Why is Zuckerberg chasing a ghost

This spring, the most popular instant messenger among US youth, Snapchat will become the third largest technology company by capitalization, if we take the moment of the IPO as an estimate. As a last resort, it will yield to Google's performance 13 years ago. And it will definitely overtake Twitter. Teenagers and young people under 25 years of age the United States occupied this photo and video messenger almost without exception. What is the secret of this communication channel?

Descriptions of how Snapchat works usually begin with the fact that it is an instant messaging service that disappears after viewing. But not only this once unique functionality made it popular. Imagine that you are watching Habr, where blog authors post photos and video reports about the life of each of them and related clever thoughts in the last 24 hours. Each author for a series of 10 second videos tells the main news, accompanied by small text and photos, applying cartoonish filters in the style of Chichvarkin, Avatar landscapes or People in Black characters for fun. Having looked at one multi-real "diary", you immediately start viewing the "diary" of the next author. The most interesting moments of reporting can be laid out on thematic pages of public categories. Text blogs also exist, but they live from a second to a day, and each commentary lives until it is read. Do you say that the main thing here is the disappearance of posts and posts within 24 hours? This is an endless festival of home-made photo and video reports about your life and the world around you with cartoonish jokes in the design.

The audience of such festivals is already 160 million people around the world, Facebook has already tried twice to buy it, twice made an attempt to launch a competitor and now attacks it from its two platforms, copying the alleged key functionality.

The popular version of the success of Snapchat focuses on the established circle of communication and common interests. Each social network has its own audience age. Something similar to our Odnoklassniki, VKontakte and the Russian segment of Facebook. However, in popularity ratings, they usually have different news. American youth did not know VKontakte. So they fled to Snapchat. The disappearance of photographs here was not the main motive. In the entire history of use, only 14% of the audience sent intimate photos that would be worth erasing by viewing.

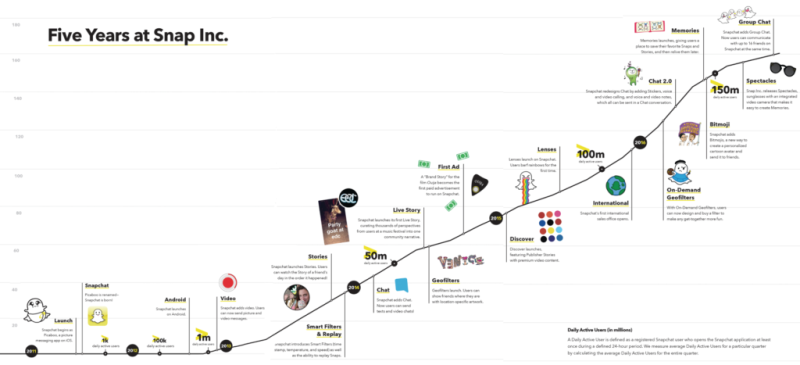

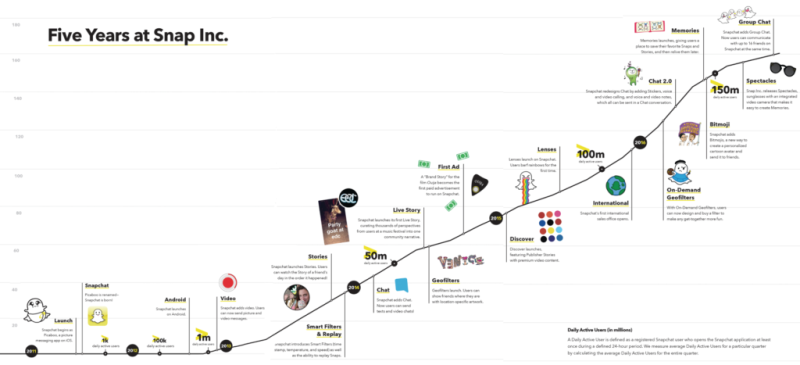

In real history and at every stage of Snapchat growth, the drivers for audience growth were different.

Snapchat was born as a means of protecting confidential photos and messages, but was originally touted by the founders as "a game to send disappearing photos to friends." This wording is from a letter from the founder and CEO of startup Evan Spiegel.

The first month brought 127 users. The first name Pictaboo was also unsuccessful - it refers to the image of a children's game when an adult covers his face with his hands. It is not surprising that with this name the game did not take off among the youth.

The name Pictaboo was soon abandoned due to a conflict with the author of the idea, which may have saved the startup. Although about the character of Evan, this break with a partner is not very good evidence.

Overcoming the “Death Valley” together, Evan Spiegel and Bob Murphy renamed the application into the now-famous Snapchat and by the spring of 2012 reached 30,000 installations. The functionality of disappearing photos turned out to be more or less in demand for sending photos of an intimate or bully character. But not only. In April 2012, Evan was found by an investor whose schoolgirl daughter began to use this application to send cheat sheets and answers to tasks. Its half a million dollars allowed to launch the version for Android and add sending video.

Unexpected benefactor of Snapchat in the late fall of 2012 was Zuckerberg. He became interested in the application, tried to buy a company and even made a competitor. But the latter did not take the audience, but only drew attention to the functionality of the missing photos and to Snapchat itself in the application store and from journalists, which gave Evan and Bob an increase of up to a million users.

Evan took advantage of Mark Zuckerberg’s attention also for public relations among investors, having organized an investment auction in 2013 between the Chinese and Google. However, none of them seemed to sell. No matter how sold and re-came to purchase Zuckerberg. Teasing the giants, he nonetheless raised $ 150 million in 2013 from lesser-known investors.

Money was needed to finance growth and court payments for 2 years of compensation of $ 158 million, which was excluded at the start of startup co-founder Frank Brown.

With new investments, Snapchat expanded its functionality by introducing filters and a “history” (collections of messages that lasted 24 hours). As a result, by the end of 2013 Snapchat was no longer just a messenger, but also a bit of a social network. In 2014, the audience reached 50 million, chat functionality appeared, and a public grouping of messages by events, topics or places became possible. In 2015, new filter lenses appeared, dialogs with integrated video messages, access to the world market and broadcasts of someone else's video content from media companies. The audience has grown to 100 million.

To create filter lenses, a Russian-Ukrainian startup Looksery was purchased, which developed the technology for changing faces in real time. Six months later, we in Russia will learn about the MSQRD application with similar functionality that Facebook will acquire in the unsuccessful competition with Snapchat at that time.

Like many other startups focused on growth through capitalization, Snapchat abandoned the user’s monetization of the application in favor of audience growth and receives all revenue only from advertising. A short successful monetization through the sale of extended lens sets brought up to a quarter of advertising revenue at the moment, but two months later paid filters were turned off. Evan's other reversed decision was to create his own content. He hired a publisher for his production. The project was led by the former first vice president of Fox. After 5 months, the project was closed. In its place came 16 famous media producers like BuzzFeed and Cosmopolitan, broadcasting their collections of videos and photonews.

In May 2016, Snapchat for the first time topped the monthly ranking of the most downloaded iOS apps. In this rating, the messenger moved iTunes U from the first position. Today, the average user logs in to 18-20 times a day, and Snapchat users have already outstripped Facebook users by the number of video views. However, Facebook is not abandoning attempts to seize Snapchat's audience.

At the end of 2016, Snapchat's audience suddenly ceased to grow rapidly, as stated in the issue prospectus for IPO. In the prospectus, this is due to the machinations of Zuckerberg, who in August introduced Instagram Stories, reminiscent of Snapchat photo collections. The threat from Zuckerberg comes not only from Instagram. although Instagram also has a youth audience, albeit older than the snapchat. In the fall of 2016, Facebook launched on trial in Poland and Australia disappearing messages and avatar filters in its messenger.

Throughout its existence, Snapchat has quite successfully improved the product, responding to or anticipating user requests. A news platform from media companies (Discover), a group of user videos from around the world on a topic, event or place (Live) were good attempts to structure the search for an interesting video. But users increasingly complained about the difficulty of finding information. To combat this problem, Snapchat bought a search service Vurb for $ 200 million. Content grouping is becoming more difficult, and friends are getting farther away, and my subjective opinion is that this can ruin Snapchat. In 2015, the authors of the study found that Snapchat is much better than all instant messengers.and social networks replaces live human communication. The only communication method that has exceeded Snapchat in this indicator is real offline. The increasing complexity of content grouping and chronological mixing of friendly posts makes Snapchat similar to Facebook in terms of moving away from chatting to an algorithmic and sponsored news feed. And in the fight against Facebook, a lot will be decided only by money and the size of the audience.

To counter Facebook, you need a lot of money. Therefore, Snapchat is going to sell part of its shares through an IPO in the amount of $ 3 billion, despite the weak stock market conditions. But not only so. Shareholders need to show the profitability of the investments made, and the founders find resources for the development and promotion of a new product - points for creating augmented reality on the Internet based on the video content shot by the user.

Evan is not a programmer, but a designer. Perhaps that is why he easily buys companies when he has money. Most do this after an IPO. and Evan started long before him. He easily chose the tactics of buying technology on the market from the first years of its existence.

In 2014, AddLive startup was acquired, which is associated with streaming video for $ 30 million. In 2014, Vergence Labs was purchased, producing smart glasses that can shoot video and transfer it to a smartphone. In 2014, Snapchat bought Scan.me for $ 54 million, which scans QR codes, and integrated the technology into users' avatars. In 2015, Snapchat bought the previously mentioned Looksery for face modification and the popular Facebook application Bitmoji, which inserts animation into messages. In 2016, they bought a Seene 3D photo app and an Israeli start-up Cimagine Media augmented reality technology startup.

Evan Spiegel identifies three main articles of monetization in the company's business model: camera, content and communication.

In the prospectus for placement on the exchange, the emphasis is on the camera. In short, more and more videos and geotags will be sponsored by someone. The remaining areas of monetization are described very vaguely. Meanwhile, even purchases in 2014 and subsequently could give reason to speculate about plans for augmented reality, for example , using 3D stickers . What finally happened in the fall of 2016.

Spectacles glasses with a camera for shooting widescreen video entered the market (the viewing angle of the lens is 115 degrees against 74 for the iPhone). A feature of viewing such a video was the independence of the video stream from the rotation of the smartphone screen. The viewer can choose the angle right when viewing. And with horizontal and vertical, even with a diagonal rotation, the picture opens up new details in the corners - as if you are transferring the focus of attention there. The video came a little closer to the impression of a "window into the world . " But only on the smartphone screen. On a desktop computer and on TV, you just see a round screen of the video stream instead of the usual rectangle - more narrow. Evan himself calls the glasses a toy for now.

The situation on the stock exchange venture market is not very successful right now, but Snapchat is still going for an IPO .

Perhaps the fact is that Snapchat's audience growth rate has decreased by the end of 2016, and Instagram is launching similar functionality? Evil languages would find a connection between entering an IPO in the current not-so-good moment of entering the exchange and a sharp increase in advertising revenue by 7 times over the past year. Earlier in 2015, a former employee already accused Snapchat of overstating the audience. Unproven, but there was no rebuttal or counterclaim. Maybe advertising fees can be legal, but cleverly exaggerate before the IPO?

Theoretically possible. If part of the advertising revenue would come from partners in advance. Accelerated placement of friendly advertising in the calculation of the return on growth in the stock price of a company that you control or just sympathize with is not such a rare occurrence.

Sony Corporation of America CEO Mike Linton has been involved in Snapchat since the company's first days (he claims). It is strange then that he was not the first investor. But in any case, since 2013, he has definitely performed the role of adviser to Evan Spiegel, entering the board of directors of the company, and now before the IPO he becomes chairman of the board of directors of Snap. A very useful contact for the monetization advertising model. Absolutely legal of course, but providing the opportunity to accumulate income at the right time for beautiful reporting ...

Recent contacts with Google also provide interesting opportunities for playing with advertising revenue in exchange for investment. The degree of integration with Google is generally a mystery in recent months. It is known about the recent contract obliging Snapchat to purchase server services for $ 2 billion for 5 years. It is also known about the discovery of Snapchat in the portfolio of the investment company Google Capital (now CapitalG). Maybe Google didn’t buy Snapchat shares, but gave them a convertible loan, but the search engine seems to be the messenger investor. Google also has good opportunities to recommend to advertisers where and when to advertise.

The foregoing is precisely conspiracy thesis, since advertisers are always late in budgeting compared to audience growth, and the sharp increase in advertising in 2016 is not so surprising. And Google can play on Evan’s terms and just sold him its services “in the long” and all Snapchat investments are just an upfront sale of equipment or a convertible loan. Most likely, the Snapchat investor KPCB fund (Kleiner Perkins Caufield & Byers) did not persuade Evan to buy his portfolio asset Bitmoji in 2015, just his animated technology successfully fit into Snapchat's filter strategy. Jumps in advertising and cashing out of early investments through IPOs are almost normal for startups. IPO troubles may come from the other side.

A group of large American investors wants to ban special classes of shares that give more votes to certain shareholders over others. The coalition of joint-stock lobbyists included 16 funds, which manage assets of more than $ 17 trillion. Snap, which is going to sell during the upcoming IPO, non-voting shares, may collect less than the expected amount if this initiative develops into a boycott, for example. Now Evan and Bob have 45% of the total number of shares, including 70% of all voting shares.

Continuation of the story here .

Fled from parents

Descriptions of how Snapchat works usually begin with the fact that it is an instant messaging service that disappears after viewing. But not only this once unique functionality made it popular. Imagine that you are watching Habr, where blog authors post photos and video reports about the life of each of them and related clever thoughts in the last 24 hours. Each author for a series of 10 second videos tells the main news, accompanied by small text and photos, applying cartoonish filters in the style of Chichvarkin, Avatar landscapes or People in Black characters for fun. Having looked at one multi-real "diary", you immediately start viewing the "diary" of the next author. The most interesting moments of reporting can be laid out on thematic pages of public categories. Text blogs also exist, but they live from a second to a day, and each commentary lives until it is read. Do you say that the main thing here is the disappearance of posts and posts within 24 hours? This is an endless festival of home-made photo and video reports about your life and the world around you with cartoonish jokes in the design.

The audience of such festivals is already 160 million people around the world, Facebook has already tried twice to buy it, twice made an attempt to launch a competitor and now attacks it from its two platforms, copying the alleged key functionality.

The popular version of the success of Snapchat focuses on the established circle of communication and common interests. Each social network has its own audience age. Something similar to our Odnoklassniki, VKontakte and the Russian segment of Facebook. However, in popularity ratings, they usually have different news. American youth did not know VKontakte. So they fled to Snapchat. The disappearance of photographs here was not the main motive. In the entire history of use, only 14% of the audience sent intimate photos that would be worth erasing by viewing.

In real history and at every stage of Snapchat growth, the drivers for audience growth were different.

How was it really

Snapchat was born as a means of protecting confidential photos and messages, but was originally touted by the founders as "a game to send disappearing photos to friends." This wording is from a letter from the founder and CEO of startup Evan Spiegel.

The first month brought 127 users. The first name Pictaboo was also unsuccessful - it refers to the image of a children's game when an adult covers his face with his hands. It is not surprising that with this name the game did not take off among the youth.

The name Pictaboo was soon abandoned due to a conflict with the author of the idea, which may have saved the startup. Although about the character of Evan, this break with a partner is not very good evidence.

Overcoming the “Death Valley” together, Evan Spiegel and Bob Murphy renamed the application into the now-famous Snapchat and by the spring of 2012 reached 30,000 installations. The functionality of disappearing photos turned out to be more or less in demand for sending photos of an intimate or bully character. But not only. In April 2012, Evan was found by an investor whose schoolgirl daughter began to use this application to send cheat sheets and answers to tasks. Its half a million dollars allowed to launch the version for Android and add sending video.

Unexpected benefactor of Snapchat in the late fall of 2012 was Zuckerberg. He became interested in the application, tried to buy a company and even made a competitor. But the latter did not take the audience, but only drew attention to the functionality of the missing photos and to Snapchat itself in the application store and from journalists, which gave Evan and Bob an increase of up to a million users.

Evan took advantage of Mark Zuckerberg’s attention also for public relations among investors, having organized an investment auction in 2013 between the Chinese and Google. However, none of them seemed to sell. No matter how sold and re-came to purchase Zuckerberg. Teasing the giants, he nonetheless raised $ 150 million in 2013 from lesser-known investors.

Money was needed to finance growth and court payments for 2 years of compensation of $ 158 million, which was excluded at the start of startup co-founder Frank Brown.

Growth stages

With new investments, Snapchat expanded its functionality by introducing filters and a “history” (collections of messages that lasted 24 hours). As a result, by the end of 2013 Snapchat was no longer just a messenger, but also a bit of a social network. In 2014, the audience reached 50 million, chat functionality appeared, and a public grouping of messages by events, topics or places became possible. In 2015, new filter lenses appeared, dialogs with integrated video messages, access to the world market and broadcasts of someone else's video content from media companies. The audience has grown to 100 million.

To create filter lenses, a Russian-Ukrainian startup Looksery was purchased, which developed the technology for changing faces in real time. Six months later, we in Russia will learn about the MSQRD application with similar functionality that Facebook will acquire in the unsuccessful competition with Snapchat at that time.

Like many other startups focused on growth through capitalization, Snapchat abandoned the user’s monetization of the application in favor of audience growth and receives all revenue only from advertising. A short successful monetization through the sale of extended lens sets brought up to a quarter of advertising revenue at the moment, but two months later paid filters were turned off. Evan's other reversed decision was to create his own content. He hired a publisher for his production. The project was led by the former first vice president of Fox. After 5 months, the project was closed. In its place came 16 famous media producers like BuzzFeed and Cosmopolitan, broadcasting their collections of videos and photonews.

In May 2016, Snapchat for the first time topped the monthly ranking of the most downloaded iOS apps. In this rating, the messenger moved iTunes U from the first position. Today, the average user logs in to 18-20 times a day, and Snapchat users have already outstripped Facebook users by the number of video views. However, Facebook is not abandoning attempts to seize Snapchat's audience.

Problems or respite

At the end of 2016, Snapchat's audience suddenly ceased to grow rapidly, as stated in the issue prospectus for IPO. In the prospectus, this is due to the machinations of Zuckerberg, who in August introduced Instagram Stories, reminiscent of Snapchat photo collections. The threat from Zuckerberg comes not only from Instagram. although Instagram also has a youth audience, albeit older than the snapchat. In the fall of 2016, Facebook launched on trial in Poland and Australia disappearing messages and avatar filters in its messenger.

Throughout its existence, Snapchat has quite successfully improved the product, responding to or anticipating user requests. A news platform from media companies (Discover), a group of user videos from around the world on a topic, event or place (Live) were good attempts to structure the search for an interesting video. But users increasingly complained about the difficulty of finding information. To combat this problem, Snapchat bought a search service Vurb for $ 200 million. Content grouping is becoming more difficult, and friends are getting farther away, and my subjective opinion is that this can ruin Snapchat. In 2015, the authors of the study found that Snapchat is much better than all instant messengers.and social networks replaces live human communication. The only communication method that has exceeded Snapchat in this indicator is real offline. The increasing complexity of content grouping and chronological mixing of friendly posts makes Snapchat similar to Facebook in terms of moving away from chatting to an algorithmic and sponsored news feed. And in the fight against Facebook, a lot will be decided only by money and the size of the audience.

To counter Facebook, you need a lot of money. Therefore, Snapchat is going to sell part of its shares through an IPO in the amount of $ 3 billion, despite the weak stock market conditions. But not only so. Shareholders need to show the profitability of the investments made, and the founders find resources for the development and promotion of a new product - points for creating augmented reality on the Internet based on the video content shot by the user.

Foreign technology

Evan is not a programmer, but a designer. Perhaps that is why he easily buys companies when he has money. Most do this after an IPO. and Evan started long before him. He easily chose the tactics of buying technology on the market from the first years of its existence.

In 2014, AddLive startup was acquired, which is associated with streaming video for $ 30 million. In 2014, Vergence Labs was purchased, producing smart glasses that can shoot video and transfer it to a smartphone. In 2014, Snapchat bought Scan.me for $ 54 million, which scans QR codes, and integrated the technology into users' avatars. In 2015, Snapchat bought the previously mentioned Looksery for face modification and the popular Facebook application Bitmoji, which inserts animation into messages. In 2016, they bought a Seene 3D photo app and an Israeli start-up Cimagine Media augmented reality technology startup.

Where to grow

Evan Spiegel identifies three main articles of monetization in the company's business model: camera, content and communication.

In the prospectus for placement on the exchange, the emphasis is on the camera. In short, more and more videos and geotags will be sponsored by someone. The remaining areas of monetization are described very vaguely. Meanwhile, even purchases in 2014 and subsequently could give reason to speculate about plans for augmented reality, for example , using 3D stickers . What finally happened in the fall of 2016.

Spectacles glasses with a camera for shooting widescreen video entered the market (the viewing angle of the lens is 115 degrees against 74 for the iPhone). A feature of viewing such a video was the independence of the video stream from the rotation of the smartphone screen. The viewer can choose the angle right when viewing. And with horizontal and vertical, even with a diagonal rotation, the picture opens up new details in the corners - as if you are transferring the focus of attention there. The video came a little closer to the impression of a "window into the world . " But only on the smartphone screen. On a desktop computer and on TV, you just see a round screen of the video stream instead of the usual rectangle - more narrow. Evan himself calls the glasses a toy for now.

Conspiracy theories of IPO motives

The situation on the stock exchange venture market is not very successful right now, but Snapchat is still going for an IPO .

Perhaps the fact is that Snapchat's audience growth rate has decreased by the end of 2016, and Instagram is launching similar functionality? Evil languages would find a connection between entering an IPO in the current not-so-good moment of entering the exchange and a sharp increase in advertising revenue by 7 times over the past year. Earlier in 2015, a former employee already accused Snapchat of overstating the audience. Unproven, but there was no rebuttal or counterclaim. Maybe advertising fees can be legal, but cleverly exaggerate before the IPO?

Theoretically possible. If part of the advertising revenue would come from partners in advance. Accelerated placement of friendly advertising in the calculation of the return on growth in the stock price of a company that you control or just sympathize with is not such a rare occurrence.

Sony Corporation of America CEO Mike Linton has been involved in Snapchat since the company's first days (he claims). It is strange then that he was not the first investor. But in any case, since 2013, he has definitely performed the role of adviser to Evan Spiegel, entering the board of directors of the company, and now before the IPO he becomes chairman of the board of directors of Snap. A very useful contact for the monetization advertising model. Absolutely legal of course, but providing the opportunity to accumulate income at the right time for beautiful reporting ...

Recent contacts with Google also provide interesting opportunities for playing with advertising revenue in exchange for investment. The degree of integration with Google is generally a mystery in recent months. It is known about the recent contract obliging Snapchat to purchase server services for $ 2 billion for 5 years. It is also known about the discovery of Snapchat in the portfolio of the investment company Google Capital (now CapitalG). Maybe Google didn’t buy Snapchat shares, but gave them a convertible loan, but the search engine seems to be the messenger investor. Google also has good opportunities to recommend to advertisers where and when to advertise.

The foregoing is precisely conspiracy thesis, since advertisers are always late in budgeting compared to audience growth, and the sharp increase in advertising in 2016 is not so surprising. And Google can play on Evan’s terms and just sold him its services “in the long” and all Snapchat investments are just an upfront sale of equipment or a convertible loan. Most likely, the Snapchat investor KPCB fund (Kleiner Perkins Caufield & Byers) did not persuade Evan to buy his portfolio asset Bitmoji in 2015, just his animated technology successfully fit into Snapchat's filter strategy. Jumps in advertising and cashing out of early investments through IPOs are almost normal for startups. IPO troubles may come from the other side.

A group of large American investors wants to ban special classes of shares that give more votes to certain shareholders over others. The coalition of joint-stock lobbyists included 16 funds, which manage assets of more than $ 17 trillion. Snap, which is going to sell during the upcoming IPO, non-voting shares, may collect less than the expected amount if this initiative develops into a boycott, for example. Now Evan and Bob have 45% of the total number of shares, including 70% of all voting shares.

Continuation of the story here .