Hawala: The algorithm of the underground banking system, preserved from ancient times

A few months ago, a material was published on Habré , which described the algorithm for the movement of money in the banking system. However, banks familiar to us are not the only instrument that residents of different countries of the world use to work with finances.

One of these financial settlement systems was called Hawala. It originated in Hindustan long before the advent of the Western-style banking system (according to various estimates, it worked already in the 8th century), and is still used by many citizens of the Middle East, Africa and Asia as an alternative settlement tool.

Underground banking

The word "hawala" in Arabic means a bill or parcel. A feature of the hawala system is the fact that all financial operations (moving money, jewelry or gold from one country to another) are performed without any documentary evidence - the work is based on the confidence of the participants in the process.

The main link in the hawala system is the brokers of the system - they are called “hawaladars”. It is they who organize transfers between countries. In this case, the money does not physically leave the state: the sender simply gives the money to the broker in one country, receives a secret code from him (for example, numbers from one of the banknotes), which then the recipient in another country must call the second broker to get the equivalent of the initial amount in local currency.

Subsequently, brokers are settled among themselves according to the clearing scheme - gold, precious metals can be used to close the balance, or some services can be provided.

The exact number of hawala brokers working in the world cannot be calculated - estimates range from 5,000 to tens of thousands. There are regional varieties of hawala, such as the Hundi in India.

How it works

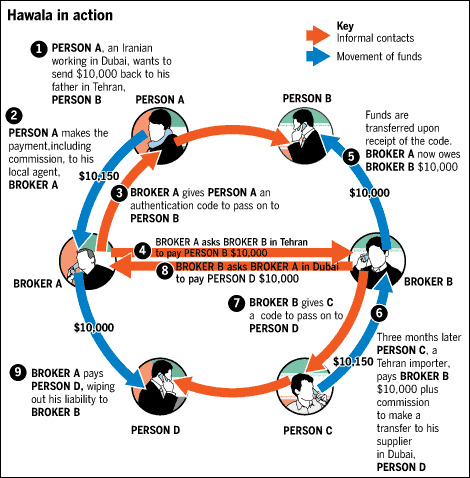

The Hawala workflow is easier to illustrate with an example.

Suppose that a client (CA) from country A wants to make a transfer (or pay some of his obligations) to a client CB from country B. Hawaladar (broker) HA from country A receives money in the currency of country A and provides him with a confirmation code transactions. Then, by email, fax or phone, he contacts the hawaladar from the second country (HB) and tells him the details of the transfer and the amount equivalent in local currency must be given to the recipient (CB). To receive money, the recipient must give the code to the hawaladar, which the first broker called the sender of the transfer. Such a scheme is called “ simple reverse hawala.”

"- in this case, the money is not physically transferred from the broker to the broker. If we assume that the sender is in the United States and the recipient is in India, then the Indian hawaladar will pay the recipient out of his own funds. Subsequently, to settle accounts, a broker in the United States will pay to the recipient in that country on behalf of a client from India.

Over time, the total net transaction amount can be balanced, but usually the asymmetry of cash flows between countries does not allow this to be achieved. Therefore, in the end, settlements are made, for which transfers can even be used using the usual banking system.

The method described above is not the only kind of hawala. There are also options for tripartite brokers.. Hawaladars may be part of a network spread over several jurisdictions. Then they use the balances of mutual settlements and correspondents to reconcile their respective accounts.

In the example above, brokers from the USA and India can work in the same wide network. After the first transaction, a hawaladar from the USA becomes a debtor to an Indian broker. Moreover, the second broker may have a client who wants to transfer to a third country, for example, Somalia. If this broker does not have partners in the right country, he can turn to the hawaladar in the USA for help, asking him to find a partner in Somalia who owes money to the US broker himself. When a hawaladar in Somalia makes a payment to the recipient on behalf of a broker in India, all settlements will be closed.

Another way to make payments through the hawala system is to use trade transactions with high or low accounts . According to a report by the Financial Action Task Force on Money Laundering (FATF), agreements of this type are common in Afghanistan, Iran, Pakistan and Somalia. In this configuration, brokers make payments from cash or cashless surpluses at the request of an organization, which, in turn, makes payments to private recipients in the country of destination of the transfer.

What is hawala for?

Hawala allows you to quickly (from 24 to 48 hours) transfer significant amounts of money with minimal fees, making operations completely “invisible” to the authorities of the countries between which transactions are carried out.

As a rule, remittance transfers are used by immigrants from developing countries to send money to their homeland. Money senders do not always want extra attention to themselves or, in principle, have the opportunity to use banking services. They may be in the country illegally or with an expired visa. In this case, hawala becomes almost the only means of sending money without the need to confirm your identity, which is required in the case of a bank transfer.

In addition to private individuals, entire countries use hawala transfers - in 2008, the Financial Times published a review of how the country bypassed the sanctions imposed on its banks using this financial system. As the journalists found out, the central bank of Iran issued hawala brokers licenses for money transfer activities, which ultimately ended up in accounts with banks in the USA, Europe and Asia.

The attitude of the authorities

The ease of use of the system, as well as its opacity for government officials and a minimum of “paperwork” make hawala an attractive tool for money laundering or tax evasion. There are also suspicions of the use of hawala by terrorist organizations - US intelligence agencies drew attention to the system after the September 11 attacks.

Hawala points were also found in Russia - for example, several years ago the media wrote about the closure of a whole network of clandestine money transfer points in Moscow.

Countering hawala "shadow banks" is an extremely difficult task. Some economists even propose not to take the path of banning them, but to prevent the use of hawala for criminal purposes. One of them is the Deputy Director of the International Monetary Fund (IMF), Mohammed El-Korchi, in his article “ The Hawala System ” back in 2002 stated that while people have reasons to use hawala, such systems will exist and even expand.

“If the formal banking sector is going to compete with the shadow money transfer business, it needs to focus on improving the quality of service and lowering commissions,” El Korchi believes. “In addition, the authorities need to constantly work to modernize and liberalize the financial sector, as well as eliminate its inefficiencies and weaknesses that create inconvenience for users.”

List of references: