Bitcoin strides around the world. Or not?

You can argue long and hard about whether it’s good that btc is growing in price and that fluctuations are simply unrealistic percentages. But the fact is that Bitcoin as a phenomenon spans more and more countries.

Recently, my colleagues and I decided to conduct several studies of cryptocurrencies (here you can find a complete collection on the topic, which includes: analysis of the legal status of Bitcoin in the world, attitude to “digital gold” in Russia, as well as translation of one of the first ECB legal reports aspects of this network).

In this habro note, I would like to share several observations that may be useful to those:

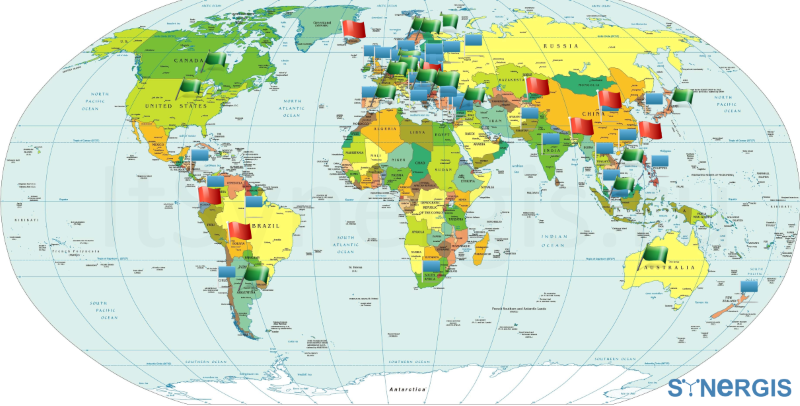

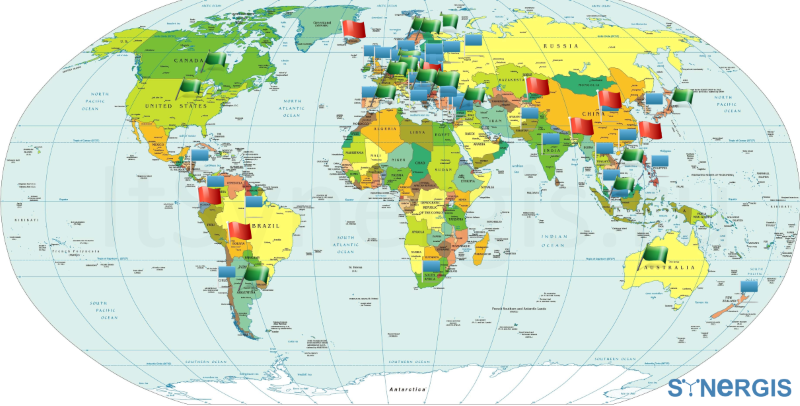

To make it clear immediately what exactly has been studied , I am attaching a map of the countries I have traveled to, studying the status of Bitcoin in terms of law (from sources - the opinions of state bodies, English-speaking, less often - in local languages, websites, as well as the statements of lawyers from these countries) .

If you take the averaged picture (and other yet - too many products), then the relation to the btc & altkoinam about the following:

Thus, used for most of the countries are still in varying degrees of doubt as to whether a "what have is this is your bitcoin? ”

I will not repeat everything, I will highlight the important:

Of those who recognize cryptocurrencies, there are those who consider them:

Opinions on how and how Bitcoin and its cousins should be regulated at all vary widely, and most importantly even within countries (the example of Russia in this regard is by no means an exception: for example, China has more than once swayed markets, just recently, including making statements that are somehow related to the cryptosphere, for example, on the prohibition of withdrawing funds from exchanges).

If you look at the map (above), you can see that all the bans are mainly related to Asia, except for Iceland. The last taboo is connected with the crisis of 2008 (if you are not aware of the issue, look at the materials on the Web, because that beautiful northern country was actually robbed and ruined that year, however, not only it).

The ban on digital currencies by the authorities does not mean that the latter are not used internally. For me, perhaps the most striking example in this regard is Colombia.

Very often, especially in South America, there was a position that “the cryptocurrency market is not yet developed in the region”, which in fact is tracing paper from the position of the ECB, but it does not always correspond to reality if you go through sites that are somehow tied to crypto in the same countries.

There is a lot of absurdity in the actions of the authorities, which really do not understand what Bitcoin is and that its essence (not only legal) is of a completely different sense than even electronic money. Again, Russia is far from the only example: here is Iceland, where the public has been on strike for a long time and for longer than in Greece; and India, where the recently promised tax and financial reform does not redistribute capital, but only eliminates it permanently among the poorest segments of the population, while giving the elite opportunities for development, including in the sphere of p2p currencies; or, say, the United Kingdom, which clearly wants to keep up with the times, but still does not know exactly how.

The last is that the doubts themselves are so different everywhere that they could be divided into several subgroups:

To make it even a little clearer how developed the network of Bitcoin communities in the world is, one more map. This time, ATM-btc.

And so that it becomes very beautiful and clear - another card: this time about the nodes in the Bitcoin network. Perhaps the correlation between these data and those given in the book will become quite obvious.

By the way, I’ve been interested in a node for many years (which was one of the most powerful in the world in terms of volume, if interactive maps about btc do not lie), which is circled in the red circle and is located in the Irkutsk region: as a resident of this region, it’s not clear , where it can be located in principle, and most importantly - who owns it. But this is a question of another article, but for now I’ll finish this one.

Yes, the approaches look confusing, but it’s understandable: for the first time, all states have to deal with so many phenomena that contradict the very centralized essence of the state as a phenomenon: torrents, Uber and Co, ciphers ... and with this everything has cross-border rights and responsibilities, uncertain responsibility and mass, just an avalanche of concepts (terms and categories), which in principle are difficult to grasp at the level of current perception.

And yet, Btc, Efiruma and the like already have their own “quiet harbors”: for example, the Isle of Man, which I’ll try to tell you about separately, which means there is hope, I have at least the original essence of Bitcoin at least partially, it will not be spoiled by speculation, the desire of the Fed and the Central Bank of all stripes to suppress this uprising, as well as the “effect of a greater fool”, which today works to unwind the creaky mechanisms of public power.

That's all for now . Questions will be a great addition to the article.

PS To make it a little clearer: the book was written for several months and contains facts about Bitcoin that are unique for the Russian-speaking environment, so this article is not just four beautiful pictures and results, but preparation for reading something more. Thanks!

Recently, my colleagues and I decided to conduct several studies of cryptocurrencies (here you can find a complete collection on the topic, which includes: analysis of the legal status of Bitcoin in the world, attitude to “digital gold” in Russia, as well as translation of one of the first ECB legal reports aspects of this network).

In this habro note, I would like to share several observations that may be useful to those:

- who wants to make a startup in the field of virtual currencies;

- who is interested, and what is the “cue ball" not from a technical point of view;

- Who is studying the laws of bit-coins;

- and, of course, to everyone who is interested in bitcoin in principle - as a phenomenon.

To make it clear immediately what exactly has been studied , I am attaching a map of the countries I have traveled to, studying the status of Bitcoin in terms of law (from sources - the opinions of state bodies, English-speaking, less often - in local languages, websites, as well as the statements of lawyers from these countries) .

If you take the averaged picture (and other yet - too many products), then the relation to the btc & altkoinam about the following:

Thus, used for most of the countries are still in varying degrees of doubt as to whether a "what have is this is your bitcoin? ”

I will not repeat everything, I will highlight the important:

Of those who recognize cryptocurrencies, there are those who consider them:

- goods;

- Currency

- intangible good;

- financial asset;

- payment instrument.

Opinions on how and how Bitcoin and its cousins should be regulated at all vary widely, and most importantly even within countries (the example of Russia in this regard is by no means an exception: for example, China has more than once swayed markets, just recently, including making statements that are somehow related to the cryptosphere, for example, on the prohibition of withdrawing funds from exchanges).

If you look at the map (above), you can see that all the bans are mainly related to Asia, except for Iceland. The last taboo is connected with the crisis of 2008 (if you are not aware of the issue, look at the materials on the Web, because that beautiful northern country was actually robbed and ruined that year, however, not only it).

The ban on digital currencies by the authorities does not mean that the latter are not used internally. For me, perhaps the most striking example in this regard is Colombia.

Very often, especially in South America, there was a position that “the cryptocurrency market is not yet developed in the region”, which in fact is tracing paper from the position of the ECB, but it does not always correspond to reality if you go through sites that are somehow tied to crypto in the same countries.

There is a lot of absurdity in the actions of the authorities, which really do not understand what Bitcoin is and that its essence (not only legal) is of a completely different sense than even electronic money. Again, Russia is far from the only example: here is Iceland, where the public has been on strike for a long time and for longer than in Greece; and India, where the recently promised tax and financial reform does not redistribute capital, but only eliminates it permanently among the poorest segments of the population, while giving the elite opportunities for development, including in the sphere of p2p currencies; or, say, the United Kingdom, which clearly wants to keep up with the times, but still does not know exactly how.

The last is that the doubts themselves are so different everywhere that they could be divided into several subgroups:

- doubt, but mostly see a positive outcome (England, Denmark, Estonia);

- doubt, but mostly see a negative outcome (India, Indonesia);

- doubt in the sense that they can’t understand at all (Nicaragua).

- doubt in other directions.

To make it even a little clearer how developed the network of Bitcoin communities in the world is, one more map. This time, ATM-btc.

And so that it becomes very beautiful and clear - another card: this time about the nodes in the Bitcoin network. Perhaps the correlation between these data and those given in the book will become quite obvious.

By the way, I’ve been interested in a node for many years (which was one of the most powerful in the world in terms of volume, if interactive maps about btc do not lie), which is circled in the red circle and is located in the Irkutsk region: as a resident of this region, it’s not clear , where it can be located in principle, and most importantly - who owns it. But this is a question of another article, but for now I’ll finish this one.

Yes, the approaches look confusing, but it’s understandable: for the first time, all states have to deal with so many phenomena that contradict the very centralized essence of the state as a phenomenon: torrents, Uber and Co, ciphers ... and with this everything has cross-border rights and responsibilities, uncertain responsibility and mass, just an avalanche of concepts (terms and categories), which in principle are difficult to grasp at the level of current perception.

And yet, Btc, Efiruma and the like already have their own “quiet harbors”: for example, the Isle of Man, which I’ll try to tell you about separately, which means there is hope, I have at least the original essence of Bitcoin at least partially, it will not be spoiled by speculation, the desire of the Fed and the Central Bank of all stripes to suppress this uprising, as well as the “effect of a greater fool”, which today works to unwind the creaky mechanisms of public power.

That's all for now . Questions will be a great addition to the article.

PS To make it a little clearer: the book was written for several months and contains facts about Bitcoin that are unique for the Russian-speaking environment, so this article is not just four beautiful pictures and results, but preparation for reading something more. Thanks!