Will the portfolio protect against crypt drawdowns?

It's no secret that the cryptocurrency market has phenomenal volatility, due to its youth and lack of regulation. In regulated markets, portfolio, which is a set of assets with periodic rebalancing, helps in the fight against volatility.

Will the portfolio help the cryptocurrency market? And will it allow to save and increase bitcoin (BTC)? We in the team decided to check it out. One of the conditions for creating a portfolio was the simplicity of maintaining it. We were selecting and searching for assets using Jupyter in Python. And this time we will consider which portfolios we managed to get.

We will analyze and search for opportunities in the last year, starting in August 2017. For this short period there were sharp ups of coins, accompanied by no less rapid falls.

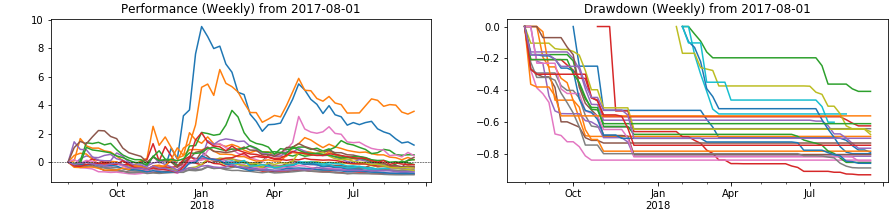

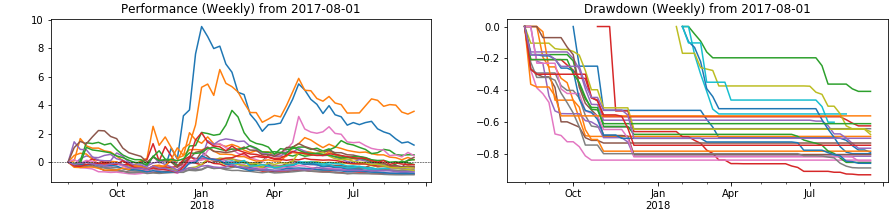

The graph above shows the yield and the maximum drawdown of coins that fell into the TOP15 by capitalization throughout the year. The table shows only five leaders in terms of profit and loss in BTC.

As the drawdown chart shows, almost all coins decreased more than twice. The minimum drawdown is -40%, with a median of -76%.

Let's start looking for portfolios, minimizing conditions:

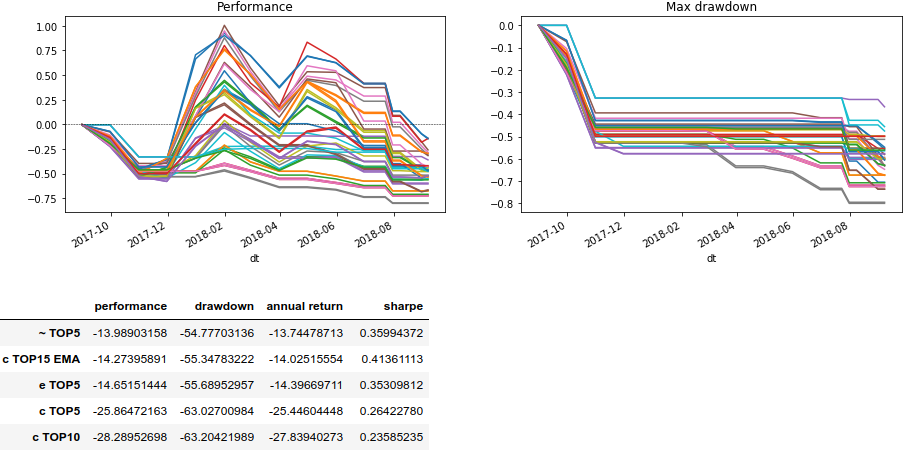

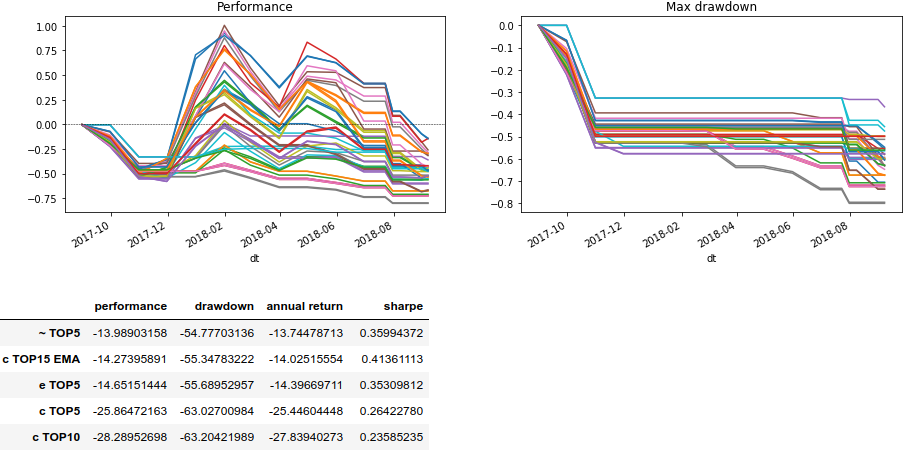

As can be seen in the graph below, monthly rebalancing leads to a stable defeat. This is not surprising, given the volatility for some coins at 100-200% during the week.

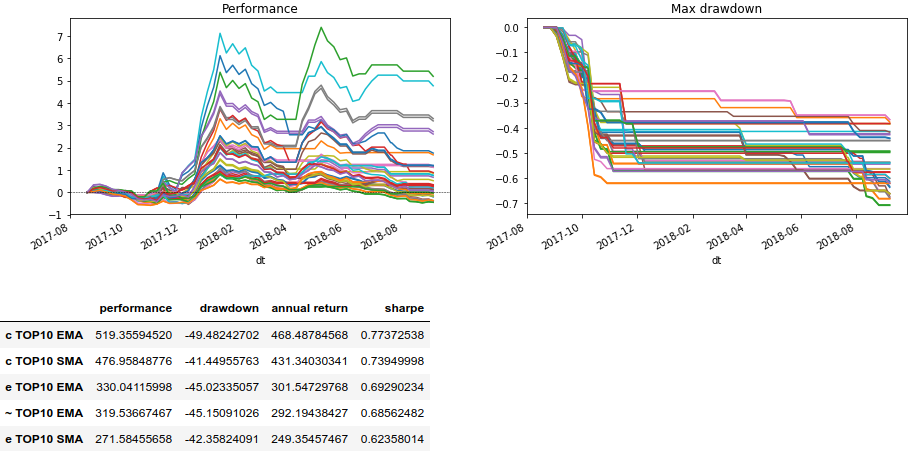

Weekly rebalancing gives better results. But the leaders are only portfolios with a trend filter at the intersection of moving averages (for 10 and 100 days).

A high drawdown remains, albeit less than -50%. In any case, there was a chance to stay in the black. But these tests are highly dependent on the time of selection of the composition of the portfolio. We will try to get rid of this by changing the composition at the time of rebalancing on the current capitalization rating.

In subsequent tests, we will rebalance the portfolios every week, since a month for cryptocurrency is too long. Conditions:

This time the results are not so impressive, but there are portfolios with a drawdown of less than -40%. And universality appeared at breaking the connection with the unified composition of the portfolio.

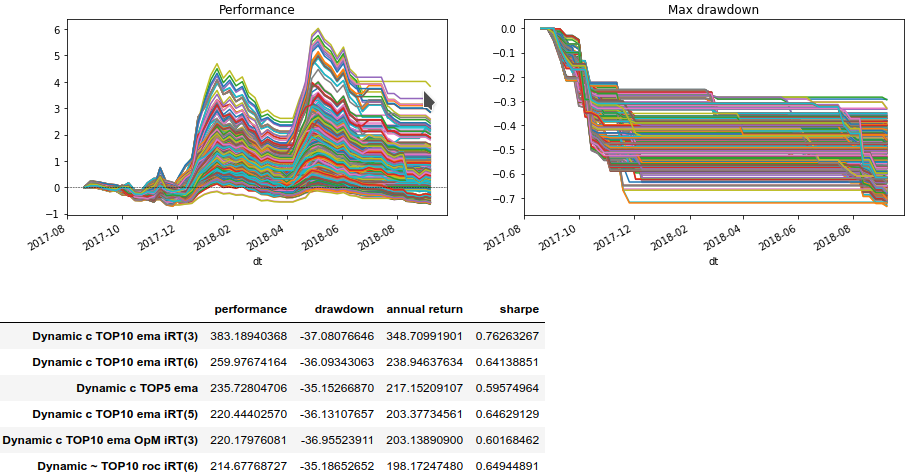

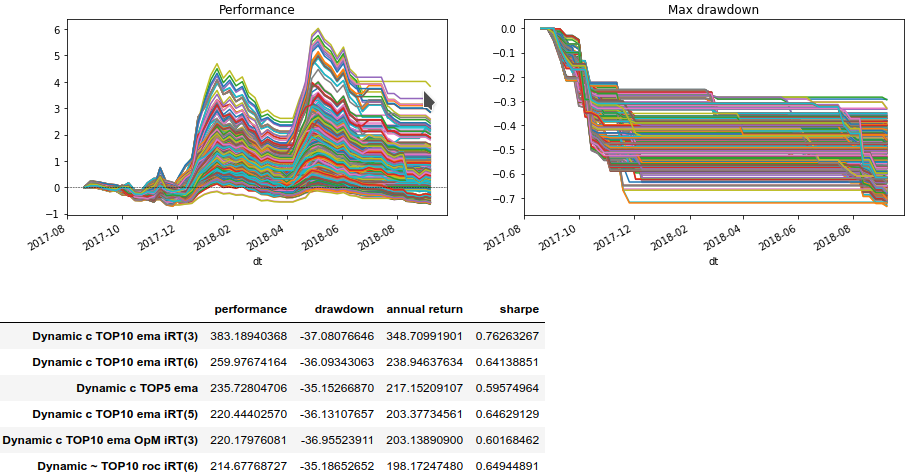

Let's try to add an additional condition - the duration of finding a coin in the TOP capitalization ( iRT (#) ). This will prevent investing in coins that have accidentally flown to the top of the capitalization rating.

For a weekly update of the portfolio we will check the TOP of the previous weeks. For monthly - TOP of previous months.

The table shows the results with a drawdown of less than -40%. Positive effect is from 6 weeks of presence in the TOP capitalization for weekly renewal of the composition. And from 3 months with a monthly update. The median yield of all observations is at 80%.

Also, these tests show the turns, which can be taken as a basis for other studies.

Potentially, working portfolios can be built on cryptocurrency, although there is still a need for additional filtering of trends. The drawdown was reduced. The most interesting portfolios that can be easily robotized consist of the top 10 coins of the capitalization rating. At the same time, to achieve the best result, they should be rebalanced once a week.

In turn, when choosing conditions, one should ignore the extreme (best) values of the results and take into account the strong influence of the day of the week when rebalancing.

Will the portfolio help the cryptocurrency market? And will it allow to save and increase bitcoin (BTC)? We in the team decided to check it out. One of the conditions for creating a portfolio was the simplicity of maintaining it. We were selecting and searching for assets using Jupyter in Python. And this time we will consider which portfolios we managed to get.

We will analyze and search for opportunities in the last year, starting in August 2017. For this short period there were sharp ups of coins, accompanied by no less rapid falls.

- close - the closing price at the end of the period.

- performance - profitability from August 1, 2017.

- drawdown - maximum drawdown to BTC during the year.

The graph above shows the yield and the maximum drawdown of coins that fell into the TOP15 by capitalization throughout the year. The table shows only five leaders in terms of profit and loss in BTC.

As the drawdown chart shows, almost all coins decreased more than twice. The minimum drawdown is -40%, with a median of -76%.

We rebalance one portfolio

Let's start looking for portfolios, minimizing conditions:

- Take the TOP (5, 10 or 15) by capitalization for August 2018.

- Exclude USDT (Tether) and BCC (BitConnect).

- We rebalance at the end of each period.

- We use the following options for calculating shares:

- Equal parts ( e ).

- In shares, taking into account capitalization (from whom more, take more) ( c ).

- Shares in reverse accordance with the capitalization (who has more, take less) ( ~ ).

- Use the rebalancing rules:

- We lead to the initial shares.

- We distribute only by coins in a growing trend (using simple indicators of technical analysis).

- We take into account twice the commission of 0.2% (every time we sell everything and then we buy).

As can be seen in the graph below, monthly rebalancing leads to a stable defeat. This is not surprising, given the volatility for some coins at 100-200% during the week.

- performance - portfolio yield.

- drawdown - the maximum drawdown of the portfolio.

- annual return - the average annual yield.

- sharpe - the annual value of the Sharpe ratio.

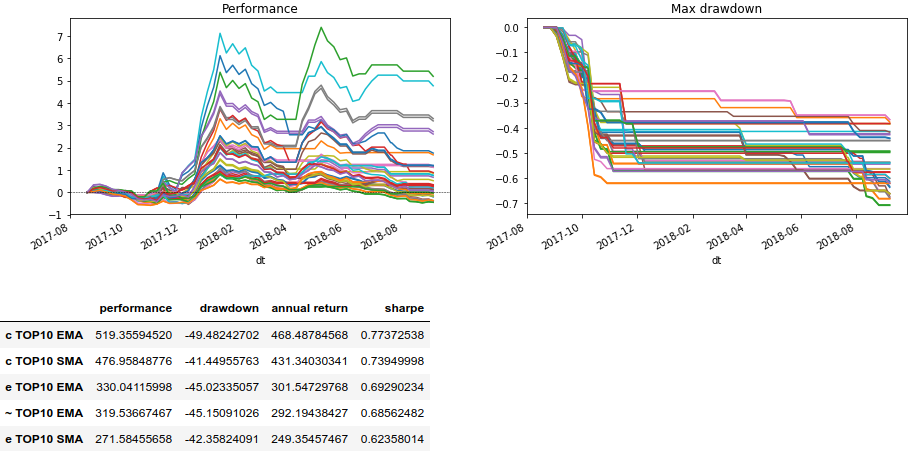

Weekly rebalancing gives better results. But the leaders are only portfolios with a trend filter at the intersection of moving averages (for 10 and 100 days).

A high drawdown remains, albeit less than -50%. In any case, there was a chance to stay in the black. But these tests are highly dependent on the time of selection of the composition of the portfolio. We will try to get rid of this by changing the composition at the time of rebalancing on the current capitalization rating.

Portfolio based on capitalization

In subsequent tests, we will rebalance the portfolios every week, since a month for cryptocurrency is too long. Conditions:

- Take the TOP (5, 10 or 15) by capitalization:

- Weekly, at the time of rebalancing.

- Monthly, in the first week of the month ( OpM ).

- Exclude USDT (Tether) and BCC (BitConnect). Other short-term TOP members such as HSR and VEN are involved.

- We rebalance at the end of each week.

- We use the calculation of shares:

- Equal parts ( e ).

- Shares, taking into account the capitalization (from whom more, take more) ( c ).

- Shares in reverse accordance with the capitalization (who has more, take less) ( ~ ).

- Use the rebalancing rules:

- We lead to the initial shares.

- We distribute only by coins in a growing trend (using simple indicators of technical analysis).

- We take into account twice the commission of 0.2% (every time we sell everything and then we buy).

This time the results are not so impressive, but there are portfolios with a drawdown of less than -40%. And universality appeared at breaking the connection with the unified composition of the portfolio.

Let's try to add an additional condition - the duration of finding a coin in the TOP capitalization ( iRT (#) ). This will prevent investing in coins that have accidentally flown to the top of the capitalization rating.

For a weekly update of the portfolio we will check the TOP of the previous weeks. For monthly - TOP of previous months.

The table shows the results with a drawdown of less than -40%. Positive effect is from 6 weeks of presence in the TOP capitalization for weekly renewal of the composition. And from 3 months with a monthly update. The median yield of all observations is at 80%.

Also, these tests show the turns, which can be taken as a basis for other studies.

Conclusion

Potentially, working portfolios can be built on cryptocurrency, although there is still a need for additional filtering of trends. The drawdown was reduced. The most interesting portfolios that can be easily robotized consist of the top 10 coins of the capitalization rating. At the same time, to achieve the best result, they should be rebalanced once a week.

In turn, when choosing conditions, one should ignore the extreme (best) values of the results and take into account the strong influence of the day of the week when rebalancing.