How to analyze paying users. Part 3, Re-payments and Conversions

With this article we end the cycle "How to analyze payers."

Previous articles:

Part 1. RFM analysis, whales and dolphins.

Part 2. Time revenue structure.

Today we’ll talk about re-payments and the time to convert to payment. What questions should you ask yourself?

What day does the user make the first payment? Second? Third?

Understanding your billing behavior will allow you to better plan your monetization activities in your product. This is the application of the traditional algorithm for product analytics:

Knowing when the user makes the next payment, you can get ahead of him and offer the right promotion (or targeted offer) at the right time.

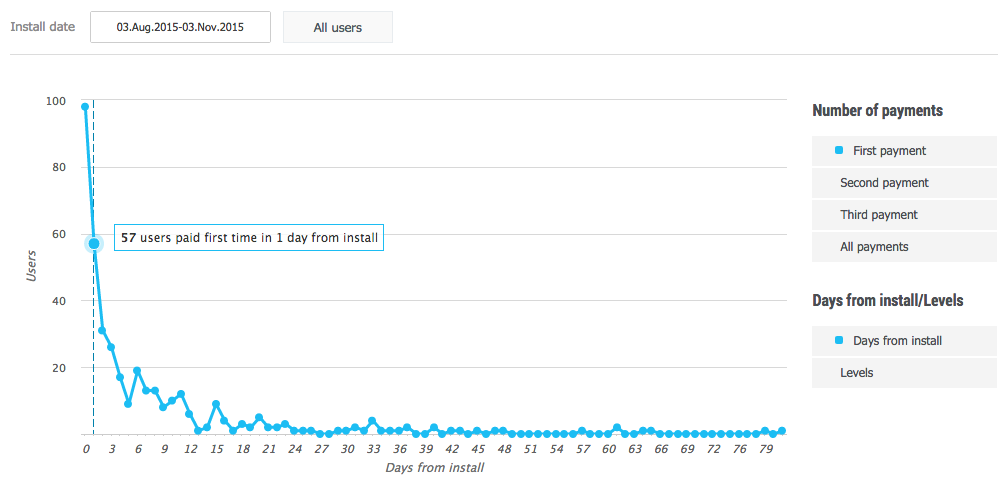

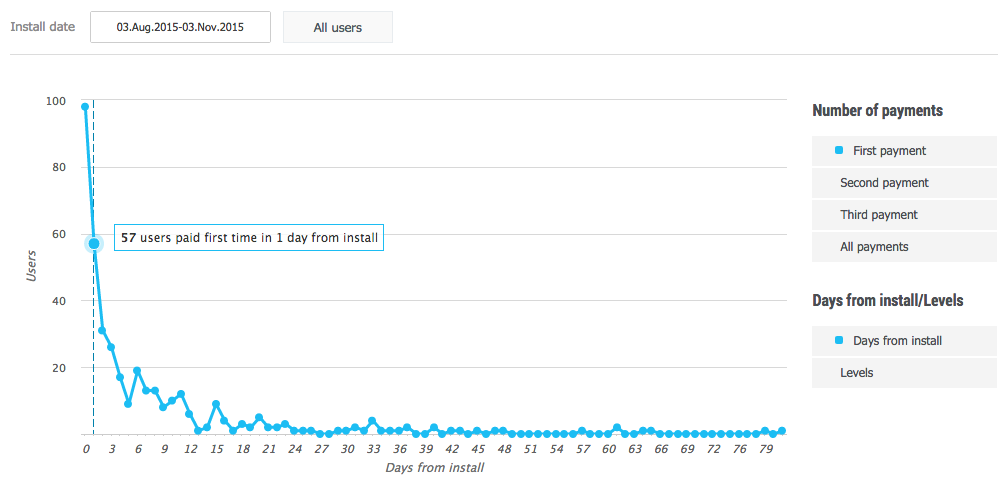

For example, we will use the report 'Period until payments' of the devtodev analytical system . We select the right time for making the first payment on the right (you can also select the second, third user payments, or all payments, regardless of their serial number), set the user registration period and look at the distribution of the time of their first payment.

We see that the bulk of the first payments are made in the first days. Moreover, on the day of user registration. And this means that we can safely offer any action from the very beginning of the user's stay in the application, from the first day.

However, it would not be very correct to offer to buy something, for example, immediately after completing the tutorial - the user will decide that the game is based only on donation and, most likely, will immediately leave the application. Therefore, we ask ourselves the following question.

At what level does the user make the first purchase? And the second? And the third?

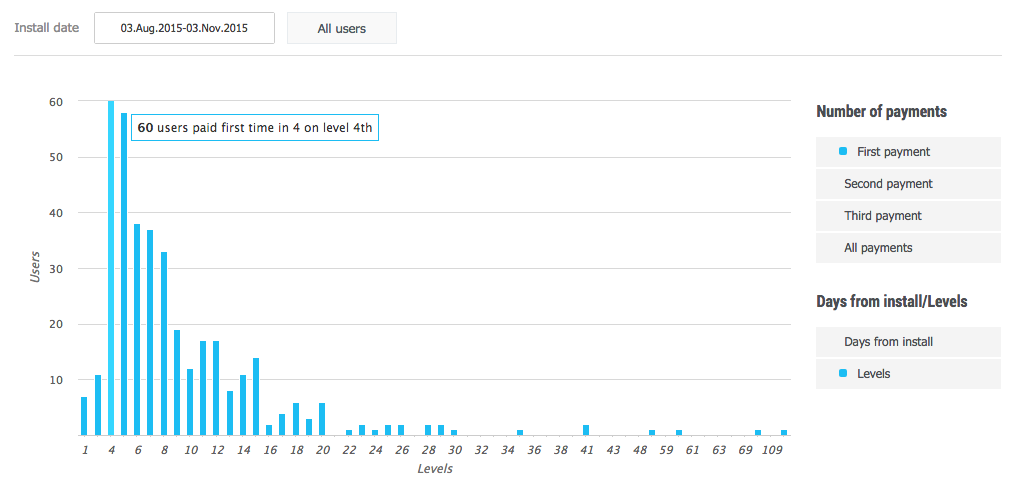

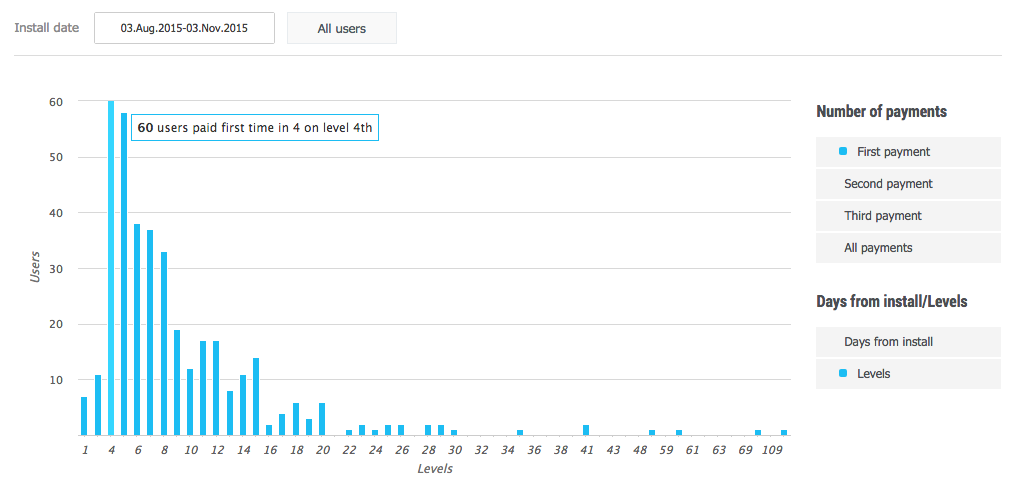

We again turn to the report 'Period until payments' and select the distribution not by days, but by levels.

Yeah! Here is the peak, on the fourth and fifth levels.

Thus, we have identified a pattern - paying users mainly make the first purchase on the day of registration upon reaching 4-5 levels.

In the future, we will be able to integrate into the product (whether it be a game or, say, a training service) a targeted offer corresponding to this pattern. And this will help us increase the conversion to paying on the first day.

How many users make one payment? How many users switch to re-payments? How are the amounts for first and repeated payments distributed?

Let's start with a little advice.

Tip : along with the Paying Users (number of paying) and Paying Share (share of paying users in the active audience) metrics, highlight the New Paying Users metric , which describes the number of users who made their first payment during the analyzed period. Without the first payment, there will be no re-payments.

Speaking of the importance of repayments. Tapjoy analyzed apps that made a million dollars and identified several common signs.

The first sign : 84% of applications in which at least 1000 users made at least three payments in the first 90 days from the date of the first login, overcame the $ 1 million barrier.

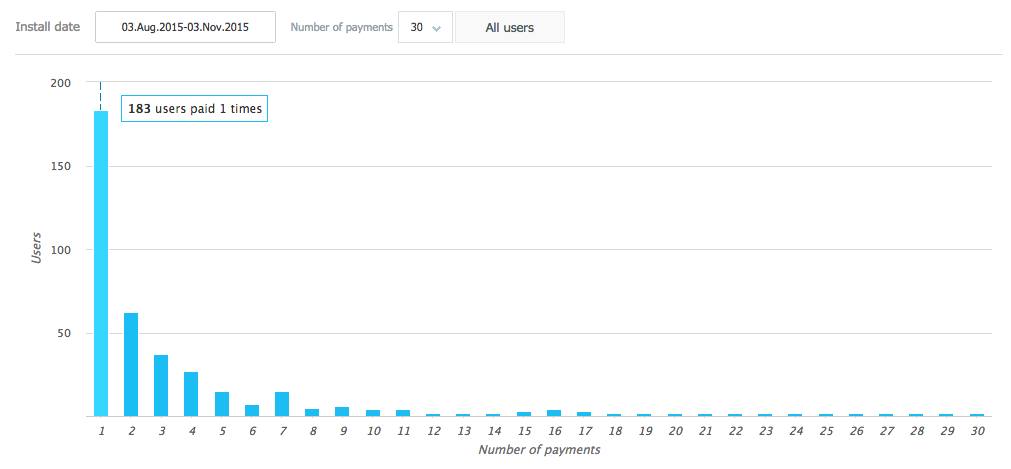

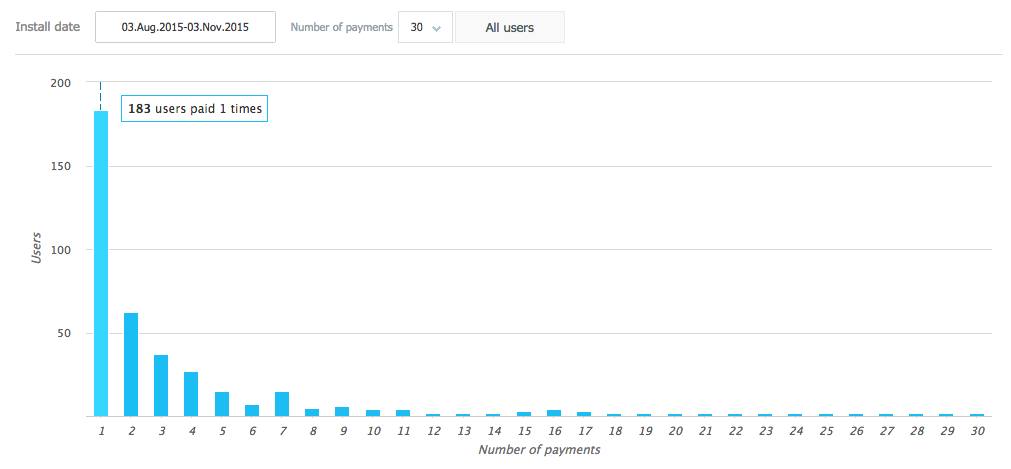

So that you can better understand the distribution of paying users by the number of payments they made, we at devtodev developed a “Users by transactions” report. It allows you to see how many users have completed one transaction, two, and so on.

Second symptom identified by Tapjoy:

If at least 35% of the users who made the first payment then make the second and third payments, then the application is likely to earn a million dollars.

The first payment is usually small in size. This can be seen in the example of the “Paying users activity” report:

Users making their first payment only want to test the advantage of paid use of your product and are not ready to immediately spend large amounts. In addition, the first payment is also an occasion to link the card to the account, if it was not linked earlier.

The main money supply is contained in repeated payments.

Thus, in order to be financially successful, your product must meet the following conditions:

This completes the series of articles on the analysis of paying.

Analyze the behavior of those who pay you, understand where your money is coming from, and increase your cash flow.

Previous articles:

Part 1. RFM analysis, whales and dolphins.

Part 2. Time revenue structure.

Today we’ll talk about re-payments and the time to convert to payment. What questions should you ask yourself?

What day does the user make the first payment? Second? Third?

Understanding your billing behavior will allow you to better plan your monetization activities in your product. This is the application of the traditional algorithm for product analytics:

- We reveal the pattern in user behavior;

- We find users whose behavior initially corresponds to this pattern;

- We suggest these users to perform another action from the pattern. For you, this looks like a logical continuation of the pattern, and for the user, it looks like a targeted offer at the right time.

Knowing when the user makes the next payment, you can get ahead of him and offer the right promotion (or targeted offer) at the right time.

For example, we will use the report 'Period until payments' of the devtodev analytical system . We select the right time for making the first payment on the right (you can also select the second, third user payments, or all payments, regardless of their serial number), set the user registration period and look at the distribution of the time of their first payment.

We see that the bulk of the first payments are made in the first days. Moreover, on the day of user registration. And this means that we can safely offer any action from the very beginning of the user's stay in the application, from the first day.

However, it would not be very correct to offer to buy something, for example, immediately after completing the tutorial - the user will decide that the game is based only on donation and, most likely, will immediately leave the application. Therefore, we ask ourselves the following question.

At what level does the user make the first purchase? And the second? And the third?

We again turn to the report 'Period until payments' and select the distribution not by days, but by levels.

Yeah! Here is the peak, on the fourth and fifth levels.

Thus, we have identified a pattern - paying users mainly make the first purchase on the day of registration upon reaching 4-5 levels.

In the future, we will be able to integrate into the product (whether it be a game or, say, a training service) a targeted offer corresponding to this pattern. And this will help us increase the conversion to paying on the first day.

How many users make one payment? How many users switch to re-payments? How are the amounts for first and repeated payments distributed?

Let's start with a little advice.

Tip : along with the Paying Users (number of paying) and Paying Share (share of paying users in the active audience) metrics, highlight the New Paying Users metric , which describes the number of users who made their first payment during the analyzed period. Without the first payment, there will be no re-payments.

Speaking of the importance of repayments. Tapjoy analyzed apps that made a million dollars and identified several common signs.

The first sign : 84% of applications in which at least 1000 users made at least three payments in the first 90 days from the date of the first login, overcame the $ 1 million barrier.

So that you can better understand the distribution of paying users by the number of payments they made, we at devtodev developed a “Users by transactions” report. It allows you to see how many users have completed one transaction, two, and so on.

Second symptom identified by Tapjoy:

If at least 35% of the users who made the first payment then make the second and third payments, then the application is likely to earn a million dollars.

The first payment is usually small in size. This can be seen in the example of the “Paying users activity” report:

Users making their first payment only want to test the advantage of paid use of your product and are not ready to immediately spend large amounts. In addition, the first payment is also an occasion to link the card to the account, if it was not linked earlier.

The main money supply is contained in repeated payments.

Thus, in order to be financially successful, your product must meet the following conditions:

- The user must come to the first payment himself, however, you can help him by identifying the pattern and making an offer at the right time

- Do not require a large down payment from the user. The first payment is usually small in size.

- The user must feel the return on investment, then he will be satisfied with the first purchase and will want to pay more.

- Your product should allow the user to pay as much as he wants. Each user, whether non-paying or a whale (the user with the highest possible check), should enjoy using your product.

- Long-term retention is the key to good monetization. If the user is non-paying, then the longer he is with you, the higher the probability of making a payment. If the user pays, then the longer he is with you, the more he can pay you.

This completes the series of articles on the analysis of paying.

Analyze the behavior of those who pay you, understand where your money is coming from, and increase your cash flow.