How chatbots give intelligence to Sberbank IT projects

A generation that is used to chatting is already actively using financial services. The customer experience of this audience is in messengers, and business has to follow after it.

The direction of chatbots began in SberTech thanks to the Sberbank-Fellow traveler internal social project, then it was further developed in several more projects. About pilot projects - under the cut ...

It is worth recognizing that there are already a lot of developments in the field of chat bots and recognition of the natural language of queries. However, most of the open libraries and major speech transformation projects focus on English. The Russian language from this point of view has its own nuances. And although Russia also has interested teams, in particular, in large technical universities or private companies, such as Yandex, Mail.ru and SberTech, there are not so many ready-made industrial solutions. And the tasks for the Russian-speaking business are no less ambitious than for the English-speaking ones.

Today we want to talk about what successes we have achieved in the field of chat bots and machine learning.

I must say that commercial solutions that are sufficiently customizable for the needs of a particular company do not yet exist - the industry itself is still too young. There are projects from private researchers, for example, for technical support, but this is still the initial version of the technology that allows categorizing calls. Moreover, not a single solution is ready for such a scale of work as that of Sberbank - for the analysis of such a large amount of information with a huge number of customers. Deep analysis tools are only emerging in the world. And in fact, from these basic tools, our company’s specialists develop their own customized products for the tasks of Sberbank.

Currently there are four significant projects for the company. Next is more about each of them.

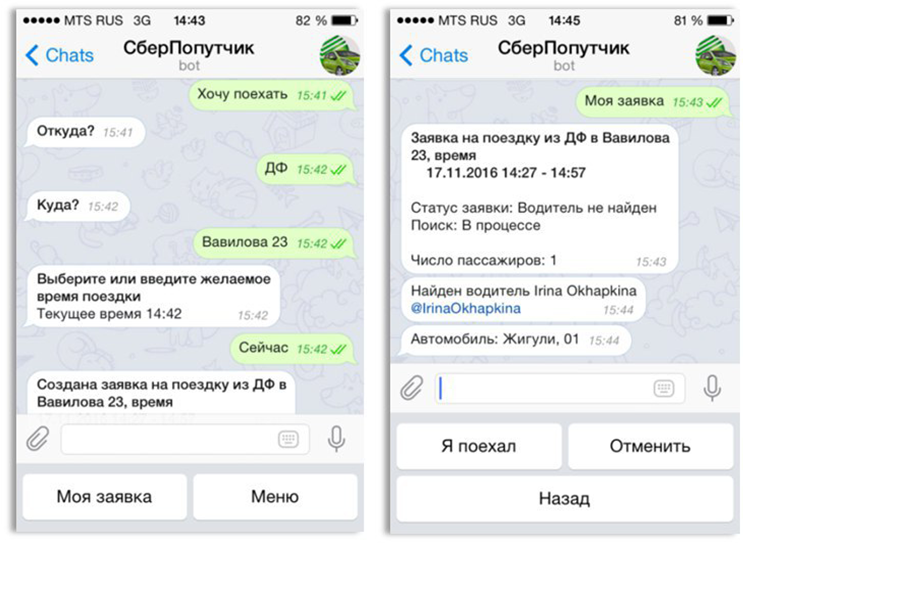

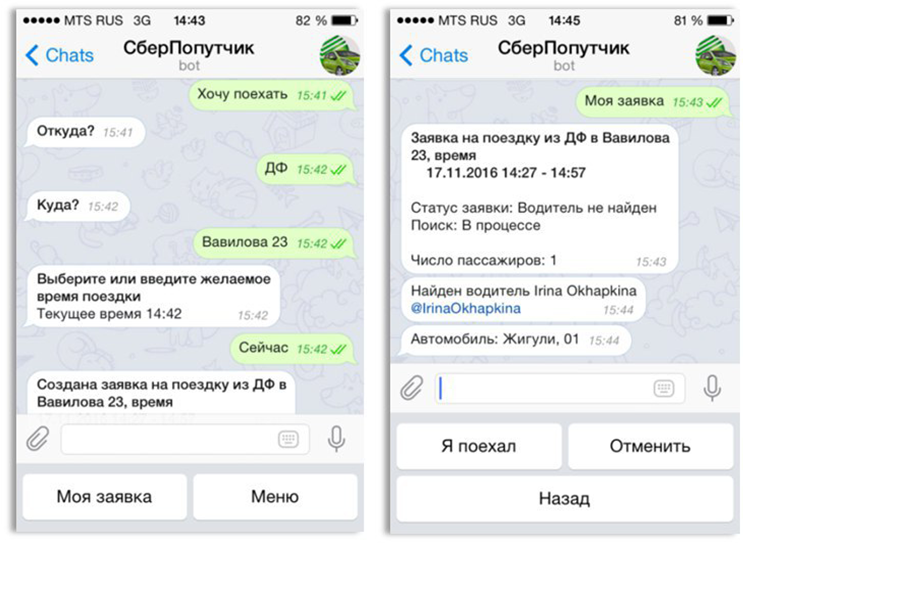

With the project "Sberbank Fellow traveler" the whole history of chat bots in the company began. On duty, Sberbank employees sometimes have to travel to remote branches, sometimes using several types of public transport. At the same time, their colleagues drive in approximately the same direction by car, with a few empty seats. It would be great to combine these employee flows by offering the company to travel alone and the ability to quickly get to work for others.

Moreover, in our country, people do not really like to give each other a lift, worrying about their safety. But internal Customer Development showed that colleagues in a company with a strong security service trust each other to a greater extent, even if they are not personally acquainted. So the idea came up to create some kind of internal community, with the help of which people could look for each other for joint trips to and from work.

As a community engine, a chatbot platform has been developed.

For about a year, employees of a number of offices have been running a pilot project. The resulting service has proven itself so well that now we are discussing the expansion of its functionality. In particular, third-party carriers - taxi services are already ready to connect to the project. It is also planned to replicate the project to all departments.

Moreover, the project is preparing to go beyond the internal kitchen of Sberbank. Sberbank community, of course, will not open outward, but partner organizations (carriers) may well replicate this successful experience to other companies or create their own community.

Another early project that utilized the developed chatbot platform is a payment bot. It was put into pilot operation at the beginning of this year (i.e. it was born about six months earlier than the similar solution presented by Google at the Google I / O 2017 conference in the spring).

In principle, the conversation went about choosing some services with the help of bots for quite some time - such systems are already widespread around the world. But the main feature was the ability to use free formulations (rather than the prescribed set of commands), as well as to pay through the bot.

The pilot project was implemented in conjunction with a food delivery restaurant. Through the chat, it was possible to select food, while the bot suggested the best options for the user's request, remembered the tastes and the consumer basket and could prompt the dishes in the next order.

In fact, the pilot bot served as a food delivery service application. However, there are many services - there are many applications (you have to download and install your own for each provider). A chat bot is just one of the contacts on the phone, in fact it’s just a new channel for receiving the same service.

The chatbot for a corporate site was the first such project that went beyond the scope of the sandbox to the big world. Here, of course, the experience from the Fellow traveler and the payment bot is used, but more mature and Machine Learning algorithms for analyzing requests and searching for suitable answers are implemented.

The task of the chatbot is to communicate with customers via chat on the site, answering questions about the company's products, as well as accounts, loans and payment orders of the client himself (in the pilot version, the range of issues to be solved is limited by product data and account opening). To do this, the chatbot analyzes the information received from the client, gives answers to simple questions formulated in a natural language, or requests additional data if they are not enough in the initial request.

The bot is built on latent-semantic analysis technology that provides a search for the answer to a client’s question taking into account the context. The technique allows you to find the most relevant answer based on the keywords and context of the dialogue in the database of ready-made answers, which include various product FAQs.

In detail, it looks as follows. First, a customer request in natural language turns into a set of keywords. Each word in the model has a specific weight. Common words that are included in most queries have less weight, and words unique to this query have more weight. Thus, the query is transformed into a set of keywords with a certain weight, by which the database is searched: according to a special algorithm, the probability that the document from the answer database corresponds to the question posed is determined. The client is given the most relevant answer, and in his absence, the chat switches to the operator.

To evaluate the solution, feedback from clients on the work of the chat bot is collected - did they like the answer that the algorithm picked up. Together with this assessment, each chat allows you to refine the existing model and response database. If the chat switches to the operator, the answer selected by the employee also falls into the knowledge base of the bot.

A pilot project will be launched soon. While the “pilot” communication is accompanied by the operator, controlling the correctness of the answers selected by the bot. When a certain level of satisfaction of customers receiving such automatic replies is reached (and, accordingly, rather high marks from the staff accompanying the pilot), a decision will be made to put the chatbot into full operation. In the future, it is planned, on the one hand, to expand the range of issues that the bot deals with, and on the other, to completely replace with the bot a part of the communication of operators, at least on standard issues.

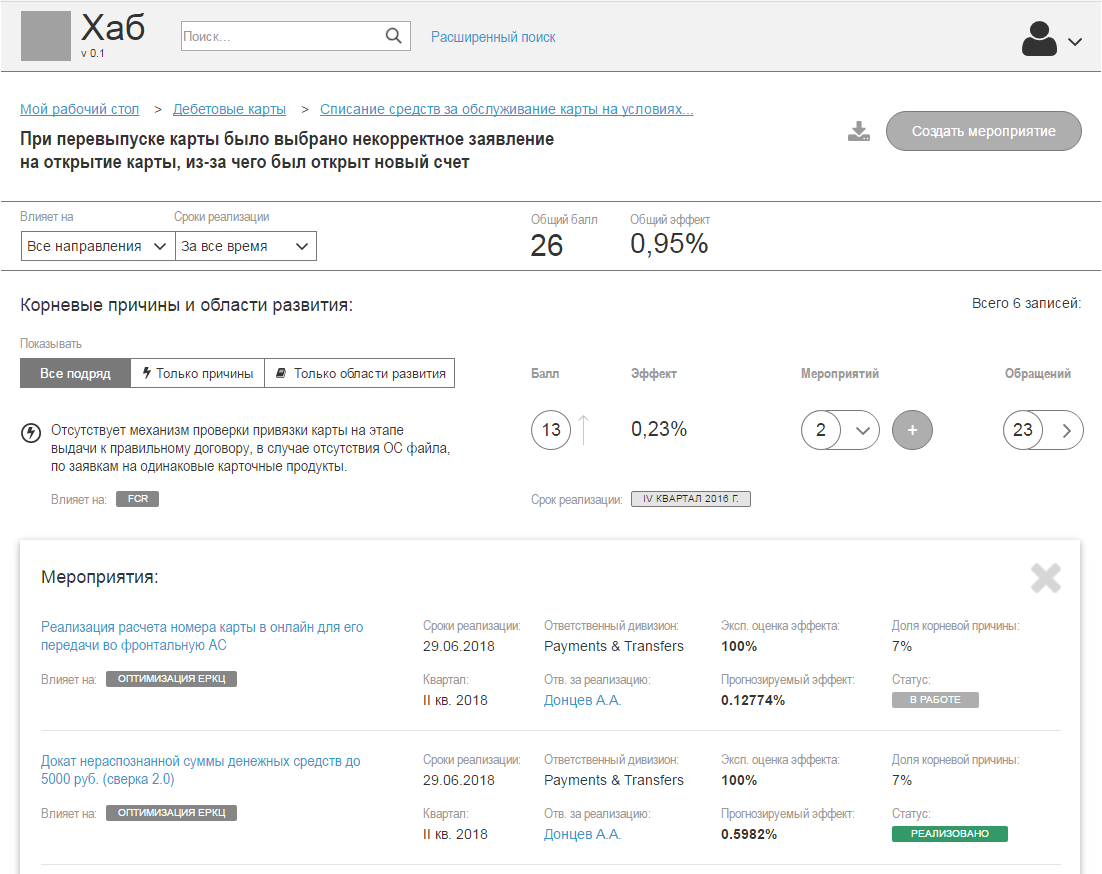

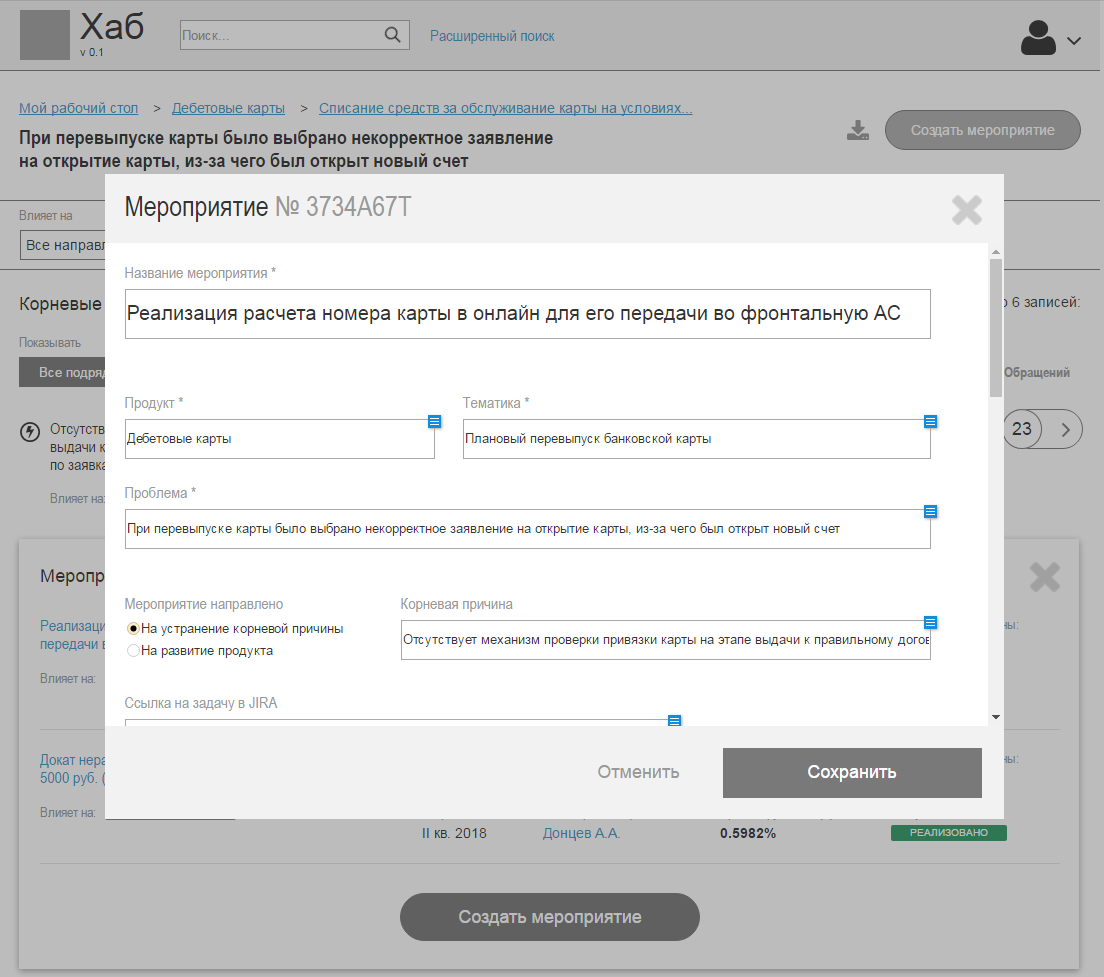

In a sense, this pilot project can be called the next evolutionary step of the entire chatbot platform. If the previous solutions somehow processed the requests, categorized them and searched for them in the existing knowledge base, then the ultimate goal of the client application processing system is to draw their own conclusions that may well affect Sberbank’s management strategy.

Around public companies, such as Sberbank, there is always some kind of information background. This can be either direct calls to the company through a feedback form or phone, or evaluations of services or products that are publicly expressed on the Internet - on personal customer pages on social networks, on reviews sites. Moreover, opinions can contain both positive and negative assessments of the Bank. It is assumed that the system will process all calls received through accessible channels, classify them (separate complaints or, conversely, gratitude, identify topics) and record trends at a higher level of abstraction - identify problems that most concern customers, identify products and services requiring close attention, prioritize.

In a way, this is a consumer opinion analysis system. But she not only collects data and carries out top-level cataloging according to the same method as the chat bot, but also reveals the essence. As an additional “bonus”, we can use it to create a profile of a client who is interested in certain services - we obtain a detailed cataloging of which segment of the audience and which products are interested. In addition, data can be viewed in various sections. For example, by analyzing all the channels in the complex, it is possible to identify complaints about different products, the essence of which will be reduced to the fact that in some department customers are simply poorly served. Those. an important factor may be the office, and not the parameters of any particular service.

The above are examples of the analysis of collected data arrays based on the assumption that we know what we are looking for. The important point is that the system is self-learning. We build a model based on the history of customer requests, supplementing it with new data as they become available, i.e. to a certain extent, each new treatment affects this model. As a result, the service allows us to solve a huge layer of problems associated with the selection of topics about which we initially do not know anything. For example, in circulation, a client can raise a topic that was not previously in the list of interests. The system allows you to add this topic to the list for monitoring, so that future applications are checked for compliance with the new topics as well.

The main consumer for this appeal analysis system is bank management, i.e. it can not be appreciated "outside". The system will allow management to stay closer to the real state of affairs: it is better to understand the general situation, the attitude of customers to the bank and its services.

So far, like other projects, the system exists in a pilot version. At the moment, she is focused on the analysis of appeals received through the feedback form. Now these are text calls, but in the future, voice will also be processed, since the main channel for communication with customers is just voice calls that will be translated into text and processed by the same tools.

An important aspect is the evaluation of the pilot. It will be performed by comparing the automatic cataloging of a certain treatment with a standard (our knowledge of what topic the treatment refers to). During the development of the model, this “distance” from the standard will be evaluated and minimized. An expert assessment is also expected from the bank.

In general, chatbots allow you to implement many ideas that affect the topic of interaction with the client in a natural language. As the embedded algorithms develop, we are able to refine previous projects. For example, if a business appears that is interested in a partnership within the framework of a payment bot, we can supplement it with more modern algorithms developed for the chat bot on the site and the system for analyzing customer requests. At the same time, we are sure that all this is only the first step in the direction of large-scale and interesting projects based on machine learning.

The material was prepared by the employees of the Central Committee for the development of billing technologies of SberTech:

nill2 , Danil Kabanov, director of the

aspera Central Committee , Ruslan Halimov, lead engineer

Stanislav Kim, development manager

The direction of chatbots began in SberTech thanks to the Sberbank-Fellow traveler internal social project, then it was further developed in several more projects. About pilot projects - under the cut ...

It is worth recognizing that there are already a lot of developments in the field of chat bots and recognition of the natural language of queries. However, most of the open libraries and major speech transformation projects focus on English. The Russian language from this point of view has its own nuances. And although Russia also has interested teams, in particular, in large technical universities or private companies, such as Yandex, Mail.ru and SberTech, there are not so many ready-made industrial solutions. And the tasks for the Russian-speaking business are no less ambitious than for the English-speaking ones.

Today we want to talk about what successes we have achieved in the field of chat bots and machine learning.

I must say that commercial solutions that are sufficiently customizable for the needs of a particular company do not yet exist - the industry itself is still too young. There are projects from private researchers, for example, for technical support, but this is still the initial version of the technology that allows categorizing calls. Moreover, not a single solution is ready for such a scale of work as that of Sberbank - for the analysis of such a large amount of information with a huge number of customers. Deep analysis tools are only emerging in the world. And in fact, from these basic tools, our company’s specialists develop their own customized products for the tasks of Sberbank.

Currently there are four significant projects for the company. Next is more about each of them.

Sberbank Travel companion

With the project "Sberbank Fellow traveler" the whole history of chat bots in the company began. On duty, Sberbank employees sometimes have to travel to remote branches, sometimes using several types of public transport. At the same time, their colleagues drive in approximately the same direction by car, with a few empty seats. It would be great to combine these employee flows by offering the company to travel alone and the ability to quickly get to work for others.

Moreover, in our country, people do not really like to give each other a lift, worrying about their safety. But internal Customer Development showed that colleagues in a company with a strong security service trust each other to a greater extent, even if they are not personally acquainted. So the idea came up to create some kind of internal community, with the help of which people could look for each other for joint trips to and from work.

As a community engine, a chatbot platform has been developed.

For about a year, employees of a number of offices have been running a pilot project. The resulting service has proven itself so well that now we are discussing the expansion of its functionality. In particular, third-party carriers - taxi services are already ready to connect to the project. It is also planned to replicate the project to all departments.

Moreover, the project is preparing to go beyond the internal kitchen of Sberbank. Sberbank community, of course, will not open outward, but partner organizations (carriers) may well replicate this successful experience to other companies or create their own community.

Payment bot

Another early project that utilized the developed chatbot platform is a payment bot. It was put into pilot operation at the beginning of this year (i.e. it was born about six months earlier than the similar solution presented by Google at the Google I / O 2017 conference in the spring).

In principle, the conversation went about choosing some services with the help of bots for quite some time - such systems are already widespread around the world. But the main feature was the ability to use free formulations (rather than the prescribed set of commands), as well as to pay through the bot.

The pilot project was implemented in conjunction with a food delivery restaurant. Through the chat, it was possible to select food, while the bot suggested the best options for the user's request, remembered the tastes and the consumer basket and could prompt the dishes in the next order.

In fact, the pilot bot served as a food delivery service application. However, there are many services - there are many applications (you have to download and install your own for each provider). A chat bot is just one of the contacts on the phone, in fact it’s just a new channel for receiving the same service.

Contact Center Chatbot

The chatbot for a corporate site was the first such project that went beyond the scope of the sandbox to the big world. Here, of course, the experience from the Fellow traveler and the payment bot is used, but more mature and Machine Learning algorithms for analyzing requests and searching for suitable answers are implemented.

The task of the chatbot is to communicate with customers via chat on the site, answering questions about the company's products, as well as accounts, loans and payment orders of the client himself (in the pilot version, the range of issues to be solved is limited by product data and account opening). To do this, the chatbot analyzes the information received from the client, gives answers to simple questions formulated in a natural language, or requests additional data if they are not enough in the initial request.

The bot is built on latent-semantic analysis technology that provides a search for the answer to a client’s question taking into account the context. The technique allows you to find the most relevant answer based on the keywords and context of the dialogue in the database of ready-made answers, which include various product FAQs.

In detail, it looks as follows. First, a customer request in natural language turns into a set of keywords. Each word in the model has a specific weight. Common words that are included in most queries have less weight, and words unique to this query have more weight. Thus, the query is transformed into a set of keywords with a certain weight, by which the database is searched: according to a special algorithm, the probability that the document from the answer database corresponds to the question posed is determined. The client is given the most relevant answer, and in his absence, the chat switches to the operator.

To evaluate the solution, feedback from clients on the work of the chat bot is collected - did they like the answer that the algorithm picked up. Together with this assessment, each chat allows you to refine the existing model and response database. If the chat switches to the operator, the answer selected by the employee also falls into the knowledge base of the bot.

A pilot project will be launched soon. While the “pilot” communication is accompanied by the operator, controlling the correctness of the answers selected by the bot. When a certain level of satisfaction of customers receiving such automatic replies is reached (and, accordingly, rather high marks from the staff accompanying the pilot), a decision will be made to put the chatbot into full operation. In the future, it is planned, on the one hand, to expand the range of issues that the bot deals with, and on the other, to completely replace with the bot a part of the communication of operators, at least on standard issues.

Client Call Processing System

In a sense, this pilot project can be called the next evolutionary step of the entire chatbot platform. If the previous solutions somehow processed the requests, categorized them and searched for them in the existing knowledge base, then the ultimate goal of the client application processing system is to draw their own conclusions that may well affect Sberbank’s management strategy.

Around public companies, such as Sberbank, there is always some kind of information background. This can be either direct calls to the company through a feedback form or phone, or evaluations of services or products that are publicly expressed on the Internet - on personal customer pages on social networks, on reviews sites. Moreover, opinions can contain both positive and negative assessments of the Bank. It is assumed that the system will process all calls received through accessible channels, classify them (separate complaints or, conversely, gratitude, identify topics) and record trends at a higher level of abstraction - identify problems that most concern customers, identify products and services requiring close attention, prioritize.

In a way, this is a consumer opinion analysis system. But she not only collects data and carries out top-level cataloging according to the same method as the chat bot, but also reveals the essence. As an additional “bonus”, we can use it to create a profile of a client who is interested in certain services - we obtain a detailed cataloging of which segment of the audience and which products are interested. In addition, data can be viewed in various sections. For example, by analyzing all the channels in the complex, it is possible to identify complaints about different products, the essence of which will be reduced to the fact that in some department customers are simply poorly served. Those. an important factor may be the office, and not the parameters of any particular service.

The above are examples of the analysis of collected data arrays based on the assumption that we know what we are looking for. The important point is that the system is self-learning. We build a model based on the history of customer requests, supplementing it with new data as they become available, i.e. to a certain extent, each new treatment affects this model. As a result, the service allows us to solve a huge layer of problems associated with the selection of topics about which we initially do not know anything. For example, in circulation, a client can raise a topic that was not previously in the list of interests. The system allows you to add this topic to the list for monitoring, so that future applications are checked for compliance with the new topics as well.

The main consumer for this appeal analysis system is bank management, i.e. it can not be appreciated "outside". The system will allow management to stay closer to the real state of affairs: it is better to understand the general situation, the attitude of customers to the bank and its services.

So far, like other projects, the system exists in a pilot version. At the moment, she is focused on the analysis of appeals received through the feedback form. Now these are text calls, but in the future, voice will also be processed, since the main channel for communication with customers is just voice calls that will be translated into text and processed by the same tools.

An important aspect is the evaluation of the pilot. It will be performed by comparing the automatic cataloging of a certain treatment with a standard (our knowledge of what topic the treatment refers to). During the development of the model, this “distance” from the standard will be evaluated and minimized. An expert assessment is also expected from the bank.

In general, chatbots allow you to implement many ideas that affect the topic of interaction with the client in a natural language. As the embedded algorithms develop, we are able to refine previous projects. For example, if a business appears that is interested in a partnership within the framework of a payment bot, we can supplement it with more modern algorithms developed for the chat bot on the site and the system for analyzing customer requests. At the same time, we are sure that all this is only the first step in the direction of large-scale and interesting projects based on machine learning.

The material was prepared by the employees of the Central Committee for the development of billing technologies of SberTech:

nill2 , Danil Kabanov, director of the

aspera Central Committee , Ruslan Halimov, lead engineer

Stanislav Kim, development manager