Facebook in the UK paid £ 35 million employee bonuses and only £ 4,327 tax deductions

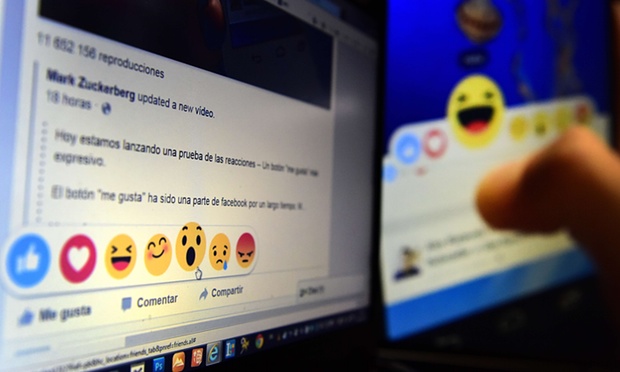

Photo: AFP / Getty Images

Each Facebook employee in the UK took home approximately £ 210,000 in 2014, plus wages and bonuses. At the same time, the company contributed to the UK treasury in the form of taxes only £ 4,327 in the same year. And this is not a joke, it was really paid only about 4 thousand pounds (approximately $ 6,140), writes TheGuadrdian.

According to documents, Facebook worked at a loss in 2014, ending the year with an operating loss of £ 28.5 million. The loss appeared after the social network paid about £ 35 million to its 365 employees in the UK. According to the laws of the country, since the company worked at a loss, the tax can be very low - and in the case of Facebook tax payments were less than £ 5000. A corporate income tax has been introduced in the UK since 1965.

Such a low tax paid by Facebook could not get past the UK lawmakers. Now the government is going to discuss the rules for evaluating the economic activity of international corporations in the country in order to prevent a recurrence of such situations. After all, Facebook receives hundreds of millions of dollars in profit a year - only in the UK last year, social network revenue amounted to £ 105 million.

According to a Facebook representative, the company continues to increase its presence in the UK and other countries, while all tax payments are made in full. according to legal requirements.

However, the UK is currently working on laws that avoid the intentional understatement of tax payments by international corporations. There are quite a few ways to do this in any country, and it is clear that the tax authorities do not like it. Currently, Facebook pays the main tax deductions in the United States, where the headquarters of the social network is located. But UK officials believe the company should pay taxes where it makes a profit. Now the government has already submitted amendments to the tax legislation of the country, which was called "Google tax". These amendments close the possibility for international corporations to use ways to reduce tax payments, in particular, income tax.