How can a freelancer open a company in Latvia and what are the benefits?

- Tutorial

1. Introduction

Hello everyone, my name is Vladislav, I am from Russia, and I am a freelance programmer. Now on Habré a very popular topic is legal and tax issues when working with Upwork, how to receive and declare fees from foreign customers, and so on.

I also studied these issues for quite some time. Russian legislation on these issues is highly regulated, and all these laws and regulations cause a lot of problems for freelancers working on the foreign market. As a result, I decided to transfer my “business” to another jurisdiction. Having studied all the possible options, I chose this way - register an LLC company in Latvia, and accept payments from customers for this company. That is, just move your business from Russia to Latvia.

I have been working in this format for a year now, I have encountered various problems and appreciated the pros and cons. In the end, I decided that in total I benefited from such a decision. In the comments to articles on freelance, I periodically read questions such as “How to work for customers from the USA”, “How to pay taxes on payments with Upwork”, and therefore I decided to share my experience, especially since I have never seen such articles anywhere .

2. Key findings and results

In short, the conclusions are:

- Monthly expenses - from 150 euros if you are idle, and about 350-400 if the work is going well. This is not counting bank fees for payments and transfers, they are highly dependent on the bank. So, it makes sense to transfer your freelance to Latvia when you already earn from $ 1000 per month, otherwise there is a big risk that you will not “pull”

- The main plus - no currency control, accept payments from any country in the world without restrictions

- Accept payments from both legal entities and individuals. Directly to a bank account. Online booking offices? No, have not heard

- You can work with PayPal, receive payments and pay for services. Almost all of my US customers preferred not to mess with documents and banks, but simply pay via PayPal, and nothing else. If you are a freelancer from Russia and you are rubbing some American game about SWIFT transfers, contracts, acts of work done for currency control, etc., he will just send you away and choose a freelancer with a more convenient payment method

- If we talk about cons, the main minus is taxes. Since I am the founder of the company, I am the director and I pay myself the minimum wage. Together with my salary, I pay taxes of 200 euros every month. If you do not earn very much, then taxes will break a sensitive gap in your budget.

- The second minus - at the initial stage you will often have to be in Latvia, solve any problems that arise with the bank, with the State Revenue Service and with the accountant. Prepare money for airline tickets and make a multi-visa Schengen. On the other hand, Latvia is still easily accessible, I can’t imagine what I would do if I registered a company somewhere in Hong Kong or in the Bahamas

- Another minus is that you have to hire an accounting outsourcing firm to conduct your business. Latvia has its own laws on accounting, its own tax reporting systems via the Internet, plus all the documents in the Latvian language ... In general, I did not understand, and just found an accountant to keep accounts for me. For accounting services I pay 100 euros per month

- As a bonus, you can write off some of your expenses as expenses of the company. From the company’s account I usually pay for airline tickets, hotels, purchase of electronics, hosting. If you are a freelance traveler, you can arrange yourself on a “business trip” and charge yourself a per diem. Just periodically bring your accountant with all checks, invoices, boarding passes, tickets, and you will be able to compensate for your expenses

- For the customer, you now look much more solid - not an individual entrepreneur in Russia, but a legal entity in Europe. You can make yourself beautiful business cards and give out at conferences. A trifle, but nice

- Register a domain and website for a company in Latvia, and you can forget about FZ-152 “On personal data”, about which there were many articles on Habré. Your site is now in the jurisdiction of the European Union. On the other hand, you now need to show a notification that your site uses cookies ...

3. Where to start and steps

If you decide to register a company in Latvia, your route will be something like this:

- Company registration (address, registered capital, etc.)

- Hiring accountant

- Opening a bank account

- Getting a PVN number

- Preparing PayPal, Upwork, getting started with customers

All of the above can cost 800-1000 euros and take 2-3 weeks. Also, for the first couple of months, under the law of meanness, there may be some kind of hitch, either with the bank, or with the State Revenue Service, or with something else. Therefore, I recommend having a Schengen multivisa and staying close to Latvia, so that if necessary you can get in there to solve the problems that have arisen. When all stages have been completed, the first payments will go, the money will be successfully withdrawn - you can relax and freelance in Russia or anywhere in the world by visiting your accountant in Latvia a couple of times a year.

Well, first I will talk about all the steps in order, and at the very end of the article will be about the sweetest thing - the withdrawal of money.

4. Step by step

4.1 Company registration

4.1.1 General information

Any non-resident can open a company in Latvia, there are practically no restrictions. The most popular form, an analogue of our LLC - SIA, Sabiedrība ar ierobežotu atbildību. In order to open a company, you need to have an address and registered capital.

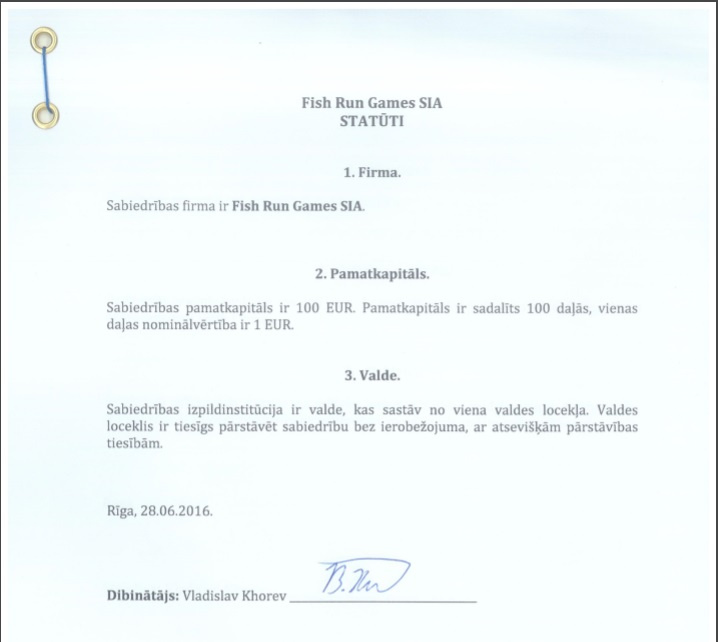

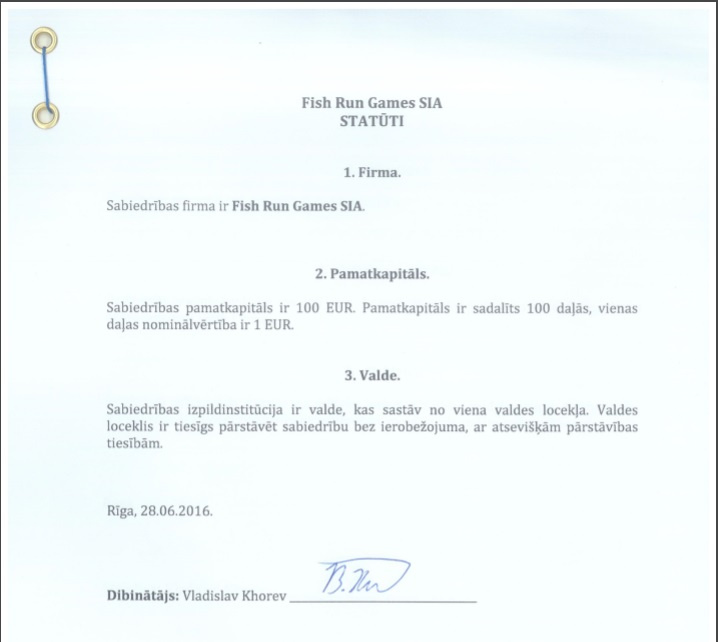

By the way, this is what the typical charter of LLC in Latvia looks like (compare with the charter of LLC in Russia):

Statuti

4.1.2 Address

The address to receive is not a problem. There are many companies in Latvia that provide the services of a “virtual office”. You pay them and they register you with them, receive your mail for you, answer calls and confirm to everyone that your company is here.

You must obtain the consent of the owner to register a legal address and an agreement on the provision of a legal address. As for correspondence - you need to arrange for them to notify you of letters, and you need to inform the accountant so that he picks them up periodically (I will write about the accountant below).

In general, in theory, it is not very good that there are many companies located at one address, but as I understand it, this can not serve as a basis for refusing registration. Consent of the owner of the premises is - it means the company will register you.

Also, when registering a virtual office, you can get documents for registration of an enterprise for a small fee - an application, charter, decision on establishment, etc. Choose a name for your company, choose an occupation. In my case, it is “Datorprogrammēšana”, “Activities in the field of computer programming” (62.01, version 2.0).

My legal address for the year cost 363 euros (300 euros + 21% VAT), and paperwork - 50 euros. The state duty for registration is about 22 euros. If I opened a company with a registered capital of 2800 euros (more on that below), then the duty would be about 140 euros. Keep all receipts for the services provided, then you can write them off as expenses.

4.1.3 Share capital

The authorized capital should be 2800 euros or more for a regular SIA or from 1 to 2799 euros for a small capital SIA. In the second case, there will be some restrictions on the founders, restrictions on receiving dividends, you will not be able to obtain a residence permit through this company and some other little things.

I registered SIA with a registered capital of 100 euros. For small freelance this is enough.

Subsequently, if you want, you can increase the authorized capital up to 2800 euros and remove the above restrictions. Even if you do not have the full amount, you can replenish the account and immediately withdraw money “under the report”. Your accountant will tell you in detail about how to do this (I will write about the accountant below).

4.1.4 Company registration

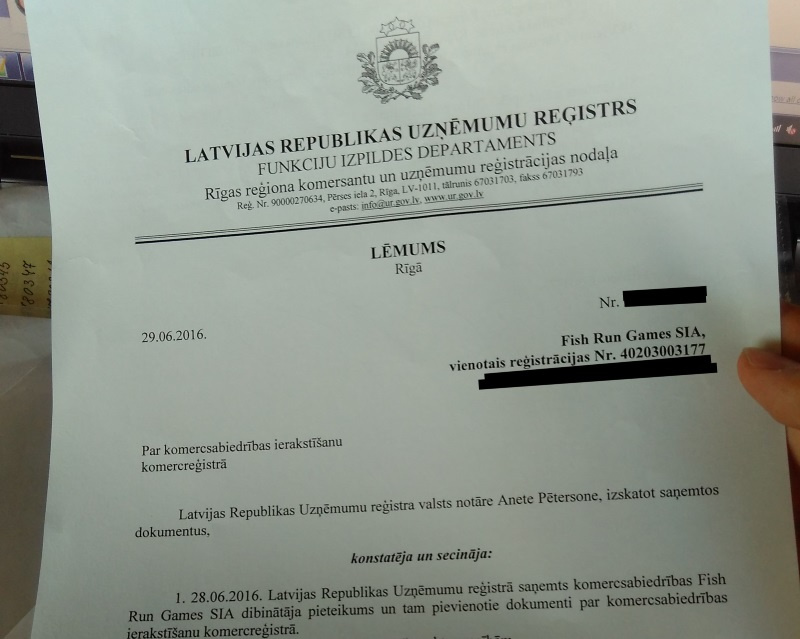

With all the documents, go to the enterprise register (Uzņēmumu reģistrs). There is a queue, but the registry staff are friendly, they know Russian and will help you if something happens.

Somewhere in 3 days the company will be registered. How to find out: go to the Lursoft lursoft.lv website and enter the name of your company in the search. If the company is found, then the company is successfully registered. Record your company registration number. Now you can go to the bank to open a current account and apply for a PVN number.

You can arrange a company for 1 day, if you pay a state fee in three times.

4.2 Printing

You do not need to have a seal, but if you want to withdraw money through IP in Russia, then for making payments through currency control you better make yourself a cool seal. There are several companies in Riga that make prints; go to any of them. Personally, I just noticed a sign during my motions in Riga. You will need documents received in the Register of Enterprises. The cost of printing is approximately 15-20 euros.

4.3 Taxes in Latvia

Taxes in Latvia are managed by the State Revenue Service (Valsts ieņēmumu dienests).

The most significant taxes you will pay are salary. You are considered the founder of the company and the only employee, and must pay your own salary. And, of course, payroll taxes are income, social, and unemployment taxes. Every month, until the 25th. I wrote about salary taxes in the salary section below.

If you had a profit last year, then you need to pay a 15% income tax for the past, and the same tax in advance for the current year. If you have more profit for the year, then pay, if not, then it will be returned to you.

If you withdraw dividends, then you, as a resident of Russia, must pay tax on dividends in Russia, and report this to the Latvian tax. I have not yet paid dividends, so I can’t say the details, sorry.

There is also a value added tax (PVN - Pievienotās vērtības nodoklis), but it is only levied for settlements within Latvia. If your customers are not in Latvia (as it was in my case), then you do not pay PVN. Nevertheless, you need to register as a PVN payer and get a PVN number, if only because it should be specified in the PayPal and Upwork settings. I’ll talk about getting a PVN number below.

On taxes, that's all. In more detail about taxes, salaries and a PVN number you will be told by an accountant hired by you.

4.4 Accountant

There are many companies in Latvia that offer accounting services and company support, as well as many freelance accountants. Choose anyone based on the cost of services, reviews, personal likes, etc. I recommend doing this as early as possible. An accountant will advise you and help you avoid problems.

As I said, accounting services cost me 100 euros per month, maybe you will find an accountant a little cheaper or more expensive.

Your interaction with the accountant will be as follows. At the first stage, your accountant registers your company in the state electronic reporting system. To do this, you and the accountant go together to the State Revenue Service, where you must provide documents from the Register of Enterprises, and also indicate the email address where notifications will fall. I recommend creating one email address specifically for the State Revenue Service and giving access to the accountant. Or make an email redirection to an accountant.

After the electronic office has been opened, your accountant will take you to work and will accrue working hours, salary and salary taxes, and will submit reports through this system, as well as conduct correspondence with the State Revenue Service if necessary.

The State Revenue Service may send you regular letters to the legal address where your company is registered. You must arrange with the accountant so that the accountant picks up correspondence and responds to these letters. Do not ignore these letters, if you do not respond, your company may be closed.

The next thing that an accountant should do for you is to issue you a PVN number. This is also a small quest, I wrote about this in the next section.

When the company is registered, the PVN number is received, the current account is open, you will interact with the accountant about 1 time per month - you will send to the accountant all your statements and accounts (received and sent), and the accountant will write to you what taxes on which details you need pay, and how much money you can transfer yourself.

Also, if you need supporting documents that you are the founder of a company in Latvia and receive a salary (for a visa or for opening a bank account as an individual), an accountant will also request and prepare them for you.

And of course, an accountant will help you write off expenses and withdraw money, more on this at the end of the article.

4.5 Issuing a PVN number

After the company is registered, you must apply for registration of the PVN number. This is done by an accountant through an electronic reporting system. Some time after you have submitted an application, the State Revenue Service will send a letter to your legal address asking you to come and tell us about your business. This letter cannot be ignored, you must come or arrange for another time.

At the appointed time, you and the accountant come to the State Revenue Service and a special employee conducts an interview with you, fills out a questionnaire about you and asks questions to make a decision on issuing a PVN number.

In my case, I already had a signed contract with the customer and experience in freelance in Russia. I came with an agreement, brought an extract from the Unified State Register of Enterprises of Regions that I have been an individual entrepreneur in Russia since 2014 and my tax returns to the simplified tax system for 2014 and 2015. That was enough. The employee of the State Revenue Service was very polite and spoke good Russian. In general, civil servants in Latvia, in my opinion, are polite and friendly, and work well.

4.6 Bank

What really struck me was the banks.

I’m used to Russian banks, where you are a welcome customer and any bank will be happy to offer you its services. Alas, in Europe this is not so. In Latvia, banks will meticulously examine you from all sides, force you to fill out 100,500 questionnaires, and present evidence of your activities.

For all the time of my work, it’s not the state, namely the banks in Latvia that have given me the most problems. In the bank you will need to communicate with living people, you will prove to the manager that your intentions are clean, you will not launder money, you will not finance terrorism, and that your cooperation with the bank will benefit them.

I do not know if all banks in Europe have such an attitude towards non-residents. The only thing that can be a plus for banks in Latvia is that you can speak with a bank employee in Russian, many Russians also run their own business here, so negotiating becomes a little easier. If I opened a business in another European country, maybe there would be even more questions for me.

As in the case of an interview for a PVN number, it helped me that I had experience working as a freelancer in Russia and that at that time I had already concluded a contract with the customer. I presented the contract and my tax return for 2014 and 2015 to the bank. If you don’t have a contract, I don’t know what you can show ... Maybe a business plan, or an extract from Upwork, or previous contracts that you entered into as an individual entrepreneur in Russia. As I said, living people work in the bank, try to find a way to convince them.

Theoretically, you do not have to open an account with a Latvian bank, by law you have the right to have a current account with any bank in the European Union. But this is theoretically, and in my case, I turned to one bank in neighboring Lithuania, and the managers, having examined my package of documents, refused - they say that you are not conducting business in Lithuania, your counterparties are not in Lithuania, so you do not have sufficient grounds in order to have an account with our bank in Lithuania, go from here.

Now I have accounts in two banks - in Rietumu and in the Latvian PrivatBank. My impressions are short: there are no problems with Rietumu, except for the price - opening an account cost 60 euros, and sometimes they charge me 50 euros per month for maintaining an account if I have a turnover below the minimum threshold. And so they are polite, and work like a clock (by European standards, of course). In PrivatBank, the cost of maintaining an account is lower, but PrivatBank very much digs into my transactions and always asks for a copy of the contract, an explanation of the transaction, or an extract from Rietumu, it always seems to them that I launder money through them.

Together with the account they give a corporate VISA or MasterCard card, be sure to demand it - firstly, you can pay for the expenses of the company with this card (airline tickets, hotels, hosting services, etc.), and secondly, in an emergency you can withdraw money from PayPal to this account. I wrote more about PayPal below.

Naturally, in no case do not lose the card and do not forget the pin code from it! If you forget the PIN code, you will have to travel to Latvia again, make a new card again, wait for it again, pay for the card issue, etc.

Well and one more of minuses - banks in Latvia work from 10 to 18, sometimes even with a lunch break. And yet, since you are a non-resident, not all branches can serve you, usually for all of Riga only one bank branch serves non-residents.

Ok, sorted out the problems. Now the advantages of a current account with the European Bank:

- Your account will be multicurrency (euro / dollar + other currencies optional), that is, you can accept SWIFT money transfers from the customer in any currency, from any countries. No currency control, no restrictions.

- If you want to change a large amount of money (for example, $ 5,000 in euros), you can contact the bank manager and he will give you a more favorable rate.

- Your account will be in the European Bank, as Latvia is a member of the EU. In addition to being prestigious, Upwork and PayPal have recently supported the function of quick withdrawal of money to an account in any European bank, which is good news.

And a little note. Why do I have two current accounts? And here is why. Theoretically, according to the SWIFT system, you can receive money from a customer from any country in the world, but I was faced with the fact that the SWIFT money transfer from HSBC in Hong Kong does not reach the Latvian Privat Bank, and comes back a few days later. Here either PrivatBank or HSBC have the wrong details, I don’t know on whose side the problem is. There was no time to understand, therefore, the customer and I solved the problem by opening an account with Rietumu and sending money to this account, there were no problems.

Conclusion: If you are working with a customer from exotic countries, then perhaps you will need to have a second bank account in another bank, “in reserve”. Well, or you should be prepared for the fact that you need to urgently go to Latvia to open a second current account. As I wrote at the very beginning, for the first couple of months, stay close to Latvia, what if a problem suddenly arises.

By law, by the way, you can have any number of current accounts in any bank of the European Union.

4.7 PayPal

4.7.1 General information

In Latvia there are no restrictions on accepting and receiving payments through PayPal. You can accept payments from legal entities and individuals from any countries, pay legal entities and individuals in any countries. In any currency and in any size. One payment or several. Well, how are things in Russia, freelancers? The Central Bank has already allowed paypal to transfer money between legal entities, no?

Okay, now serious. Here are the reasons you should open PayPal:

- Americans are accustomed to PayPal, this is their usual tool for paying for services

- PayPal commissions are rather big (~ 4%, sometimes currency conversion), but still not horse-drawn 20%, as on Upwork. If you worked with a customer from the USA on Upwork, offer him to pay for your services through PayPal, I am sure he will not refuse.

- With PayPal you can also pay for hosting services, for example. This will go to costs.

- PayPal has fairly convenient reporting

- You can withdraw money to an account with the European Bank or to a Visa / MasterCard.

4.7.2 Opening a PayPal Account

You can open a PayPal account as soon as you receive the PVN. You need to open a new account, the old one is not good. I opened an account on my work email.

Be sure to register as a legal entity and be sure to “in Latvia”: that is, either go to paypal.com from the Latvian IP or, when you open paypal.com at the bottom of the page, select your location - Latvia.

After registration, your PayPal account will be frozen and asked to fill out a long questionnaire to combat money laundering. You will need to indicate the company name, address, PVN number, name of the company owner (i.e. you), your address, passport details, etc., you will also need to upload your copy of the passport. At the last stage, you will be asked to download scans of documents confirming that the company belongs to you. You need to scan LĒMUMS, which you were given in the Latvian company register.

LĒMUMS

At this stage, there was a slight gag, after filling out all the items on the questionnaire, PayPal did not defrost my account. The problem was resolved after a call to support, I told them that I filled out a questionnaire, and they thawed my account manually. PayPal has a bad interface, but the telephone support service is working quite well, if you have any problem, call them, do not be shy.

Sorry, I don’t remember how long the above took, but it seems from 7 to 14 days from the date of registration, taking into account the freezing of the account.

Further. There is one more restriction, which is very annoying - novice PayPal sellers can withdraw money from PayPal only after they “lie down” on their account for 20 days. If I’m not mistaken, in 2016, in order to get out of the “novice seller” status, it was necessary to fulfill 2 conditions:

- So that from the moment of the first payment 50 days pass

- So you get 10 payments

To solve this issue, find any of your friends who have a PayPal account and live outside Latvia (it doesn’t matter, in the EU, in the USA or elsewhere) and give them 10 bills for $ 1 for any services, for example, a consultation or fixing bugs in the site, or something like that. Issue invoices without PVN (VAT), as the customer is located outside Latvia. Then you download all the invoices and give them to your accountant.

When 10 payments are ready - you are delightful, it remains to wait 50 days.

These numbers (50 days, 10 payments) were relevant in 2016, perhaps the rules have now changed.

4.7.3 Billing at PayPal

After you have done the work for the customer, you ask the customer for his data and the email address of the PayPal wallet. All my customers are companies, so from them you need to know the name of the company, the registration address and the name of the contact person.

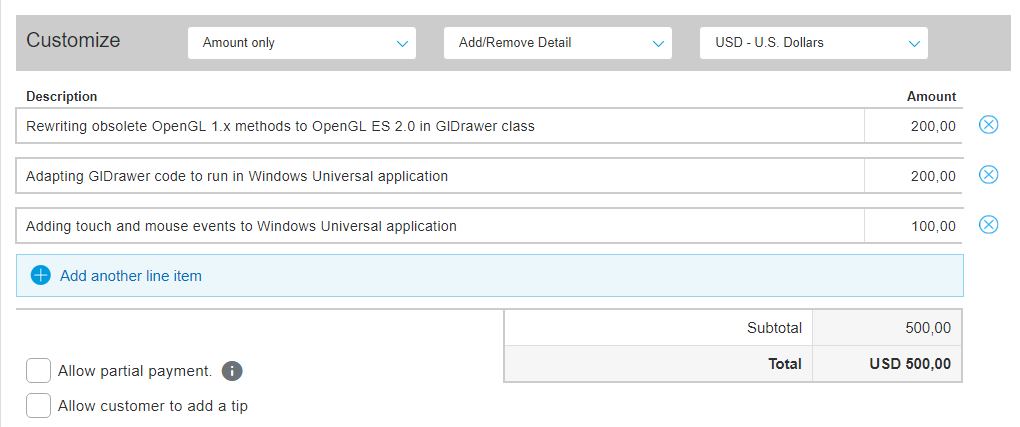

Then you go to Tools / Invoicing and create an invoice for the services provided. Write the points and cost there. If you want - indicate a fixed amount, or hours of operation, as you and the customer are more convenient. If you provide services outside of Latvia you do not pay VAT (PVN), therefore you leave the field with tax empty.

It turns out something like this:

My typical PayPal account

Then press "SEND" and wait for the customer to pay for the work. When the money is on your PayPal account, you can manage the money - pay for their hosting, for example, or withdraw to the bank.

Some customers pay payments directly, without bills. In this case, you still need to create an account in PayPal so that there is something to report to the accountant. Make sure that the invoice date is set before the actual payment by the customer. Naturally, it is not necessary to send such an invoice to the customer.

4.7.4 Withdrawing money

In PayPal you can add a corporate Visa / MasterCard or a bank account, I recommend that you add both.

When adding a bank account, you must indicate the bank details: Swift code, address, name, etc., as well as the account number and information about it. You can find the bank details on the official website, look at your account number and information about it in your online bank. The account number looks like LV00XXX0000123456789

Your account in a Latvian bank, I think, is a multi-currency dollar / euro (by default). Therefore, the currency of the account can indicate at least the euro, at least the dollar, theoretically, money should in any case reach.

If you specify the currency in euros, and on PayPal you will receive money in dollars, then when withdrawing money, PayPal will force them to convert euros at its own rate. A PayPal rate is less profitable than at your bank.

Also note: You cannot change the account currency in the future. Perhaps this can be done through PayPal technical support, or if you untie the account and bind it again? I have not tried.

After you add your current account to PayPal, you will receive one or two payments from PayPal in this account. You will need to look at the code in the payment description and enter it in PayPal to confirm. Or, as an option, you will need to name the amount of payment to confirm, for example, 0.01 and 0.11 euros. A little later PayPal will write off this money back.

After the accounts are confirmed, you can withdraw money to them. Previously, the withdrawal of money took 5-7 days. After you order the withdrawal of money, first your order will be checked by the PayPal security service, after 1-2 days you will receive a message in the mail that the withdrawal is approved, and after 3 days the money will be in the bank account. Recently, money has been in the account the very next day.

With the binding of the card, the same thing - you indicate the card details (number, expiration date, name of the holder), and then confirm it through payments from PayPal, as I wrote above. Of course, the card must be corporate, and belong to your company, and not to you as an individual! In this case, something like FOR BUSINESS will be written on the card, and ACCESS TO ACCOUNT will be written as the name of the owner. This is what my map looks like:

Map

When you add a card to PayPal, you cannot write “ACCESS TO ACCOUNT” there as an owner, because PayPal automatically substitutes your last name there. Do not worry, write your name and surname to the card holder, there will be no problems, money will still come to the card.

Based on my experience, the money goes on the card longer, up to 14 days. If for some reason you were unable to add an account number (for example, PayPal code payments didn’t drop into your account, or what kind of plug-in happened), and you urgently need a “cache” or you are far from Latvia, you can use the card to “Emergency” withdrawal of money to it, while you deal with the bank why payments do not reach. Although damn it, the urgent cache with a delay of 14 days somehow does not sound very good.

4.7.5 PayPal Reporting

Once a month, download all the invoices that you received or paid for the previous month, as well as download the statement, and send it to the accountant.

Go to Reports, then Activity Download. Set Transaction Type: Balance affecting. Then specify the period (for the previous month) and click Create Report. After a while, you will receive a notification in the mail that the report is ready.

Take invoices from the Tools - Invoicing section, download each invoice as a PDF.

Send the report and invoices to the accountant and forget about it until the next month.

4.8 Upwork

4.8.1 General information

When I registered the company and received PVN, I had an empty profile on Upwork, so I created a new one, for work email. I don’t know what to do if you already have reviews, ratings, etc., I think you are also better off registering a new account, alas.

After registration, indicate your legal address in Latvia in Contact Info, then go to Tax Information and indicate your details - company name, address and PVN (VAT) number. This PVN number needs to be confirmed, this process is automatic, usually Upwork confirms it in 1 day. Do not forget to specify in the settings that you are not a US resident.

Upwork will be sent to you with a 21% VAT tax, but if you pay by mutual settlement (from your balance) or through PayPal, for some reason VAT will not be charged. I don’t know what this is connected with, but in any case, this is already Upwork troubles, if Upwork considers it wrong, this is already their headache. In your case, the calculation is simple - if you provide services outside of Latvia, you do not pay VAT, period.

Otherwise, everything is as usual - we replenish the connects, look for customers, get payment for mailstones from them and monitor how the amount grows on the balance sheet.

4.8.2 Withdraw money with Upwork

This is still easier than with PayPal. You can withdraw money to a PayPal wallet or to a bank account in a European bank. To withdraw to PayPal - indicate your email address to which the PayPal wallet is registered. For a bank - indicate the details of your bank (Swift code, name, address), as well as your account information. I remind you that you can find the bank details on the official website, look at your account number and information about it in your online bank.

Money in an account with a European bank comes within 24 hours. It is preferable to withdraw money to the account, but just in case, add both methods (account and PayPal) of withdrawal of money.

4.8.3 Reporting in Upwork

Once a month, go to Reports / Transaction History, set the period to the previous month, then save the table and save all invoices. And send the table and invoices to your accountant. It is best to save the table by printing the entire web page in PDF, because the CSV file offered by Upwork is completely unreadable.

Again, as with PayPal, this can be done in 5 minutes by lazily drinking smoothies.

5. How to withdraw money from the company

5.1 General information

And now we pass to the most pleasant! So, your company works, you have bank accounts, you have PayPal, Upwork attached, you work for customers, customers pay, money from customers flock to the current account in different ways, and now you only need to get them!

There are 4 main ways to withdraw money from the company into your pocket:

- Dividends

- Salary

- Travel expenses

- If you have an IP or LLC in Russia, order services from this IP / LLC and make payment through currency control

5.2 Conventional withdrawal methods

5.2.1 Dividends

I have not yet dealt with dividends in detail. If I’m not mistaken, then when you pay dividends, you must pay taxes in Russia, since you are a resident of Russia. Dividend tax in Russia is 13%, and in Latvia 10%, Russia and Latvia have an agreement on avoiding double taxation, so you must provide the state revenue service with information that you have already consolidated this tax in Russia and should not pay anything in Latvia. And one more thing: if you have an SIA with a registered capital of less than 2800 euros, dividends can be withdrawn only under certain conditions. Consult your accountant about this.

5.2.2 Salary

Since the company cannot be without employees, after registering the company, the accountant adds you to the company for the position of “Member of the Board” (Valdes loceklis in Latvian) and registers you in the electronic reporting system. You get a certain salary and pay taxes once a month. It turns out interesting - you work in Latvia, officially, wow! But this does not give you a residence permit, it does not give you any advantages at all. Well, maybe next time when applying for a visa in Latvia you will be given multiple Schengen for 90 days, that’s all the advantage.

Once a year you pay an unemployment risk tax of 3.6 euros. On a monthly basis, upon receipt of a salary, you pay two main taxes - social 34.09% and personal income tax 23%. The minimum salary in 2017 is 380 euros, but you can pay less if the accountant puts you few working hours.

For example, if you want to spend less money on taxes, ask an accountant to take your minimum wage, for example, that you worked 2 hours a month. This will fail if you did not conduct any activity this month and did not receive payments from customers. For example, if July was an “empty” month, I pay myself a salary of 4.13 euros, a social tax of 2.05 euros and an income tax of 1.24 euros. In another month, the figures may be different, depending on the number of working hours in a month.

If I conducted some activity, but not completely, then I pay a salary, for example 103.37 euros, social. tax 51.14, personal income tax 30.88 euros. I remind you that the minimum wage in Latvia is 380 euros per month; in theory, you can assign yourself any salary and any working hours in any month.

Well, the third option, if you have a lot of customers and the cache is pouring in, pay a full salary: pay iedzīvotāju ~ 78, sociālais ~ 129 and a salary for issuing ~ 261 euros.

5.2.3 Costs

You can also write off expenses for the company. You can write off an invoice for office rent, airline tickets, hotel checks, public transport checks, any materials you need for work (electronics), hosting bills, software license bills. You cannot write off expenses for food and restaurants / cafes. For confirmation, you need a fiscal check or invoice plus an extract from a corporate bank card. Collect all the checks, then bring them to your accountant. The accountant considers you how much money you can get, you transfer this money to yourself. Profit!

5.2.4 Travel and airline tickets

If you travel often, you can also get travel allowances as an added bonus to airline tickets. Just an accountant arranges your stay in another country as a business trip, and charges you a per diem.

Learn more about business trips and per diem from your accountant.

5.2.5 Repayment of the loan of the founder

When you open a checking account, you probably replenished it with some kind of starting capital. This replenishment is considered as a loan from the founder, and in the course of your activity you can return this money back, in parts or in full, at any time.

5.3 How to receive money

5.3.1 General information

Suppose your accountant has calculated your salary, per diem, and you also decided to return part of the money, you can get this money as follows:

- Снимаете деньги в банкомате с корпоративной карты, дальше бухгалтер отчитывается за них в информационной системе. Это не очень хороший способ, потому что при частом снятии больших сумм наличных ваш банк начинает бить тревогу и требовать от вас отчетных документов, угрожая закрыть ваш счет и обвиняя в отмывании денег. Конечно, в банке работают люди, вы можете им все объяснить и успокоить их, но все-таки лучше лишний раз не давать им повода нервничать

- Оформляете себе карточку в латвийском банке, но уже как физ.лицо, и выводите туда, в назначении платежа пишете по латвийски «avansu norēkini» (подотчет) или «Darba alga par [месяц] [год]» (зарплата) или «aizdevuma atgriešana» (возврат займа). Бухгалтер вам точно скажет, какие суммы под каким заголовком вы можете выводить. Самый безопасный способ, но вам придется потратить время и оформить карточку в банке

- Выводите эти деньги в Россию на счет физлица в российском банке. Через валютный контроль. Я не пробовал, но наверняка это не очень хорошая идея

5.3.2 Банковская карта в Латвии для физ.лица

As I said, banks will be meticulously considering you, and you will need to prove to the bank manager that you are worthy to have an account with their bank. At the time of issuing the card, I had already been operating for about six months, so the accountant printed out the information about the information that I am an employee, pay taxes, etc., printed out the information about my company from the Lursoft system, that was enough.

I opened a card in the Latvian PrivatBank. I got a simple Visa Electron card, the same dull without a chip, which in Russia is also called a “salary card”. As in the case with a corporate card - in no case do not lose the pin code from this card, the pin code can neither be changed nor restored. If you lose your pincode, you will have to go to Latvia again and order a new card.

When you have a card, you can withdraw money from this card at an ATM or pay with it in terminals wherever Visa Electron is accepted.

Now - about how to withdraw cash from her in Russia. Filming in rubles is not an option, because PrivatBank’s exchange rate is simply predatory. In my case, the most profitable way so far is to withdraw in euros from Alfa Bank ATMs. The commission for withdrawing money from Privat is 2.5 euros for one withdrawal, and you can withdraw at a time only 100 euros. So far I’m looking for more convenient ways, but I haven’t found it, alas.

Well and still: in the Latvian bank have notified me that they will inform tax authorities of Russia that I have an account abroad. So I'm under the hood. Under the deoffshorization law, I have to notify the tax on the status of the account every quarter.

5.4 Withdraw funds through IP / LLC

5.4.1 General information

I have an IP, so I wrote about IP. Everything that is written below applies to LLC as well.

It is necessary to withdraw money to the IP by completing the transaction. That is, in essence, your company in Latvia enters into an agreement with an IP and pays to a foreign currency account, then the IP withdraws this money through foreign exchange control. On the topic of currency control, there were many articles on Habré, they are all relevant. I only note that since you enter into an agreement with yourself, you can specify flexible terms of payment and terms in the agreement. For example, I made one contract, and when I need money, I conclude extra. agreement, invoice, pay and close by act. Or sometimes even without ext. agreements are simply an account and an act. Make sure that the total amount of money transferred under 1 contract does not exceed $ 50,000, otherwise you need to prepare a transaction passport, if necessary, close one contract and open another.

Contract and add. I have agreements in two languages (Russian / English), accounts and acts can not be translated, standard accounts from 1C are suitable, from the Latvian side there are no requirements for the preparation of accounts or for their translation.

As you understand, due to currency control this is the most problematic way to withdraw money, but it is also the cheapest - you pay some commission to the bank for a SWIFT transfer (usually around 15-30 euros, it almost does not depend on the size of the payment) and 6% STS in Russia. Let me remind you that when you withdraw through dividends, you pay 13% of the tax, while through salary you withdraw half.

Theoretically, the State Revenue Service or a bank can get to the bottom, such as what kind of Kama Sutra is with payments to yourself. This is approximately like the well-known LLC + IP scheme in Russia. The method of protection is the same as in Russia - justify the need for these payments with documents, do not overcharge.

But so far, neither the State Revenue Service, nor even the banks have found fault. And this is very strange, by the way. As soon as I removed 1600 euros from a corporate card, the bank bombarded me with letters demanding to provide supporting documents from whom I received my income and on what basis. And the fact that three times large amounts go to Russia does not bother them.

5.4.2 CFC Law

Now, about the same thing, but from the Russian side. So, in Russia there is a law on controlled foreign companies. Since you are the owner of a company in Latvia, you must inform the tax office that you have this company. To do this, there is a certain application form, you must fill out it and submit it to the tax at the place of residence. That's all for now, if you get less than 10 million rubles a year from your company, then you can do nothing more. And if more - hire an accountant and read the weighted average rates with him.

Also, all your transactions between a Latvian company and individual entrepreneur, according to the tax code of the Russian Federation, are controlled, as they are made between interdependent parties. This is not prohibited, but it imposes an obligation on you to report to your tax office about completed transactions once a year. Just notify the tax authorities, and if your individual entrepreneur keeps market prices for the provision of his services, does not overestimate or understate them, then there should be no problems.

6. Residence permit

Under certain conditions, a company in Latvia gives you the opportunity to obtain a residence permit. If I understand correctly, the most affordable conditions are that you must be a member of the board of your company, the company must be older than 1 year, the authorized capital of the company must be 2800 euros, your salary should be ~ 1800 euros and you must pay taxes for the year in the amount of ~ 22,000 euros. Under these conditions, you get a residence permit for 1 year. Then you renew it every year, and if every year the above conditions are met, then after 5 years you will receive a permanent residence permit.

I have not yet passed the requirements, but in general I look in this direction, it would be interesting.

The big advantage of a residence permit in Latvia is that it does not need to be “supported” by living in the country. You can dangle around the world and freelance even in Goa, even in Thailand. As long as you fall under the conditions, a residence permit will be extended to you without any problems.

7. Conclusion

The article unexpectedly turned out to be very long, but I hope you did not get bored, and could get valuable knowledge from this article. If you have any questions, you can ask them in the comments, I will try to answer.

Thank you for reading to the end!