How to save finances: Ways to minimize risks when investing on the stock exchange

In our blogs on Habré and Geektimes, we write a lot about stock trading - we analyze the algorithms of trading strategies and talk about existing technologies. However, many people are frightened by the risk of losing their money when investing - especially when it comes to savings.

In the modern financial market, there are effective ways to minimize such risks up to their complete elimination - and we are not talking about bank deposits. For example, these include an individual investment account (IIS) and structured products.

IIS Accounts: Investments and Tax Credits

Since January 1, 2015, a new financial instrument has been launched in Russia that allows you to make low-risk investments on the exchange and receive tax benefits - it is called an individual investment account (IIA).

In fact, IIS is a special brokerage account into which you can deposit up to 400 thousand rubles, which must be on it for at least three years. With the help of accounts of this type, you can receive tax benefits of two types.

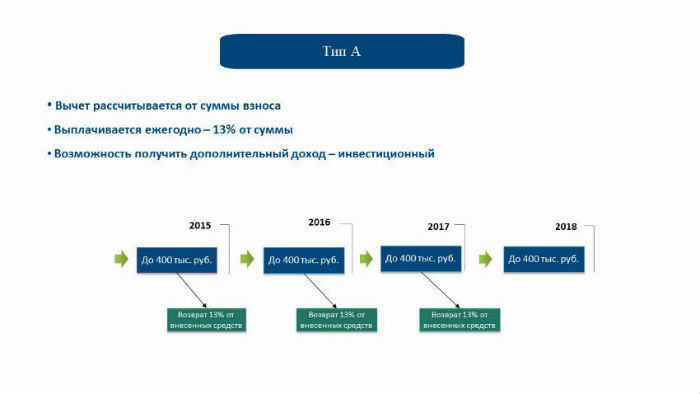

The first of these is a tax deduction of 13% of the amount deposited to the account. This type of account is suitable for people who are not going to engage in active investments, but simply want to keep their finances, having received some benefit from them.

It works like this - if a person in the current 2015 deposited (or will deposit), for example, the same 400 thousand rubles, then a tax deduction of 52 thousand rubles (13%) for this year will be returned to him. Moreover, you can make money even by December, and already in January 2016 receive a deduction.

At the same time, it is not necessary to carry out any operations on the exchange with the help of your investment account - although no one forbids doing this. You can simply deposit money into the account and receive a deduction from them once. If investments are nevertheless made, then the right to a deduction is retained - in our example, it will be possible to get 52 thousand deductions and what can be earned by buying and selling, for example, shares.

Parameters of IIS accounts of the first type

The minus of accounts of this type can be called the need to “freeze” money for them for three years - if the investor receives a tax deduction in the first year, and then withdraws money from the account, then the payment will have to be returned.

In this case, of course, you can deposit money into the account every year and receive deductions from the “new” amounts, but these additional injections will also be frozen in the account until the end of the third year of its existence. If we assume that 400 thousand rubles are paid each year, then for three years the account will be “blocked” (conditionally, you can use this money for investments anyway) 1.2 million rubles, which can be withdrawn without the need for a tax deduction only after this period. This option, obviously, is not suitable for everyone.

The privilege of the second type is designed for people who not only put money into the account, but also actively use it to invest in various financial instruments: bonds, stocks, currency, and so on - the benefit is that there are no restrictions on what to invest in .

In this case, if the profit from trading for three years exceeds 100% of the amount initially deposited in the account, then this money is exempted from having to pay income tax - for comparison, when working on the exchange using “regular” brokerage accounts, the tax profit must always be paid.

Parameters of IIA accounts

The important point is that to determine the type of desired benefit - tax deduction or exemption from income tax - the holder of an individual investment account may not immediately, but even at the end of the third year of existence of the account, weighing the pros and cons in the current situation.

A low-risk investment option using IIS accounts is to work with federal loan bonds (OFZ). The yield on such bonds is guaranteed by the state (now the yield is about 10%). Circumstances in which the state will not be able to fulfill such obligations is a default, in which problems will arise in the country's banking system (with corresponding consequences for household deposits).

Therefore, the owner of the IIS can count on income from OFZ plus the same tax deduction of 13%. The result is a total return that is higher than can be calculated in the case of bank deposits.

In addition, there are more complex options for using IMS, which can offer financial organizations that have their own brokerage and banking units. For example, you can create an IIA account, receive a deduction of 13%, and for the next two years this account will be equated to a regular deposit (with appropriate interest), but it will not be possible to withdraw money until the end of the third year of storage.

You can learn more about IIS and options for using this account from our video:

To open an IIS account, you need to fill out an application on the website of the selected broker - here is the form on the ITinvest website .

Structured Products: Protecting Initial Investments

Another tool that allows the investor to receive a guarantee of complete protection of his initial money, even in the event of adverse market developments.

A structured product is a financial instrument that combines various assets and has a number of basic parameters:

- The level of capital protection (it may be different at the choice of the investor);

- validity period (half a year, year);

- underlying asset;

- Participation in rising or falling prices;

- Threshold prices;

- Participation rate.

There are various types of structured products that involve varying degrees of capital protection and investor participation in working with assets. That is, there is an opportunity to simply invest in a product that includes various assets already pre-formed by analysts of an investment company, or to independently configure such a combination.

For example, at ITinvest, customers can work with three types of capital-protected products.

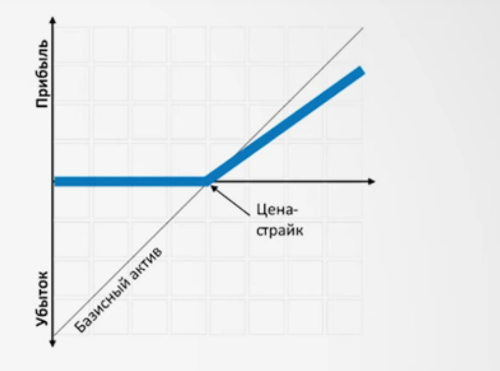

Notes featuring

In this case, the calculation is based on the growth of the underlying asset and volatility, and the possibility of a sharp fall in the underlying asset is also assumed. In this case, the client can choose full or partial protection of the initial amount of investment and receive unlimited profitability from operations with assets.

You can select several basic assets from which a structured product will be formed - for example, currency, stocks, futures or indices. As with any investment, there is credit risk. Also in this case, there is a likelihood of shortfalls in profit, since investments exclusively in one of the underlying assets, and not in a kind of basket of several financial instruments, may be more profitable under favorable circumstances.

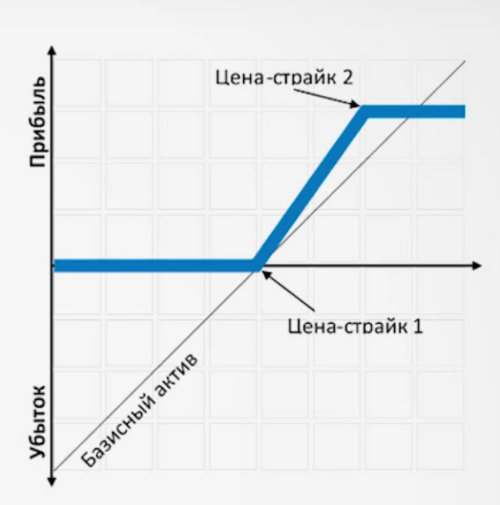

Limited Notes

They are characterized by moderate growth of the underlying asset and the possibility of a sharp fall. In general, this tool is similar to the previous one, except that the potential return is limited.

Consider using notes with limited participation as an example. If the investor has 1 million rubles that he invested in the dollar-ruble currency pair in June 2015, then the price was about 56 rubles per dollar. In this case, the strike price would be set, for example, 60 rubles per dollar, and the note would have expired in 102 days.

As we recall, in the summer of 2015, the dollar appreciated against the ruble (the chart can be seen, for example, on banki.ru website ), but the investor’s profit here would be limited to the price of 60 rubles.

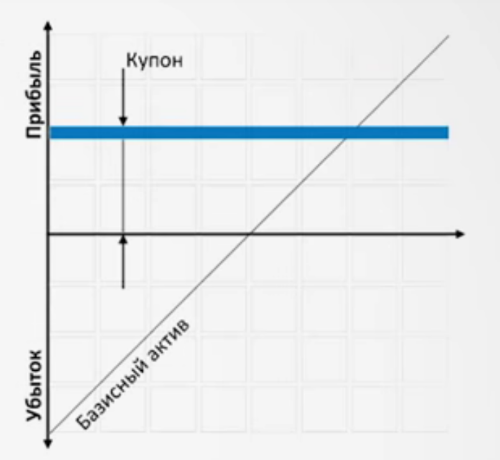

Coupon notes

Calculation of stabilization or reduction of rates in the fixed-income instruments market and reduction of credit risks. In this case, the investor receives full protection of the initial invested amount and a predetermined fixed coupon income from the selected instruments. At the moment, yields are held at 10-12% per annum.

Everything is like using a regular bank deposit. Also, as in the bank, there is credit risk - that is, in this case, the risk of default by the company that issued the bonds, obligations to their customers. This risk can be realized when the financial condition of the company worsens and lead to a partial or complete loss of funds by the client.

In the case of a bank, a license may be revoked from him, or he may go broke, then the client will receive only a part of his investments guaranteed by the deposit insurance system (if they exceeded 700 thousand rubles).

You can learn more about structured products and their use cases from our video:

Conclusion

Investment accounts and structured products are financial instruments that have been known for a long time and are used all over the world (analogues of the same IMS exist in the USA, Canada and Great Britain).

All this contributes, among other things, to the fact that in the West ordinary citizens take a significant part in the work of financial markets, whose main business is not speculation on the exchange. At the same time, the use of tools available on modern exchanges allows conditional teachers, doctors and office workers to save and increase their finances.

Gradually, more and more tools that allow you to easily understand the structure of the stock market and gain skills in evaluating various options for investment without too much risk are gradually appearing among Russians.

Other ITinvest exchange trading posts:

- Stock market: How are exchanges arranged and why are they needed?

- How to save finances: Banks vs Exchanges

- Stock Market Instruments: Derivatives

- Banks vs Exchanges: where it is more profitable to buy currency

- Stock Market and Saving Finances: How to Buy Gold Bars

- Stock Market Toolkit: What are Futures and How Do They Work?

- Stock market toolkit: what options are and how they work