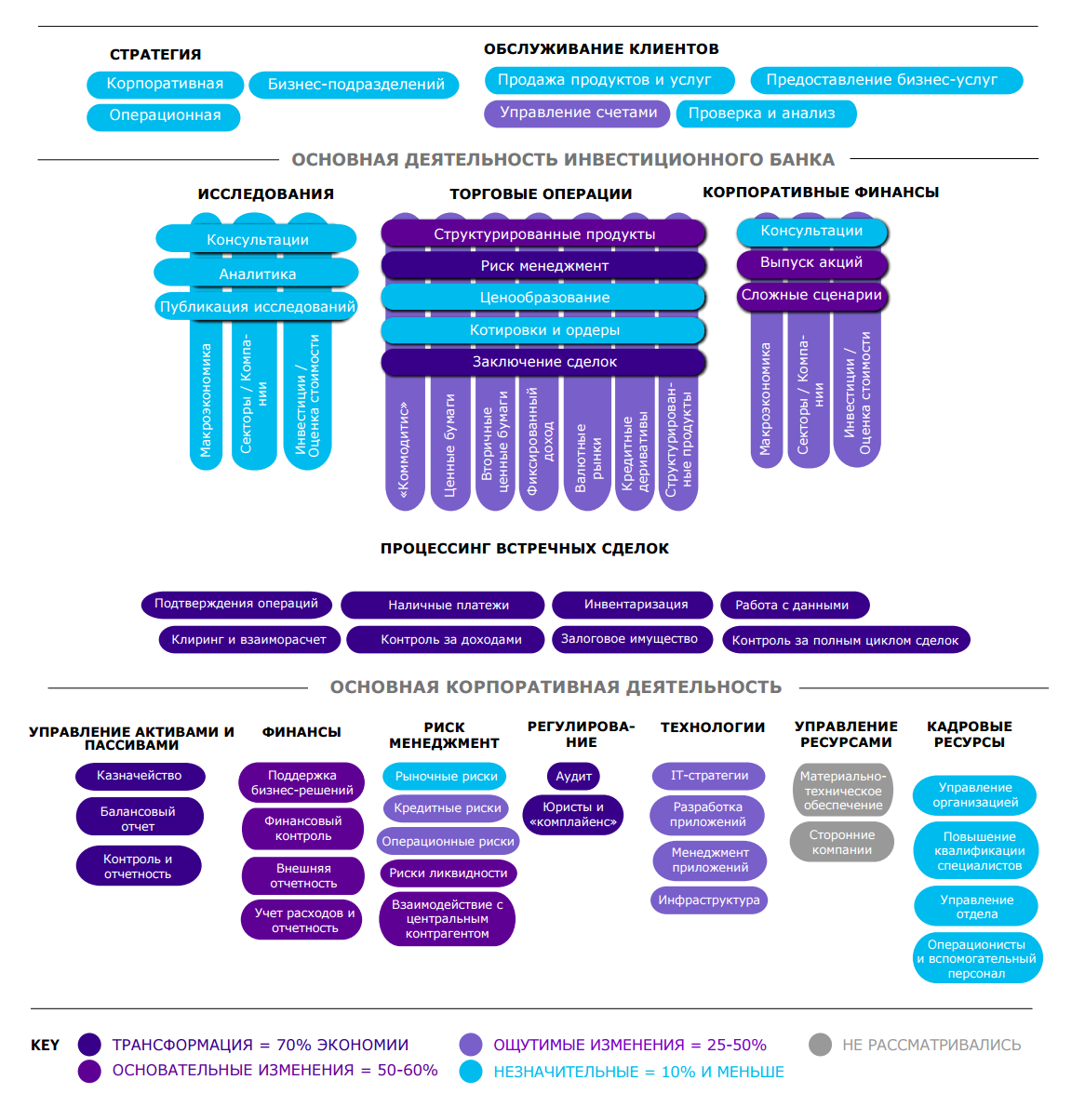

Diagram 1. Assessment of the impact of the Blockchain on the activities of investment banks (based on analysis using the Accenture High Performance Investment Bank corporate model):

Analysis of more than 50 operating cost metrics provided by McLagan using our High Performance Investment Bank model allowed us to identify clear indicators. As a brief description of our model, below we give 4 examples of indicators of the Blockchain impact on operational efficiency.

The results show that in the current cost structure, the study participants could save $ 8 billion, while the current total spending figure of $ 30 billion. This estimate does not include potential costs and investments to implement Blockchain. In other words, the total savings for all 8 banks could be 27 percent.

As reference points for our research, we used a set of conservative criteria, including the following assumptions:

At this stage, these assumptions are quite conservative. According to the initial estimates, a whole group of expenditure items experienced the “solid” influence of technology, that is, the savings on them amounted to about 50%, and this fact is reflected in the infographic. In fact, our early cases, experimental concepts and tests indicate that there are prerequisites for a further increase in savings in these articles to more than 70%, as a result of which they could go over the category of "transformation". In light of this, the annual cost savings could potentially amount to 38% of the total, or about $ 12 billion. Taking the average of this value and the previously found $ 8 billion, we get the annual savings of $ 10 billion.

It is important to note that in case of serious problems or obstacles on the part of the regulator, which impede the widespread use of Blockchain, this savings may not be achieved.

Not surprisingly, given the projected substantial savings, the practice of financing Blockchain projects in the financial services sector is gaining momentum. This is especially true now, when raising capital is becoming more and more difficult, and traditional methods of increasing profitability are becoming less and less effective. Projectedmade in September 2015 by the independent research organization Aite Group, which specializes in analytics in the field of financial services, it was assumed that capital market players would spend about $ 125 million on Blockchain in 2016. Only nine months later, an independent industry research firm Greenwich Associates doubled this amount more than 2 times in its research , predicting a total investment of approximately $ 280 million. This indicates not only the growth of investment in Blockchain from industry representatives, but also that it becomes impossible to estimate this growth even approximately due to the constant increase in its rates.

Individual blockchain elements, such as cryptographic hashes, distributed databases, and consensus building, are not new in themselves. However, their combination creates a very effective new form of data transfer and assets that can eliminate the need for intermediaries, third-party central bodies and expensive reconciliation processes.

After the global financial crisis of 2008, the capital markets industry faced an unprecedented avalanche of income-eating problems, largely due to stricter regulatory requirements, rising liquidity costs and the need for capital allocation, as well as declining revenues.

According to our calculations, investment banks spend about two thirds of their IT budgets to support old infrastructure, investing additional billions of dollars in cost-cutting projects each year.

In other words, banks invest too much time, effort, liquidity and capital in support of processes that do not offer a significant increase in the profitability of the organization. As a result, banks, central banks, stock exchanges and clearing organizations are making every effort to study as soon as possible the possibilities of Blockchain as an instrument of influencing the fundamental indicators of expenditures, allowing them to return to profit indicators sufficient to increase the level of capital profitability.

However, it should be clarified and emphasized that we do not consider Blockchain to be a panacea that can cure all investment banking illnesses. In many cases, structures based on traditional databases or processes can show similar results without the need to finance the development of blockchain solutions and overcome the difficulties associated with it. Examples include such areas as internal automation, downsizing, outsourcing, and offshoring.

Nevertheless, there are visual evidence that the Blockchain is able to radically reduce, if not completely eliminate, many existing clearing and reciprocal processes.

The technology can seriously affect the procedures for confirming transactions, reconciliation, cash management, optimization of assets and other business processes costing companies billions of dollars a year.

The technology creates the prerequisites for optimizing the settlement procedures, allowing to significantly reduce or completely eliminate the time intervals adopted in the industry, while fully supporting the activities of market makers.

Ultimately, the Blockchain can make it possible to abandon a large number of elements of a modern operating infrastructure, qualitatively improving key processes and having a serious impact on the dynamics of costs.

The enthusiasm expressed by the financial services companies, especially among the capital market players, about Blockchain is undoubtedly well-founded. Of course, we do not think that technology will be able to completely eliminate intermediaries or replace the current ecosystem. And at the same time, we are convinced that its influence truly transforms the entire market.

Blockchain is often compared to the Internet. The perception of new Internet technologies has allowed companies to create completely new products and business models, and the fruits of these works did not disappoint all participants in the development of a new market. Of course, many models were ultimately insolvent and caused considerable losses. In a similar way, the Blockchain challenges the players in the financial sector, inviting them to seriously reconsider the processes of working with data. It is no longer possible to reverse this process: the new technology encourages investment banks to rethink business models, operational processes and assess profit margins in both the short and long term. Nevertheless, managers should remain vigilant and strive to minimize risks by carefully controlling the process of implementing Blockchain solutions.

However, in order for expectations to become a reality, investment banks should take a fresh look at strategies, approaches to optimizing the workforce, requirements for data centers, data storage, networking and security. As in the case of the Internet, the pioneers will not only have the greatest advantage in terms of cost optimization, but also access to completely new revenue channels and, in general, more than others will experience all the advantages of Blockchain. After studying past experience, investment banks have already developed certain strategies for new technologies. As a rule, they include the opening of internal laboratories, participation in industry consortia and financing of firms that have invested all their resources in working with Blockchain, as well as the creation of joint ventures with them.

Companies have an attractive prospect, attracting a lot of attention, innovation and investment. Are they ready to "catch the moment"?

The application of the Blockchain technology with maximum benefit begins with the development of an action plan to answer the following questions:

What is your strategy for phasing out your business to the next level? What combination of innovations will be the main tool for change? Where do you find more value for yourself?

How are your multi-year investment plans combined with available technologies, opportunities and market offers and take into account the continuous development of the situation? Is your investment thinking limited to current opportunities, or is your gaze focused on the future in search of new solutions?

Do you choose industry, regulatory and intersectoral innovation forums as sources of information that allow your company to remain an active player, notice the emergence of new technologies in time and use them for your own purposes?

Have you been studying what human and technological resources are required to support systems based on distributed registry technology?

The results of our research suggest that Blockchain technology can help significantly improve the performance of your organization.

Investment banks wishing to get the most out of the Blockchain application first need to convert many elements of the current system. However, some industry leaders have already managed to demonstrate certain technology capabilities.

A methodical and consistent approach, combined with a clear vision, will allow you to get an efficient, safe and economical operating model, which in the long run will significantly increase profitability, savings and gain a competitive advantage.

Like many other new technologies, Blockchain was greeted by the general public with enthusiasm. Some analysts already give a positive assessment of the increase in efficiency, saving billions of dollars and a significant reduction in risks in the field of Internet technologies that have resulted from the use of technology. Nevertheless, it is impossible not to note the excessive rush that has arisen around such projects.

In this regard, the question arises: “What are the real advantages, savings and business applications does Blockchain offer?”

To answer this question, we have combined our efforts with one of the leading analytical companies in the benchmarking market McLagan, which is part of Aon plc Corporation (a major international provider of risk management, insurance, investment banking), to conduct in-depth analysis and actual assessment of the reduction potential costs and other benefits that can be achieved as a result of technology implementation.

Causes of hype around Blockchain

Blockchain, as it is often collectively called all technologies of distributed registries, is a new type of database organization system, allowing a wide group of participants to obtain almost simultaneous sharing of common data, with an unprecedented level of confidentiality.

Today reconciliation and reconciliation of data (reconciliation) is at the core of most business models. However, due to the fact that each company independently maintains the relevance of data in its systems, many processes are slow and inefficient due to the need for continuous two-way data exchange between various parties to solve various tasks. The blockchain can replace multiple and consistent data consistency models by proposing a more efficient and holistic approach, in which reconciliation becomes an integral part of the overall transaction processing process.

Opportunities

Banks are facing a new perspective on transferring the main operating and financial systems, as well as risk assessment systems to the new data processing platform based on Blockchain.

This will allow them to seriously simplify the processes, abandoning a large number of existing processes and elements of the information infrastructure. However, even though such outcomes will take time and will require careful study, the prospects for a significant reduction in costs and efficiency will continue to fuel interest in technology and its financing.

Despite the fact that today some predictions about the potential of the Blockchain are already available to the general public, we believe that the leaders of the capital market need a more detailed analysis of the prospects for implementing the technology to make decisions on their own blockchain cases. Such assessments are especially important for top managers of companies who need to timely assess the potential of emerging technologies on the market and decide on the need to implement them. As a rule, such decisions should take into account both the features of the systems of the previous generation and the requirements of the regulatory bodies. In addition, management should be able to convince all interested parties of the correctness of their choice. How to determine that a bet on the blockchain will provide a competitive advantage, and the end result will not disappoint shareholders?

Our study

In order to get a complete picture of how Blockchain can affect the operational activities of banks, our company, together with McLagan, conducted a study. World-class capital markets analyst provider McLagan annually conducts a comprehensive financial assessment of the largest banks. The company uses detailed expenditure data obtained directly from the general books of the participating banks.

In our study, McLagan used the cumulative data on operating expenses of the 8 largest (by income level) investment banks in the world. The information provided was analyzed using the Accenture High Performance Investment Bank proprietary model. This allowed us to gain an understanding of which indicators and operational metrics of investment banks can experience the greatest impact of technology.

Diagram 1. Assessment of the impact of the Blockchain on the activities of investment banks (based on analysis using the Accenture High Performance Investment Bank corporate model):

results

Analysis of more than 50 operating cost metrics provided by McLagan using our High Performance Investment Bank model allowed us to identify clear indicators. As a brief description of our model, below we give 4 examples of indicators of the Blockchain impact on operational efficiency.

- 70% potential cost reduction in key financial statements

As a result of optimized data quality, transparency and internal control. - 30-50% potential reduction in regulatory compliance costs

Both at the product level and in general, due to the increased transparency and ease of re-checking financial transactions. - 50% potential reduction in costs for centralized activities

Such as KYC and the design of new customers due to improved digital identification mechanisms and simplified sharing of customer data for all participants in the process. - 50% potential reduction of costs for business operations

The activities of specialists in support and control of transactions, clearing and mutual settlements, investigations can be fully or partially automated by reducing the need for such key elements today as reconciliation and confirmation of transactions and analysis of erroneous transactions.

How 8 banks could save more than 8 billion dollars

The results show that in the current cost structure, the study participants could save $ 8 billion, while the current total spending figure of $ 30 billion. This estimate does not include potential costs and investments to implement Blockchain. In other words, the total savings for all 8 banks could be 27 percent.

Criteria

As reference points for our research, we used a set of conservative criteria, including the following assumptions:

- The network effect will manifest itself in developed markets only by 2025.

- Regulatory authorities will allow the practical implementation of blockchain solutions and the abandonment of the infrastructure of the previous generation. After the 2008 credit crunch, regulators are unlikely to want to significantly reduce the role of a relatively new and enhanced clearing infrastructure (automated clearing house, real-time gross settlement systems, single clearing counterparties, central depositories) without being absolutely sure that blockchain networks are safe , a protected and sustainable alternative.

- The study does not take into account the impact of costs on the maintenance of buildings and structures.

- The study takes into account the differences between fixed and variable costs.

At this stage, these assumptions are quite conservative. According to the initial estimates, a whole group of expenditure items experienced the “solid” influence of technology, that is, the savings on them amounted to about 50%, and this fact is reflected in the infographic. In fact, our early cases, experimental concepts and tests indicate that there are prerequisites for a further increase in savings in these articles to more than 70%, as a result of which they could go over the category of "transformation". In light of this, the annual cost savings could potentially amount to 38% of the total, or about $ 12 billion. Taking the average of this value and the previously found $ 8 billion, we get the annual savings of $ 10 billion.

It is important to note that in case of serious problems or obstacles on the part of the regulator, which impede the widespread use of Blockchain, this savings may not be achieved.

Not surprisingly, given the projected substantial savings, the practice of financing Blockchain projects in the financial services sector is gaining momentum. This is especially true now, when raising capital is becoming more and more difficult, and traditional methods of increasing profitability are becoming less and less effective. Projectedmade in September 2015 by the independent research organization Aite Group, which specializes in analytics in the field of financial services, it was assumed that capital market players would spend about $ 125 million on Blockchain in 2016. Only nine months later, an independent industry research firm Greenwich Associates doubled this amount more than 2 times in its research , predicting a total investment of approximately $ 280 million. This indicates not only the growth of investment in Blockchain from industry representatives, but also that it becomes impossible to estimate this growth even approximately due to the constant increase in its rates.

- 280 million dollars

The amount that capital market players spent on Blockchain, twice the calculations of experts. - 30%

Potential annual average savings

Conclusions and assessments

Individual blockchain elements, such as cryptographic hashes, distributed databases, and consensus building, are not new in themselves. However, their combination creates a very effective new form of data transfer and assets that can eliminate the need for intermediaries, third-party central bodies and expensive reconciliation processes.

After the global financial crisis of 2008, the capital markets industry faced an unprecedented avalanche of income-eating problems, largely due to stricter regulatory requirements, rising liquidity costs and the need for capital allocation, as well as declining revenues.

According to our calculations, investment banks spend about two thirds of their IT budgets to support old infrastructure, investing additional billions of dollars in cost-cutting projects each year.

In other words, banks invest too much time, effort, liquidity and capital in support of processes that do not offer a significant increase in the profitability of the organization. As a result, banks, central banks, stock exchanges and clearing organizations are making every effort to study as soon as possible the possibilities of Blockchain as an instrument of influencing the fundamental indicators of expenditures, allowing them to return to profit indicators sufficient to increase the level of capital profitability.

However, it should be clarified and emphasized that we do not consider Blockchain to be a panacea that can cure all investment banking illnesses. In many cases, structures based on traditional databases or processes can show similar results without the need to finance the development of blockchain solutions and overcome the difficulties associated with it. Examples include such areas as internal automation, downsizing, outsourcing, and offshoring.

Nevertheless, there are visual evidence that the Blockchain is able to radically reduce, if not completely eliminate, many existing clearing and reciprocal processes.

Saving billions of dollars a year

The technology can seriously affect the procedures for confirming transactions, reconciliation, cash management, optimization of assets and other business processes costing companies billions of dollars a year.

Shorter time frame

The technology creates the prerequisites for optimizing the settlement procedures, allowing to significantly reduce or completely eliminate the time intervals adopted in the industry, while fully supporting the activities of market makers.

Impact on spending dynamics

Ultimately, the Blockchain can make it possible to abandon a large number of elements of a modern operating infrastructure, qualitatively improving key processes and having a serious impact on the dynamics of costs.

Blockchain-gin has already flown out of the bottle

The enthusiasm expressed by the financial services companies, especially among the capital market players, about Blockchain is undoubtedly well-founded. Of course, we do not think that technology will be able to completely eliminate intermediaries or replace the current ecosystem. And at the same time, we are convinced that its influence truly transforms the entire market.

Blockchain is often compared to the Internet. The perception of new Internet technologies has allowed companies to create completely new products and business models, and the fruits of these works did not disappoint all participants in the development of a new market. Of course, many models were ultimately insolvent and caused considerable losses. In a similar way, the Blockchain challenges the players in the financial sector, inviting them to seriously reconsider the processes of working with data. It is no longer possible to reverse this process: the new technology encourages investment banks to rethink business models, operational processes and assess profit margins in both the short and long term. Nevertheless, managers should remain vigilant and strive to minimize risks by carefully controlling the process of implementing Blockchain solutions.

However, in order for expectations to become a reality, investment banks should take a fresh look at strategies, approaches to optimizing the workforce, requirements for data centers, data storage, networking and security. As in the case of the Internet, the pioneers will not only have the greatest advantage in terms of cost optimization, but also access to completely new revenue channels and, in general, more than others will experience all the advantages of Blockchain. After studying past experience, investment banks have already developed certain strategies for new technologies. As a rule, they include the opening of internal laboratories, participation in industry consortia and financing of firms that have invested all their resources in working with Blockchain, as well as the creation of joint ventures with them.

Companies have an attractive prospect, attracting a lot of attention, innovation and investment. Are they ready to "catch the moment"?

Next steps: developing an action plan

The application of the Blockchain technology with maximum benefit begins with the development of an action plan to answer the following questions:

Strategy adjustment

What is your strategy for phasing out your business to the next level? What combination of innovations will be the main tool for change? Where do you find more value for yourself?

Adjustment of investment plans

How are your multi-year investment plans combined with available technologies, opportunities and market offers and take into account the continuous development of the situation? Is your investment thinking limited to current opportunities, or is your gaze focused on the future in search of new solutions?

Knowledge

Do you choose industry, regulatory and intersectoral innovation forums as sources of information that allow your company to remain an active player, notice the emergence of new technologies in time and use them for your own purposes?

Study of

Have you been studying what human and technological resources are required to support systems based on distributed registry technology?

Are you ready to experience all the benefits of Blockchain?

The results of our research suggest that Blockchain technology can help significantly improve the performance of your organization.

Investment banks wishing to get the most out of the Blockchain application first need to convert many elements of the current system. However, some industry leaders have already managed to demonstrate certain technology capabilities.

A methodical and consistent approach, combined with a clear vision, will allow you to get an efficient, safe and economical operating model, which in the long run will significantly increase profitability, savings and gain a competitive advantage.