Lyft and Uber go public IPO. Why invest in Lyft?

At United Traders, we follow all the technology companies that go public IPOs, and of course, the biggest ones. Perhaps many people know that on March 29 Lyft goes on the exchange, and in April promises to go Uber.

To talk about Lyft, Uber's competitor in the US and Canada, we translated the CCN article, supplemented it with numbers and presented our forecast. For UT, comparing these companies, their financial performance and product advantages is an extremely interesting topic. We hope for readers of Habr too. In any case, write in the comments.

As soon as plans to enter the IPO of the two largest ridersharing services became known, disputes about which company is best to invest in do not subside. It may seem that companies offer the same services, but upon closer examination, things are not so clear. In this article, we present five reasons why Lyft can be a serious threat to Uber and a more profitable investment.

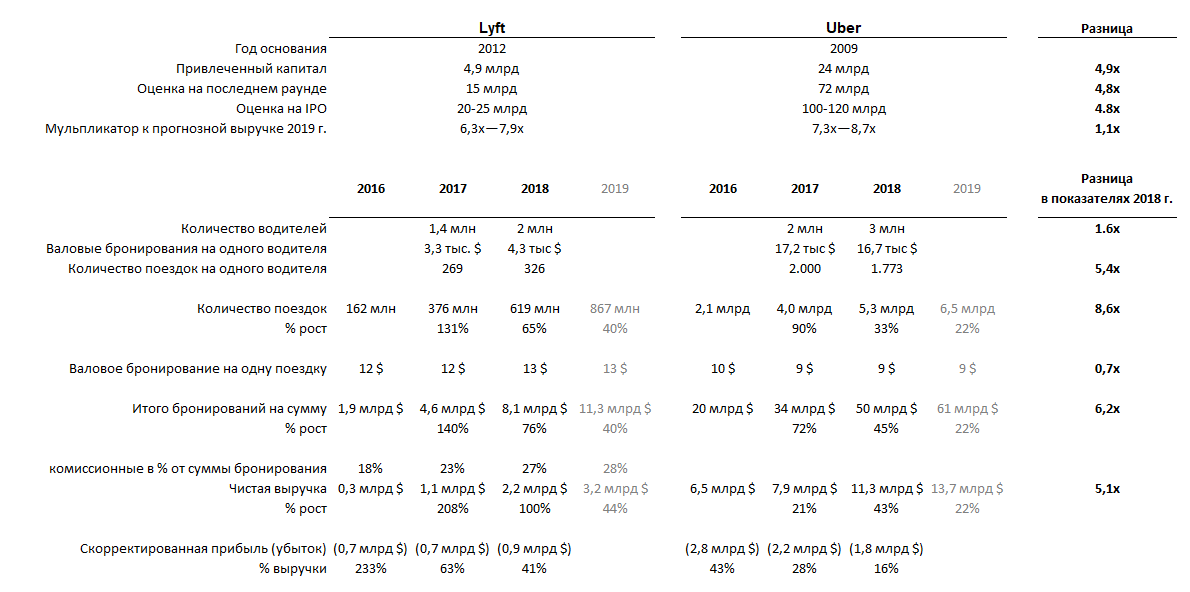

Technically, Lyft looks like a classic unicorn worth more than $ 1 billion. However, in its IPO application, the company revealed a lot of interesting financial information. With this in mind, as well as metered-published data from Uber, for the first time we had the opportunity to compare the business of the two companies.

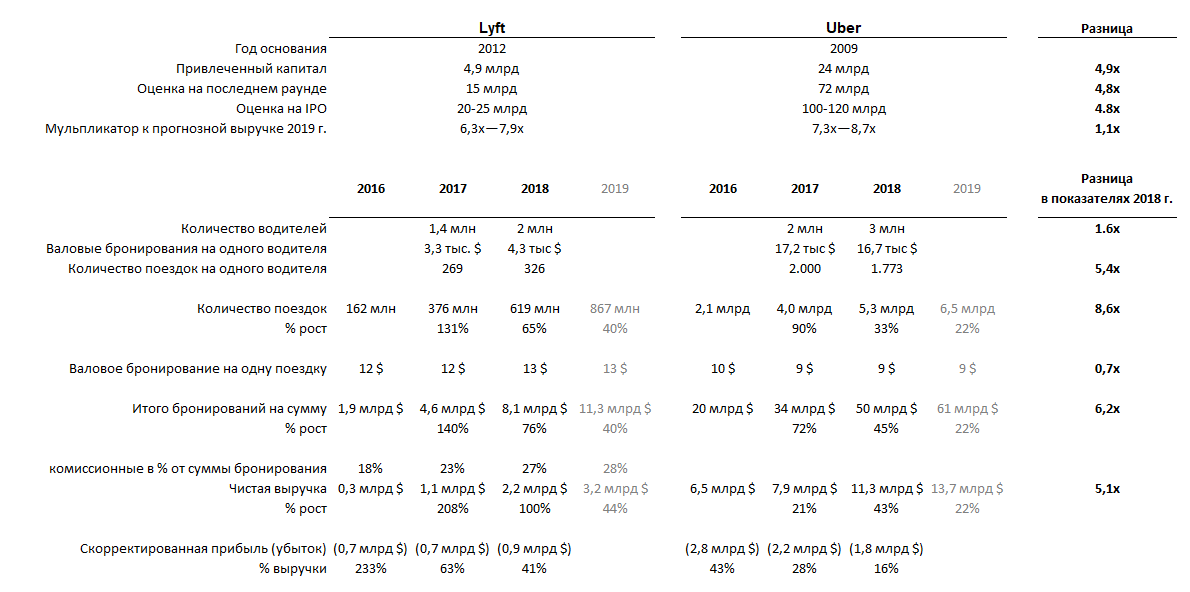

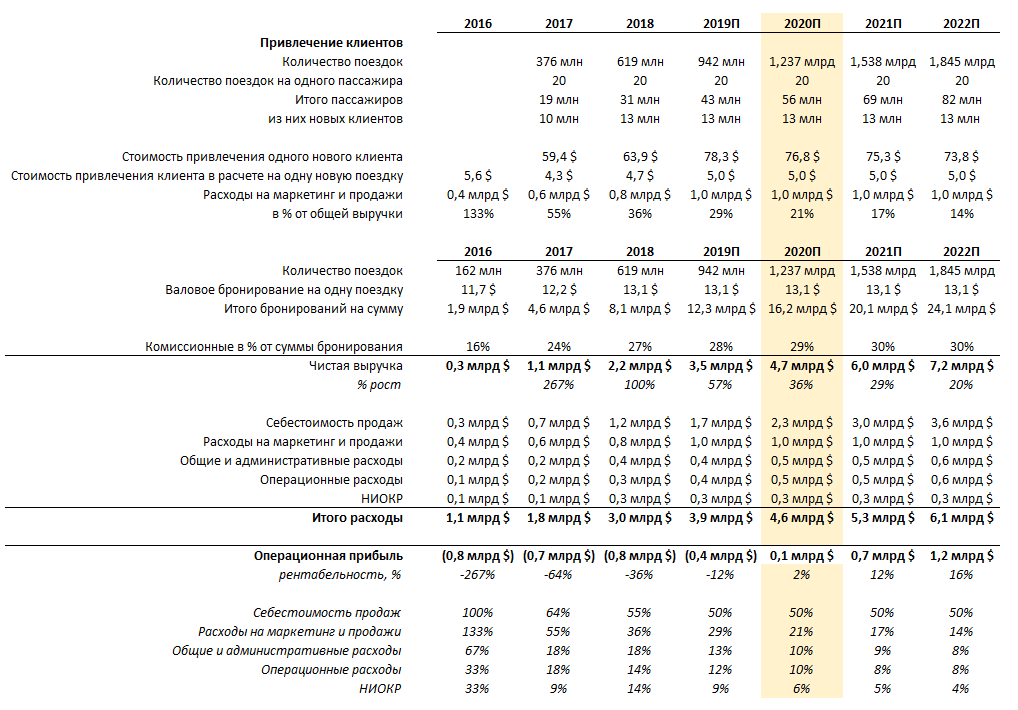

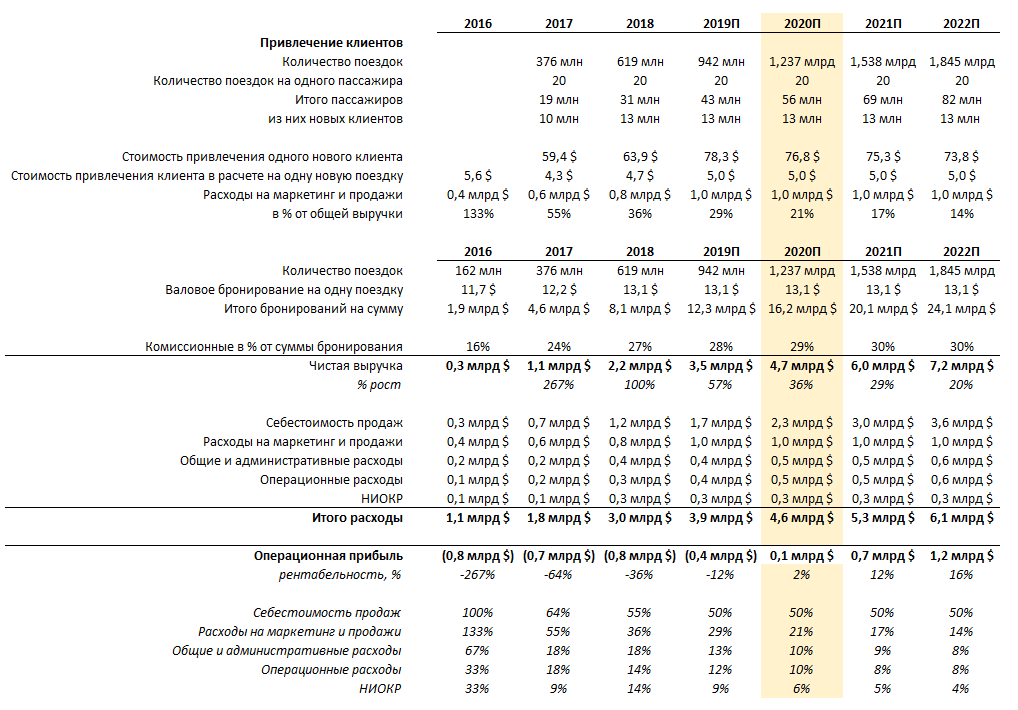

Data: Form S-1; figures for 2019 are a forecast.

The fundamental difference between the two companies is their size. While Uber operates in nearly 70 countries, Lyft services are available in only 300 cities in the United States and Canada.

Someone might think that buying Uber shares would be a more reasonable investment due to the size of the company, but this is not entirely true. The larger the company, the higher the costs and operational risks it carries. As long as Uber remains under the watch of regulators, Lyft is present only in the USA and Canada and is not familiar with most of these problems.

As the younger brother oversees the older, so Lyft learns from the mistakes of Uber.

Both companies remain unprofitable, but let's take a look at the dynamics of their growth.

Lyft's revenue in 2018 grew 100% to $ 2.2 billion, while Uber’s revenue grew “only” 45% to $ 11 billion. In part, such a strong growth in Lyft is associated with an increase in commissions (from 23% to 27%), which may well be a temporary phenomenon. Therefore, it is better to look at the number of bookings: Lyft they grew by 76% compared to last year, and Uber by 45%. As you can see, the difference in growth rates is not so serious, especially when you consider that Uber is five times larger in size than Lyft.

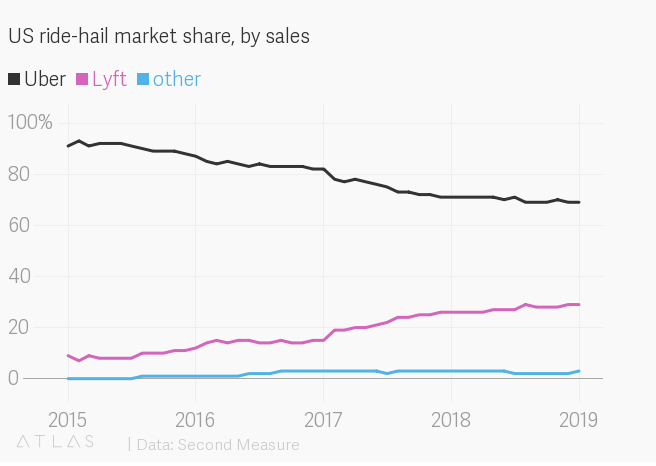

However, these numbers clearly indicate that Lyft is growing faster. At the same time, interestingly, in the USA Lyft is growing, taking away market share from Uber: the company itself says about 39%, while Second Measure, which analyzes credit card payment data, estimates Lyft's share at 29% (and Uber - 69%). In terms of individual cities, these statistics look even more interesting: in Seattle, for example, Lyft's share is close to 50%.

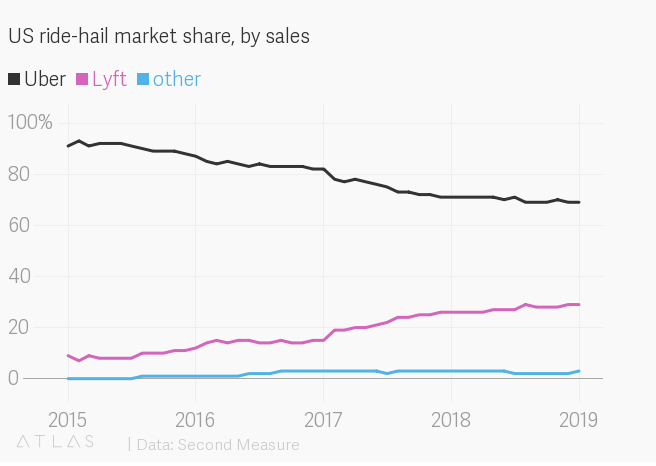

Market share in terms of sales

Judging by the numbers above, Lyft's strategy to concentrate its efforts in the US market seems justified, which is largely facilitated by the liberal position of the country's regulatory authorities, which so far differs from the position of authorities in many countries where Uber operates.

If you argue hypothetically, the main obstacle to the use of ride sharing is the safety of the trip. All the passenger needs is to get to the destination safely and quickly. For both companies, this is number one priority. Of course, in those days when there were no alternatives to Uber on the market, the choice was obvious. But as we can see, Lyft is gradually taking away market share from Uber, which confirms the trust of customers in the drivers of this company.

By applying for an IPO and having every chance of becoming the first public company to advocate an innovative approach to passenger transportation, Lyft attracted the attention of the general public (and not least because now it is constantly compared with its direct competitor - Uber). In a niche where customer confidence in the company rules, declaring oneself as a public company is worth a lot. In addition, both Lyft founders, after changing the status of the company, will retain both their visionary and managerial roles in it, which contrasts very strongly with the history of the founder of Uber and can also add Lyft attractiveness both in the eyes of potential investors and its clients.

Lyft and Uber have different driver profiles - most Lyft drivers work part-time in their free time, while for Uber drivers this employment is their main source of income. This is confirmed by the available figures: the average driver Lyft earns $ 4.3 thousand per year, and this figure has been growing in recent years; and the average Uber driver earns $ 16.7 thousand per year (and the rate is down).

On average, 1 trip per day (or 326 trips per year) per Lyft driver, and 5 trips per day (1773 trips per year) per Uber driver. Uber has only 1.5 times more drivers than Lyft (3 million and 1.9 million drivers, respectively), although the size of the company’s business is 5 times larger.

At the same time, many drivers use the applications of both companies and they do not care what service a new order will come from. In this case, it is important that the small and less well-known company Lyft was able to achieve a sufficient number of available drivers who are satisfied with working with the company despite the fact that Lyft has significantly fewer customers than Uber.

Maintaining the availability of drivers in the cities where the service is present is a difficult task and a critical factor determining the choice of customers. After all, few people, having waited 20 minutes in the rain, will want to use this service at least once more. And the more drivers, the more customers: Lyft will be able to increase the number of cars available on the road as long as it is profitable for drivers.

One of the major advantages of Uber as an object of investment on the expected IPO is its positioning itself not only as a taxi, but also as a food delivery service and the developer of a much more attractive technology for unmanned vehicles. Lyft is also investing in the development of unmanned vehicles, although there is little mention of this in public space.

In the development of progressive ideas for the development of urban transport companies go foot and foot. So, in April 2018 Lyft signed a five-year strategic partnership agreement with Magna, a manufacturer of spare parts and components for the automotive industry, according to which the companies will share technological developments in the field of unmanned vehicles with each other, and in October 2018, the company acquired a London-based developer of computer solutions View Blue Vision Labs.

In addition to its own development, Lyft also plans to allow third-party unmanned vehicle manufacturers to its platform (and customer base), which should accelerate the gradual transition to unmanned vehicles. Thus, in January 2018, the commercial use of unmanned vehicles (with a driver in the cabin) on the Lyft platform was launched in Las Vegas in Las Vegas: almost a year, passengers made more than 35,000 trips.

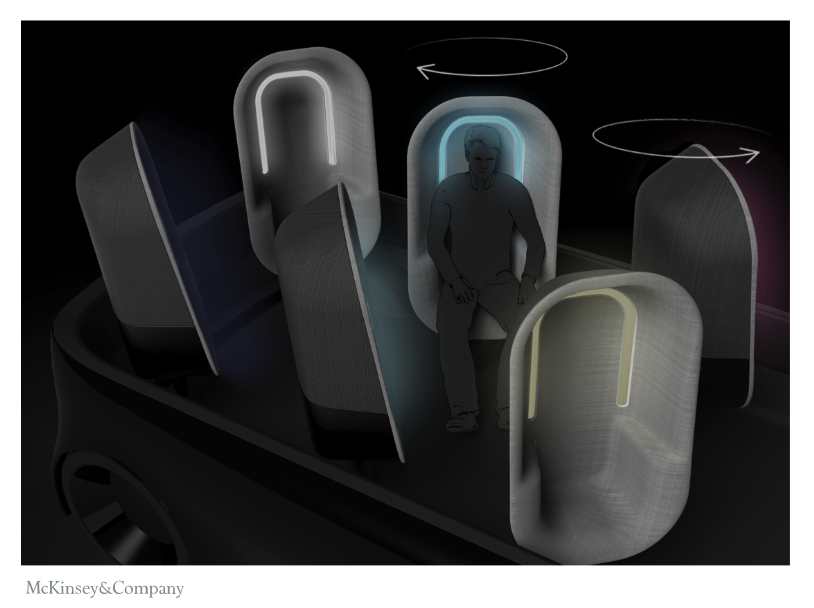

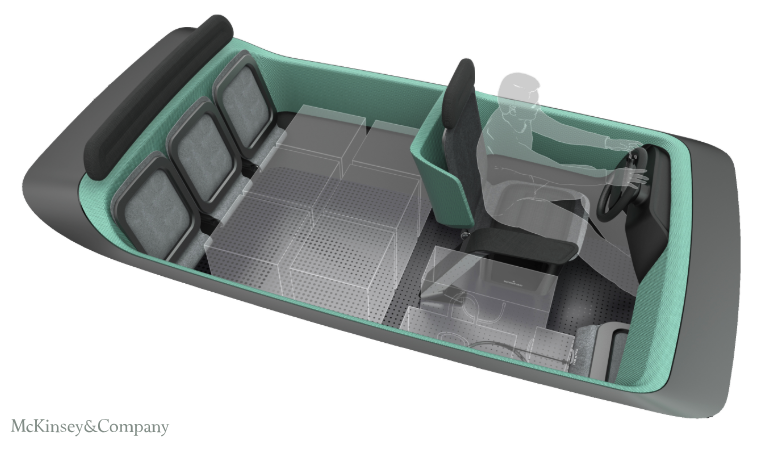

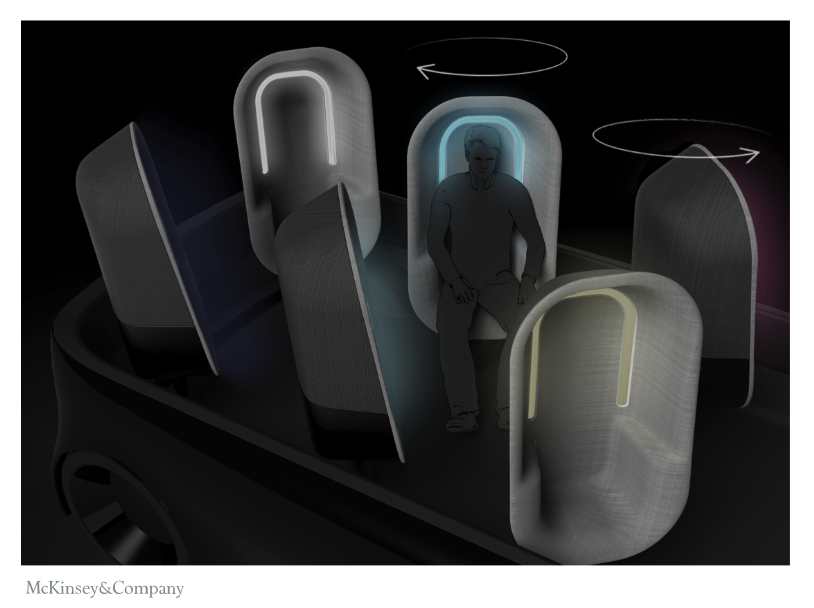

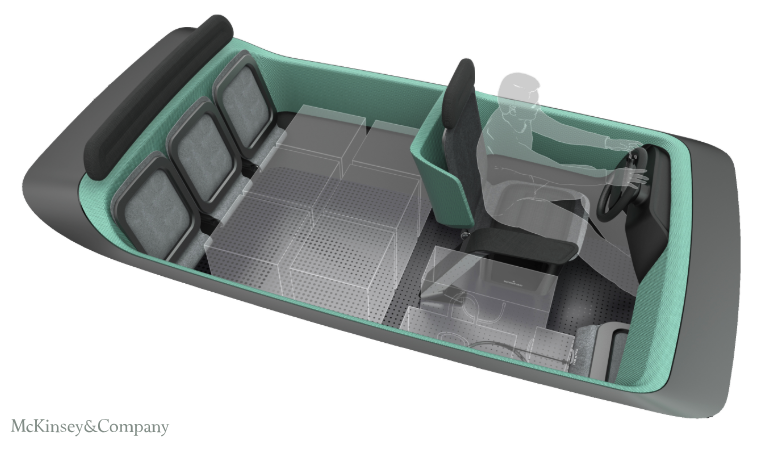

Unmanned vehicles will not only help rider-sharing companies get rid of the costs of paying drivers, but also attract new categories of customers who are still reluctant to use their services: for example, those who return home after shopping, families with children (who use very few due to difficulties with the availability of suitable seats), as well as regular customers (for example, daily getting to work this way), who are not always comfortable in the cabin with unfamiliar travel companions. To do this, you will have to change the interior of unmanned cars.

McKinsey , an unmanned vehicle design for multi-person transportation

McKinsey , an unmanned vehicle design for shopping delivery

Another development direction is bicycle rental: Uber entered this market in April 2018, having bought Jump Bikes and invested in the rental of electric scooters Lime, and Lyft acquired Motivate in July of the same year and launched a pilot project for the rental of electric scooters in Denver. At the same time, the market leaders Bird and Lime are already valued at $ 2 billion each.

There is a lot of talk in the financial markets about momentum and momentum, and often this is extremely subjective. Just because something grew by X last month does not mean continued growth. But often these trends should be taken into account, as they can shed some light on consumer behavior.

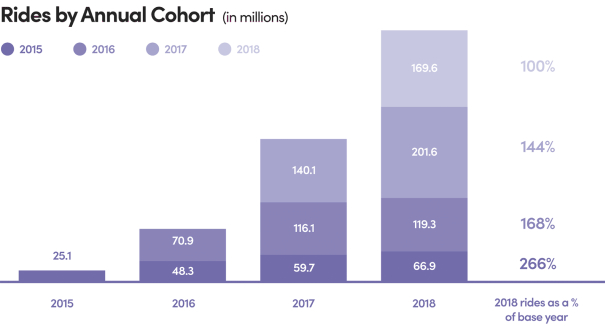

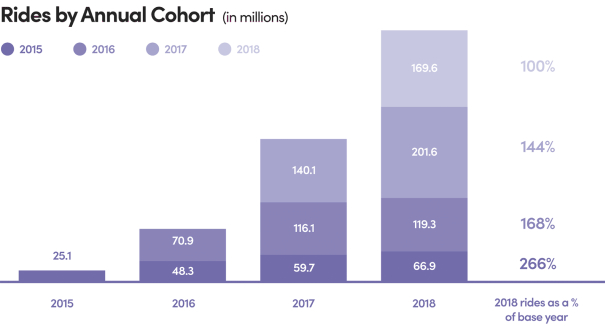

The statistics of trips made by existing Lyft customers look quite impressive. In this graph, customers are divided into cohorts by the year they are attracted.

As you can see, every year the number of trips of new customers is growing, as is the number of trips of those customers whom the company has attracted in past years. Lyft attracted about 13 million new customers in 2018 (an increase from 19 million to 31 million per year). Knowing the company's expenses on marketing and sales ($ 0.8 billion in 2018), we can approximately calculate the cost of attracting one client - about $ 70. At the same time, revenue per client per year is also approximately equal to $ 70 (on average, one client made 20 trips in 2018), but the company's margin is only half this amount. Thus, investments in attracting a client pay off only in two years, but in the light of statistics above, such expenses look quite justified.

The most important issue, which is equally relevant for Lyft and Uber, concerns their current profitability and profit prospects. Based on Lyft’s current operating indicators, their relative values and their dynamics over the past few years, we predict that the company will be able to break even in 2020 with continued growth of the business, but slowdown.

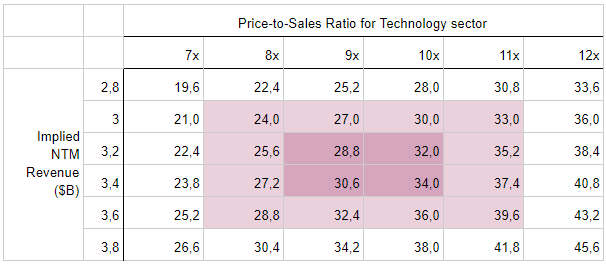

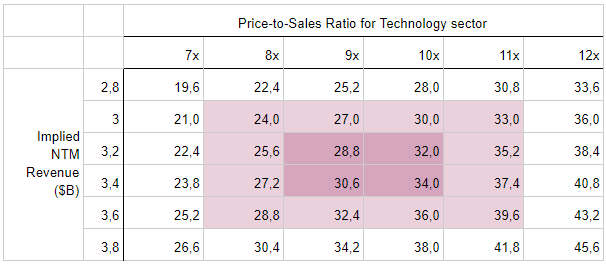

One of the most popular methods of evaluating a company for an IPO is a comparative analysis of the Price-to-Sales indicator, where Price is the cost of equity and Sales is the predicted revenue of the company in the next 12 months after the IPO.

Lyft is the first company to enter the IPO from the sharing economy segment, and there are no similar companies for comparison yet, but if Lyft is assigned to the US technological sector, then the average P / S is currently 10x.

In 2017 and 2018, the company's revenue was $ 1.06 billion and $ 2.16 billion, respectively. Lyft showed significant revenue growth over this period (209% and 103%). Given these indicators, in the baseline scenario, we forecast revenue of $ 3.2- $ 3.4 billion in 2019 (expected growth of 50%).

Thus, the expected market value of Lyft in the base case will be $ 31.3 billion. At the moment, it is known that Lyft will be placed in the range of $ 62-68 per share, which will give an estimate of $ 19.3 billion at the upper limit of the price range. It can be concluded that the growth potential of stocks on the market will be 62%.

When forecasting the return on investment, we take into account the difference between the price (pricing) and the fundamental value of the company (intrinsic valuation). The horizon of investing in an IPO is 1-3 months - in this case, increased investor interest is the determining driver of stock prices. In other words, investing in an IPO involves evaluating a company in terms of short-term demand, while evaluating a company for a buy-and-hold strategy involves predicting the fundamental or fair value of a company. Therefore, the comparative strategy is the most suitable valuation method for the first strategy, and the cash flow discounting method is the second.

Even if everyone around you wants to combine Uber and Lyft, from an investment point of view, this is probably a mistake. Yes, companies offer the same service, but their ambitions vary widely. Uber is an attempt to create a global monopoly, and Lyft wants to become a leader in the domestic market of ride sharing and to rethink the movement of people in urban space.

It is for this reason, and despite the smaller size of the company, Lyft may be a safer option in terms of investing in IPOs. We do not want to say that Lyft has no problems, but taking into account the global scale of the business and a series of scandals in the past, Uber has more not only drivers and passengers, but also problems and risks.

To talk about Lyft, Uber's competitor in the US and Canada, we translated the CCN article, supplemented it with numbers and presented our forecast. For UT, comparing these companies, their financial performance and product advantages is an extremely interesting topic. We hope for readers of Habr too. In any case, write in the comments.

As soon as plans to enter the IPO of the two largest ridersharing services became known, disputes about which company is best to invest in do not subside. It may seem that companies offer the same services, but upon closer examination, things are not so clear. In this article, we present five reasons why Lyft can be a serious threat to Uber and a more profitable investment.

Technically, Lyft looks like a classic unicorn worth more than $ 1 billion. However, in its IPO application, the company revealed a lot of interesting financial information. With this in mind, as well as metered-published data from Uber, for the first time we had the opportunity to compare the business of the two companies.

Data: Form S-1; figures for 2019 are a forecast.

1. Lyft grows faster than Uber

The fundamental difference between the two companies is their size. While Uber operates in nearly 70 countries, Lyft services are available in only 300 cities in the United States and Canada.

Someone might think that buying Uber shares would be a more reasonable investment due to the size of the company, but this is not entirely true. The larger the company, the higher the costs and operational risks it carries. As long as Uber remains under the watch of regulators, Lyft is present only in the USA and Canada and is not familiar with most of these problems.

As the younger brother oversees the older, so Lyft learns from the mistakes of Uber.

Both companies remain unprofitable, but let's take a look at the dynamics of their growth.

Lyft's revenue in 2018 grew 100% to $ 2.2 billion, while Uber’s revenue grew “only” 45% to $ 11 billion. In part, such a strong growth in Lyft is associated with an increase in commissions (from 23% to 27%), which may well be a temporary phenomenon. Therefore, it is better to look at the number of bookings: Lyft they grew by 76% compared to last year, and Uber by 45%. As you can see, the difference in growth rates is not so serious, especially when you consider that Uber is five times larger in size than Lyft.

However, these numbers clearly indicate that Lyft is growing faster. At the same time, interestingly, in the USA Lyft is growing, taking away market share from Uber: the company itself says about 39%, while Second Measure, which analyzes credit card payment data, estimates Lyft's share at 29% (and Uber - 69%). In terms of individual cities, these statistics look even more interesting: in Seattle, for example, Lyft's share is close to 50%.

Market share in terms of sales

Judging by the numbers above, Lyft's strategy to concentrate its efforts in the US market seems justified, which is largely facilitated by the liberal position of the country's regulatory authorities, which so far differs from the position of authorities in many countries where Uber operates.

2. Lyft's IPO boosts company confidence

If you argue hypothetically, the main obstacle to the use of ride sharing is the safety of the trip. All the passenger needs is to get to the destination safely and quickly. For both companies, this is number one priority. Of course, in those days when there were no alternatives to Uber on the market, the choice was obvious. But as we can see, Lyft is gradually taking away market share from Uber, which confirms the trust of customers in the drivers of this company.

By applying for an IPO and having every chance of becoming the first public company to advocate an innovative approach to passenger transportation, Lyft attracted the attention of the general public (and not least because now it is constantly compared with its direct competitor - Uber). In a niche where customer confidence in the company rules, declaring oneself as a public company is worth a lot. In addition, both Lyft founders, after changing the status of the company, will retain both their visionary and managerial roles in it, which contrasts very strongly with the history of the founder of Uber and can also add Lyft attractiveness both in the eyes of potential investors and its clients.

3. “Lyft drivers earn extra money in their free time, Uber drivers earn a living”

Lyft and Uber have different driver profiles - most Lyft drivers work part-time in their free time, while for Uber drivers this employment is their main source of income. This is confirmed by the available figures: the average driver Lyft earns $ 4.3 thousand per year, and this figure has been growing in recent years; and the average Uber driver earns $ 16.7 thousand per year (and the rate is down).

On average, 1 trip per day (or 326 trips per year) per Lyft driver, and 5 trips per day (1773 trips per year) per Uber driver. Uber has only 1.5 times more drivers than Lyft (3 million and 1.9 million drivers, respectively), although the size of the company’s business is 5 times larger.

At the same time, many drivers use the applications of both companies and they do not care what service a new order will come from. In this case, it is important that the small and less well-known company Lyft was able to achieve a sufficient number of available drivers who are satisfied with working with the company despite the fact that Lyft has significantly fewer customers than Uber.

Maintaining the availability of drivers in the cities where the service is present is a difficult task and a critical factor determining the choice of customers. After all, few people, having waited 20 minutes in the rain, will want to use this service at least once more. And the more drivers, the more customers: Lyft will be able to increase the number of cars available on the road as long as it is profitable for drivers.

4. Lyft seeks new customers and launches ridesharing of unmanned vehicles, bicycles and electric scooters

One of the major advantages of Uber as an object of investment on the expected IPO is its positioning itself not only as a taxi, but also as a food delivery service and the developer of a much more attractive technology for unmanned vehicles. Lyft is also investing in the development of unmanned vehicles, although there is little mention of this in public space.

In the development of progressive ideas for the development of urban transport companies go foot and foot. So, in April 2018 Lyft signed a five-year strategic partnership agreement with Magna, a manufacturer of spare parts and components for the automotive industry, according to which the companies will share technological developments in the field of unmanned vehicles with each other, and in October 2018, the company acquired a London-based developer of computer solutions View Blue Vision Labs.

In addition to its own development, Lyft also plans to allow third-party unmanned vehicle manufacturers to its platform (and customer base), which should accelerate the gradual transition to unmanned vehicles. Thus, in January 2018, the commercial use of unmanned vehicles (with a driver in the cabin) on the Lyft platform was launched in Las Vegas in Las Vegas: almost a year, passengers made more than 35,000 trips.

Unmanned vehicles will not only help rider-sharing companies get rid of the costs of paying drivers, but also attract new categories of customers who are still reluctant to use their services: for example, those who return home after shopping, families with children (who use very few due to difficulties with the availability of suitable seats), as well as regular customers (for example, daily getting to work this way), who are not always comfortable in the cabin with unfamiliar travel companions. To do this, you will have to change the interior of unmanned cars.

McKinsey , an unmanned vehicle design for multi-person transportation

McKinsey , an unmanned vehicle design for shopping delivery

Another development direction is bicycle rental: Uber entered this market in April 2018, having bought Jump Bikes and invested in the rental of electric scooters Lime, and Lyft acquired Motivate in July of the same year and launched a pilot project for the rental of electric scooters in Denver. At the same time, the market leaders Bird and Lime are already valued at $ 2 billion each.

5. Lyft enters breakeven

There is a lot of talk in the financial markets about momentum and momentum, and often this is extremely subjective. Just because something grew by X last month does not mean continued growth. But often these trends should be taken into account, as they can shed some light on consumer behavior.

The statistics of trips made by existing Lyft customers look quite impressive. In this graph, customers are divided into cohorts by the year they are attracted.

As you can see, every year the number of trips of new customers is growing, as is the number of trips of those customers whom the company has attracted in past years. Lyft attracted about 13 million new customers in 2018 (an increase from 19 million to 31 million per year). Knowing the company's expenses on marketing and sales ($ 0.8 billion in 2018), we can approximately calculate the cost of attracting one client - about $ 70. At the same time, revenue per client per year is also approximately equal to $ 70 (on average, one client made 20 trips in 2018), but the company's margin is only half this amount. Thus, investments in attracting a client pay off only in two years, but in the light of statistics above, such expenses look quite justified.

The most important issue, which is equally relevant for Lyft and Uber, concerns their current profitability and profit prospects. Based on Lyft’s current operating indicators, their relative values and their dynamics over the past few years, we predict that the company will be able to break even in 2020 with continued growth of the business, but slowdown.

United Traders Lyft Score

One of the most popular methods of evaluating a company for an IPO is a comparative analysis of the Price-to-Sales indicator, where Price is the cost of equity and Sales is the predicted revenue of the company in the next 12 months after the IPO.

Lyft is the first company to enter the IPO from the sharing economy segment, and there are no similar companies for comparison yet, but if Lyft is assigned to the US technological sector, then the average P / S is currently 10x.

In 2017 and 2018, the company's revenue was $ 1.06 billion and $ 2.16 billion, respectively. Lyft showed significant revenue growth over this period (209% and 103%). Given these indicators, in the baseline scenario, we forecast revenue of $ 3.2- $ 3.4 billion in 2019 (expected growth of 50%).

Thus, the expected market value of Lyft in the base case will be $ 31.3 billion. At the moment, it is known that Lyft will be placed in the range of $ 62-68 per share, which will give an estimate of $ 19.3 billion at the upper limit of the price range. It can be concluded that the growth potential of stocks on the market will be 62%.

When forecasting the return on investment, we take into account the difference between the price (pricing) and the fundamental value of the company (intrinsic valuation). The horizon of investing in an IPO is 1-3 months - in this case, increased investor interest is the determining driver of stock prices. In other words, investing in an IPO involves evaluating a company in terms of short-term demand, while evaluating a company for a buy-and-hold strategy involves predicting the fundamental or fair value of a company. Therefore, the comparative strategy is the most suitable valuation method for the first strategy, and the cash flow discounting method is the second.

So why Lyft?

Even if everyone around you wants to combine Uber and Lyft, from an investment point of view, this is probably a mistake. Yes, companies offer the same service, but their ambitions vary widely. Uber is an attempt to create a global monopoly, and Lyft wants to become a leader in the domestic market of ride sharing and to rethink the movement of people in urban space.

It is for this reason, and despite the smaller size of the company, Lyft may be a safer option in terms of investing in IPOs. We do not want to say that Lyft has no problems, but taking into account the global scale of the business and a series of scandals in the past, Uber has more not only drivers and passengers, but also problems and risks.

Only registered users can participate in the survey. Please come in.

Uber or Lyft?

- 33.3% Uber 11

- 66.6% Lyft 22