How easy it is to legally organize your startup in the form of a simple partnership

Having over 12 years of legal practice, including in different jurisdictions, and including in the IT field, I want to share tips backed up by real experience.

So, this article is for enterprising people who want to make their first independent commercial project possible together with partners.

It is very important for the future project to fix the rights, duties, responsibilities and then, if you suddenly have the opportunity to legally present it.

Creating a legal entity, say, a limited liability company is one of the most well-trodden paths and certainly has its advantages.

However, what if it does not fit? Let’s say you don’t want to bear the considerable initial costs of registration, legal and accounting support for LLCs? And what if the project fails, you will curtail work on it, and the liquidation of a legal entity is a much more dreary problem than the creation, and therefore you need to either continue to maintain it, or dump a round sum for liquidation.

I bring to your attention a guide on such a form of doing business as a “simple partnership,” and my experience in applying to an IT business project.

It is proposed to use the form of a simple partnership ( general partnership is not a literal translation, but a conceptual analogue in the common English law system), which is created on the basis of a joint activity agreement ( partnership agreement - similarly) and does not require organization of internal investment relationships by project partners. registration of a legal entity.

Recommended starter information:

The benefits of just a partnership:

The creation of a legal entity in comparison with a simple partnership has disadvantages because regardless of whether a business project will take place, considerable costs must be borne from the very start, and on a regular basis.

Disadvantages of registration of a legal entity:

Registration of a legal entity in decent jurisdiction with paid expenses for the first year of work can cost an average of approximately $ 1,000 - 5,000.

Therefore, when choosing a form of management, you should correlate the costs of registering an enterprise with the costs of the project itself. Say, with a project cost of $ 15,000, registration at $ 5,000 can be considered a round sum, ¼ of costs!

Also, in case of failure of the project, the legal entity remains and regular expenses must be borne on it. At the same time, the liquidation of a legal entity can cost even more than registration, and usually much longer.

It should be mentioned that an additional advantage of a simple society is that if the project is successful, when its prospects become clear, it can always be turned into a legal entity by registering in the usual way.

Different countries have their own characteristics of the legal status of a simple partnership.

So, for example, under Russian law, only individual entrepreneurs and commercial organizations (Article 1041 of the Civil Code of the Russian Federation) can be comrades; in Ukrainian, there can also be individuals. In some European countries, PT is not recognized as a legal entity, while in others it acts as an independent entity, but without state registration.

In my project, I chose English common law ( Partnership Act 1890 ). To get started, you need to draw up an agreement - partnership agreement.

Although a simple partnership is not a legal entity and is not subject to registration, nevertheless, registration with the tax authority of England may be necessary only if the partnership includes a British resident.

I requested a legal opinion from two solicitors (lawyers in England). Next, I quote the original text with the authorship and translation.

1. Simon Fagan LLB (Hons) Solicitor Advocate

“If the Partnership (or any legal entity) trades in the UK, it must be registered with the HMRC (tax authority - approx. Translator) for tax purposes, as soon as it reaches the minimum VAT threshold - which I currently have 50 Pounds sterling. If the partnership opens a bank account in the UK or intends to make payments in the UK from this bank account, it will need a tax certificate. If the partnership agreement is to be governed only by UK law and not by intra-UK trade, then there is no need to register an HMRC. ”

2. Christian. The Law Firm.

“[...] You do not need to register such a partnership with the UK tax authority.”

UK law, it seems to me, is the most convenient solution for a startup without creating a legal entity, given if your partners are scattered around the world.

It is also possible to consider other jurisdictions, but I would adhere to this principle: English-speaking countries (it is easier to solve problems later, because another jurisdiction is a different language), and common law, for example, Hong Kong.

However, other solutions may also occur.

It is necessary to determine the composition of participants, contributions and shares.

We conclude an agreement on joint activities (Partnership agreement on the common law of England). You can bilingual.

In the contract indicate the deposits, shares, and the procedure for profit. We describe the project, goals and objectives. As an annex to the contract is a business plan, presentation and TK.

Here it is also necessary to decide in principle whether the partners can act on behalf of the partnership or they will choose one (two, three ... representatives). By analogy with the director. A representative may even be a legal entity. If nothing is specified in the contract, then by default, all partners can act on behalf of the partnership independently of each other, and everyone, acting on behalf of the partnership, can acquire the rights and obligations for the partnership. You can also define some specific rules, for example, transactions for a certain amount need a collegial decision, etc.

As mentioned above, a simple partnership can act as a business unit. But in the world there are not many who understand this form and difficulties may arise in foreign transactions.

Therefore, I propose to choose a legal entity for external representation. At first, it may even be some familiar legal entity, appointing him the attorney of the partnership with the right to enter into transactions with third parties in the interests of the partnership.

This type of relationship is drawn up by an agreement between the partnership ( principal ) and the company ( attorney ).

In my case, my partners and I decided the following. According to the contract, I was appointed managing partner, and was authorized to conduct business relations with market participants.

Transactions from 30,000 USD require the consent of partners by a general remote vote by a simple majority. For communication, we created a chat in the Telegram and agreed that all the issues specified in it acquire legally binding force for us.

For transactions requiring that we have a legal entity, one of the partners will act (the partners include individuals and legal entities).

But for external relations, we drew up a contract of assignment with this legal entity and a power of attorney for that, in case you need to confirm the authority. An attorney acting in the interests of a simple partnership [principal], all that he acquires is the property of the partnership [principal], including money, intellectual property rights. Thus, we solved the issue with the bank, because the legal entity has an account and can pay or accept money.

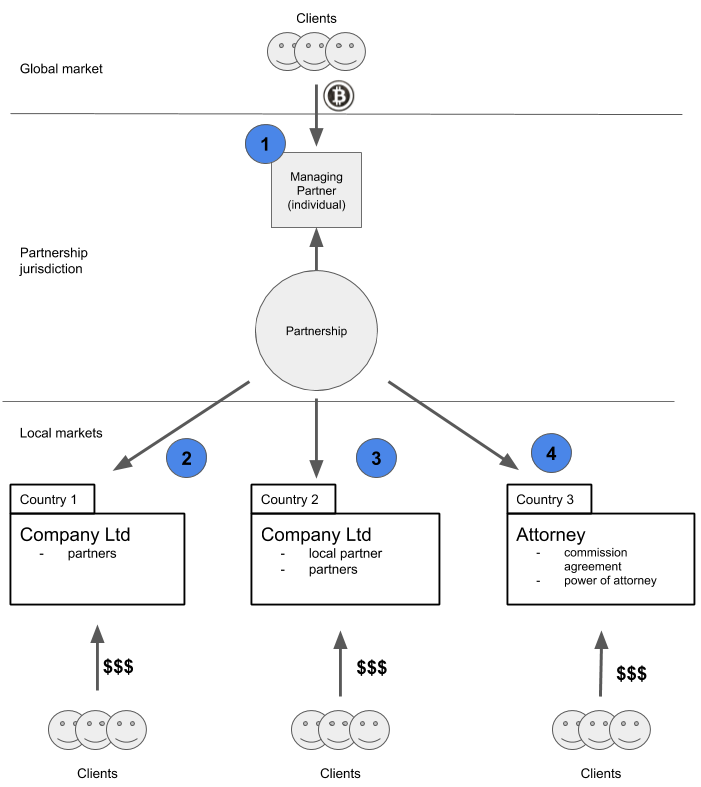

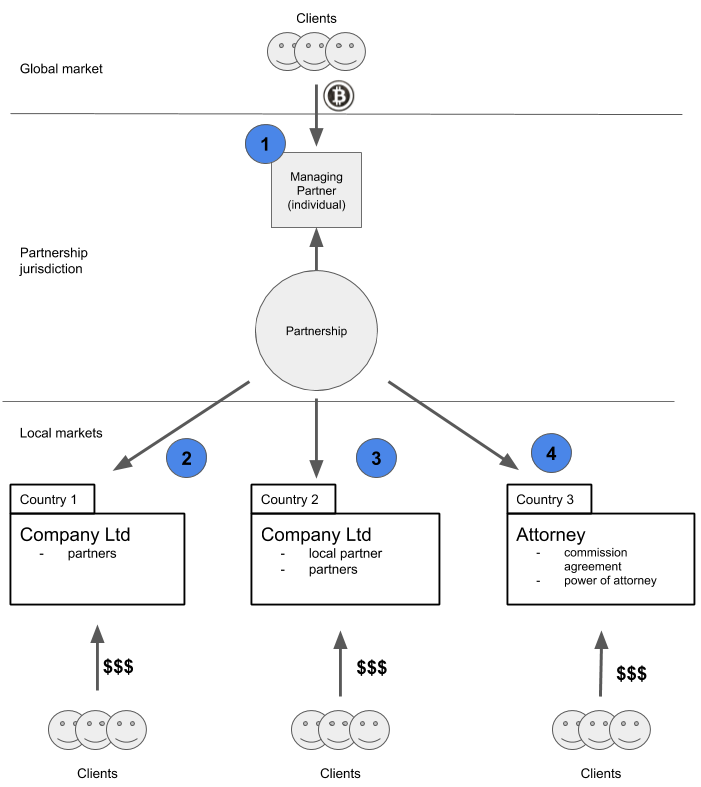

However, this is not the only work model. The diagram below shows other options for organizing relationships.

In reality, all relations have to be built on the movement of money and property rights.

Scheme 1

Managing partner is an individual. He will be able to manage the project, but an individual is unlikely to legally succeed in opening an account for entrepreneurial activity elsewhere. Therefore, in terms of revenue management, such a partner can only work with cryptocurrency. As the only scheme, it is suitable if the revenue is only in cryptocurrency. Otherwise, it must be combined with other schemes. The managing partner distributes cryptocurrency profits among other partners, and those, in turn, being law-abiding citizens of their states, declare it and pay taxes.

Scheme 2

A legal entity is created in some jurisdictions (for example, LLC) and becomes an attorney of a simple partnership. In principle, a partnership scheme is no longer needed if the same partners are included on the same terms. Nevertheless, it can be an additional element if there is cryptocurrency in the calculations, and you do not want to shine and draw on this legal entity. Moreover, most likely in many jurisdictions you will encounter real problems when working with crypto and tokens, many banks simply refuse to service. Therefore, it is very likely that you need a combination with Scheme 1.

Scheme 3

A legal entity is created, which includes partners from just a partnership and a local partner. We will call this a regional representation scheme. Such a legal entity also works under a contract of assignment from a simple partnership. Especially it makes sense if your business requires a local presence. Then the local partner has the task of leading the company and developing the business locally. The issue is also solved by finances - the company will calmly open a bank account, and the proceeds will be distributed among partners.

Scheme 4

A legal entity or an individual entrepreneur under a contract of assignment from a simple partnership. The scheme is also good, as a legal entity and individual entrepreneurs can open a bank account and accept payments from customers. The attorney will transfer the profit to the partners of a simple partnership (after all, all proceeds belong to the trustee under the contract agreement!), And leave a commission for the work performed.

This part is optional, as there are many ways to conclude.

In our case, all partners were in different countries and it was difficult to meet.

We decided to use modern technology. In particular, we drew up an agreement in electronic form. The contract included the blockchain address of each of us and indicated that we consider this contract to be concluded when each partner publishes a hash in the blockchain of the amount of the file for this contract from the specified addresses. Emercoin was chosen as a blockchain, and the carousel signing scheme. What does it mean. The first signer creates an NVS record with the hash of the contract, and then transfers this record to the address of the next signatory (in essence, like a token), and so each partner in a circle, and when the record returns to the first, the circle closes - the contract is signed. Partners (and all who fell into the hands of this file) can verify the addresses that participated in the carousel, and if they coincide with those announced, the contract is considered signed by the appropriate parties. And by the way, We also send crypto revenue to the same addresses. Operational and strategic issues are resolved in a separate telegram chat, all decisions agreed there are recognized by partners as legally binding.

In the end, I think it will be important to note that each country may have its own peculiarities with taxes and accounting. So, for citizens and residents of the Russian Federation there is a requirement to notify the tax authority of their participation in this kind of organization, including abroad. But a simple notification is still better than a full-fledged registration and maintenance of a legal entity for a just starting project. And, yes, you need to pay taxes. What can you do?

The organization of a simple partnership has its pros and cons. Perhaps some will think that this is all sewn with white thread and this form will not protect you legally. My many years of experience have shown that the most reinforced concrete legal schemes may not help at all. Everything can turn out to be protracted and debilitating litigation for partners, and often the winner still does not get anything, since there is nothing to recover from the debtor (he sold everything long ago, wrote it to his grandmother and generally disappeared). Common sense dictates that the matter is not in the best legal scheme, but in the decency of partners. In the dashing 90s (and even now often) no one ever concluded written agreements. Shook hands and let's work. And if you decided to throw, then they can shoot your head. Fortunately, for many, these times are left behind and in the bottom line. Reputation.

Now, when information about a person is disseminated with the power of thought, it may very quickly turn out that everyone will simply refuse to deal with the scammer further. And here we need a contract. Not for the court (although for him), but for public censure. When a serious matter and serious partners are at stake, credibility is capital that is long and hard to earn, but you can lose in a second.

For those who naively believe that “a file is not a contract”, “electronic correspondence will not work in court”, I dare dispel doubts. Initially, competently organized legal work in accordance with the jurisdiction where it is carried out, in most cases will help push the villain to the wall in court, and especially when the case is very bad and the proceedings are no longer on an economic plane, but in a criminal one. But let it not come to this.

I wish you success in your endeavors!

So, this article is for enterprising people who want to make their first independent commercial project possible together with partners.

It is very important for the future project to fix the rights, duties, responsibilities and then, if you suddenly have the opportunity to legally present it.

Creating a legal entity, say, a limited liability company is one of the most well-trodden paths and certainly has its advantages.

However, what if it does not fit? Let’s say you don’t want to bear the considerable initial costs of registration, legal and accounting support for LLCs? And what if the project fails, you will curtail work on it, and the liquidation of a legal entity is a much more dreary problem than the creation, and therefore you need to either continue to maintain it, or dump a round sum for liquidation.

I bring to your attention a guide on such a form of doing business as a “simple partnership,” and my experience in applying to an IT business project.

Investment scheme

It is proposed to use the form of a simple partnership ( general partnership is not a literal translation, but a conceptual analogue in the common English law system), which is created on the basis of a joint activity agreement ( partnership agreement - similarly) and does not require organization of internal investment relationships by project partners. registration of a legal entity.

Recommended starter information:

- Video of General Partnership under English law (Engl.)

- wiki article

- Chapter 55 “Simple Partnership” Civil Code of the Russian Federation

- General Partnership in English common law and civil law of different countries (English)

The benefits of just a partnership:

- no legal entity registration required

- it is enough to conclude an agreement on joint activities, defining the contributions, the distribution of profits, intellectual property rights and other conditions

- a simple society can act as a business entity and enter into transactions

- on behalf of the company, all partners or the selected partner or even a third party may act on behalf of (analogue of the hired director)

- no administrative costs (legal address, accountant, etc.)

- no taxes, because each partner has personal obligations regarding taxes on income received from the partnership in the jurisdiction where

- convenient for partners who are in different countries

The creation of a legal entity in comparison with a simple partnership has disadvantages because regardless of whether a business project will take place, considerable costs must be borne from the very start, and on a regular basis.

Disadvantages of registration of a legal entity:

- legal entity registration costs (official payments)

- costs of legal registration services

- pay authorized capital

- in a number of jurisdictions, a non-resident founder must have an agent (representative)

- purchase of legal address (regular expenses)

- hire a director (regular costs)

- hire an accountant (regular costs)

- time spent on starting a business (1 month at best)

Registration of a legal entity in decent jurisdiction with paid expenses for the first year of work can cost an average of approximately $ 1,000 - 5,000.

Therefore, when choosing a form of management, you should correlate the costs of registering an enterprise with the costs of the project itself. Say, with a project cost of $ 15,000, registration at $ 5,000 can be considered a round sum, ¼ of costs!

Also, in case of failure of the project, the legal entity remains and regular expenses must be borne on it. At the same time, the liquidation of a legal entity can cost even more than registration, and usually much longer.

It should be mentioned that an additional advantage of a simple society is that if the project is successful, when its prospects become clear, it can always be turned into a legal entity by registering in the usual way.

Choice of jurisdiction

Different countries have their own characteristics of the legal status of a simple partnership.

So, for example, under Russian law, only individual entrepreneurs and commercial organizations (Article 1041 of the Civil Code of the Russian Federation) can be comrades; in Ukrainian, there can also be individuals. In some European countries, PT is not recognized as a legal entity, while in others it acts as an independent entity, but without state registration.

In my project, I chose English common law ( Partnership Act 1890 ). To get started, you need to draw up an agreement - partnership agreement.

Although a simple partnership is not a legal entity and is not subject to registration, nevertheless, registration with the tax authority of England may be necessary only if the partnership includes a British resident.

I requested a legal opinion from two solicitors (lawyers in England). Next, I quote the original text with the authorship and translation.

Legal opinions

1. Simon Fagan LLB (Hons) Solicitor Advocate

If the Partnership (or any legal entity) trades in the UK, then it will need to be registered with the HMRC for tax purposes once it has achieved the minimum VAT threshold - which I currently believe to be £ 50,000. If the partnership is opening a bank account in the UK, or intends to make payments in the UK from that bank account, then it will need a tax reference. If the partnership agreement is to be governed only by UK legislation and not, in itself, trade within the UK, then there is no need for there to be any HMRC registration.Translation:

“If the Partnership (or any legal entity) trades in the UK, it must be registered with the HMRC (tax authority - approx. Translator) for tax purposes, as soon as it reaches the minimum VAT threshold - which I currently have 50 Pounds sterling. If the partnership opens a bank account in the UK or intends to make payments in the UK from this bank account, it will need a tax certificate. If the partnership agreement is to be governed only by UK law and not by intra-UK trade, then there is no need to register an HMRC. ”

2. Christian. The Law Firm.

[...] You do not need to register this partnership with HM Revenue & Customs in the UK.Translation:

“[...] You do not need to register such a partnership with the UK tax authority.”

UK law, it seems to me, is the most convenient solution for a startup without creating a legal entity, given if your partners are scattered around the world.

It is also possible to consider other jurisdictions, but I would adhere to this principle: English-speaking countries (it is easier to solve problems later, because another jurisdiction is a different language), and common law, for example, Hong Kong.

However, other solutions may also occur.

Relationship Organization

It is necessary to determine the composition of participants, contributions and shares.

We conclude an agreement on joint activities (Partnership agreement on the common law of England). You can bilingual.

In the contract indicate the deposits, shares, and the procedure for profit. We describe the project, goals and objectives. As an annex to the contract is a business plan, presentation and TK.

Here it is also necessary to decide in principle whether the partners can act on behalf of the partnership or they will choose one (two, three ... representatives). By analogy with the director. A representative may even be a legal entity. If nothing is specified in the contract, then by default, all partners can act on behalf of the partnership independently of each other, and everyone, acting on behalf of the partnership, can acquire the rights and obligations for the partnership. You can also define some specific rules, for example, transactions for a certain amount need a collegial decision, etc.

As mentioned above, a simple partnership can act as a business unit. But in the world there are not many who understand this form and difficulties may arise in foreign transactions.

Therefore, I propose to choose a legal entity for external representation. At first, it may even be some familiar legal entity, appointing him the attorney of the partnership with the right to enter into transactions with third parties in the interests of the partnership.

This type of relationship is drawn up by an agreement between the partnership ( principal ) and the company ( attorney ).

In my case, my partners and I decided the following. According to the contract, I was appointed managing partner, and was authorized to conduct business relations with market participants.

Transactions from 30,000 USD require the consent of partners by a general remote vote by a simple majority. For communication, we created a chat in the Telegram and agreed that all the issues specified in it acquire legally binding force for us.

For transactions requiring that we have a legal entity, one of the partners will act (the partners include individuals and legal entities).

But for external relations, we drew up a contract of assignment with this legal entity and a power of attorney for that, in case you need to confirm the authority. An attorney acting in the interests of a simple partnership [principal], all that he acquires is the property of the partnership [principal], including money, intellectual property rights. Thus, we solved the issue with the bank, because the legal entity has an account and can pay or accept money.

However, this is not the only work model. The diagram below shows other options for organizing relationships.

In reality, all relations have to be built on the movement of money and property rights.

Scheme 1

Managing partner is an individual. He will be able to manage the project, but an individual is unlikely to legally succeed in opening an account for entrepreneurial activity elsewhere. Therefore, in terms of revenue management, such a partner can only work with cryptocurrency. As the only scheme, it is suitable if the revenue is only in cryptocurrency. Otherwise, it must be combined with other schemes. The managing partner distributes cryptocurrency profits among other partners, and those, in turn, being law-abiding citizens of their states, declare it and pay taxes.

Scheme 2

A legal entity is created in some jurisdictions (for example, LLC) and becomes an attorney of a simple partnership. In principle, a partnership scheme is no longer needed if the same partners are included on the same terms. Nevertheless, it can be an additional element if there is cryptocurrency in the calculations, and you do not want to shine and draw on this legal entity. Moreover, most likely in many jurisdictions you will encounter real problems when working with crypto and tokens, many banks simply refuse to service. Therefore, it is very likely that you need a combination with Scheme 1.

Scheme 3

A legal entity is created, which includes partners from just a partnership and a local partner. We will call this a regional representation scheme. Such a legal entity also works under a contract of assignment from a simple partnership. Especially it makes sense if your business requires a local presence. Then the local partner has the task of leading the company and developing the business locally. The issue is also solved by finances - the company will calmly open a bank account, and the proceeds will be distributed among partners.

Scheme 4

A legal entity or an individual entrepreneur under a contract of assignment from a simple partnership. The scheme is also good, as a legal entity and individual entrepreneurs can open a bank account and accept payments from customers. The attorney will transfer the profit to the partners of a simple partnership (after all, all proceeds belong to the trustee under the contract agreement!), And leave a commission for the work performed.

How we made a contract

This part is optional, as there are many ways to conclude.

In our case, all partners were in different countries and it was difficult to meet.

We decided to use modern technology. In particular, we drew up an agreement in electronic form. The contract included the blockchain address of each of us and indicated that we consider this contract to be concluded when each partner publishes a hash in the blockchain of the amount of the file for this contract from the specified addresses. Emercoin was chosen as a blockchain, and the carousel signing scheme. What does it mean. The first signer creates an NVS record with the hash of the contract, and then transfers this record to the address of the next signatory (in essence, like a token), and so each partner in a circle, and when the record returns to the first, the circle closes - the contract is signed. Partners (and all who fell into the hands of this file) can verify the addresses that participated in the carousel, and if they coincide with those announced, the contract is considered signed by the appropriate parties. And by the way, We also send crypto revenue to the same addresses. Operational and strategic issues are resolved in a separate telegram chat, all decisions agreed there are recognized by partners as legally binding.

In the end, I think it will be important to note that each country may have its own peculiarities with taxes and accounting. So, for citizens and residents of the Russian Federation there is a requirement to notify the tax authority of their participation in this kind of organization, including abroad. But a simple notification is still better than a full-fledged registration and maintenance of a legal entity for a just starting project. And, yes, you need to pay taxes. What can you do?

Summary

- relations between partners and the operational director (managing partner) are determined by the cooperation agreement (simple partnership) with the choice of jurisdiction

- as a jurisdiction, English law is appropriate especially when partners are located in different countries

- the director can also be hired, then you need to decide who will sign the contract with the leader, all partners or who they will appoint for this task

- the managing partner and / or the hired director are given the right to make decisions on project management within a certain amount, the remaining decisions are collegial partners; also collegial decisions: on entry / exit of partners, increase and decrease in the amount of investment, share and goals and objectives of the project

- relations with attorneys are determined by the agreement with the partnership [principal]. An attorney is a legal entity or individual authorized to manage finances

- a simple partnership scheme is necessary if you need to work with cryptocurrency, and banks are denied service

- decisions are made online via chat, and all partners in the contract initially recognized their legal force

- at any time, for example, when it becomes clear that the project has taken place and things have gone, you can always turn it into a legal entity by registering in the usual way

PS

The organization of a simple partnership has its pros and cons. Perhaps some will think that this is all sewn with white thread and this form will not protect you legally. My many years of experience have shown that the most reinforced concrete legal schemes may not help at all. Everything can turn out to be protracted and debilitating litigation for partners, and often the winner still does not get anything, since there is nothing to recover from the debtor (he sold everything long ago, wrote it to his grandmother and generally disappeared). Common sense dictates that the matter is not in the best legal scheme, but in the decency of partners. In the dashing 90s (and even now often) no one ever concluded written agreements. Shook hands and let's work. And if you decided to throw, then they can shoot your head. Fortunately, for many, these times are left behind and in the bottom line. Reputation.

Now, when information about a person is disseminated with the power of thought, it may very quickly turn out that everyone will simply refuse to deal with the scammer further. And here we need a contract. Not for the court (although for him), but for public censure. When a serious matter and serious partners are at stake, credibility is capital that is long and hard to earn, but you can lose in a second.

For those who naively believe that “a file is not a contract”, “electronic correspondence will not work in court”, I dare dispel doubts. Initially, competently organized legal work in accordance with the jurisdiction where it is carried out, in most cases will help push the villain to the wall in court, and especially when the case is very bad and the proceedings are no longer on an economic plane, but in a criminal one. But let it not come to this.

I wish you success in your endeavors!