In 2016, Tesla plans to sell more electricity storage devices than the entire volume of this US market in 2015

In accordance with loud promises of data at the beginning of last year ( one , two ), by the end of the year, in addition to the sale of electric vehicles, Tesla began supplying stationary electric energy storage systems based on lithium batteries: Tesla Powerwall for residential use by private customers and Tesla Powerpack for commercial and industrial use .

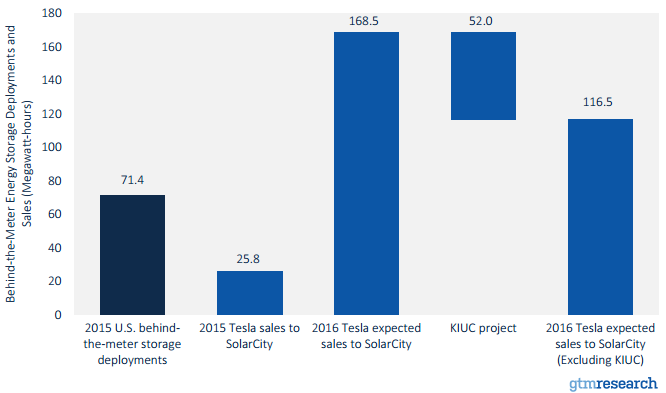

Apparently, the start of sales went very well, at least at the recently held board of directors and in the reports submitted by the company to the US Securities Commission (SEC) it was predicted that sales in the direction of stationary energy storage in 2016 will increase by almost 10 times relative to 2015. In financial terms, this corresponds to revenue growth from $ 4.9 million in 2015 to $ 44 million in 2016. Source (page 44). And this is the minimum estimate - in this case we are talking only about the supply of equipment through one affiliated company (SolarCity), excluding other sales channels. But even in this one direction, they thoughtanalysts, in physical terms, this corresponds to the supply of drives with a total capacity of 116.5 MW * h, which exceeds the entire volume of the corresponding US market, which amounted to only 71.4 MW * h by the end of 2015.

Under the cut some details and information about the start of construction in Hawaii of one of the world's largest energy storage devices based on these batteries. And as a supplement, a brief analysis of the question “is there enough lithium reserves with such a large use of batteries based on it?”, Which usually arises in discussions of such news.

For a start it is worth making a small clarification: the title is not about the energy storage market as a whole, but only about one of its segments, the so-called “Behind-The-Meter” (BTM), “after the counter” in the literal translation. It refers to the drives installed by end-users of electricity (or in a situation where the consumer and the manufacturer is one person - that is, autonomous and semi-autonomous power supply systems, usually based on renewable energy), and not energy producers or centralized network supply companies. As can be seen from the diagram at the beginning of the article, the volume of this market in 2015 amounted to 71.4 MW * h for all suppliers combined, including, including Tesla itself, which for the year received a 36% market share with an indicator of 25.8 MW * h. And for 2016, the sales forecast for Tesla drives is already 116.

This is an industrial solar power plant with a capacity of 13 MW on the island of Kauai from the archipelago of the Hawaiian Islands. One similar station of 12 MW was built there and put into operation in 2014 and since then it has been producing about 5% of the energy consumed on the island. Currently, a second similar SES with a capacity of 13 MW is being built, but this time one of the world's largest energy storage devices with a capacity of 52 MW * h will be built with it on the basis of Powerpack modules supplied by Tesla. The corresponding contract was signed last fall, construction should be completed by the end of this year. The final cost of electricity, including both the generation of solar energy and its storage according to a 20-year agreementwill amount to 14.5 cents per kWh, which is already lower than the cost of energy received from traditional sources, which in the case of the Hawaiian Islands have to be almost completely imported (mostly liquefied natural gas and diesel fuel). All this will help fulfill the ambitious plan adopted by the Government of Hawaii , according to which the share of electricity from local renewable sources should be at least 30% by 2020, 50% by 2025 and reach a full 100% no later than 2045.

Well, at the end of the promised information on lithium, in relation to the volume of production and reserves of which very often quite reasonable questions arise in the light of news about plans / forecasts for the rapid growth of production and sales of electric vehicles and energy storage devices. Will this optimistic trend be broken due to the banal shortage of raw materials and, first of all, lithium itself?

Everyone who is interested in this issue is recommended to download a good Mineral Commodity Summaries report.The United States Geological Survey (USGS) is annually updated, which briefly discusses prices, export / import volumes, total production volumes and proven reserves of all major industrial raw materials at once. Including, of course, lithium - in the last report of 2016, compiled on the basis of 2015 data, the section we need is on pages 100-101. All data in this report, except average prices, are based on pure (metallic) lithium.

For readers who save time or have trouble with English, briefly squeezing facts about lithium from this review and other sources:

- despite the rapid growth in the production of electric vehicles and energy storages in recent years, the share of battery production accounts for only 35% of the consumption of produced lithium, while more than half of this part goes to power batteries, and a large amount goes to different electronic gadgets (mobile phones, laptops, tablets, etc.), which, although they have a very small unit capacity of batteries, but are produced by billions of pieces annually;

- current world production rates are 32,500 tons per year;

- the current reserves in the main supplying countries are estimated at 14,000,000 tonnes, including reserves that have been explored and whose extraction is possible and economically justified with the current development of technologies and the current average price level for raw materials, and a very rough estimate of the total available resources is even higher - about 40 million tons;

- The consumption of lithium in the production of electric batteries now amounts to no more than 200 grams of this metal per 1 kWh of capacity, and as technology improves, it may still drop significantly further, since currently achieved in practice, the efficiency of its use does not exceed 35-40% of the theoretical maximum;

- The average cost of lithium "battery" quality in bulk in 2015 amounted to $ 34 per 1 kg (at the rate of $ 6400 per ton of lithium carbonate, in which lithium itself accounts for about 19% by weight) or $ 7 per kWh battery capacity, with their market value in the form of finished products of at least $ 300 per kWh

Conclusions everyone can make their own based on this data. For me personally, they will be:

With the current production rates of already known and studied reserves lasts for more than 400 years, this is one of the highest levels of reserves in the mining industry. Of course, production rates will grow quite quickly following the growing demand (for example, the “gigafafabrika” of batteries, which Tesla is currently building after reaching full capacity will consume about 10,000 tons of lithium per year), but in any case, the problem of lithium reserves is not worth it at all . And there will not be at least decades more, and after decades, the main source of lithium should not be its primary production, but the recycling of old batteries that are out of service. The construction of the first plants for their utilization and extraction of valuable resources (lithium, cobalt, nickel) is already underway.

In this case, problems are possible not in terms of reserves, but with insufficient production rates. But such problems can be easily resolved through the usual market mechanisms: a temporary jump in prices on the commodity market, if production growth starts to lag significantly behind consumption growth -> a wave of large investments in expanding the capacity of mining companies -> a jump in production volumes -> a fall in prices back maybe even below the entry level. Given the very small share of lithium in the final cost of lithium batteries (currently only about 2.5%), such a possible jump in prices for raw materials does not harm the development of this industry. Rather, in this case other consumers of lithium will be the first to suffer, who will be forced to temporarily reduce its use,