Tinkoff and everything, everything, everything: IoT, analytics and observation for banks

There is no science that studies money, but there are experts in various fields who specialize in money: mathematics, psychologists, criminologists, financiers, and even biologists. The latter have found out that gram-positive bacteria, staphylococcus, fungi, parasitic worms - representatives of hundreds and even several thousand genera are found on paper notes.

It is on the bills that fragments of cocaine or heroin are found. But money is not only an environment for life and crime, but also a high-tech product. For the production of paper money need special dyes, chemical compounds, complex equipment. Cash must be durable to circulate in all walks of life.

To explore money is interesting, but difficult. It is impossible to put a microcamera on a banknote, as on a rare animal. Fortunately, cameras help in all other cases. The largest hub in a complex money circulation system is a bank. Banks taught us that the camera is not only security during collections. Video surveillance gives analytics on clients, a channel for remote business management and something else ... about which we will tell further.

Special requirements: security, control, storage

Many years have passed since the first attempts to explain to entrepreneurs that a camera in a warehouse could replace a watchdog dog (1968, the city of Olin, New York State). Organizations have moved from local video surveillance systems to cloud services that provide their video storage and processing infrastructure.

A client of cloud surveillance simply connect the camera to the Internet and register an account in the cloud. However, the bank is an unusual customer. There are increased security requirements. And even the highly reliable, but “alien” cloud has become for many an obstacle to the introduction of modern systems.

All banks in Russia follow the PCI DSS standard(Payment Card Industry Data Security Standard), developed by the PCI SSC (Payment Card Industry Security Standards Council). The Council defines with its standard a specific list of security requirements for payment card data, affecting both the organizational and technical side.

440 different verification procedures are prescribed in PCI DSS. According to the standard, cloud is a special service that ensures safe work with payment cards for organizations that have their infrastructure on the side of a certified cloud provider.

Video surveillance in PCI DSS includes four important points:

9.1.1 Use either surveillance cameras or access control mechanisms (or both) to track each case.

9.1.1.a Make sure that either surveillance cameras or access control mechanisms (or both) are installed to monitor the entry (exit) points to critical premises.

9.1.1.b Ensure that either surveillance cameras or access control mechanisms (or both) are protected from physical interference or shutdown.

9.1.1.c Make sure that the data obtained from surveillance cameras and (or) access control mechanisms are checked and that data is stored for at least 3 months .

How to build a video surveillance for the bank

The solution to the problem of the availability of cloud services for the bank was a closed and secured Private Cloud, which is deployed at the perimeter of organizations that place increased demands on the level of security and location of servers. In addition, the bank has its own requirements for hardware, installation, location of cameras.

Ivideon Private Cloud is an integrated platform that is deployed and operates exclusively on the customer’s network. Platform combines:

- an unlimited number of geographically distributed cameras and servers of video surveillance - that is, not only the central office of the bank, but also all branches in one country or different countries of the world;

- intellectual analysis and video analytics modules;

- receiving and processing data from external devices and external business applications;

- business logic for processing, routing and displaying the received data.

The private cloud is located on the equipment that the client itself has. On the basis of this solution, you can build a system for solving various problems in the banking industry. The most obvious thing to imagine is the control of cash transactions with cash - the very “research” of money.

But besides the circulation of money in the offices there are many interesting events. These can be queues, VIP customer service, visitor counting, and other situations. Now the camera in our service can easily (and server load) analyze the gender and age of visitors, fill out the data into reports.

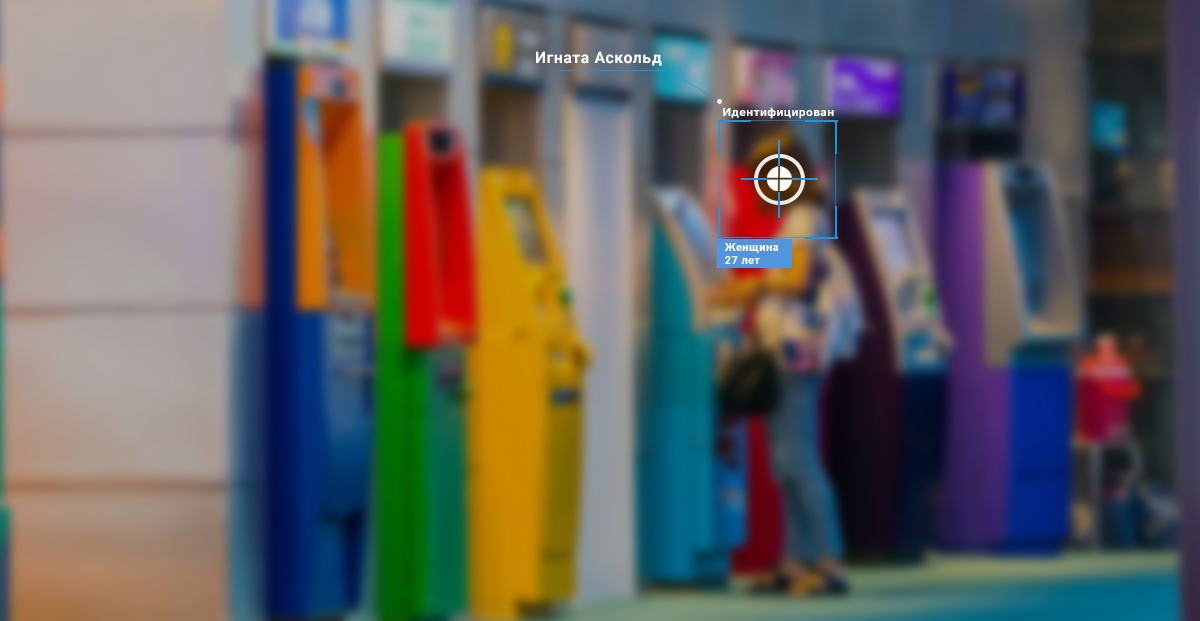

With the camera and analytics, the process of working with an ATM becomes “smarter”. The camera is able to identify the client before it inserts the card, sends an alarm if the client’s person is on the “police are looking for” list, collects telemetry data and sends the recording to the cloud or local bank storage.

The evolution of solutions: translation, cache, analytics

New ways to interact with the bank increase security requirements. Tinkoff Bank does not have branches, but according to the law, a bank representative is obliged to hold a personal meeting with a client, so Tinkoff employees take pictures of him using a special mobile application that converts an image into an impersonal code. Next, the system compares the code with the database. This allows you to make sure that the representative is the person who filed the documents.

Since 2017, the Ivideon system for banks has been used by Oleg Tinkoff’s organization and not only. We optimize the service for business tasks and often these tasks are unique. Some banks with the help of our video analytics solve the problem of queues, while Tinkoff Bank modernizes ordinary ATMs.

ATM Tinkoff stands out even in appearance - it is narrower and often smaller than relatives. In addition, this device supports NFC, QR codes (contactless payment) and cash-recycling technology.

In conventional ATMs, the money is divided into two independent masses: bills for dispensing are filled into one cassette, and banknotes sent by customers are sent to the other cassette. The money deposited goes to the bank with collection.

ATMs with cash-recycling return the deposited money to other customers, but at the same time they select notes according to the degree of wear and send them to a separate tray that are unsuitable for further issuance. If among the deposited funds there are suspicious notes, they are also withdrawn by the ATM from further circulation, and the data of the card used is recorded.

Integrated video surveillance for ATMs

If you go to the Tinkoff Bank ATM, you will see the Video Surveillance icon on it. What is it and why?

In Russia, the volume of cash money in circulation is almost 6 billion banknotes - in pieces. Almost all of this money is constantly circulating through banks and ATMs. Paradoxically, the amount of cash does not decrease, but only grows. Therefore, ATMs are so in demand.

The most interesting thing is that banks are not obliged to follow who the ATM issues cash. However, many people prefer to keep a record - if an attacker tries to use a skimmer or commit other fraudulent acts, his face will be recorded.

If you used the card, but suddenly remembered the cat hungry at home and ran away without waiting for the money, the bank uses the video as proof that this is not a system error.

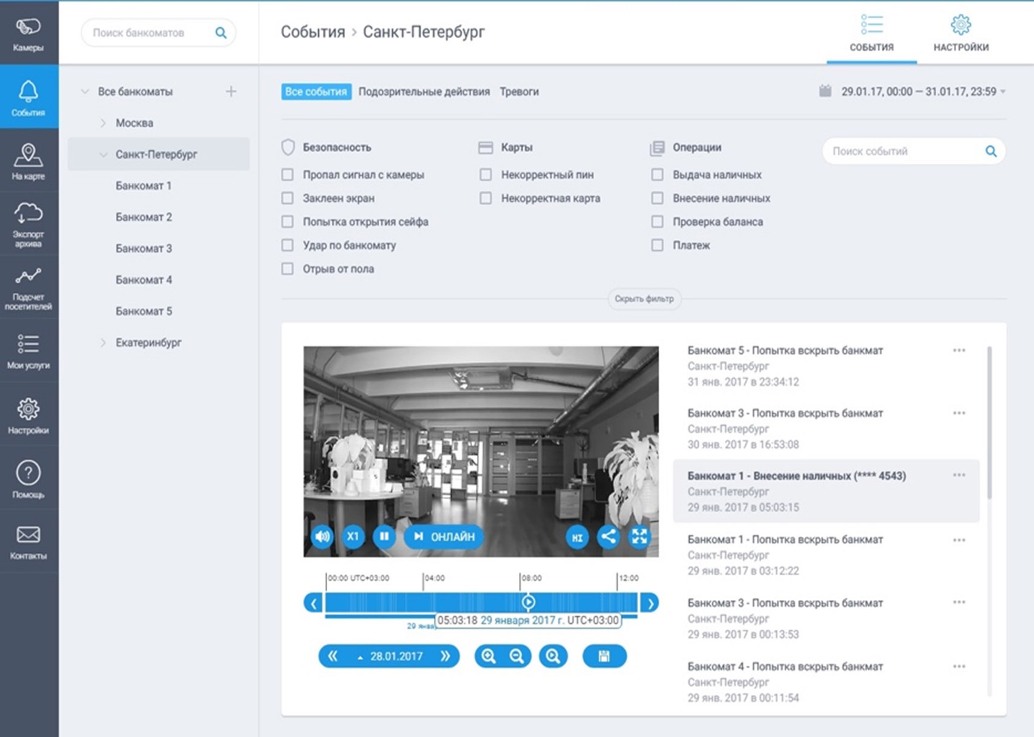

The internal interface of the ATM management system in the Ivideon solution.

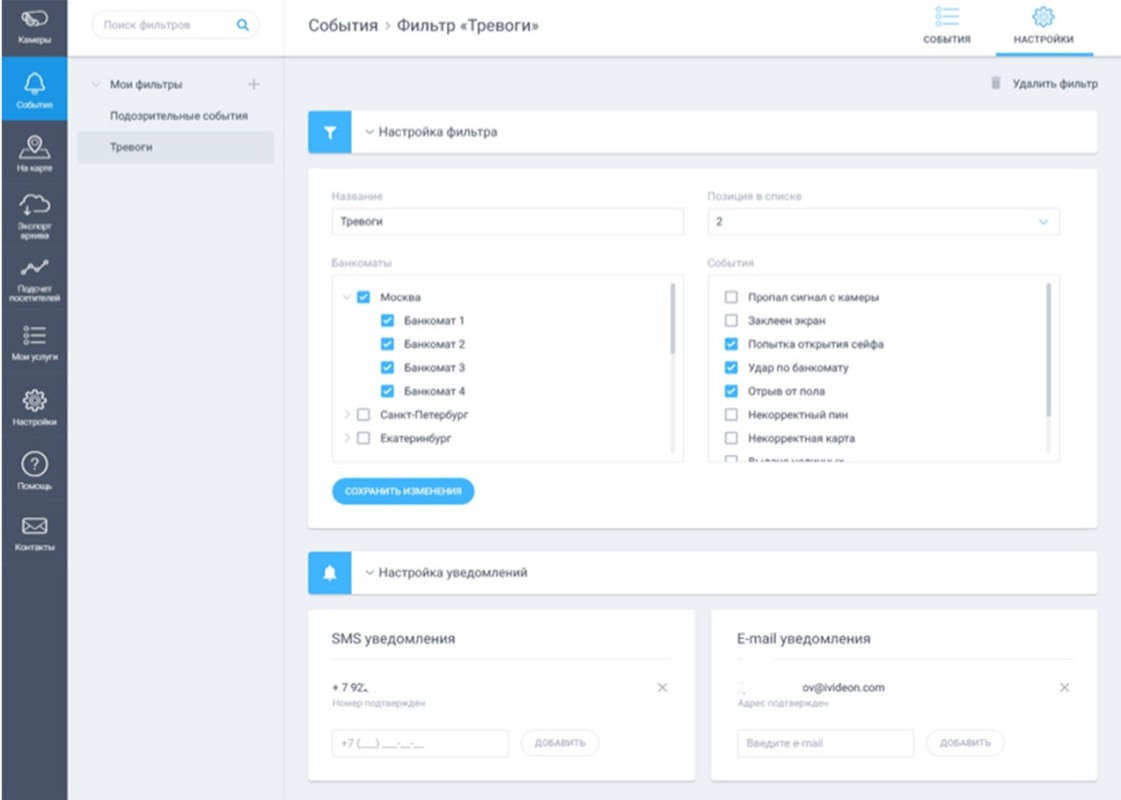

Various incidents sensors can be connected to the ATM: attempt to open, hit, detach from the floor, and so on. If something incomprehensible happens to the ATM, the camera will send a notification and record. This recording will look and be stored just like any other piece of video data in the Ivideon service.

A regular camera can transfer a lot of useful data from an ATM.

Leaving a record inside the ATM is unreliable, so our solution transfers everything to the selected storage using an encrypted channel. The video data from the ATM in real-time is transferred to the security department of the bank, and is also recorded in the archive, where they can be found using special filters. The camera itself will send notifications on the configured filters.

Preliminary results

No one in the banking sector is idle. Otkrytie Bank has already launched a face recognition system to optimize customer service and customer waiting times. “Alfa-Bank”, as far as we know, at ATMs still costs “without features”, but the technology itself is familiar to them — at the Alfa Future People festival, visitors could find their photos among hundreds of others by sending a selfie to a chat bot.

In the future, the camera will allow the use of banking services without cards, smartphones and any "intermediaries". ATMs will be able to recognize customers by persons. In Russia, projects for the introduction of biometric identifiers in the financial sector are investigated by almost all the largest banks.

Security requirements in banks impose serious restrictions on the use of classic video surveillance systems.

All the capabilities of cloud-based video surveillance systems in the financial sector cannot be used 100% without control over the cloud itself.

We solve this problem with the help of Ivideon Private Cloud - a closed cloud platform for video surveillance, video analytics and IoT, which is being implemented in the perimeter of the customer.

Ivideon Private Cloud is used in Tinkoff Bank to improve the quality of customer service.

Very soon, every bank in Russia will use one or another system with video analytics.

Traditionally, in all matters of connection, please contact us .