We work with a budget institution. Part 1

If you are working or are just planning to work with a budget institution, this article (as well as the entire cycle) may be useful to you. A customer approached you with a proposal to develop certain software for him (sell / assemble computers, take office equipment for service). And this customer is a budget institution. What should I look for? What to fear? Is it possible to somehow minimize the risks of such cooperation? What is a promise of money and why is it not enough? And where does the open data come from? If this interests you - I ask for a cat.

Initially, the article was planned as a kind of memo about some features of working with budgetary institutions for small IT companies or IT specialists who are individual entrepreneurs, but in the process of writing it turned out that the range of issues addressed was too wide for both the format of the memo and the format of one article .

With high probability, two options could turn out:

1. The memo is short and abstract, but understandable only to those who have sufficient training in this area ... and is rather useless for everyone (or almost all) of the rest.

2. An article containing an introductory course covering some issues of the legal status of institutions, procurement law, civil law, etc., etc., filled with details and background information, considering the issues raised from different points of view and taking into account numerous development options events, but ... which lost its relevance in the process of writing (it’s hard even to imagine how long it will take), swollen to disgrace and causing overwhelming majority (including the author himself ) Desire to immediately close a tab, and in the few readers pereborovshih this impulse - a sense of irresistible boredom after reading the first two or three chapters.

To avoid this and make the material useful and readable for many, several strong-willed decisions were made:

1. Do not try to grasp the immensity: if you cannot manage with one article, let it be a series of articles. The main goal is to give the most understandable and reflective reality idea of the features of working with budgetary institutions, so a detailed explanation of some of the related issues will have to be neglected and some information should be given as an axiom (or to consider such issues in separate articles).

2. Graduality is the basis of the foundations: many issues require, of course, a comprehensive review, but to tell everything at once will not work. Therefore, we will move in stages (step by step), periodically referring to what has already been stated, inevitably simplifying and coarsening something.

3. Boundary conditions: it is very tempting to try to describe as many options as possible depending on the type of customer, cost and type of work, some other circumstances, but this is simply unrealistic, so sometimes we will move from particular to general, and sometimes and vice versa. We will try to consider everything that goes beyond the boundary conditions another time, actively using comparisons and analogies.

As a result of the above-described volitional decisions, instead of one article, so far we havecollected collected works in fifty-eight volumes of approximately three. Approximately - because some rearrangement of the material may still occur.

Who can use all this? Those who work (or just going to work) with budgetary institutions.

Will the information be useful for those who work:

1. Under a fixed-term employment contract with a budget institution?

Hardly: in this case, the main role is played by labor legislation. But in order to broaden one's horizons, why not read it?

2. With a budget institution, but whose activities are not related to IT?

Yes. A lot of work with budgetary institutions does not depend on what exactly you do, but everywhere there is a specificity and some points relate exclusively to the IT sphere - keep this in mind.

3. Not with a budget, but with a government, autonomous institution, or even an executive body or local government?

Yes, there is so much in common. In order not to be constantly distracted by clarifications about the type of customers in question, which would only complicate the writing of the article and its reading, it was decided to consider the features of working with them in a separate comparison article (if it would be interesting to readers).

4. Not with a budget but with a commercial institution?

Information will be useful starting from the second half of the second article, but you still have to take into account the specifics.

5. With a budgetary institution, but on the basis of an agreement concluded as a result of an auction, tender, request for quotations, request for proposals?

Yes, a significant part of the information will be relevant, but in this case, the specifics associated with the organization, conduct and participation in competitive procedures are added, and, on the contrary, the process of agreeing on the terms of the contract almost disappears. There is a non-zero probability that some interesting points will be considered in a separate article.

Do not forget that each situation is unique in its own way, and draw analogies, despite the possible similarities (real or only apparent), you must be extremely careful.

The article is my first publication on Habré, and, accordingly, the first article on the subject. I don’t know how much the raised topic will be in demand, therefore if: you are interested in something; some issue is not considered in sufficient detail and requires additional explanation; you strongly disagree with something - please write in the comments or through personal messages.

A little about the author and the reasons for writing the article: I am a long-time reader of Habr, but as it happened, I registered only now. For all this time, a lot of information was obtained from Habr, which turned out to be not only interesting, but also useful: for professional activities, and for various hobbies, and even for some domestic needs. There was so much of this information that the periodically arising idea that it would be nice to somehow “give myself away” (I do not like to remain in debt) at some point transformed into the article that you see.

Answers to some possible questions are given under the spoiler at the end of the article. Also, some images (mainly visualizing the description of transitions on the menu of sites) and information: background information (excerpts from the text of laws and other documents) and not directly related to the topic of the article, but related to it, are removed under the spoiler.

So, the promised boundary conditions: a budgetary institution will act as a customer, a small (or large) company or individual entrepreneur will act as you, the subject of the contract will be software development, and the contract itself will be concluded directly with you, and not based on the results of competition, auction or request for quotes (competitive methods of procurement is a topic for a separate discussion), the cost is approximately known and even the task does not cause special problems (at first glance).

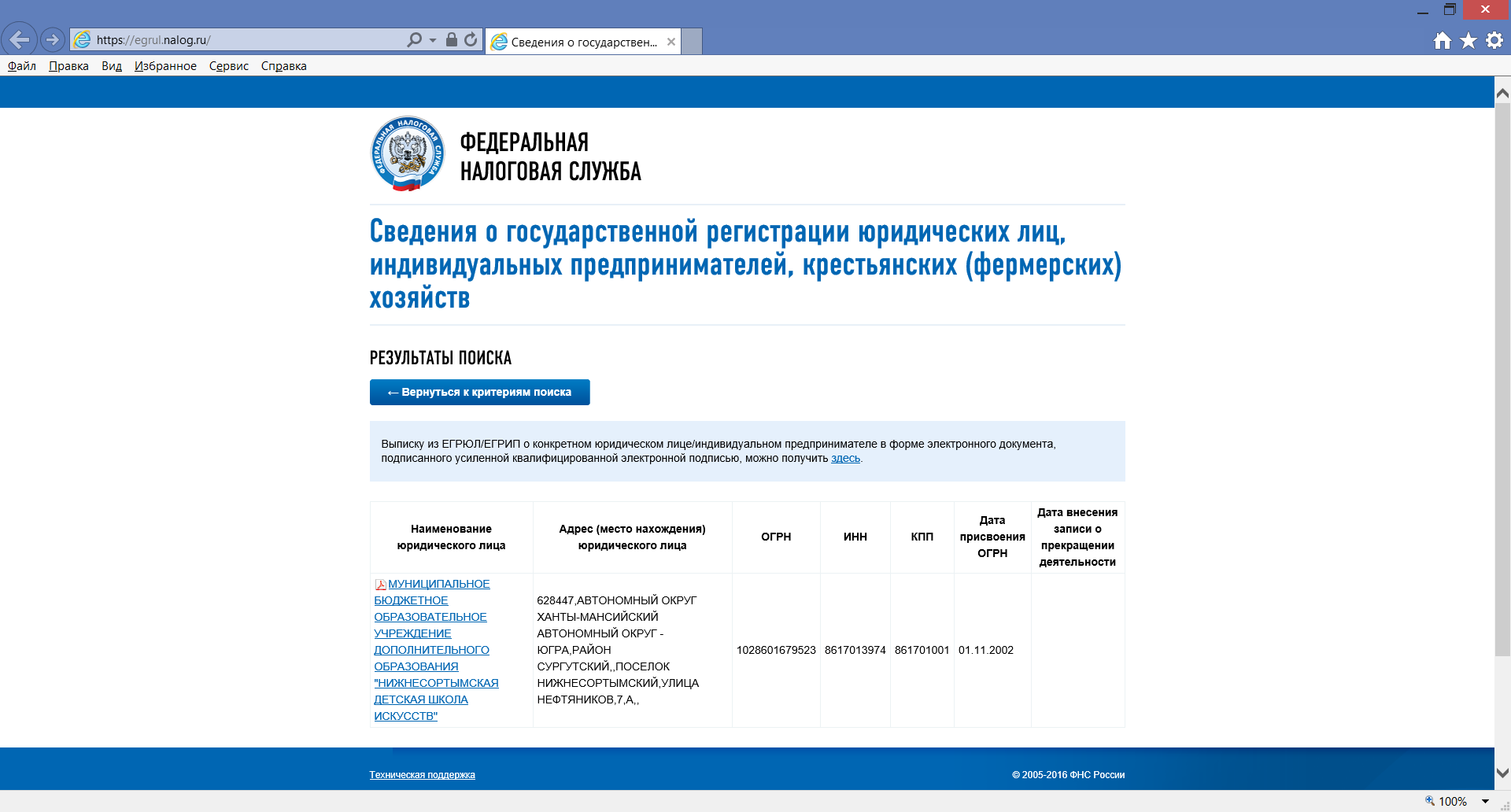

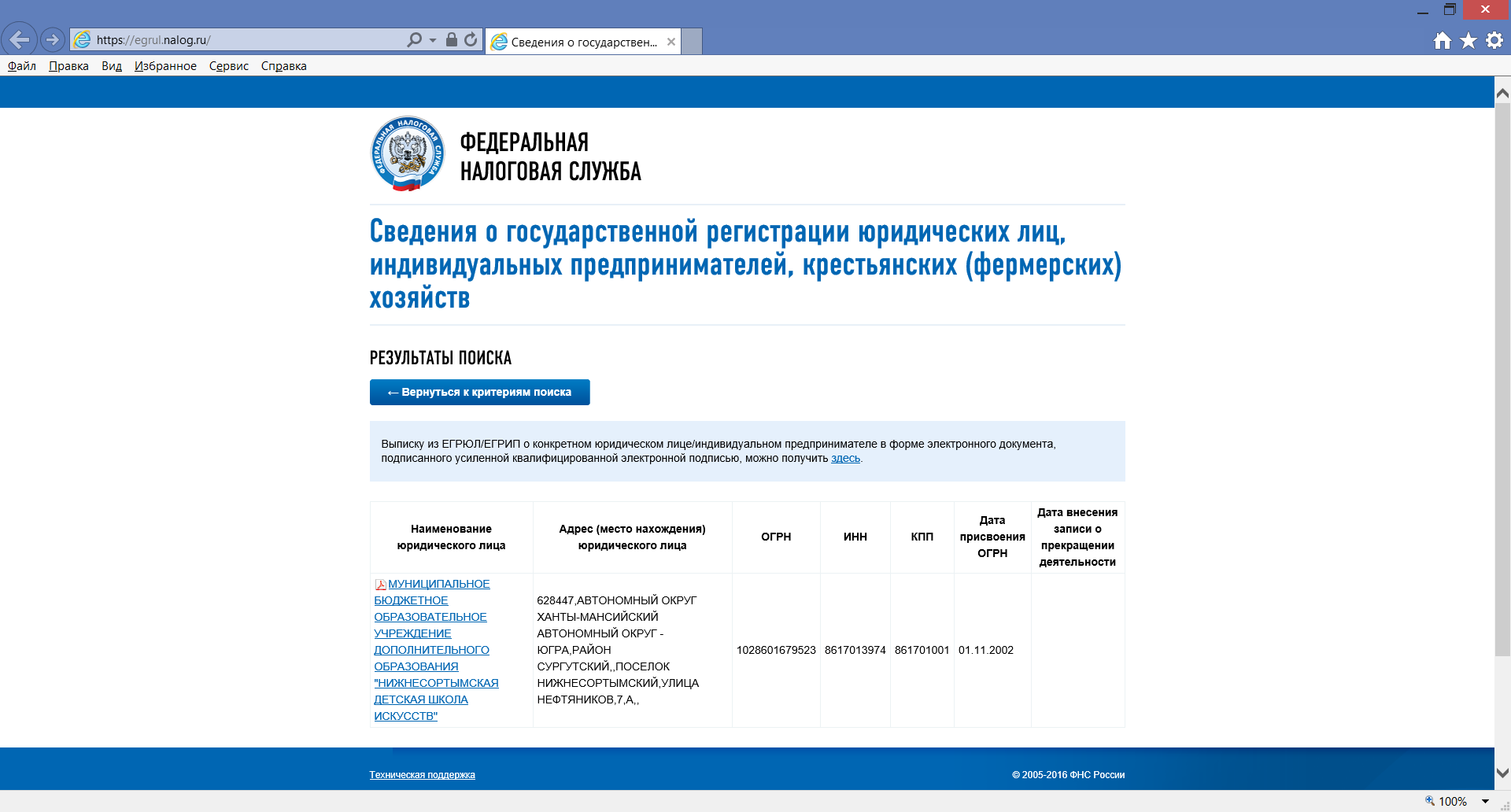

How to find out the TIN by the name of the customer is not a secret, but for the sake of completeness, this is worth mentioning. On the website of the tax office egrul.nalog.ruYou can search by TIN / BIN or by name of legal entity (IP). Let our customer be the Municipal Budget Institution “Nizhnesortimsk Children's Art School” (these and other institutions are completely random and are used solely as an example).

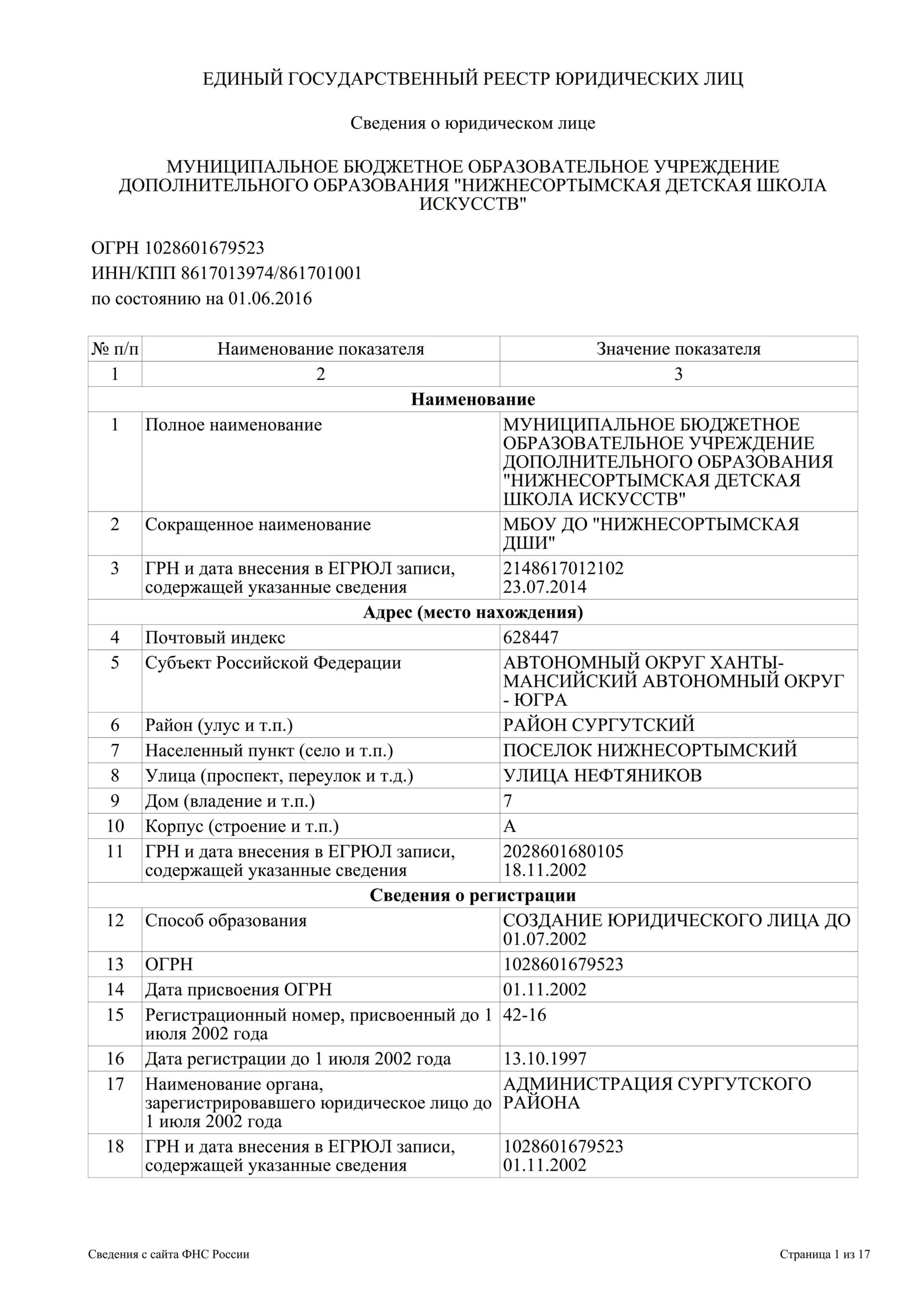

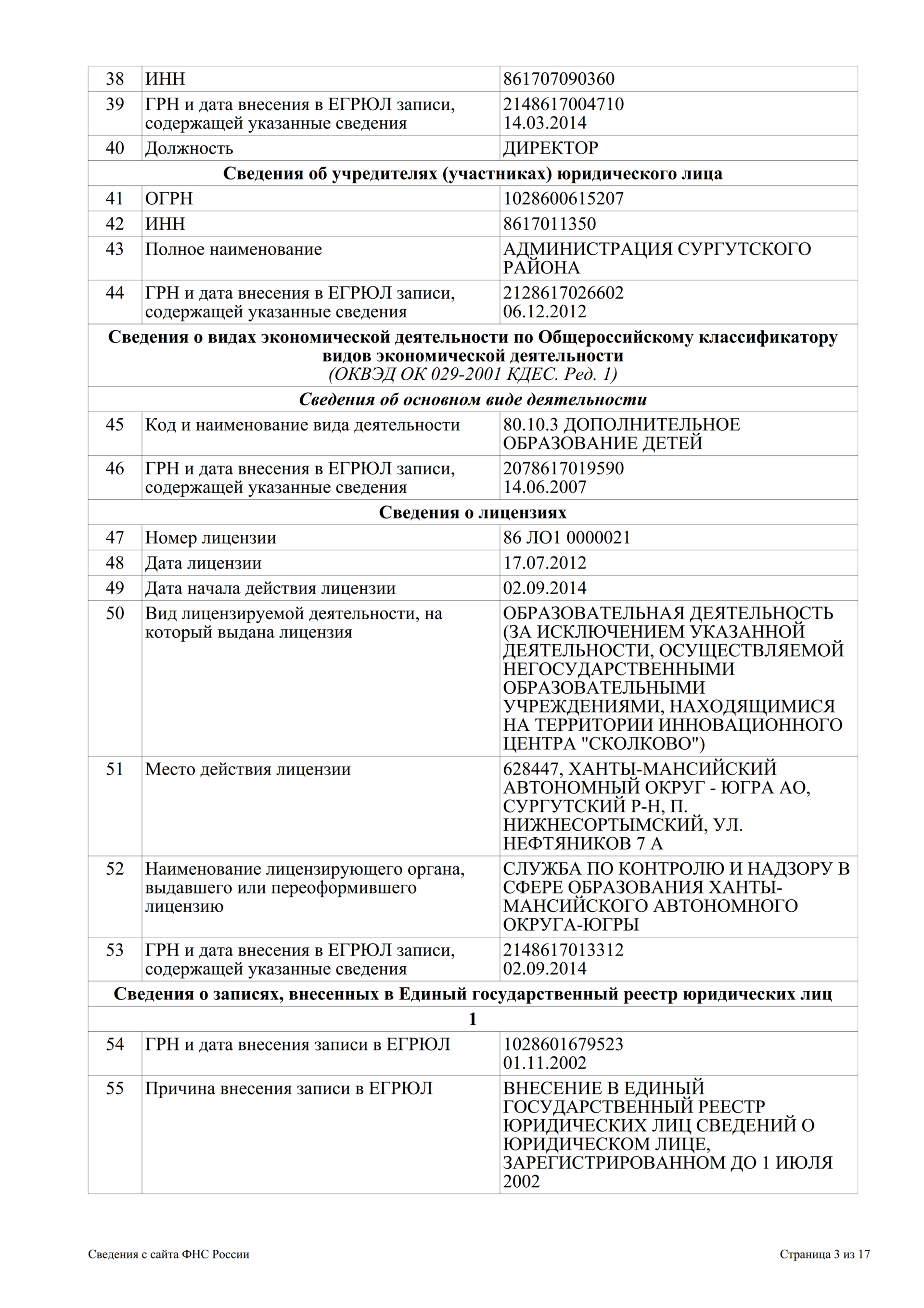

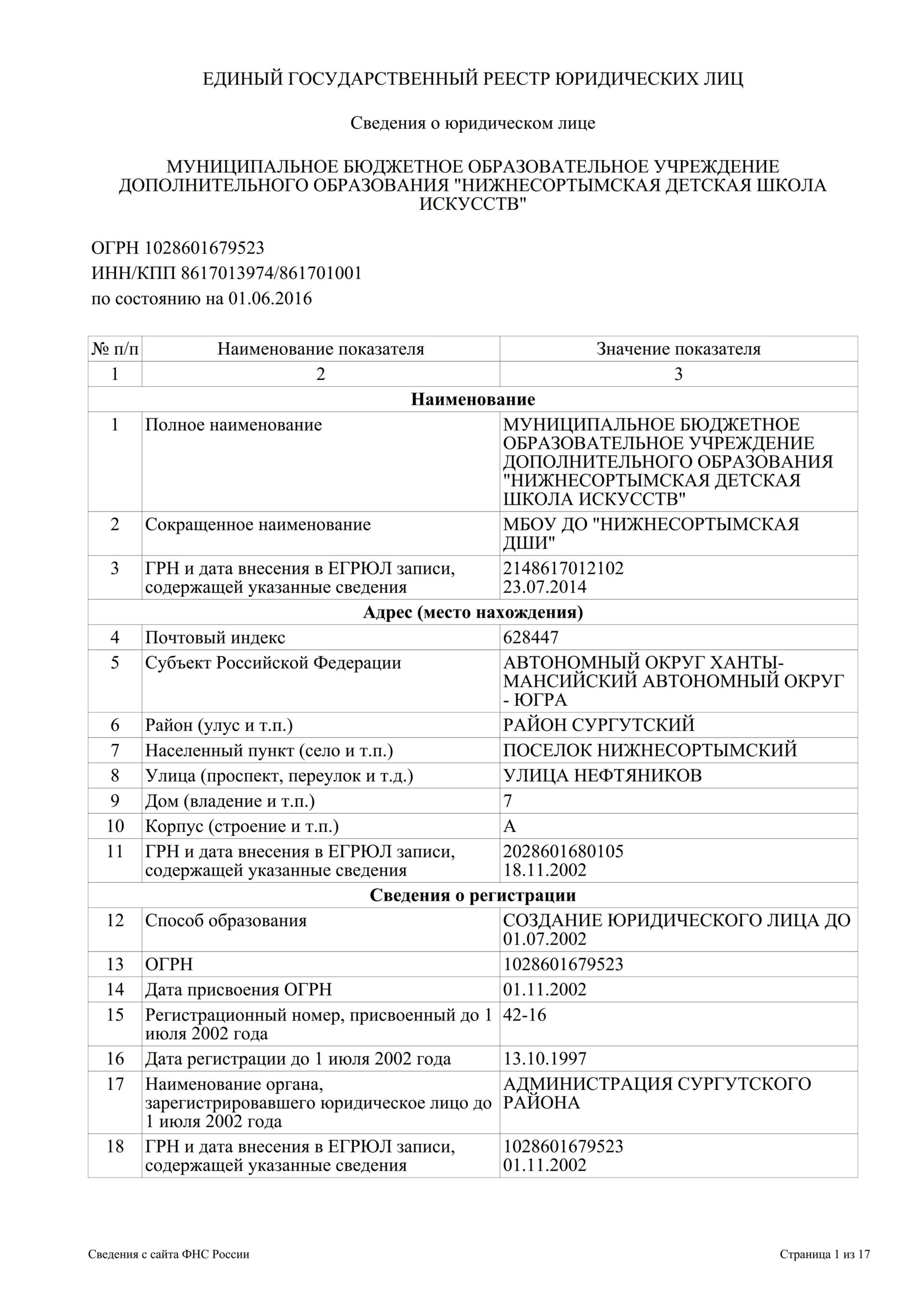

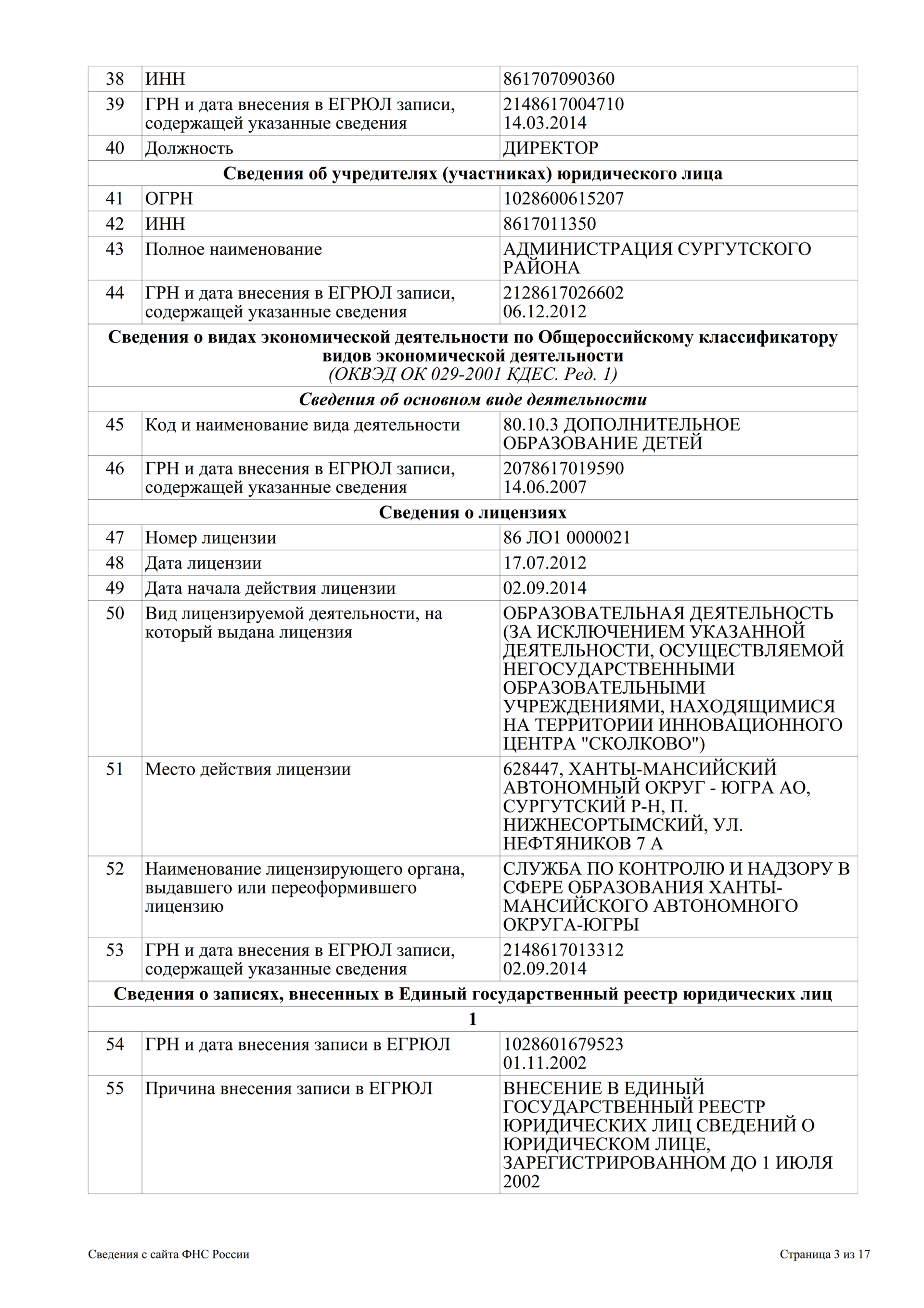

By clicking on the name of the institution, you can download the extract (.pdf). Usually, the most interesting is contained in the first three to four pages, but no one forbids viewing them all.

Now we have the TIN of the customer (8617013974), the name of the director, address (location), founders, activities (OKVED), licenses, etc. Why do we need this?

TIN - we will use it for further searches.

Name of the director - in order to know with whom we should conclude an agreement (on the importance of having the person concluding the agreement, the appropriate authority and possible unpleasant consequences - in the third article of the cycle).

Address (location) - firstly, it’s always useful to know where you can find a customer (and if the nature of the work you are doing is related to a physical visit to the customer, it’s not just useful, but necessary), and secondly, we may need this address for exchange correspondence.

The founder is a higher authority for our customer, and in some cases it will be useful to address it with those problems that the customer cannot or does not want to solve.

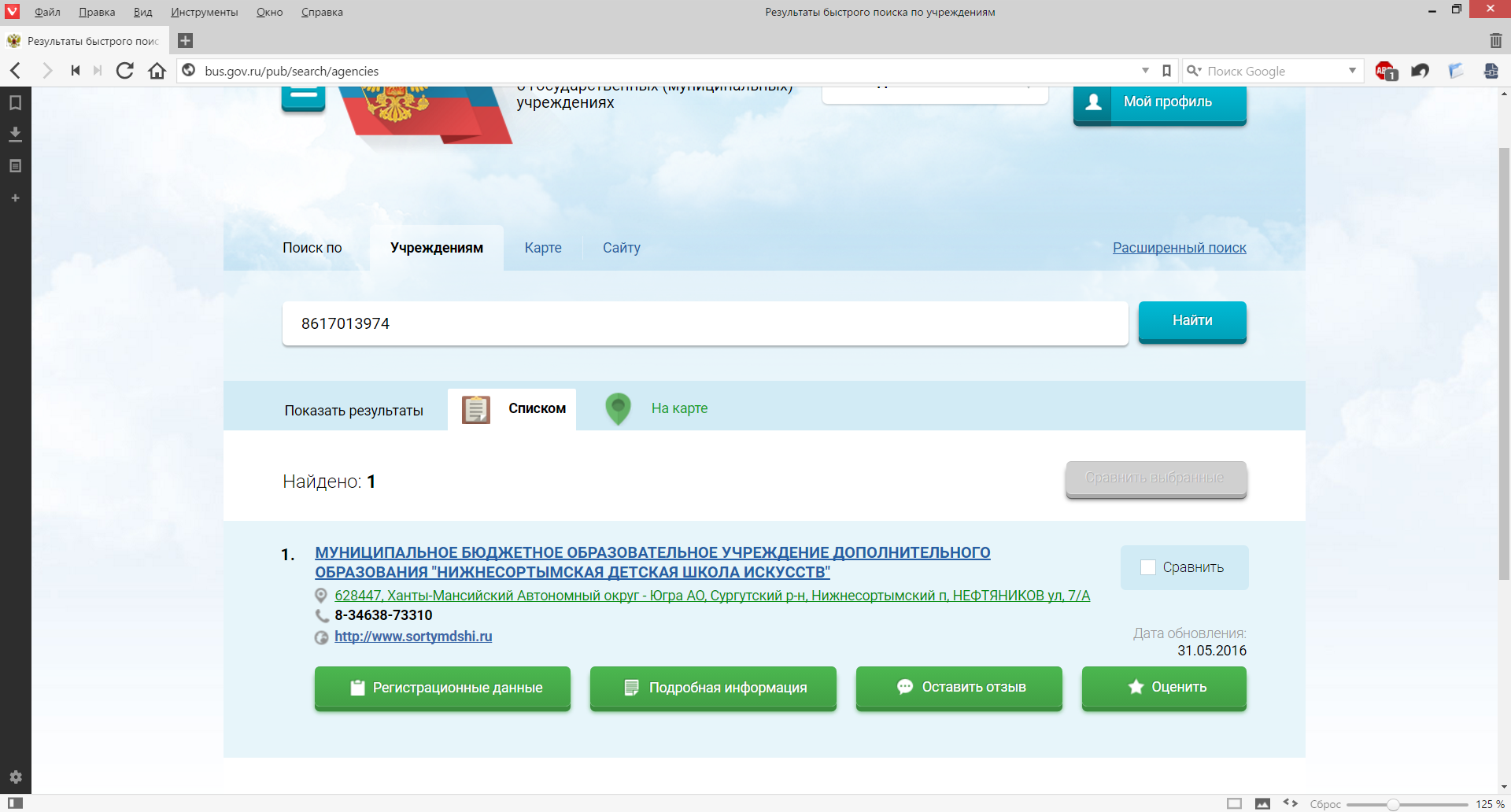

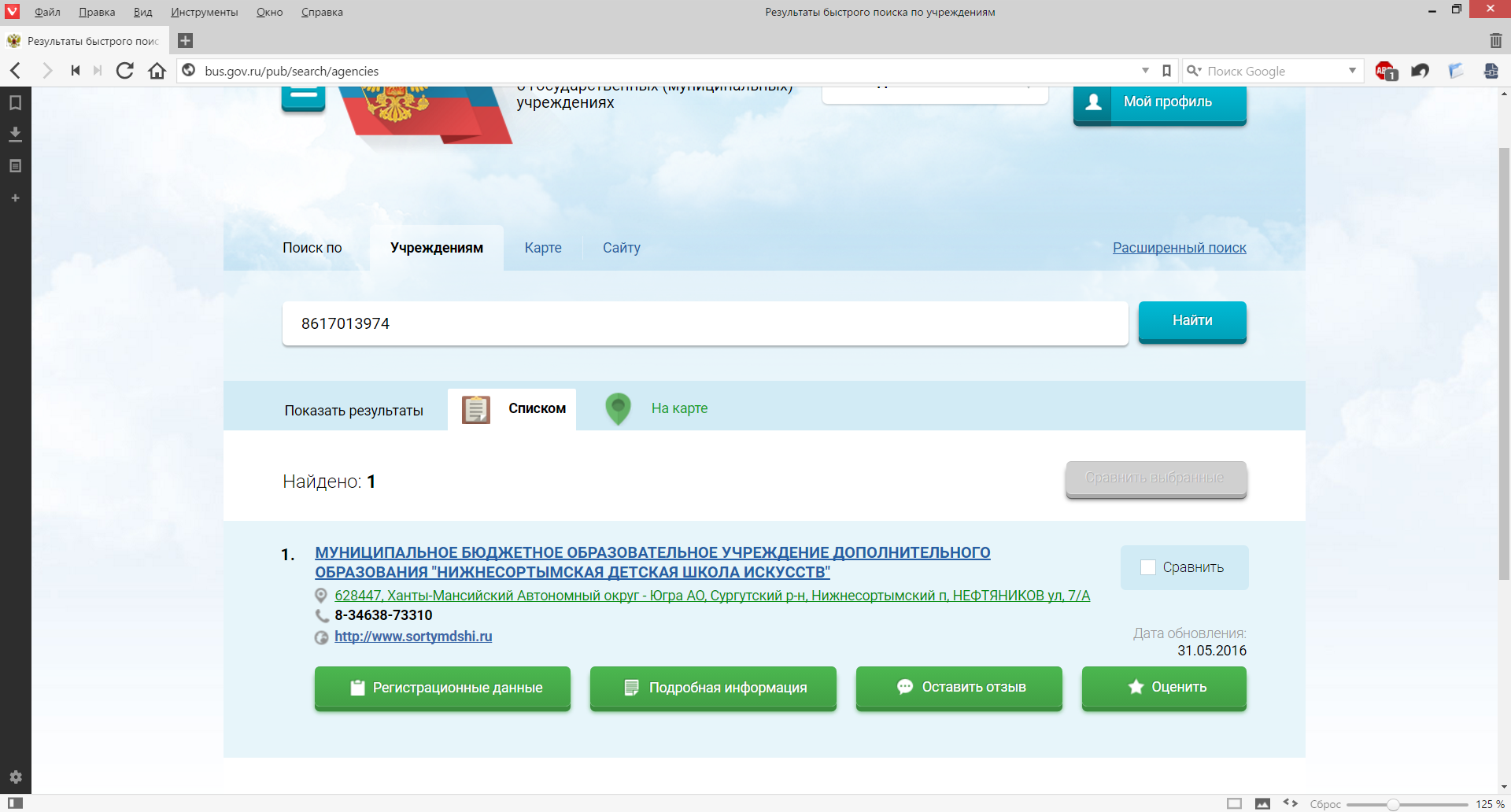

And if you want to know more? There are other sources of information, for example, the official website for posting information on state (municipal) institutions bus.gov.ru/pub/home .

Just in case, I quote a link for self-viewing: bus.gov.ru/pub/agency/3071 . On this page are the name of the institution (full and abbreviated), founder, type of institution (do we still remember that we work with a budgetary institution?), Address, name of the head, phone number and even the website (of course, the customer does not always have a website )

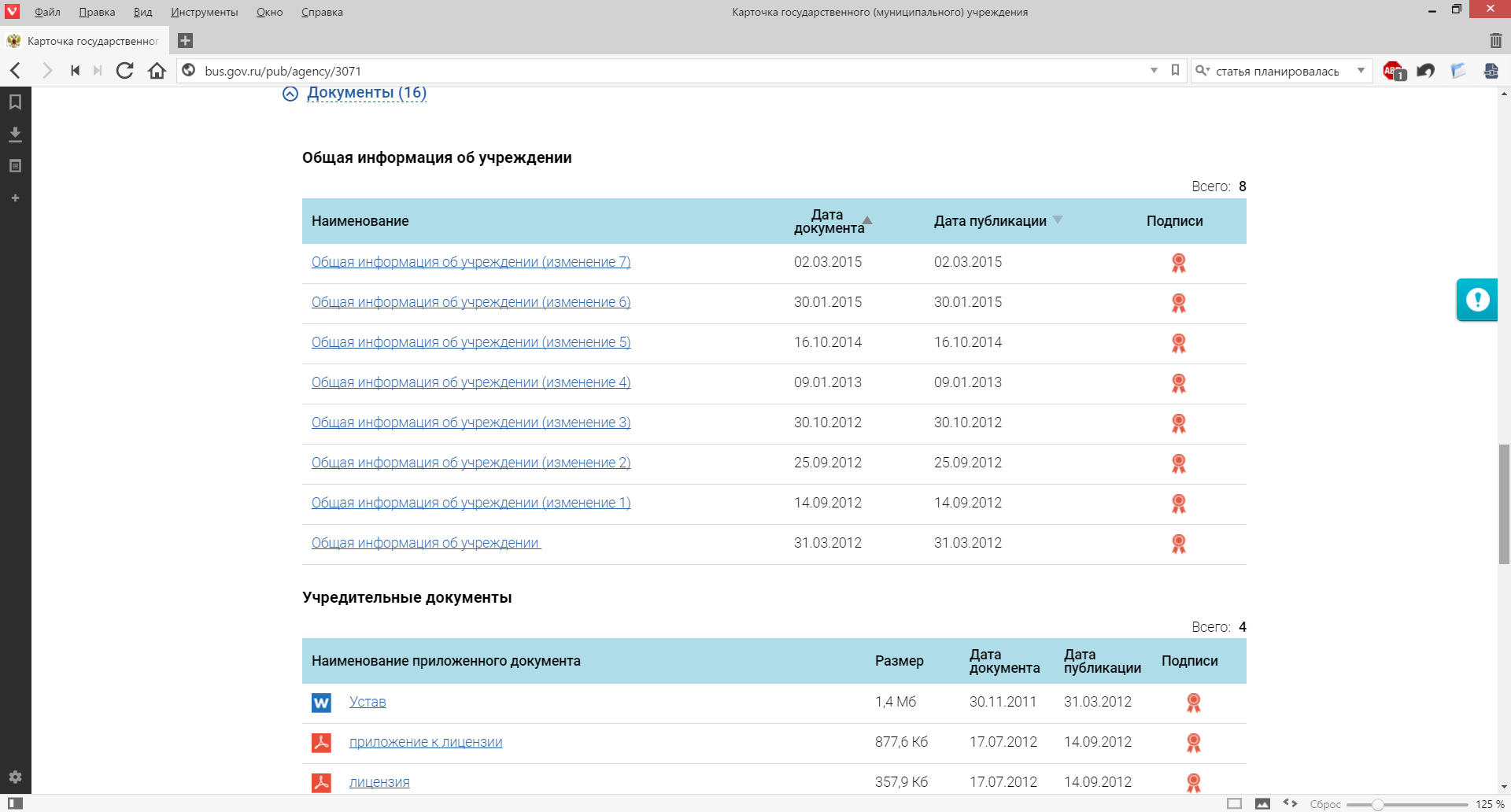

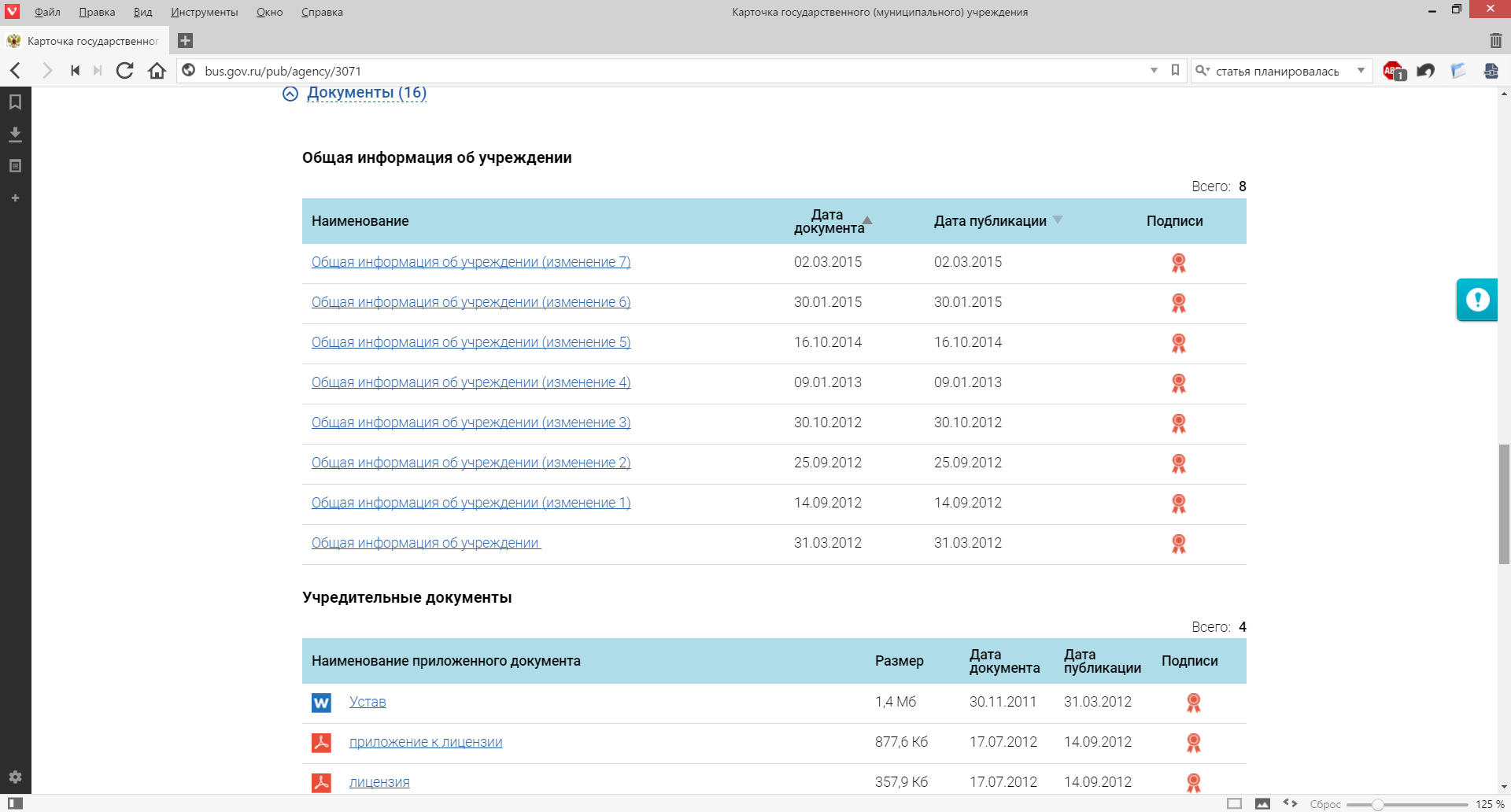

Here are the Charter of the institution, a license for educational activities, an order on the appointment of a director and other documents.

Is this useful information? Yes of course. In addition to the data obtained from the tax inspection website, we now know the type of institution: usually in the name of budgetary institutions there is the word “budgetary” (the letter “B” in the abbreviation), but it may not be - this is not prohibited by law. We also have a Charter where you can get information about the powers of the institution and its founders, about the sources of financial support and other details. The directive on the appointment of the director is also a useful document.

Possible problems: not in all institutions (read - municipalities and even regions) due attention is given to timely updating of information.

It would seem to us what difference? If only I paid on time and in full. But this is in theory, but in practice - a source of financing or a source of financial support (as it is called officially) is very important. Nobody wants to be in a situation where the work is completed and successfully completed, and no one is in a hurry to pay for it. The whole variety of reasons for the customer (unfunded expenses, took money for other needs and another 1000 and one) should not be a problem for the contractor. We’ll talk more about payment issues in the following articles, but for now let's see what you can find out about the presence / absence of funds from the customer.

A budgetary institution has two main sources of financing: “budget” and “extrabudgetary”. The definitions are not entirely correct - therefore, in quotation marks.

“Budget” is the money allocated by the state (yes, the author is aware that local authorities are not included in the system of state authorities, but this is easier than writing FOIV, OIV and LSG every time): this may be the budget of the settlement , municipal district, oblast, krai, etc. For budgetary institutions, the main sources of budgetary funds are subsidies for the fulfillment of a state (municipal) task and subsidies for other purposes.

"Extrabudgetary" is what the customer earned himself: his income from entrepreneurial and other income-generating activities.

And why do we need this? When planning to work with a budget institution, you need to understand the following:

A “budget” is not yet real money held by the customer on the accounts and which he can pay “right now.” These are only planned (and not always) expenses. In other words - so far this is only a promise of the state to give this money to the customer. A promise can be taken back (not to give money) or revised (reduce the amount or change its purpose). The customer can try to resist this in an extremely limited number of cases, and even then without a guarantee of success.

"Extrabudgetary" is also not always real money. Sometimes, of course, the customer already has money, but often he still has to earn it, and then this is again a promise: only now is the promise not of the state, but of the customer. A promise is possible ... However, we will not repeat it.

The main financial document for a budgetary institution is the Plan of financial and economic activities or, in short, the plan of FCD (there are also agreements on the allocation of subsidies and other documents, but they have nothing to do with our topic). It is signed by the head and chief accountant of the institution, approved by the founder, and it is in it that the promises (of the state and the customer) are spelled out, about which we spoke above.

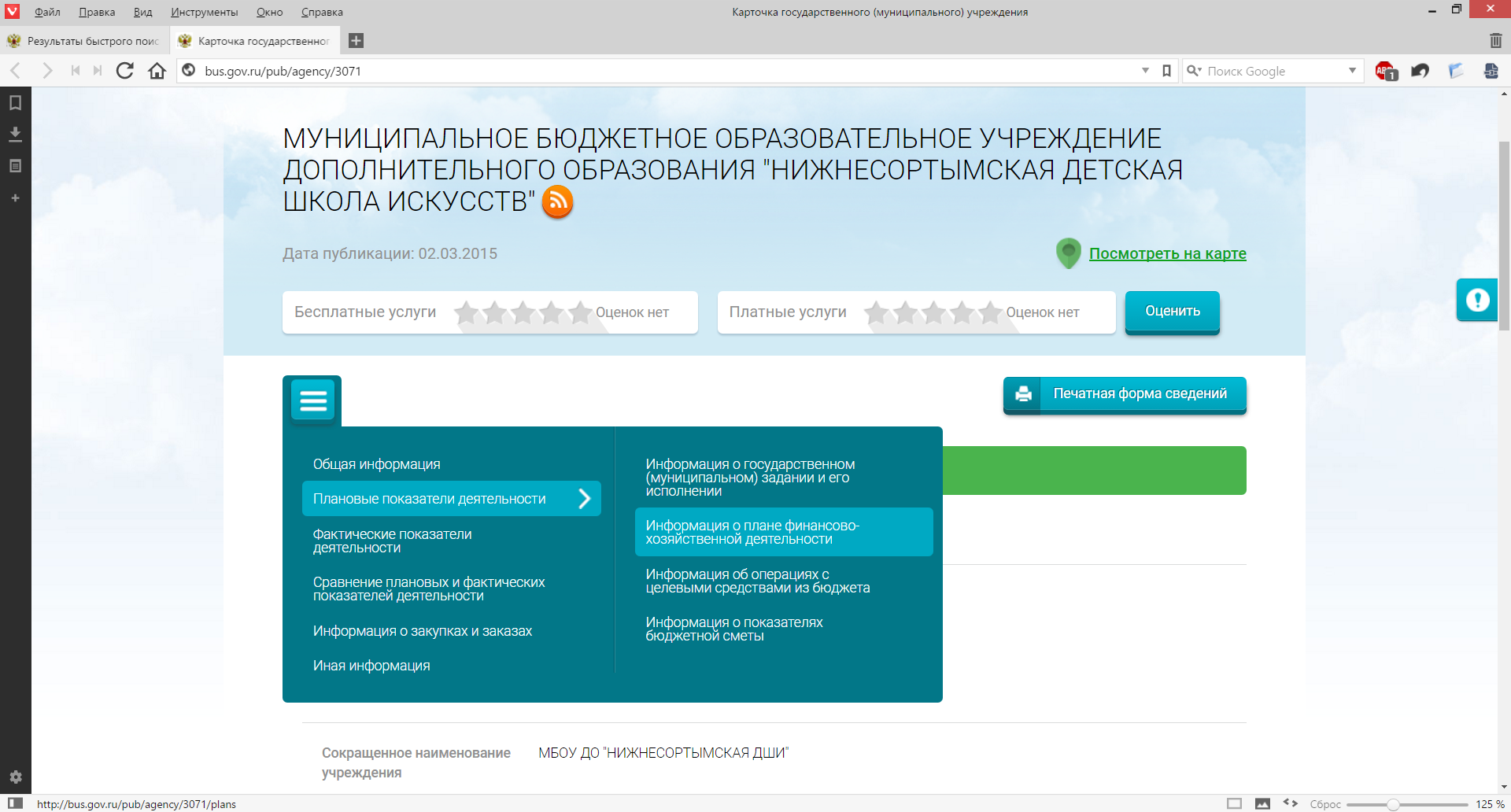

Let us return to the official site we already know for posting information on state (municipal) institutions. If in the menu with information about the institution choose

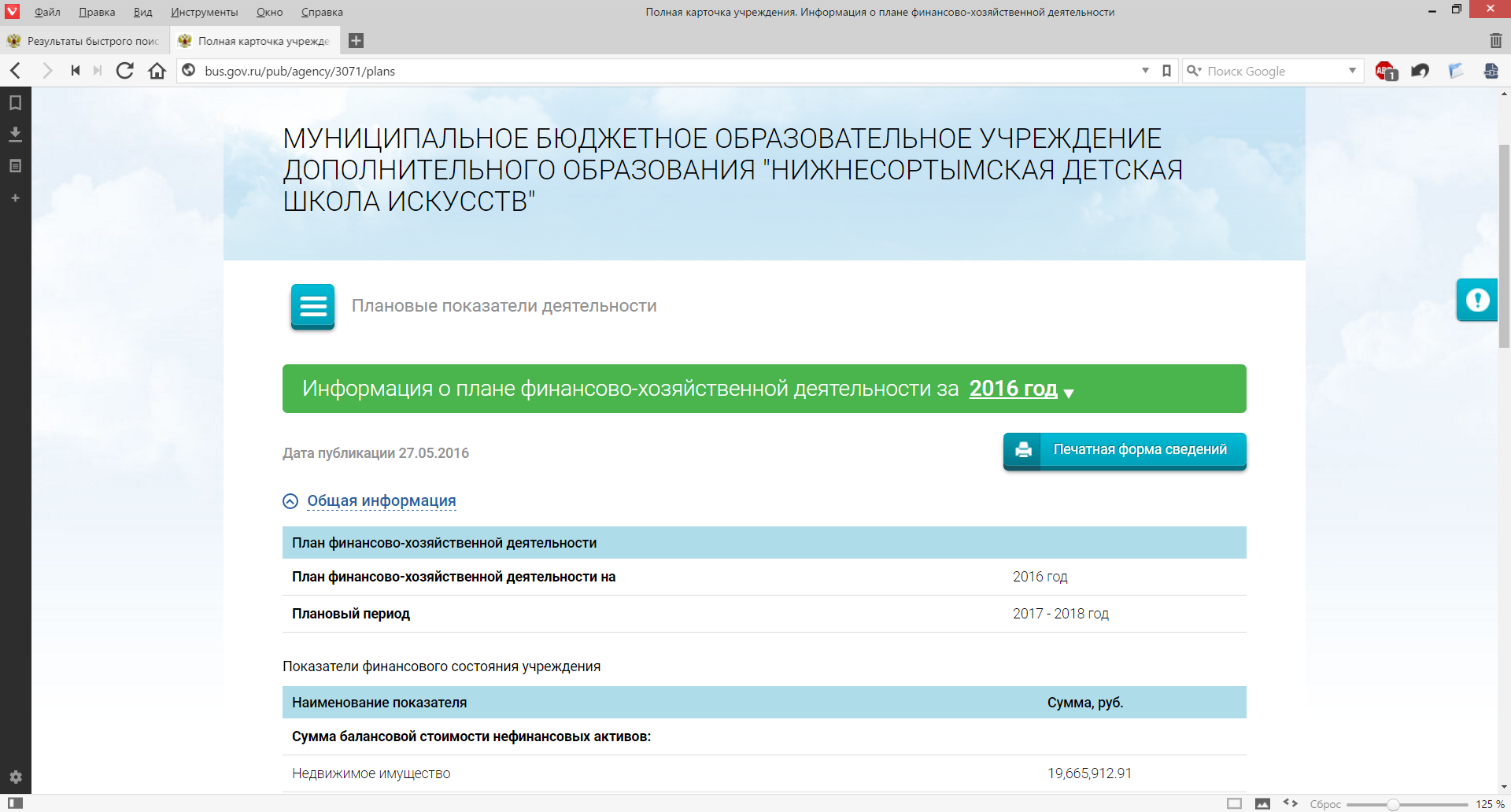

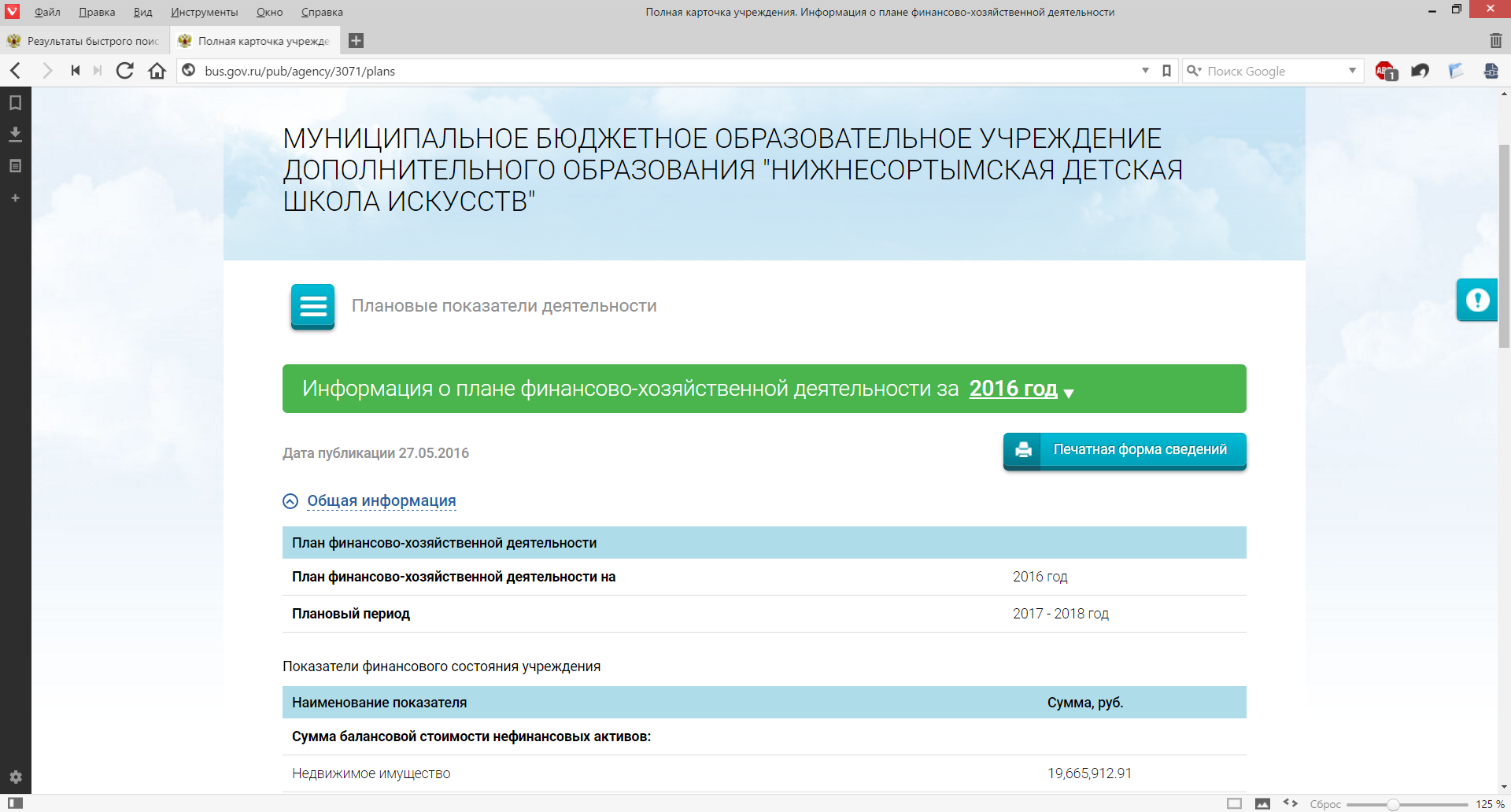

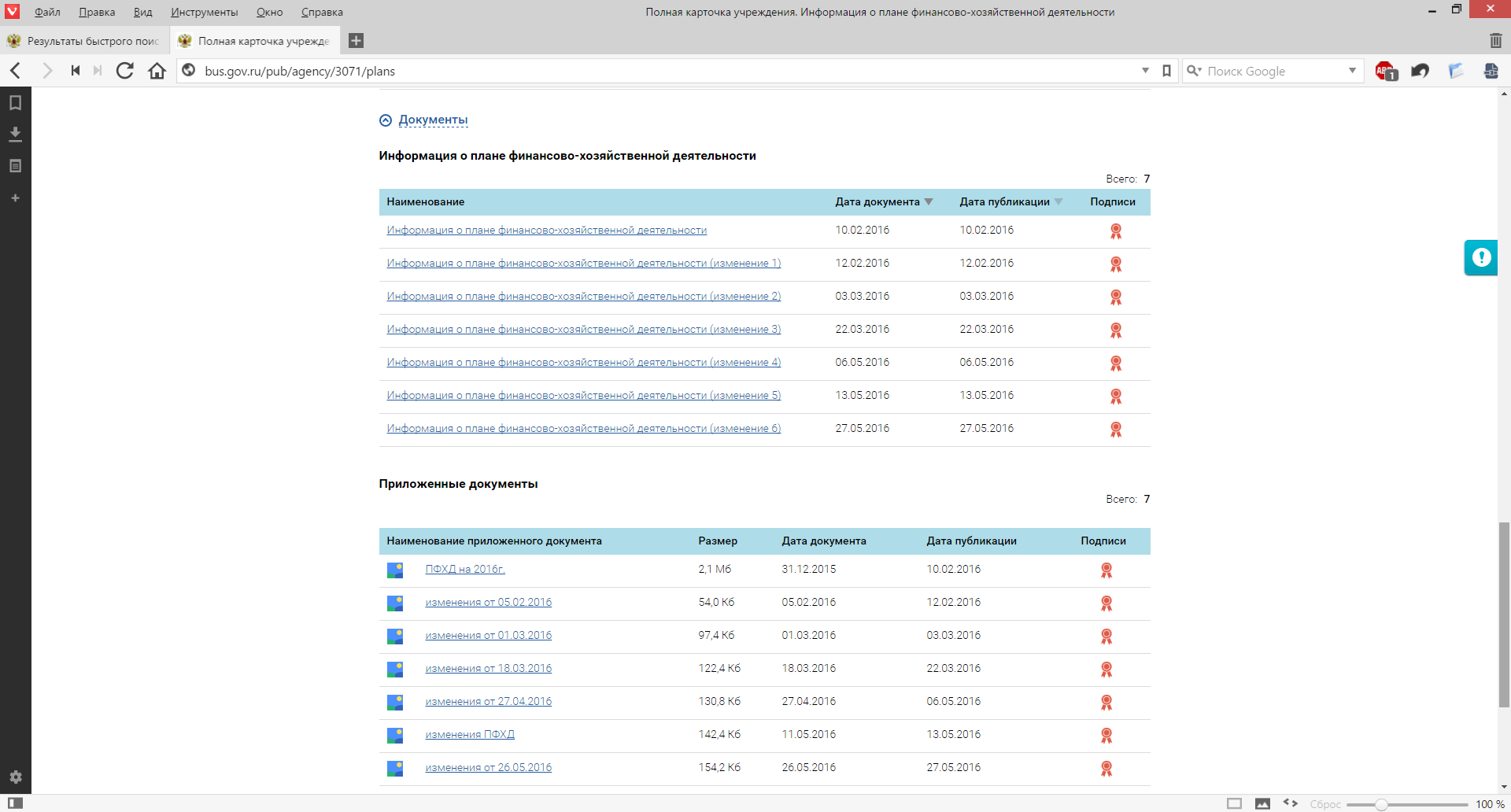

Download the latest version of the Plan of financial and economic activities (we focus on the date of publication, at the time of writing, the latest version is dated 05/27/2016).

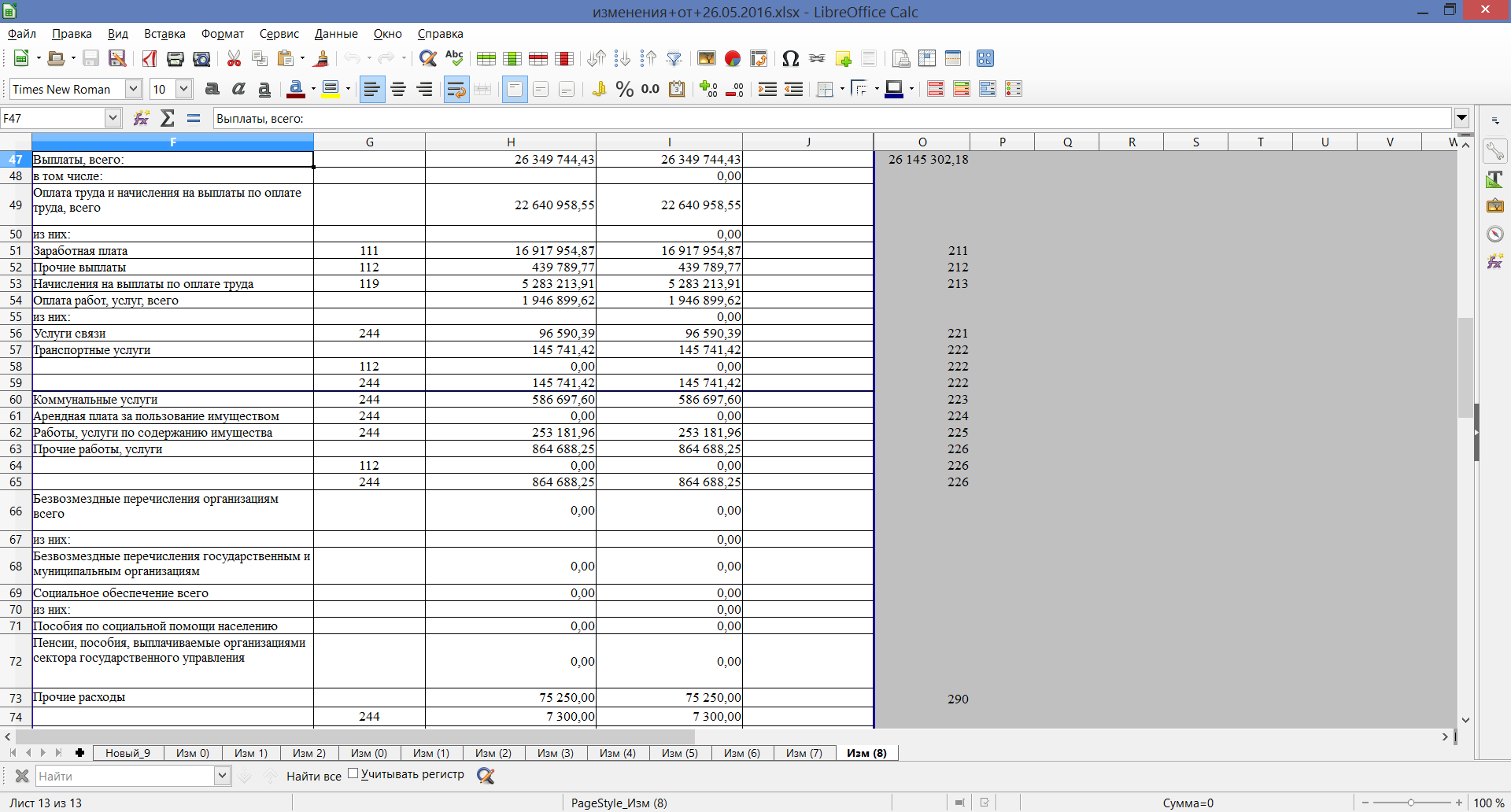

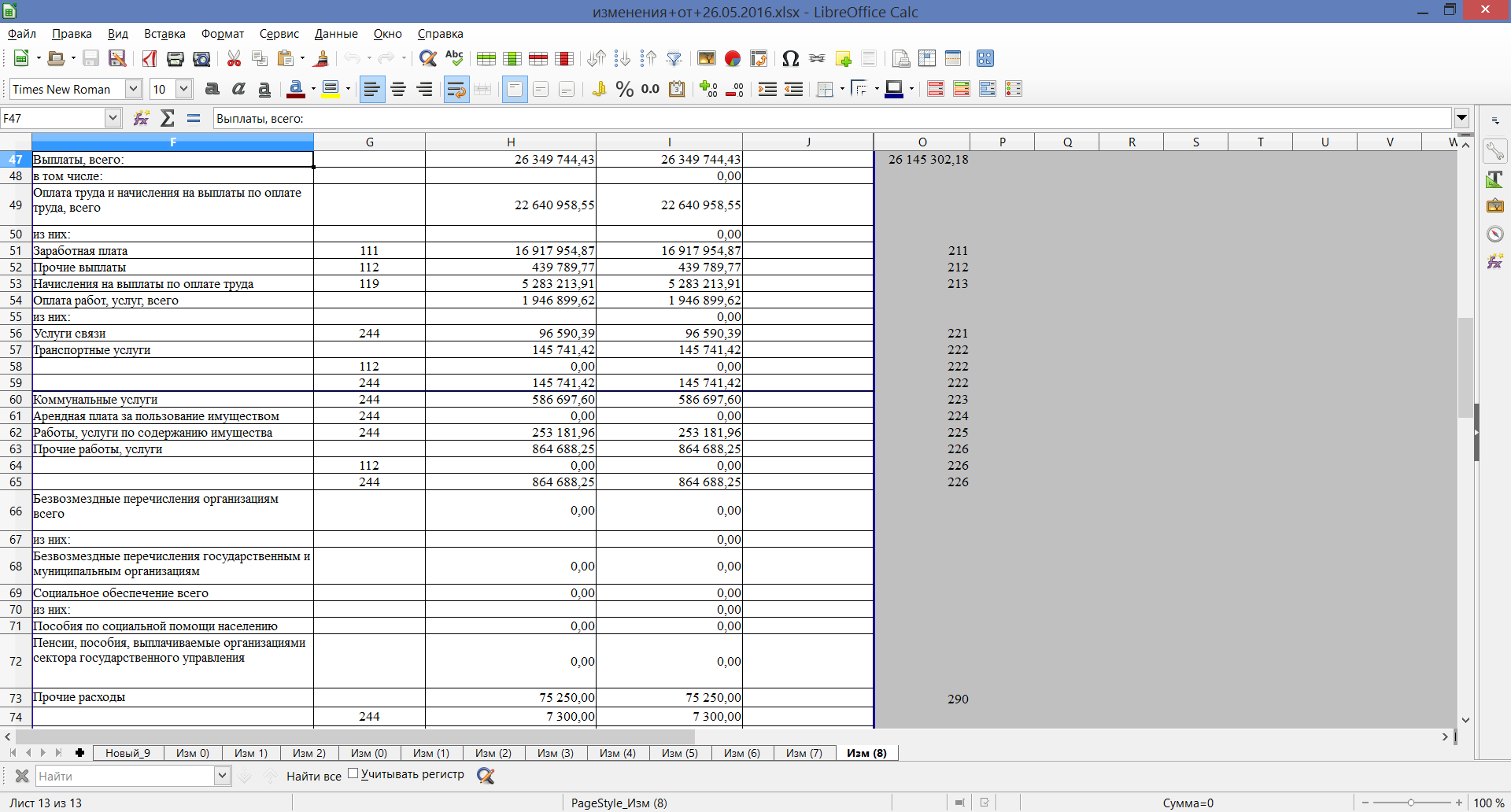

In this case we have to deal with .xlsx file (in principle, we could get and .doc, .pdf and .jpg and even), where on a sheet of "Change (8)" is the current version of the plan of financial and economic activity:

In the receipts (begins with line 22) reflects sources of financing from which the customer plans to receive money (I emphasize - plans). Lines 24 and 27 contain information on subsidies for fulfilling the municipal task and subsidies for other purposes (this is the “budget").

How do these types of subsidies differ? This is not directly related to the topic of the article, so who cares - I ask for a spoiler.

Line 29 is the income from entrepreneurial and other income-generating activities (the next lines are detailed), or “extrabudgetary”.

So, the promise of the state ("budget") - 24042309.13 rubles., The promise of the customer ("extrabudgetary") - 1466280 rubles. A logical question arises: what source of financing is more profitable from the point of view of the contractor? There is no exact answer.

The amount of subsidies for the fulfillment of a municipal task is known, as a rule, from the beginning of the year (someone knows it in advance, and someone can find out their financing, for example, in March), should not change and should not be reduced (although the Prime Minister and recently stated that unused money must be taken away), but in practice this happens quite often due to the fact that there is no money.

Subsidies for other purposes are slightly more secure when they have already been promised (read - issued with an appropriate order or decree), but if they are not yet executed, they can easily go to other needs or to another customer. If this is a subsidy from a higher budget, then someone may be punished for not using the allocated funds, so they try to pay them promptly - again, if there is money.

The customer also needs to earn money from entrepreneurial activity, and in a crisis situation with the "budget", institutions often have to plug holes just with the "extra-budget". Different regions and municipalities have their own approach, which costs to “cut” in the first place, so all that can be advised is to talk with colleagues who have already worked with this customer (or with others who have the same founder).

It is important to keep in mind that a contract, like a customer, can have several sources of financing. Funds for the purchase of something can be simultaneously provided for by a subsidy for the fulfillment of a municipal task, and by a subsidy for other purposes (there may also be several targeted subsidies: often this situation occurs when co-financing from budgets of different levels), and even extrabudgetary (for example, if budget not enough money). In this case, finding the answer to the question of where the customer got the money for our purchase from can be very difficult. However, in the agreements we are considering, the presence of several sources of financing is rare.

In fact, it is far from always possible to get an unambiguous answer to this question, but fish is the reason for lack of fish and cancer. As a rule, in the plan of PCD there are no detailed directions of expenses for the customer, and all figures are given in the context of articles KOSGU.

KOSGU is a classification of operations of the general government sector (approved by Order of the Ministry of Finance of Russia of July 1, 2013 N 65n “On Approving Instructions on the Procedure for Using the Budget Classification of the Russian Federation”). You can look at it, for example, here base.garant.ru/70408460/5 , you can also read about it there (starting from the "Costs" section). We list only those articles of KOSGU that may be useful to us:

1) maintenance or repair of computers and office equipment - 225;

2) refilling cartridges - 225;

3) the supply of computers or office equipment - 310;

4) supply of spare parts - 340;

5) transfer of non-exclusive rights to software - 226;

6) transfer of exclusive rights to software - 320.

The correspondence given above is usually true. But there are exceptions: there are problem points associated with the ambiguity of the wording; there is a position of specific financial authorities (of very different levels); there is a dependence on spending goals and accounting entries.

Regarding software: please note that if you transfer exclusive rights to the customer for the developed software , then this is article 320, if non-exclusive rights (under, for example, a license agreement), then this is article 226. Also, article 226 will apply to article your customer non-exclusive rights to an existingsoftware. Copyright and related rights issues are not relevant to the topic of the article, so just keep that in mind.

It should be noted that the costs may be incurred immediately under several articles KOSGU. For example, in the case of computer-class equipment, the customer may stipulate in one contract both the repair of existing computers (KOSGU article 225), and the supply of new ones (KOSGU article 310), and the construction of a simple local network between them (KOSGU article 226). Such situations, of course, do not simplify the process of finding information, but they happen, fortunately, much less often than when the KOSGU article is one.

We make a small clarification in our boundary conditions: the customer does not insist on transferring exclusive rights to the software being developed to him, therefore our article by KOSGU is 226. We

return to the plan of FCD. The “Payments” section (starting with line 47) contains the planned payments of the institution:

In the “O” column, we see the KOSGU articles kindly affixed. Naturally, we will not see such a decryption on paper and in general it is necessary to focus on the names of the articles (column “F”).

Frankly, in this case, the requirements for the design of the FCD plan are minimal (the customer, by the way, is not to blame for this - the form of the plan is not approved by him), therefore there is not only a breakdown of subsidy codes (about them a little later), but also elementary "Budget" and "extrabudgetary." We can only see that under KOSGU 226 funds are provided (line 65). More detailed information can be obtained by comparing several sources of information, but this process is not simple, time-consuming and difficult to formalize.

Studying information about the customer it is necessary to be prepared for such a result.

Now let's look at the PCB plan of another customer (again, completely random). Its TIN is 5514008737. We get the plan for PCB in the same way as described above:

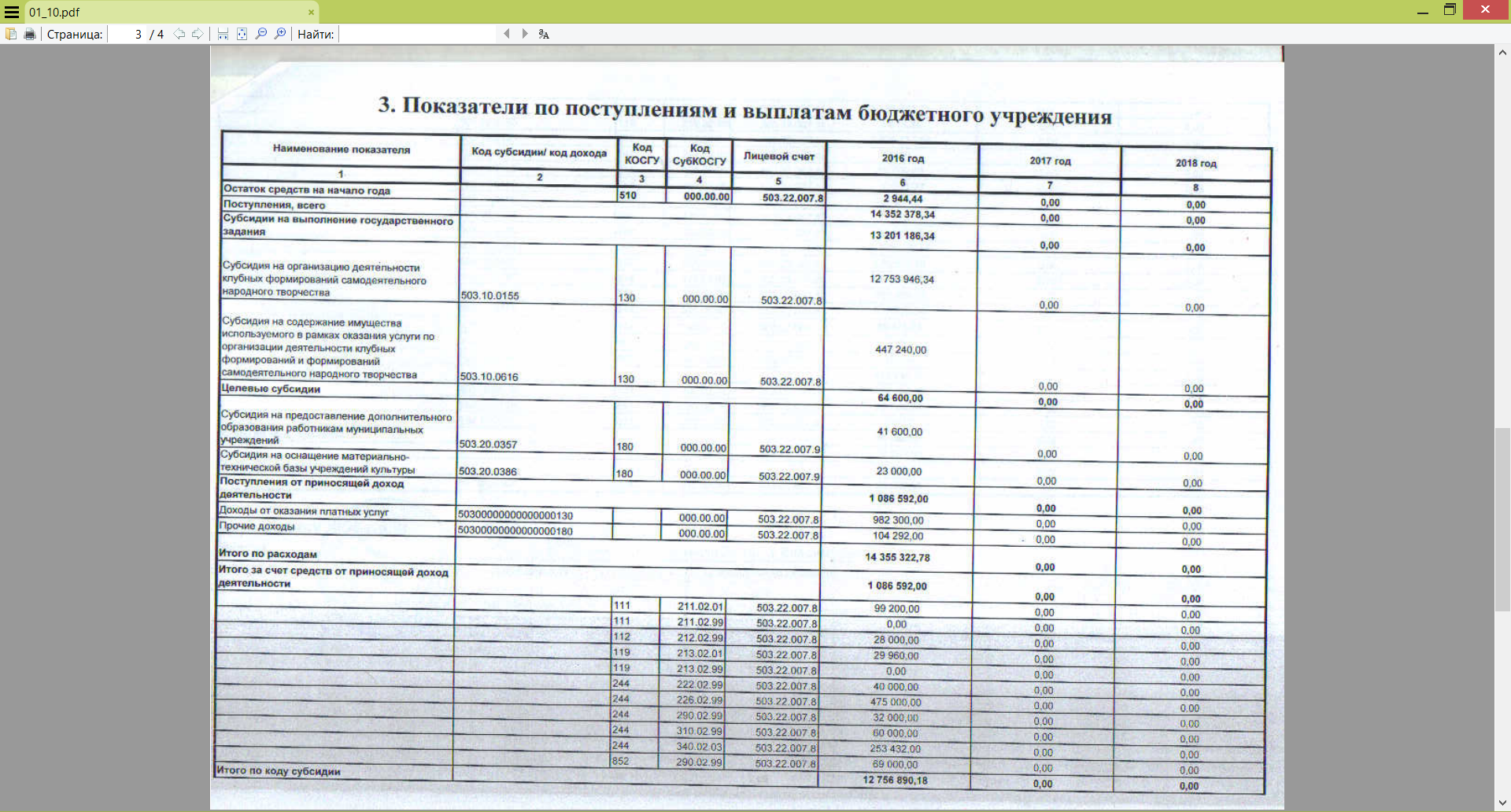

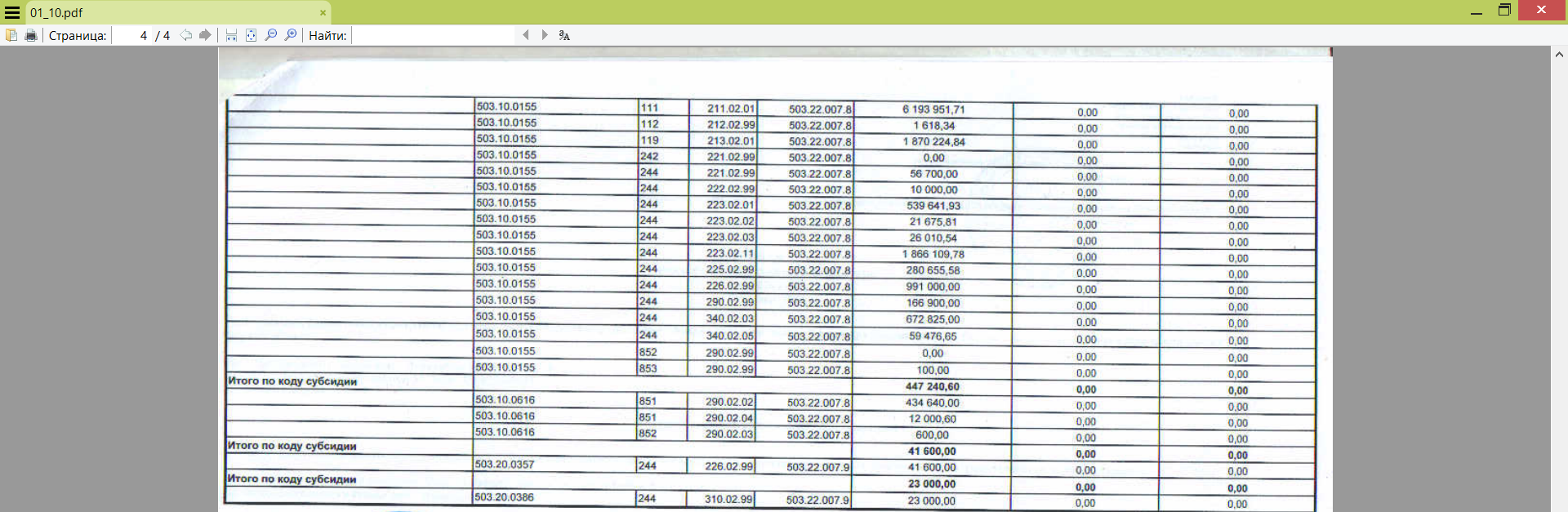

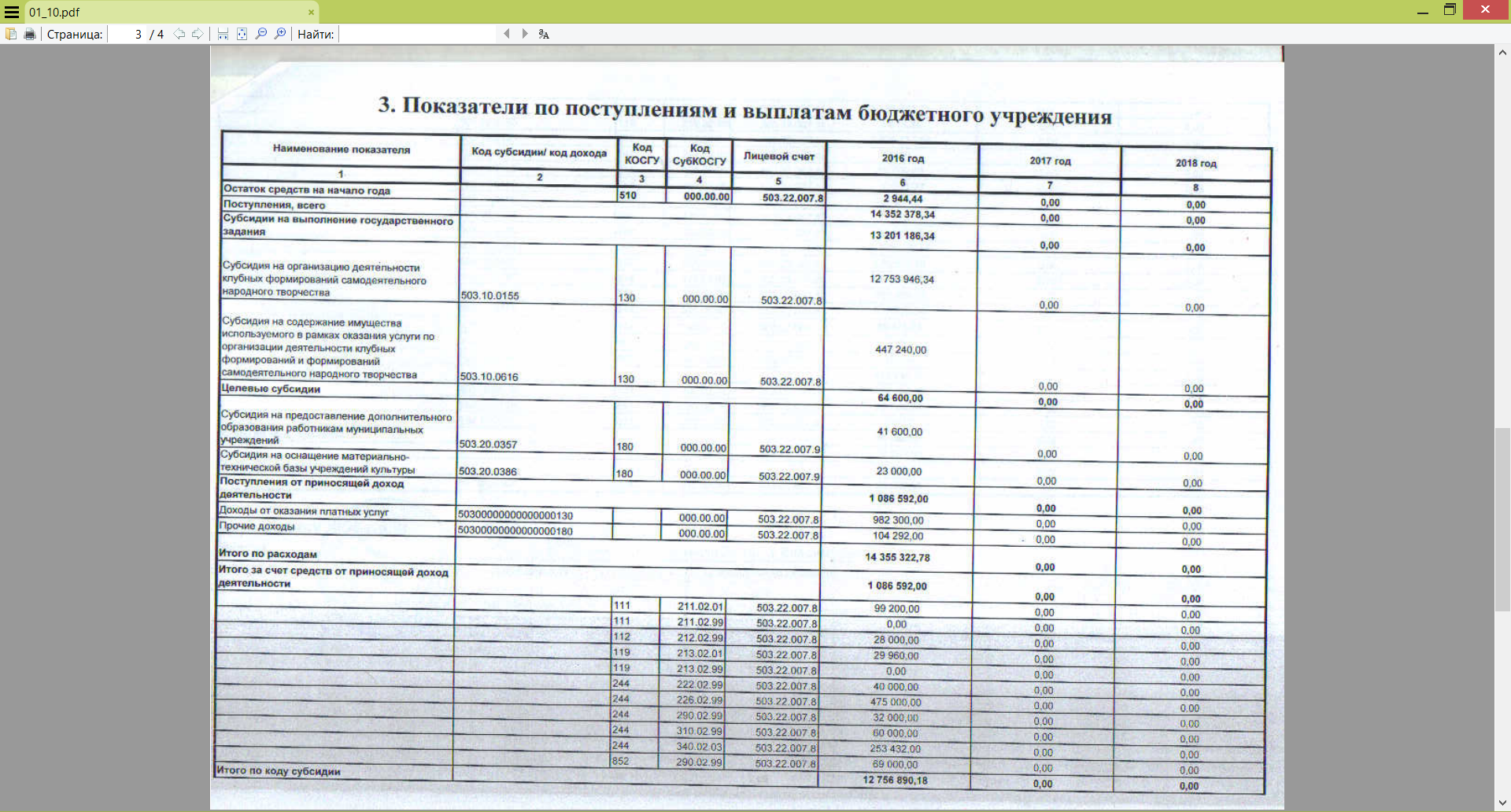

This PCB plan (this time in pdf format) is much more informative. On this page we see that the institution receives subsidies for the fulfillment of the municipal task, subsidies for other purposes and income from entrepreneurial and other income-generating activities. Moreover, the subsidy code, the KOSGU code, the SubKOSGU code, and even the personal account are indicated.

In the line “Revenues, total” we see the total volume of planned revenues (1,4352,378.34 rubles), which is detailed below by funding sources, and starting from the line “Total by expenses” detailed expenses are located. Moreover, detailed and by source of funding, too! How to figure it out?

In the line “Total at the expense of funds from income-generating activities” and below, expenses are calculated at the expense of the “extra-budget”. At the same time, the articles of KOSGU, which we have already considered, are the first three digits of the value from column 4 (SubKOSGU).

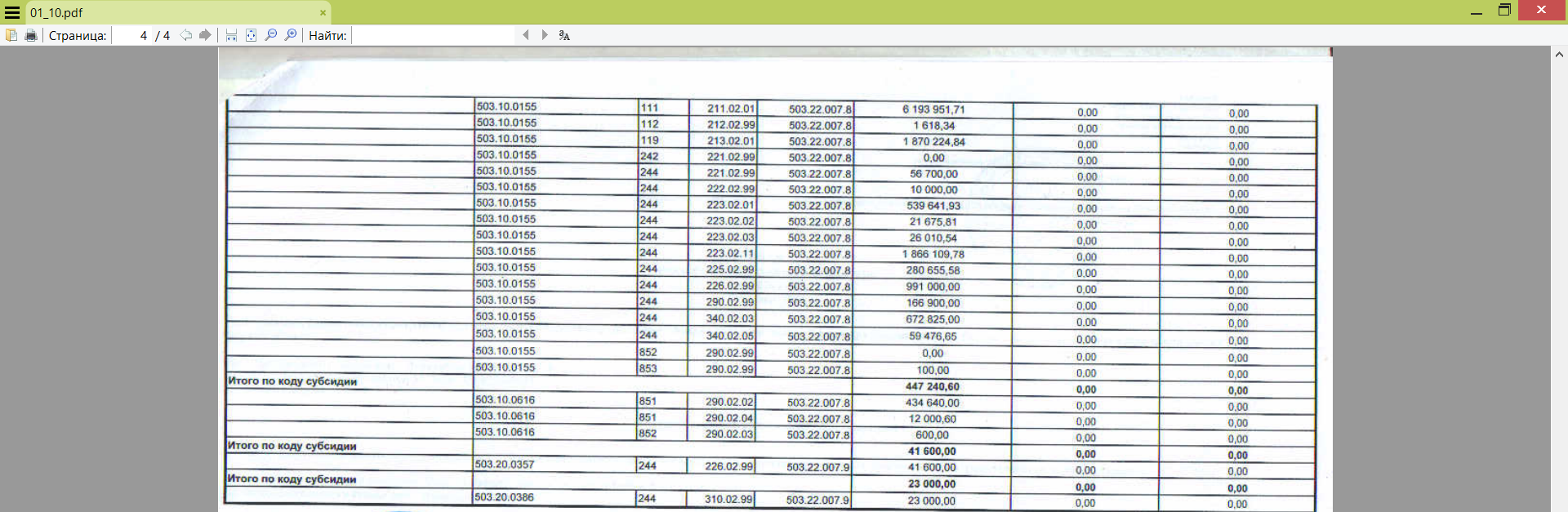

Below is a detailed description of expenses for other sources of financing:

How to determine what expenses are planned from which funding source? Firstly, by subsidy code. These codes, in fact, are used to separately account for various subsidies: as can be seen from the FCD plan, there are several subsidies both for the fulfillment of the municipal task and for other purposes, and each has its own code. The value in column 2 (Subsidy Code) of the expense line needs to find a “couple” in the line of income - if they match, then this is the desired source of funding. Secondly, by amounts: the value in the line “Total by subsidy code” must be compared with the values in the lines related to receipts.

In column 4, the article of interest to us at KOSGU 226 corresponds to three lines (we search from the end of the document):

No. 1. The amount of the section in which our line is located is 41600. Only the line of receipts “Subsidy for the provision of additional education by an employee of municipal institutions”, located in the “Targeted subsidies” section, contains the same amount. We will get a similar result when comparing the subsidy code (503.20.0357 both there and there).

No. 2. According to the subsidy code (503.10.0155), we find the source of financing - “Subsidies for the organization of activities of club groups of amateur folk art,” but the amount does not match: 12756890.18 in expenses and 12753946.34 in revenues, the difference is 2944, 18. The discrepancy takes place, but it is simply explained: the fact is that the institution may have funds that were not used by it at the end of the year (in our case, these funds are indicated in the line “Balance at the beginning of the year” - 2944.44). They cannot be attributed to the planned revenues of the current year - they have already arrived to the institution last year, but they must be taken into account in the planned expenses - they need to be spent. But all the same, it does not fight: 2944.44 - 2944.18 = 0.60. Where have 60 kopecks gone? Let's look at subsidy code 503.10. 0616 (it also refers to subsidies for the fulfillment of a municipal task): expenses - 447240.60, receipts - 447240.00, difference - 0.60 rubles. So the missing pennies were found: the customer allocated the balance of last year to two codes of subsidies for the current year.

Number 3. Suppose we noticed a speaking title of a section (“Total at the expense of funds from income-generating activities”), in which there is a line with our article KOSGU. By the amount of the section (1086592 rubles), we easily find that these expenses will be carried out at the expense of funds from entrepreneurial activity. What about the subsidy code? The fact is that the subsidy code for funds from entrepreneurial activity is zero. How to reflect it in the plans of the FCD (and not only in them) is decided at the level of the manager of budget funds. In our case, we see that there is no code at all in expenditures, and in receipts - 503 many zeros 130 and 180. 503 is the code of the budget manager, many zeros are many zeros, and 130 and 180 are additional details (it can be seen from the names of the corresponding lines).

What conclusions can be drawn? The costs for the article of KOSGU that interests us in terms of FCD are provided by the customer. The source of financing for the purchase of interest to us is the targeted subsidy (No. 1 in our table), most likely, is not. Why? Because it is called the “Subsidy for the provision of additional education to employees of municipal institutions” (such expenses also relate to KOSGU article 226) and it is unlikely that software development is hidden behind it. No, if the customer, of course, needs some kind of training software for his employees, then everything can be. But more often than not, this means banal advanced training.

Why did we need all this?

1. In a number of regions there are rather stringent requirements for plans for FCD and they contain a lot of useful information.

2. The complete lack of funds for the article of interest to KOSGU should alert us: it turns out that so far there is not even a promise of money, not to mention obligations and guarantees.

3. The wrong choice of the KOSGU article by the customer can result in not only a significant loss of time, but also problems with paying for your services and even with the execution of the contract itself. Yes, "where is the estate, and where is the water", but this is true. More details in the following articles.

4. The site that we used to familiarize ourselves with some documents of the institution and its plan of FCD contains other information. For example, if the menu with information about the institution does not select “Planned performance indicators”,

, then we will be able to get acquainted with the information on the annual financial statements (including - on the fulfillment by the institution of the FCD plan for the past year), on the results of activity and on the use of property, on control measures and their results (suddenly our potential customer is a malicious defaulter, regularly audited on this basis?).

And if we don’t know / don’t know how / don’t want to determine which article of KOSGU procurement refers to and what source of financing is used? Or did we try to do this on our own, but there are no results (the FCD plan is uninformative) or are they ambiguous (for example, due to the presence of several sources of funding or articles of the KOSGU)?

Talk to the customer. This information is not a secret, and in a normal situation you will receive it without any problems. And then it will be possible to try to verify the information in the manner described above.

And if the customer leaves the answer to the questions or says that he does not know?

Perhaps he really does not know yet, either ... But let's not draw premature conclusions: we have not yet exhausted all sources of publicly available information (this will be discussed in the next article).

In any case, even if you are completely sure that you understand everything correctly - communicate with the customer. To avoid surprises.

We know the source of funding and the KOSGU article, according to which the customer plans to carry out expenses. What's next? At this stage, doing something is not necessary at all, but if you want to act now, we will consider several situations. We focus on three main points: the presence / absence of an article by the KOSGU in terms of FCD; coincidence / mismatch of the amount under this article with that proposed by the customer; and whether the article itself suits you.

Situation 1. Articles KOSGU generally not in terms of FCD.

We politely ask the customer to explain this phenomenon to us and bring the PCB plan up to date. Especially if you need to conclude a contract right now. (You don’t start working without a contract? If you start, think again). If it is still a long way to the conclusion of the contract, then you can wait, but keep in mind: making changes to the PCB plan is an elementary procedure in itself, but taking into account bureaucratic procedures can easily take a couple of weeks, or even more (of course, it can be much faster).

Situation 2. There is a KOSGU article, but the amount does not match.

If the amount in the PCB plan is greater than the amount announced by the customer, then most likely it provides for expenses not only for you. At this stage, you won’t be able to verify this, so we leave everything as it is. No, of course, you can ask the customer to write an official letter that specifically so much money is provided for your purchase, and even to assure this letter from its founder, but ... Let's just say: this option (despite the seeming fantastic) has the right to existence (in some situations), but it’s too early to resort to it. Very early.

If the amount in the plan of FCD is less, then we act on situation 1.

Situation 3. There is an article of KOSGU, and there are no questions on the sum, but the article of KOSGU itself categorically does not suit you.

We ask the customer for clarification. If this is a common mistake, proceed further with situation 1, and if it is not a mistake, then it is likely that you are not fully aware of the subject matter of the future contract or any other significant circumstances. More details in the following articles.

Situation 4. There is no general plan for FCD.

This should not be. You can look at the presence / absence of FCD plans for other customers who have the same founder. It is possible, of course, that this is their family life, but let them learn to publish the plan of FCD. If the customer does not want to publish the plan of FCD, then you can ask him for a certified copy of this document on paper. In this case, the search for the KOSGU article and other information that we are interested in will have to be carried out just from this copy.

The article turned out to be rather big, but then it will be much simpler further.

1. In working with budgetary institutions, there are features due, inter alia, to the legal status of these institutions and the financing system.

2. Of course, it is not necessary to know such features, but in some cases it can be very useful.

3. The type of institution, the source of funding and the KOSGU article are important. Do not neglect such information - this will help you make a more informed decision.

4. The promise of money (by the state or by the customer) is just a promise that must be correctly turned into a commitment and provided with guarantees.

5. Do not neglect open sources of information.

- how the customer is going to spend money (44-ФЗ, 223-ФЗ and other terrible abbreviations);

- again open data;

- once again about promises and their absence;

- what leads to carelessness;

- a long way from a promise to a commitment;

- pitfalls of technical specifications;

- KOSGU as a time bomb;

- and much more.

PS Naturally, the author does not bear any responsibility for any losses incurred by you, your loved ones, friends, colleagues, pets, your organization, your contractors and all other third parties due to your inaction or any actions committed as influenced by this article, and without taking it into account, in accordance with the material set out or contrary to it.

Chapter 0. Boring, but necessary

Initially, the article was planned as a kind of memo about some features of working with budgetary institutions for small IT companies or IT specialists who are individual entrepreneurs, but in the process of writing it turned out that the range of issues addressed was too wide for both the format of the memo and the format of one article .

With high probability, two options could turn out:

1. The memo is short and abstract, but understandable only to those who have sufficient training in this area ... and is rather useless for everyone (or almost all) of the rest.

2. An article containing an introductory course covering some issues of the legal status of institutions, procurement law, civil law, etc., etc., filled with details and background information, considering the issues raised from different points of view and taking into account numerous development options events, but ... which lost its relevance in the process of writing (it’s hard even to imagine how long it will take), swollen to disgrace and causing overwhelming majority (including the author himself ) Desire to immediately close a tab, and in the few readers pereborovshih this impulse - a sense of irresistible boredom after reading the first two or three chapters.

To avoid this and make the material useful and readable for many, several strong-willed decisions were made:

1. Do not try to grasp the immensity: if you cannot manage with one article, let it be a series of articles. The main goal is to give the most understandable and reflective reality idea of the features of working with budgetary institutions, so a detailed explanation of some of the related issues will have to be neglected and some information should be given as an axiom (or to consider such issues in separate articles).

2. Graduality is the basis of the foundations: many issues require, of course, a comprehensive review, but to tell everything at once will not work. Therefore, we will move in stages (step by step), periodically referring to what has already been stated, inevitably simplifying and coarsening something.

3. Boundary conditions: it is very tempting to try to describe as many options as possible depending on the type of customer, cost and type of work, some other circumstances, but this is simply unrealistic, so sometimes we will move from particular to general, and sometimes and vice versa. We will try to consider everything that goes beyond the boundary conditions another time, actively using comparisons and analogies.

As a result of the above-described volitional decisions, instead of one article, so far we have

Who can use all this? Those who work (or just going to work) with budgetary institutions.

Will the information be useful for those who work:

1. Under a fixed-term employment contract with a budget institution?

Hardly: in this case, the main role is played by labor legislation. But in order to broaden one's horizons, why not read it?

2. With a budget institution, but whose activities are not related to IT?

Yes. A lot of work with budgetary institutions does not depend on what exactly you do, but everywhere there is a specificity and some points relate exclusively to the IT sphere - keep this in mind.

3. Not with a budget, but with a government, autonomous institution, or even an executive body or local government?

Yes, there is so much in common. In order not to be constantly distracted by clarifications about the type of customers in question, which would only complicate the writing of the article and its reading, it was decided to consider the features of working with them in a separate comparison article (if it would be interesting to readers).

4. Not with a budget but with a commercial institution?

Information will be useful starting from the second half of the second article, but you still have to take into account the specifics.

5. With a budgetary institution, but on the basis of an agreement concluded as a result of an auction, tender, request for quotations, request for proposals?

Yes, a significant part of the information will be relevant, but in this case, the specifics associated with the organization, conduct and participation in competitive procedures are added, and, on the contrary, the process of agreeing on the terms of the contract almost disappears. There is a non-zero probability that some interesting points will be considered in a separate article.

Do not forget that each situation is unique in its own way, and draw analogies, despite the possible similarities (real or only apparent), you must be extremely careful.

The article is my first publication on Habré, and, accordingly, the first article on the subject. I don’t know how much the raised topic will be in demand, therefore if: you are interested in something; some issue is not considered in sufficient detail and requires additional explanation; you strongly disagree with something - please write in the comments or through personal messages.

A little about the author and the reasons for writing the article: I am a long-time reader of Habr, but as it happened, I registered only now. For all this time, a lot of information was obtained from Habr, which turned out to be not only interesting, but also useful: for professional activities, and for various hobbies, and even for some domestic needs. There was so much of this information that the periodically arising idea that it would be nice to somehow “give myself away” (I do not like to remain in debt) at some point transformed into the article that you see.

Answers to some possible questions are given under the spoiler at the end of the article. Also, some images (mainly visualizing the description of transitions on the menu of sites) and information: background information (excerpts from the text of laws and other documents) and not directly related to the topic of the article, but related to it, are removed under the spoiler.

Chapter 1. Who are we dealing with?

So, the promised boundary conditions: a budgetary institution will act as a customer, a small (or large) company or individual entrepreneur will act as you, the subject of the contract will be software development, and the contract itself will be concluded directly with you, and not based on the results of competition, auction or request for quotes (competitive methods of procurement is a topic for a separate discussion), the cost is approximately known and even the task does not cause special problems (at first glance).

How to find out the TIN by the name of the customer is not a secret, but for the sake of completeness, this is worth mentioning. On the website of the tax office egrul.nalog.ruYou can search by TIN / BIN or by name of legal entity (IP). Let our customer be the Municipal Budget Institution “Nizhnesortimsk Children's Art School” (these and other institutions are completely random and are used solely as an example).

Choosing the type of search, entering the desired name and captcha, we get the following picture:

By clicking on the name of the institution, you can download the extract (.pdf). Usually, the most interesting is contained in the first three to four pages, but no one forbids viewing them all.

The first three pages of the statement:

Now we have the TIN of the customer (8617013974), the name of the director, address (location), founders, activities (OKVED), licenses, etc. Why do we need this?

TIN - we will use it for further searches.

Name of the director - in order to know with whom we should conclude an agreement (on the importance of having the person concluding the agreement, the appropriate authority and possible unpleasant consequences - in the third article of the cycle).

Address (location) - firstly, it’s always useful to know where you can find a customer (and if the nature of the work you are doing is related to a physical visit to the customer, it’s not just useful, but necessary), and secondly, we may need this address for exchange correspondence.

The founder is a higher authority for our customer, and in some cases it will be useful to address it with those problems that the customer cannot or does not want to solve.

And if you want to know more? There are other sources of information, for example, the official website for posting information on state (municipal) institutions bus.gov.ru/pub/home .

Enter the TIN in the search field, hover over the name of the institution and get:

Select "Details":

Just in case, I quote a link for self-viewing: bus.gov.ru/pub/agency/3071 . On this page are the name of the institution (full and abbreviated), founder, type of institution (do we still remember that we work with a budgetary institution?), Address, name of the head, phone number and even the website (of course, the customer does not always have a website )

Let's open the “Documents” section:

Here are the Charter of the institution, a license for educational activities, an order on the appointment of a director and other documents.

Is this useful information? Yes of course. In addition to the data obtained from the tax inspection website, we now know the type of institution: usually in the name of budgetary institutions there is the word “budgetary” (the letter “B” in the abbreviation), but it may not be - this is not prohibited by law. We also have a Charter where you can get information about the powers of the institution and its founders, about the sources of financial support and other details. The directive on the appointment of the director is also a useful document.

Possible problems: not in all institutions (read - municipalities and even regions) due attention is given to timely updating of information.

Some details about this site:

Также здесь можно получить информацию о государственном (муниципальном) задании, плане финансово-хозяйственной деятельности, операциях с целевыми субсидиями, годовой бухгалтерской отчетности, результатах деятельности и многом другом.

Информацию о самом сайте можно найти в разделе «Главное меню — Документы» (и далее в подменю выбрать «Альбомы ТФФ», «Руководства пользователей» или что-нибудь другое по вкусу). Наборы открытых данных находятся в разделе «Главное меню — Открытые данные». Для получения дополнительной информации о заказчике можно использовать его сайт (при наличии) или сервисы проверки контрагентов.

Информацию о самом сайте можно найти в разделе «Главное меню — Документы» (и далее в подменю выбрать «Альбомы ТФФ», «Руководства пользователей» или что-нибудь другое по вкусу). Наборы открытых данных находятся в разделе «Главное меню — Открытые данные». Для получения дополнительной информации о заказчике можно использовать его сайт (при наличии) или сервисы проверки контрагентов.

Chapter 2. Where does the customer get the money from?

It would seem to us what difference? If only I paid on time and in full. But this is in theory, but in practice - a source of financing or a source of financial support (as it is called officially) is very important. Nobody wants to be in a situation where the work is completed and successfully completed, and no one is in a hurry to pay for it. The whole variety of reasons for the customer (unfunded expenses, took money for other needs and another 1000 and one) should not be a problem for the contractor. We’ll talk more about payment issues in the following articles, but for now let's see what you can find out about the presence / absence of funds from the customer.

A budgetary institution has two main sources of financing: “budget” and “extrabudgetary”. The definitions are not entirely correct - therefore, in quotation marks.

“Budget” is the money allocated by the state (yes, the author is aware that local authorities are not included in the system of state authorities, but this is easier than writing FOIV, OIV and LSG every time): this may be the budget of the settlement , municipal district, oblast, krai, etc. For budgetary institutions, the main sources of budgetary funds are subsidies for the fulfillment of a state (municipal) task and subsidies for other purposes.

"Extrabudgetary" is what the customer earned himself: his income from entrepreneurial and other income-generating activities.

And why do we need this? When planning to work with a budget institution, you need to understand the following:

A “budget” is not yet real money held by the customer on the accounts and which he can pay “right now.” These are only planned (and not always) expenses. In other words - so far this is only a promise of the state to give this money to the customer. A promise can be taken back (not to give money) or revised (reduce the amount or change its purpose). The customer can try to resist this in an extremely limited number of cases, and even then without a guarantee of success.

"Extrabudgetary" is also not always real money. Sometimes, of course, the customer already has money, but often he still has to earn it, and then this is again a promise: only now is the promise not of the state, but of the customer. A promise is possible ... However, we will not repeat it.

The main financial document for a budgetary institution is the Plan of financial and economic activities or, in short, the plan of FCD (there are also agreements on the allocation of subsidies and other documents, but they have nothing to do with our topic). It is signed by the head and chief accountant of the institution, approved by the founder, and it is in it that the promises (of the state and the customer) are spelled out, about which we spoke above.

Let us return to the official site we already know for posting information on state (municipal) institutions. If in the menu with information about the institution choose

"Planned performance indicators - Information on the plan of financial and economic activity",

then we will get into the section devoted to the plan of FCD:

In the section “Documents - Attached documents” we see several files:

Download the latest version of the Plan of financial and economic activities (we focus on the date of publication, at the time of writing, the latest version is dated 05/27/2016).

In this case we have to deal with .xlsx file (in principle, we could get and .doc, .pdf and .jpg and even), where on a sheet of "Change (8)" is the current version of the plan of financial and economic activity:

In the receipts (begins with line 22) reflects sources of financing from which the customer plans to receive money (I emphasize - plans). Lines 24 and 27 contain information on subsidies for fulfilling the municipal task and subsidies for other purposes (this is the “budget").

How do these types of subsidies differ? This is not directly related to the topic of the article, so who cares - I ask for a spoiler.

A bit about subsidies:

В теории, субсидии на выполнение муниципального задания должны обеспечивать повседневные регулярные нужды учреждения (выплата заработной платы, оплата коммунальных услуг, услуг связи, вывоз мусора и пр.), без которых оно существовать не может. Например, учреждение должно обучить 10000 детей, или выдать 50000 справок. Для этого ему необходимо 50 млн. руб в год. Это и должно быть предусмотрено субсидией на выполнение муниципального задания. А субсидии на иные цели призваны обеспечивать те нужды учреждения, которые возникают нерегулярно, являются внеплановыми (например, аварийный ремонт кровли), или необходимы для повышения качества чего-либо: например, модернизация системы отопления, плановый ремонт кровли и помещений, приобретение нового оборудования взамен морально устаревшего и другое.

На практике, естественно, происходит по-разному. Как правило, субсидии на выполнение муниципального задания не обеспечивают потребности учреждения в полной мере, и часть финансирования доводится (если вообще доводится) посредством субсидий на иные цели. Бывает и наоборот: когда расходы, которые следовало бы финансировать за счет субсидий на иные цели, закладываются в субсидии на выполнение муниципального задания. Есть конечно и счастливые учреждения, ни в чем себе не отказывающие, но таких мало. Также в рамках субсидий на иные цели учреждение может получать средства по каким-либо федеральным, государственным и муниципальным программам.

На практике, естественно, происходит по-разному. Как правило, субсидии на выполнение муниципального задания не обеспечивают потребности учреждения в полной мере, и часть финансирования доводится (если вообще доводится) посредством субсидий на иные цели. Бывает и наоборот: когда расходы, которые следовало бы финансировать за счет субсидий на иные цели, закладываются в субсидии на выполнение муниципального задания. Есть конечно и счастливые учреждения, ни в чем себе не отказывающие, но таких мало. Также в рамках субсидий на иные цели учреждение может получать средства по каким-либо федеральным, государственным и муниципальным программам.

Line 29 is the income from entrepreneurial and other income-generating activities (the next lines are detailed), or “extrabudgetary”.

So, the promise of the state ("budget") - 24042309.13 rubles., The promise of the customer ("extrabudgetary") - 1466280 rubles. A logical question arises: what source of financing is more profitable from the point of view of the contractor? There is no exact answer.

The amount of subsidies for the fulfillment of a municipal task is known, as a rule, from the beginning of the year (someone knows it in advance, and someone can find out their financing, for example, in March), should not change and should not be reduced (although the Prime Minister and recently stated that unused money must be taken away), but in practice this happens quite often due to the fact that there is no money.

Subsidies for other purposes are slightly more secure when they have already been promised (read - issued with an appropriate order or decree), but if they are not yet executed, they can easily go to other needs or to another customer. If this is a subsidy from a higher budget, then someone may be punished for not using the allocated funds, so they try to pay them promptly - again, if there is money.

The customer also needs to earn money from entrepreneurial activity, and in a crisis situation with the "budget", institutions often have to plug holes just with the "extra-budget". Different regions and municipalities have their own approach, which costs to “cut” in the first place, so all that can be advised is to talk with colleagues who have already worked with this customer (or with others who have the same founder).

It is important to keep in mind that a contract, like a customer, can have several sources of financing. Funds for the purchase of something can be simultaneously provided for by a subsidy for the fulfillment of a municipal task, and by a subsidy for other purposes (there may also be several targeted subsidies: often this situation occurs when co-financing from budgets of different levels), and even extrabudgetary (for example, if budget not enough money). In this case, finding the answer to the question of where the customer got the money for our purchase from can be very difficult. However, in the agreements we are considering, the presence of several sources of financing is rare.

Chapter 3. Where is the customer going to spend the money?

In fact, it is far from always possible to get an unambiguous answer to this question, but fish is the reason for lack of fish and cancer. As a rule, in the plan of PCD there are no detailed directions of expenses for the customer, and all figures are given in the context of articles KOSGU.

KOSGU is a classification of operations of the general government sector (approved by Order of the Ministry of Finance of Russia of July 1, 2013 N 65n “On Approving Instructions on the Procedure for Using the Budget Classification of the Russian Federation”). You can look at it, for example, here base.garant.ru/70408460/5 , you can also read about it there (starting from the "Costs" section). We list only those articles of KOSGU that may be useful to us:

1) maintenance or repair of computers and office equipment - 225;

2) refilling cartridges - 225;

3) the supply of computers or office equipment - 310;

4) supply of spare parts - 340;

5) transfer of non-exclusive rights to software - 226;

6) transfer of exclusive rights to software - 320.

Excerpts from the wording of some articles KOSGU:

225: «На данную подстатью КОСГУ относятся расходы по оплате договоров на выполнение работ, оказание услуг, связанных с содержанием (работы и услуги, осуществляемые с целью поддержания и (или) восстановления функциональных, пользовательских характеристик объекта), обслуживанием, ремонтом нефинансовых активов, полученных в аренду или безвозмездное пользование, находящихся на праве оперативного управления и в государственной казне Российской Федерации, субъекта Российской Федерации, казне муниципального образования, в том числе на:

ремонт (текущий и капитальный) и реставрацию нефинансовых активов:

— устранение неисправностей (восстановление работоспособности) отдельных объектов нефинансовых активов, а также объектов и систем (охранная, пожарная сигнализация, система вентиляции и т.п.), входящих в состав отдельных объектов нефинансовых активов;

— поддержание технико-экономических и эксплуатационных показателей объектов нефинансовых активов (срок полезного использования, мощность, качество применения, количество и площадь объектов, пропускная способность и т.п.) на изначально предусмотренном уровне;

заправка картриджей;»

310: «На данную статью КОСГУ относятся расходы получателей бюджетных средств, а также государственных (муниципальных) бюджетных и автономных учреждений по оплате государственных (муниципальных) контрактов, договоров на строительство, приобретение (изготовление) объектов, относящихся к основным средствам, а также на реконструкцию, техническое перевооружение, расширение, модернизацию (модернизацию с дооборудованием) основных средств, находящихся в государственной, муниципальной собственности, полученных в аренду или безвозмездное пользование, в том числе:

— изготовление объектов основных средств из материала подрядчика;»

340: «На данную статью КОСГУ относятся расходы по оплате договоров на приобретение (изготовление) объектов, относящихся к материальным запасам, в том числе:

— запасных и (или) составных частей для машин, оборудования, оргтехники, вычислительной техники, систем телекоммуникаций и локальных вычислительных сетей, систем передачи и отображения информации, защиты информации, информационно-вычислительных систем, средств связи и т.п.;»

226: «На данную подстатью КОСГУ относятся расходы на выполнение работ, оказание услуг, не отнесенных на подстатьи КОСГУ 221 — 225, в том числе:

услуги в области информационных технологий:

— приобретение неисключительных (пользовательских), лицензионных прав на программное обеспечение;

— приобретение и обновление справочно-информационных баз данных;

— обеспечение безопасности информации и режимно-секретных мероприятий;

— услуги по защите электронного документооборота (поддержке программного продукта) с использованием сертификационных средств криптографической защиты информации;

— периодическая проверка (в т.ч. аттестация) объекта информатизации (АРМ) на ПЭВМ на соответствие специальным требованиям и рекомендациям по защите информации, составляющей государственную тайну, от утечки по техническим каналам;»

320: «На данную статью КОСГУ относятся расходы по оплате договоров на приобретение в государственную, муниципальную собственность исключительных прав на результаты интеллектуальной деятельности или средства индивидуализации, в том числе:

— на программное обеспечение и базы данных для ЭВМ».

ремонт (текущий и капитальный) и реставрацию нефинансовых активов:

— устранение неисправностей (восстановление работоспособности) отдельных объектов нефинансовых активов, а также объектов и систем (охранная, пожарная сигнализация, система вентиляции и т.п.), входящих в состав отдельных объектов нефинансовых активов;

— поддержание технико-экономических и эксплуатационных показателей объектов нефинансовых активов (срок полезного использования, мощность, качество применения, количество и площадь объектов, пропускная способность и т.п.) на изначально предусмотренном уровне;

заправка картриджей;»

310: «На данную статью КОСГУ относятся расходы получателей бюджетных средств, а также государственных (муниципальных) бюджетных и автономных учреждений по оплате государственных (муниципальных) контрактов, договоров на строительство, приобретение (изготовление) объектов, относящихся к основным средствам, а также на реконструкцию, техническое перевооружение, расширение, модернизацию (модернизацию с дооборудованием) основных средств, находящихся в государственной, муниципальной собственности, полученных в аренду или безвозмездное пользование, в том числе:

— изготовление объектов основных средств из материала подрядчика;»

340: «На данную статью КОСГУ относятся расходы по оплате договоров на приобретение (изготовление) объектов, относящихся к материальным запасам, в том числе:

— запасных и (или) составных частей для машин, оборудования, оргтехники, вычислительной техники, систем телекоммуникаций и локальных вычислительных сетей, систем передачи и отображения информации, защиты информации, информационно-вычислительных систем, средств связи и т.п.;»

226: «На данную подстатью КОСГУ относятся расходы на выполнение работ, оказание услуг, не отнесенных на подстатьи КОСГУ 221 — 225, в том числе:

услуги в области информационных технологий:

— приобретение неисключительных (пользовательских), лицензионных прав на программное обеспечение;

— приобретение и обновление справочно-информационных баз данных;

— обеспечение безопасности информации и режимно-секретных мероприятий;

— услуги по защите электронного документооборота (поддержке программного продукта) с использованием сертификационных средств криптографической защиты информации;

— периодическая проверка (в т.ч. аттестация) объекта информатизации (АРМ) на ПЭВМ на соответствие специальным требованиям и рекомендациям по защите информации, составляющей государственную тайну, от утечки по техническим каналам;»

320: «На данную статью КОСГУ относятся расходы по оплате договоров на приобретение в государственную, муниципальную собственность исключительных прав на результаты интеллектуальной деятельности или средства индивидуализации, в том числе:

— на программное обеспечение и базы данных для ЭВМ».

The correspondence given above is usually true. But there are exceptions: there are problem points associated with the ambiguity of the wording; there is a position of specific financial authorities (of very different levels); there is a dependence on spending goals and accounting entries.

Regarding software: please note that if you transfer exclusive rights to the customer for the developed software , then this is article 320, if non-exclusive rights (under, for example, a license agreement), then this is article 226. Also, article 226 will apply to article your customer non-exclusive rights to an existingsoftware. Copyright and related rights issues are not relevant to the topic of the article, so just keep that in mind.

It should be noted that the costs may be incurred immediately under several articles KOSGU. For example, in the case of computer-class equipment, the customer may stipulate in one contract both the repair of existing computers (KOSGU article 225), and the supply of new ones (KOSGU article 310), and the construction of a simple local network between them (KOSGU article 226). Such situations, of course, do not simplify the process of finding information, but they happen, fortunately, much less often than when the KOSGU article is one.

Chapter 4. Where is the customer going to spend the money? - 2

We make a small clarification in our boundary conditions: the customer does not insist on transferring exclusive rights to the software being developed to him, therefore our article by KOSGU is 226. We

return to the plan of FCD. The “Payments” section (starting with line 47) contains the planned payments of the institution:

In the “O” column, we see the KOSGU articles kindly affixed. Naturally, we will not see such a decryption on paper and in general it is necessary to focus on the names of the articles (column “F”).

Frankly, in this case, the requirements for the design of the FCD plan are minimal (the customer, by the way, is not to blame for this - the form of the plan is not approved by him), therefore there is not only a breakdown of subsidy codes (about them a little later), but also elementary "Budget" and "extrabudgetary." We can only see that under KOSGU 226 funds are provided (line 65). More detailed information can be obtained by comparing several sources of information, but this process is not simple, time-consuming and difficult to formalize.

Studying information about the customer it is necessary to be prepared for such a result.

Now let's look at the PCB plan of another customer (again, completely random). Its TIN is 5514008737. We get the plan for PCB in the same way as described above:

This PCB plan (this time in pdf format) is much more informative. On this page we see that the institution receives subsidies for the fulfillment of the municipal task, subsidies for other purposes and income from entrepreneurial and other income-generating activities. Moreover, the subsidy code, the KOSGU code, the SubKOSGU code, and even the personal account are indicated.

In the line “Revenues, total” we see the total volume of planned revenues (1,4352,378.34 rubles), which is detailed below by funding sources, and starting from the line “Total by expenses” detailed expenses are located. Moreover, detailed and by source of funding, too! How to figure it out?

In the line “Total at the expense of funds from income-generating activities” and below, expenses are calculated at the expense of the “extra-budget”. At the same time, the articles of KOSGU, which we have already considered, are the first three digits of the value from column 4 (SubKOSGU).

Below is a detailed description of expenses for other sources of financing:

How to determine what expenses are planned from which funding source? Firstly, by subsidy code. These codes, in fact, are used to separately account for various subsidies: as can be seen from the FCD plan, there are several subsidies both for the fulfillment of the municipal task and for other purposes, and each has its own code. The value in column 2 (Subsidy Code) of the expense line needs to find a “couple” in the line of income - if they match, then this is the desired source of funding. Secondly, by amounts: the value in the line “Total by subsidy code” must be compared with the values in the lines related to receipts.

In column 4, the article of interest to us at KOSGU 226 corresponds to three lines (we search from the end of the document):

| No. p / p | Column 4 (SubCOSGU Code) | Column 2 (Grant Code) | Column 6 (Amount for 2016, rubles) |

| one | 02/22/99 | 503.20.0357 | 41600 |

| 2 | 02/22/99 | 503.10.0155 | 991000 |

| 3 | 02/22/99 | - | 475,000 |

No. 1. The amount of the section in which our line is located is 41600. Only the line of receipts “Subsidy for the provision of additional education by an employee of municipal institutions”, located in the “Targeted subsidies” section, contains the same amount. We will get a similar result when comparing the subsidy code (503.20.0357 both there and there).

No. 2. According to the subsidy code (503.10.0155), we find the source of financing - “Subsidies for the organization of activities of club groups of amateur folk art,” but the amount does not match: 12756890.18 in expenses and 12753946.34 in revenues, the difference is 2944, 18. The discrepancy takes place, but it is simply explained: the fact is that the institution may have funds that were not used by it at the end of the year (in our case, these funds are indicated in the line “Balance at the beginning of the year” - 2944.44). They cannot be attributed to the planned revenues of the current year - they have already arrived to the institution last year, but they must be taken into account in the planned expenses - they need to be spent. But all the same, it does not fight: 2944.44 - 2944.18 = 0.60. Where have 60 kopecks gone? Let's look at subsidy code 503.10. 0616 (it also refers to subsidies for the fulfillment of a municipal task): expenses - 447240.60, receipts - 447240.00, difference - 0.60 rubles. So the missing pennies were found: the customer allocated the balance of last year to two codes of subsidies for the current year.

Number 3. Suppose we noticed a speaking title of a section (“Total at the expense of funds from income-generating activities”), in which there is a line with our article KOSGU. By the amount of the section (1086592 rubles), we easily find that these expenses will be carried out at the expense of funds from entrepreneurial activity. What about the subsidy code? The fact is that the subsidy code for funds from entrepreneurial activity is zero. How to reflect it in the plans of the FCD (and not only in them) is decided at the level of the manager of budget funds. In our case, we see that there is no code at all in expenditures, and in receipts - 503 many zeros 130 and 180. 503 is the code of the budget manager, many zeros are many zeros, and 130 and 180 are additional details (it can be seen from the names of the corresponding lines).

What conclusions can be drawn? The costs for the article of KOSGU that interests us in terms of FCD are provided by the customer. The source of financing for the purchase of interest to us is the targeted subsidy (No. 1 in our table), most likely, is not. Why? Because it is called the “Subsidy for the provision of additional education to employees of municipal institutions” (such expenses also relate to KOSGU article 226) and it is unlikely that software development is hidden behind it. No, if the customer, of course, needs some kind of training software for his employees, then everything can be. But more often than not, this means banal advanced training.

Why did we need all this?

1. In a number of regions there are rather stringent requirements for plans for FCD and they contain a lot of useful information.

2. The complete lack of funds for the article of interest to KOSGU should alert us: it turns out that so far there is not even a promise of money, not to mention obligations and guarantees.

3. The wrong choice of the KOSGU article by the customer can result in not only a significant loss of time, but also problems with paying for your services and even with the execution of the contract itself. Yes, "where is the estate, and where is the water", but this is true. More details in the following articles.

4. The site that we used to familiarize ourselves with some documents of the institution and its plan of FCD contains other information. For example, if the menu with information about the institution does not select “Planned performance indicators”,

Actual Performance Indicators:

, then we will be able to get acquainted with the information on the annual financial statements (including - on the fulfillment by the institution of the FCD plan for the past year), on the results of activity and on the use of property, on control measures and their results (suddenly our potential customer is a malicious defaulter, regularly audited on this basis?).

Chapter 5. Possible problems and (finally!) Our actions

And if we don’t know / don’t know how / don’t want to determine which article of KOSGU procurement refers to and what source of financing is used? Or did we try to do this on our own, but there are no results (the FCD plan is uninformative) or are they ambiguous (for example, due to the presence of several sources of funding or articles of the KOSGU)?

Talk to the customer. This information is not a secret, and in a normal situation you will receive it without any problems. And then it will be possible to try to verify the information in the manner described above.

And if the customer leaves the answer to the questions or says that he does not know?

Perhaps he really does not know yet, either ... But let's not draw premature conclusions: we have not yet exhausted all sources of publicly available information (this will be discussed in the next article).

In any case, even if you are completely sure that you understand everything correctly - communicate with the customer. To avoid surprises.

We know the source of funding and the KOSGU article, according to which the customer plans to carry out expenses. What's next? At this stage, doing something is not necessary at all, but if you want to act now, we will consider several situations. We focus on three main points: the presence / absence of an article by the KOSGU in terms of FCD; coincidence / mismatch of the amount under this article with that proposed by the customer; and whether the article itself suits you.

Situation 1. Articles KOSGU generally not in terms of FCD.

We politely ask the customer to explain this phenomenon to us and bring the PCB plan up to date. Especially if you need to conclude a contract right now. (You don’t start working without a contract? If you start, think again). If it is still a long way to the conclusion of the contract, then you can wait, but keep in mind: making changes to the PCB plan is an elementary procedure in itself, but taking into account bureaucratic procedures can easily take a couple of weeks, or even more (of course, it can be much faster).

Situation 2. There is a KOSGU article, but the amount does not match.

If the amount in the PCB plan is greater than the amount announced by the customer, then most likely it provides for expenses not only for you. At this stage, you won’t be able to verify this, so we leave everything as it is. No, of course, you can ask the customer to write an official letter that specifically so much money is provided for your purchase, and even to assure this letter from its founder, but ... Let's just say: this option (despite the seeming fantastic) has the right to existence (in some situations), but it’s too early to resort to it. Very early.

If the amount in the plan of FCD is less, then we act on situation 1.

Situation 3. There is an article of KOSGU, and there are no questions on the sum, but the article of KOSGU itself categorically does not suit you.

We ask the customer for clarification. If this is a common mistake, proceed further with situation 1, and if it is not a mistake, then it is likely that you are not fully aware of the subject matter of the future contract or any other significant circumstances. More details in the following articles.

Situation 4. There is no general plan for FCD.

This should not be. You can look at the presence / absence of FCD plans for other customers who have the same founder. It is possible, of course, that this is their family life, but let them learn to publish the plan of FCD. If the customer does not want to publish the plan of FCD, then you can ask him for a certified copy of this document on paper. In this case, the search for the KOSGU article and other information that we are interested in will have to be carried out just from this copy.

The article turned out to be rather big, but then it will be much simpler further.

Conclusion

1. In working with budgetary institutions, there are features due, inter alia, to the legal status of these institutions and the financing system.

2. Of course, it is not necessary to know such features, but in some cases it can be very useful.

3. The type of institution, the source of funding and the KOSGU article are important. Do not neglect such information - this will help you make a more informed decision.

4. The promise of money (by the state or by the customer) is just a promise that must be correctly turned into a commitment and provided with guarantees.

5. Do not neglect open sources of information.

In the next series

- how the customer is going to spend money (44-ФЗ, 223-ФЗ and other terrible abbreviations);

- again open data;

- once again about promises and their absence;

- what leads to carelessness;

- a long way from a promise to a commitment;

- pitfalls of technical specifications;

- KOSGU as a time bomb;

- and much more.

PS Naturally, the author does not bear any responsibility for any losses incurred by you, your loved ones, friends, colleagues, pets, your organization, your contractors and all other third parties due to your inaction or any actions committed as influenced by this article, and without taking it into account, in accordance with the material set out or contrary to it.

Read the answers to some possible questions here:

1. Рассматриваемые методы обязательны, необходимы и достаточны?

Ни в коем случае. Автор статьи предлагает лишь еще несколько инструментов для получения дополнительной информации, которая может пригодиться при принятии решения о работе с заказчиком. Применять ли эти инструменты, как часто и каким образом, можно ли доверять полученной таким способом информации и как ее интерпретировать — остается на ваше усмотрение.

2. И что, с каждым заказчиком так мучиться?

Конечно же нет. Есть огромное количество других обстоятельств, влияющих на ситуацию. Для кого-то договор на 100 тыс. руб. — мелочь в общем потоке договоров, а для кого-то — очень серьезное и ответственное мероприятие. Кто-то предпочитает отстаивать свои интересы в суде (и имеет в этом обширный опыт), а для кого-то проще решать вопросы в досудебном порядке. Кто-то готов в любом суде доказать что угодно — и поэтому не затрудняет себя составлением подробного техзадания или оттачиванием формулировок договора, а кто-то предпочитает, чтобы каждая мелочь была зафиксирована документально. Люди, организации, ситуации — разные, требуемые трудозатраты — тоже. Поэтому решать только вам.

3. Может быть, проще вообще не работать с бюджетными учреждениями?

Во-первых, мы здесь сознательно рассматриваем ситуацию с точки зрения возможных проблем. Во-вторых, кто сказал, что с коммерческими учреждениями работать проще? Там тоже есть такой массив сложностей, что мама не горюй. Ну и в-третьих: «Если у вас нету дома, пожары ему не страшны...».

4. В статье изложена правда, вся правда и ничего кроме правды? Ошибок быть не может?

Во-первых, все мы люди и все мы ошибаемся. Во-вторых, законодательство имеет тенденцию меняться, и, зачастую, довольно быстрыми темпами. В-третьих, всех обстоятельств предусмотреть в рамках статьи невозможно: требуется изучать конкретную ситуацию. В-четвертых, есть спорные, неоднозначные вопросы, по которым существуют различные мнения — это тоже надо учитывать. В-пятых, автор просто мог что-то упустить.

В любом случае, если вас что-то смутило — пишите об этом в комментариях или посредством личных сообщений: от этого зависит насколько информация, изложенная в статье, будет достоверной, актуальной и многосторонней.

5. А возможно ли в отдельной статье рассмотреть вопрос о (содержание вопроса)?

Возможно многое. Пишите автору, и еслизвезды будут располагаться нужным образом в наличии будут время, возможность, силы, и, главное, информация по интересующему вас вопросу — почему бы и нет.

Ни в коем случае. Автор статьи предлагает лишь еще несколько инструментов для получения дополнительной информации, которая может пригодиться при принятии решения о работе с заказчиком. Применять ли эти инструменты, как часто и каким образом, можно ли доверять полученной таким способом информации и как ее интерпретировать — остается на ваше усмотрение.

2. И что, с каждым заказчиком так мучиться?

Конечно же нет. Есть огромное количество других обстоятельств, влияющих на ситуацию. Для кого-то договор на 100 тыс. руб. — мелочь в общем потоке договоров, а для кого-то — очень серьезное и ответственное мероприятие. Кто-то предпочитает отстаивать свои интересы в суде (и имеет в этом обширный опыт), а для кого-то проще решать вопросы в досудебном порядке. Кто-то готов в любом суде доказать что угодно — и поэтому не затрудняет себя составлением подробного техзадания или оттачиванием формулировок договора, а кто-то предпочитает, чтобы каждая мелочь была зафиксирована документально. Люди, организации, ситуации — разные, требуемые трудозатраты — тоже. Поэтому решать только вам.

3. Может быть, проще вообще не работать с бюджетными учреждениями?

Во-первых, мы здесь сознательно рассматриваем ситуацию с точки зрения возможных проблем. Во-вторых, кто сказал, что с коммерческими учреждениями работать проще? Там тоже есть такой массив сложностей, что мама не горюй. Ну и в-третьих: «Если у вас нету дома, пожары ему не страшны...».

4. В статье изложена правда, вся правда и ничего кроме правды? Ошибок быть не может?

Во-первых, все мы люди и все мы ошибаемся. Во-вторых, законодательство имеет тенденцию меняться, и, зачастую, довольно быстрыми темпами. В-третьих, всех обстоятельств предусмотреть в рамках статьи невозможно: требуется изучать конкретную ситуацию. В-четвертых, есть спорные, неоднозначные вопросы, по которым существуют различные мнения — это тоже надо учитывать. В-пятых, автор просто мог что-то упустить.

В любом случае, если вас что-то смутило — пишите об этом в комментариях или посредством личных сообщений: от этого зависит насколько информация, изложенная в статье, будет достоверной, актуальной и многосторонней.

5. А возможно ли в отдельной статье рассмотреть вопрос о (содержание вопроса)?

Возможно многое. Пишите автору, и если

UPD. 06/06/19

1. Добавлена ссылка на следующую часть.

2. Исправлена опечатка.

3. Наименование блока «В следующей серии» изменено на «В следующих сериях»: не всегда получается уместить в статью все, что планировалось.

2. Исправлена опечатка.

3. Наименование блока «В следующей серии» изменено на «В следующих сериях»: не всегда получается уместить в статью все, что планировалось.

UPD. 2016.11.03

Ссылка на следующую часть заменена на содержание всего цикла.