What happened in the world of finance for week # 3

Hi Geektimes! We continue to publish reports on major events in the world of finance and the stock market.

The previous issue of the information digest can be found at this link .

Last week, already traditionally, the ruble continued to decline - at the Moscow Exchange, the Russian currency broke through the mark of 58 rubles per dollar, and the euro went up to 72.94 rubles.

The official dollar exchange rate set by the Central Bank on December 13, 2014 amounted to 56.8919 rubles. The official euro rate was set at around 70.5289 rubles.

The ruble fell along with lower oil prices - during the evening trading on the ICE Futures exchange, the price of Brent crude futures for delivery in January 2015 fell below $ 62 per barrel. At the opening of trading, a barrel of oil was given $ 63.28.

The decline in oil prices was caused, inter alia, by the news that the International Energy Agency (IEA) worsened the forecast for fuel demand in 2015 for the fourth time in five months - analysts believe that next year oil demand will not be 93.6 million barrels per day, and a total of 93.3 million barrels.

The OPEC organization of oil exporting countries is not conducive to rising prices either - their representatives said they did not plan to reduce oil production even if the price of black gold dropped to $ 40 per barrel.

Former Russian Finance Minister Alexei Kudrin made a forecast according to which the ruble will continue to fall. According to the expert, there will be no sharp drops over the next year, but in the next two or three years the domestic currency will weaken. The course will follow the price of oil - and according to Kudrin’s forecast, it will fall first to $ 50-60 per barrel, but against the backdrop of economic growth in the world, it may increase to $ 80 per barrel.

At the same time, international experts do not predict an increase in oil prices - in their opinion, the “shale revolution” in the US has radically changed the energy market, and you can forget about the three-digit oil prices.

ITinvest analyst Dmitry Solodin also does not see any prerequisites for the strengthening of the ruble in the near future.

Last week, the price of shares of Russian companies in foreign markets decreased (in particular, depository receipts for Yandex shares became cheaper).

Read also: Situation: Shares of Russian technology companies are getting cheaper again.

Here is how ITinvest chief economist Sergei Yegishyants describes this situation in his weekly review of world markets:

On Monday, trading on Russian stock exchanges opened with a multidirectional change in the indices - the MICEX index increased slightly (in the morning its value was 1469.59 points), and the RTS index calculated in dollars, on the contrary, fell even further - to 795.67 points.

ITinvest analyst Vasily Oleinik believes that Russian indices at the beginning of the week can, in general, expand their movement and begin to grow:

In 2015, Vasily Oleinik also spoke about the prospects of the Russian economy and the oil market with domestic experts Grigory Beglaryan and Vadim Pischikov:

That's all for today, thanks for watching. More analytical materials from leading experts on the ITinvest website .

Forex markets

Last week, already traditionally, the ruble continued to decline - at the Moscow Exchange, the Russian currency broke through the mark of 58 rubles per dollar, and the euro went up to 72.94 rubles.

The official dollar exchange rate set by the Central Bank on December 13, 2014 amounted to 56.8919 rubles. The official euro rate was set at around 70.5289 rubles.

The ruble fell along with lower oil prices - during the evening trading on the ICE Futures exchange, the price of Brent crude futures for delivery in January 2015 fell below $ 62 per barrel. At the opening of trading, a barrel of oil was given $ 63.28.

The decline in oil prices was caused, inter alia, by the news that the International Energy Agency (IEA) worsened the forecast for fuel demand in 2015 for the fourth time in five months - analysts believe that next year oil demand will not be 93.6 million barrels per day, and a total of 93.3 million barrels.

The OPEC organization of oil exporting countries is not conducive to rising prices either - their representatives said they did not plan to reduce oil production even if the price of black gold dropped to $ 40 per barrel.

“We are not going to change our minds because prices have come to $ 60 or $ 40,” said UAE Energy Minister Suheil al-Mazrui to Bloomberg.

Former Russian Finance Minister Alexei Kudrin made a forecast according to which the ruble will continue to fall. According to the expert, there will be no sharp drops over the next year, but in the next two or three years the domestic currency will weaken. The course will follow the price of oil - and according to Kudrin’s forecast, it will fall first to $ 50-60 per barrel, but against the backdrop of economic growth in the world, it may increase to $ 80 per barrel.

At the same time, international experts do not predict an increase in oil prices - in their opinion, the “shale revolution” in the US has radically changed the energy market, and you can forget about the three-digit oil prices.

ITinvest analyst Dmitry Solodin also does not see any prerequisites for the strengthening of the ruble in the near future.

Stock markets

Last week, the price of shares of Russian companies in foreign markets decreased (in particular, depository receipts for Yandex shares became cheaper).

Read also: Situation: Shares of Russian technology companies are getting cheaper again.

Here is how ITinvest chief economist Sergei Yegishyants describes this situation in his weekly review of world markets:

Russian stocks fall on their own - especially in foreign currency terms; it would be strange to expect otherwise - with a mess in the country's financial system and the weakness of the economy.

On Monday, trading on Russian stock exchanges opened with a multidirectional change in the indices - the MICEX index increased slightly (in the morning its value was 1469.59 points), and the RTS index calculated in dollars, on the contrary, fell even further - to 795.67 points.

ITinvest analyst Vasily Oleinik believes that Russian indices at the beginning of the week can, in general, expand their movement and begin to grow:

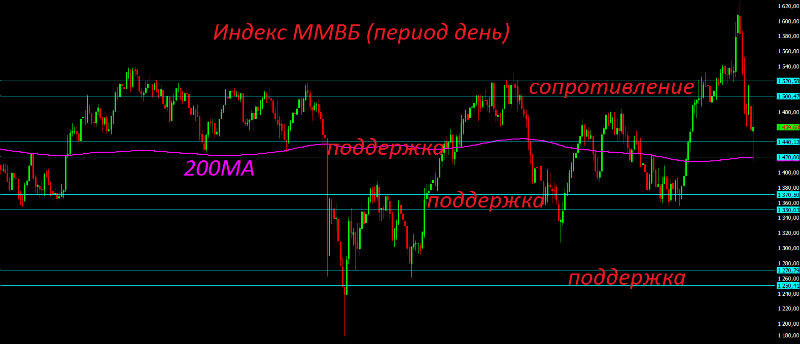

From a technical point of view, Russian indices came close to resistance levels, from which a technical rebound may well take place. The MICEX index on Friday tested the strength of the range 1420-1440, where there is strong support and a 200-day moving from which the index showed a rebound.

[...]

Last week, the RTS currency index closed below 800 points. From a technical point of view, in the monthly period, the price has not yet reached strong support at around 700 points, but in the weekly period, the price can easily turn around from the lower border of the downward channel, which runs near the mark of 780 points.

Do not forget about the most important internal event of the day - a quarterly expiration. It is possible that it was under it that major players tried to lower the RTS currency index as low as possible, because the rates on derivatives are not very small, and on the ruble too. Perhaps it is after expiration that the long-awaited reversal of the Russian currency and the RTS currency index will begin.

In 2015, Vasily Oleinik also spoke about the prospects of the Russian economy and the oil market with domestic experts Grigory Beglaryan and Vadim Pischikov:

That's all for today, thanks for watching. More analytical materials from leading experts on the ITinvest website .