Wirex platform: a new step in the development of financial services

In recent years, it has become clear that the financial sector needs major changes. Modern technology does not stand still, and the financial revolution in the IT world began a long time ago. Traditional banking has outlived itself, and high-tech fintech startups are replacing classic solutions that do not fit into the growing rhythm of modern life.

In recent years, it has become clear that the financial sector needs major changes. Modern technology does not stand still, and the financial revolution in the IT world began a long time ago. Traditional banking has outlived itself, and high-tech fintech startups are replacing classic solutions that do not fit into the growing rhythm of modern life. Given the changes, the current mission of the Wirex service, which we would like to talk about today, sounds simple and logical - providing quality and fast service that is available to everyone. We are a company that offers a hybrid financial solution for managing personal accounts, which is much more flexible and convenient to use than traditional banking. Our service allows you to make instant money transfers in USD, EUR, GBP and digital currency, easily converting currencies between you, with the ability to issue a virtual or plastic card for payments wherever MasterCard is accepted and for withdrawing cash from an ATM. Wirex provides its services all over the world, without tying you to the working schedule of bank branches and without excessive bureaucracy.

The ancestor of Wirex was E-Coin, which became one of the first startups to offer a convenient transaction solution for debit Visco and MasterCard bitcoin cards. Already in the first year of its existence, E-Coin gathered an army of 100 thousand users from more than 130 countries of the world, and the monthly volume of transactions grew to $ 2 million. This success showed us that this direction has great potential, so we are launching the new Wirex service, which provides a much wider range of financial services and uses the most modern solutions and technologies. Currently, we are implementing a gradual integration of Wirex with E-Coin, which is painless for our early startup clients.

In tune with the times

Our company lives with modern technologies and trends, including the recent increase in the number of mobile devices, increased interest in cloud services and globalization. We try to anticipate trends in the world of fintech and stay ahead of our competitors, investing in our service all the best that gives us progress. Thus, we make the life of the end user easier and we make our product not only useful, but also easily accessible. Wirex services can be used by everyone, regardless of their location, which makes it especially attractive for modern “citizens of the world” - travelers, businessmen, digital nomads, that is, for all those who work, study and build their lives abroad.

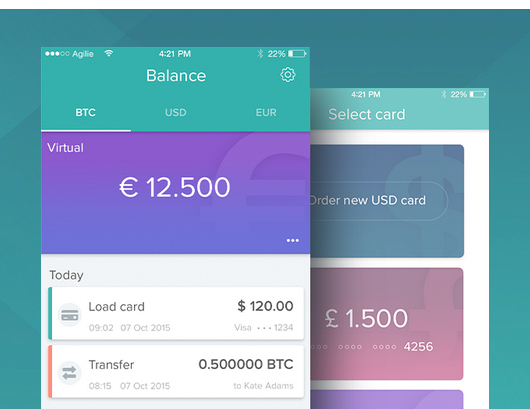

Our company lives with modern technologies and trends, including the recent increase in the number of mobile devices, increased interest in cloud services and globalization. We try to anticipate trends in the world of fintech and stay ahead of our competitors, investing in our service all the best that gives us progress. Thus, we make the life of the end user easier and we make our product not only useful, but also easily accessible. Wirex services can be used by everyone, regardless of their location, which makes it especially attractive for modern “citizens of the world” - travelers, businessmen, digital nomads, that is, for all those who work, study and build their lives abroad.The Wirex application is a convenient mobile platform with an intuitive interface that allows you to easily perform various financial transactions with different currencies, be it transactions, instant money transfers or digital currency conversion in USD, EURO and GBP.

FAQ

This post is not the first in our GeekTimes blog, and we have already been able to put together some list of questions that many people are interested in. Next, a small FAQ:

Who can I transfer money from your card?

You can transfer money to a person who also has our card or any Bitcoin user .

How do you use Bitcoin and Blockchain technology in your service?

Our service uses payments using Bitcoin. And for processing transactions instantly without a ten-minute delay, BitGo Instant is integrated into the system.. This technology allows transactions without a single confirmation, i.e. instantly, between the wallets that use it, these include many exchanges and services. All conversions within the framework of the service from fiat currency to digital and back are carried out using an internal automated exchange. Those. our user Alice needs to exchange $ 500 for 1 btc, and Bob wants to change 1 bts for $ 500, we will link the requests of these two users and get the most favorable exchange rate. In the case when we can not pick up the necessary applications, we use Bitpay as a backup method.

What will happen with the money of users, in case of any trouble at the service?

We have a partnership agreement with the bank, which is the licensee of VISA and MasterCard. Money credited to the card is not our property, we do not have access to it. Therefore, even in the case of our bankruptcy, the cards will work, and the balance will not change. Funds in digital currency are stored in the wallets of our partner, the company BitGo , the world leader in Multi-Sig wallets.

Can someone transfer my money to my card from any other card?

It is not yet possible to accept payments from cards issued by other services or banks. Transfers between Wirex cards work without problems.

What jurisdiction do you work in?

The company that owns the service is registered in the UK. We, together with the bank issuing cards, comply with all AML / KYC requirements.

Can I replenish your card through PayPal or other payments?

Yes you can. We already have dozens of methods of replenishment through a variety of payment systems.

Can I bind your card to services such as PayPal, Amazon and Skrill?

Yes, you can link a card wherever Visa or Mastercard is used.

Where did you get investment in the development of the service?

We received a seed-investment of $ 200 thousand from 99 investors in November last year in the process of crowdfunding campaign on the platform Bnk To The Future . At the moment we are negotiating with several foundations on holding the A round.

Is it possible to open a map on jur. face?

No, we work only with nat. by individuals.

Do you have a personal user account on the site or only mobile apps?

At the moment, Wirex has only mobile applications, the launch of web-admin is planned. While you can use the old version of the personal account on the site e-coin.io

Plastic cards Wirex with embossed letters?

Yes, at the bottom of this page, enter your name and see what your map will look like.

Debit card

We want our customers to always have a choice, so we provide users with a universal debit card for digital and traditional currencies (currently US dollars, euros and pounds sterling), which allows for conversion at an optimal rate. Also, users can choose between plastic and virtual cards Wirex, the latter are issued immediately and free of charge after installing the application. With a Wirex debit card, you can pay at the terminal and withdraw money from ATMs that support Visa and MasterCard payment cards. The following are the main rates and limits:

We want our customers to always have a choice, so we provide users with a universal debit card for digital and traditional currencies (currently US dollars, euros and pounds sterling), which allows for conversion at an optimal rate. Also, users can choose between plastic and virtual cards Wirex, the latter are issued immediately and free of charge after installing the application. With a Wirex debit card, you can pay at the terminal and withdraw money from ATMs that support Visa and MasterCard payment cards. The following are the main rates and limits:| Wirex debit card (USD, EUR, GBR) | ||||

|---|---|---|---|---|

| Royal Mail Delivery Without tracking delivery | DHL delivery Possible to track delivery | Virtual card | The name on the map | Card activation |

| $ 17 | $ 50 | $ 3 | Is free | Is free |

| USD | EUR | GBR | |

|---|---|---|---|

| POS / ePOS payments | No commission | No commission | No commission |

| Internal ATM transactions * | $ 2.50 | € 2.25 | £ 1.75 |

| International ATM Transactions ** | $ 3.50 | € 2.75 | £ 2.25 |

| Payments in foreign currency *** | 3% | 3% | 3% |

| Monthly account maintenance fee (if there is a balance) | $ 1.00 | € 1.00 | £ 1.00 |

| Inactive card service fee | Not charged | Not charged | Not charged |

| Change PIN | $ 1.00 | € 0.80 | £ 0.60 |

* Domestic ATM transactions - withdrawals from an ATM in the currency of your card.

** International ATM transactions - withdrawals from an ATM in any currency other than the currency of your card.

*** Any transactions in any currency other than the established currency of your card.

The card is issued instantly. You do not need to provide any documents, in which case you will simply have more limited limits. In case you upload 2 scans of documents confirming your name and address, then all limits will significantly increase, and some will be canceled altogether.

Limits on not verified card

| USD | EUR | GBP | |

| Top-up cards with Bitcoin | |||

| Number of incoming transactions / per day * | 2 | 2 | 2 |

| Minimum amount of incoming payment / within 1 transaction | $ 10 | € 10 | £ 10 |

| Maximum amount of incoming payment / per day | $ 2500 | € 2500 | £ 2000 |

| Maximum amount of incoming transactions / per day | $ 2500 | € 2500 | £ 2000 |

| Maximum amount of incoming transactions during the card validity period ** | $ 2500 | € 2500 | £ 2000 |

| Top-up cards using Fast Bank Transfer or alternatively | |||

| Number of incoming transactions / per day | 2 | 2 | 2 |

| Maximum amount of incoming payment / within 1 transaction | $ 500 | € 500 | £ 400 |

| Maximum amount of incoming transactions / per day | $ 500 | € 500 | £ 400 |

| Maximum amount of incoming transactions for the duration of the card | $ 2500 | € 2500 | £ 2000 |

| POS / ePOS payments | |||

| Number of transactions / per day | Not limited | Not limited | Not limited |

| Maximum transaction amount / per day | Not limited | Not limited | Not limited |

| ATM cash withdrawal | |||

| ATM transactions per day | 2 | 2 | 2 |

| The maximum amount of cash that can be withdrawn in ATM / within 1 transaction | $ 200 | € 200 | £ 160 |

| Maximum amount of cash that can be withdrawn at ATM / per day | $ 400 | € 400 | £ 320 |

| The maximum amount of cash that can be withdrawn at ATM / for the duration of the card | $ 1000 | € 1000 | £ 800 |

Limits on verified card

| USD | EUR | GBP | |

| Top-up cards with Bitcoin | |||

| Number of incoming transactions / per day | 2 | 2 | 2 |

| Minimum amount of incoming payment / within 1 transaction | $ 10 | € 10 | £ 10 |

| Maximum amount of incoming payment / per day | $ 2500 | € 2500 | £ 2000 |

| Maximum amount of incoming transactions / per day | $ 2500 | € 2500 | £ 2000 |

| Maximum amount of incoming transactions for the duration of the card | Not limited | Not limited | Not limited |

| Top-up cards using Fast Bank Transfer or alternatively | |||

| Number of incoming transactions / per day | 2 | 2 | 2 |

| Maximum amount of incoming payment / within 1 transaction | $ 5000 | € 5000 | £ 4000 |

| Maximum amount of incoming transactions / per day | $ 5000 | € 5000 | £ 4000 |

| Maximum amount of incoming transactions for the duration of the card | Not limited | Not limited | Not limited |

| POS / ePOS payments | |||

| Number of transactions / per day | Not limited | Not limited | Not limited |

| Maximum amount of payments / per day | Not limited | Not limited | Not limited |

| ATM cash withdrawal | |||

| Number of transactions / per day | 2 | 2 | 2 |

| The maximum amount of cash that can be withdrawn in ATM / within 1 transaction | $ 1000 | € 1000 | £ 800 |

| Maximum amount of cash that can be withdrawn at ATM / per day | $ 2000 | € 2000 | £ 1600 |

| The maximum amount of cash that can be withdrawn at ATM / for the duration of the card | Not limited | Not limited | Not limited |

* per day = 24 hours.

** card validity time = 3 years.

*** POS (Point of Sale) - offline payment acceptance point - offline stores. ePOS - online payment acceptance point - any online store / service.

Wirex command

The Wirex team includes serial entrepreneurs and technical professions with years of experience in their field. Each member of our team - from an ordinary employee to the founders of the company - is involved in the project and performs the duties assigned to it with full dedication to the common cause.

Dmitry Lazarichev, one of the co-founders of Wirex, assesses the campaign and deals with consulting issues. Georgiy Sokolov brings experience in sales and business development. Pavel Matveyev, who previously worked at Barclays Capital, Morgan Stanley, BNP Paribas and Credit Suisse, brings experience in the field of software and banking.

We love the time and peace of mind of people who entrust us with their financial accounts, so our customer support team promptly answers questions from users from all over the world. We pride ourselves on our responsiveness as well as the convenient help section .

Our service is developing and improving, Wirex plastic debit cards are becoming available in more than 130 countries around the world, and we are constantly working to increase their number by opening new regions. Virtual Wirex card is now available regardless of the user's country of residence. Join our service, and we, on our part, will try to do everything possible so that you do not regret your choice!