How are the last days of the race to $ 1 trillion (UPD .: Apple won)

There are last weeks left (and maybe even days) before the first American company with a price of $ 1 trillion appears in the world. This promises some goodies. She will write her name in history forever, generate a positive informational guide, give her fans, employees and CEO an extra reason to rejoice, and wipe her nose at the scoundrels. Who will be this company? Apparently, Apple. But analysts are betting on other options. Competitors are not going to surrender, and are preparing their final spurt. The day before yesterday, the financial reports of the world's largest companies were published, in one day they shook the markets into hundreds of billions. It seems that the last stage of the race promises to be quite interesting.

Finish line

To win the rally to $ 1 trillion, until recently there were two main contenders. Apple, which costs more, and Amazon, which costs less, but grows at some inexplicable pace. Just a couple of weeks ago, they were estimated roughly the same, about $ 900– $ 920 billion. But at the finish line, Apple suddenly had a second wind.

The day before yesterday, July 31, the company almost unequivocally secured itself in the status of the winner. She released her third quarter report, reporting a revenue growth of 17% and an increase in average iPhone revenue. It turned out that the company sold less iPhones than experts had expected, but due to the high price of the iPhone X, Apple’s revenues were even higher than usual (the price of the average iPhone sold was $ 724).

For one quarter, the firm earned $ 53.3 billion, $ 1 billion more than expected. This is the most successful result of the company in the history. And considering that autumn is coming when users are waiting for the presentation of new cool new products, and December is the most profitable month of the year, if there is no new scandal, Apple is guaranteed to move to $ 1 trillion by 2019.

In total, the company sold 41.3 million iPhones, 1% more than last year, but received 20% more profit from them. iPad sold 11.55 million, also + 1%. Because of the problems with the new thin keyboards with butterfly switches that have surfaced in recent months (the keys go down and "die"), Mac sales are the only ones that showed a drop: only 3.7 million units, -13% compared to 2017 m And most of all, the profit from services has increased - iCloud, Apple Music, Apple Care. On them, the company received $ 9.55 billion, + 31%.

On such news, the company's stock jumped 2.5%, which is a very good result for the giant-sized Apple. For this year, the company has already added 20%, plus - announced that it is going to return the bonus $ 100 billion to its investors in its new program. All this makes the brainchild of Steve Jobs a very welcome asset for those who want to invest. Apple entrenched itself in the status of the most expensive company in the world, with a capitalization of $ 980 billion. If its shares rise by only 3%, Apple will become the first privately owned company with a capitalization above $ 1 trillion.

Not so fast!

But nothing has been decided yet. A vivid example of this was shown by Facebook. Less than a week ago, the company showed good results in its report: + 42% profit compared with the same quarter of the previous year. But analysts were waiting for 43%! And the growth in the number of new users in this quarter slowed down, which undermined confidence in the future social network. Plus - the scandals with Russia's interference in the elections of the United States, insufficiently weighty responses from Zuckerberg to Congress and the use of similar strategies through Facebook in elections in Pakistan and Mexico. The negative news background, which has long been worrying investors, has finally found at least some confirmation in numbers.

The result - the company lost $ 120 billion during the day! The state of Zuckerberg himself fell by $ 15 billion. The worst day in the history of the American company on the stock market. Previously, none of the companies did not even lose $ 100 billion. Before that, two of the most serious crises occurred in 2000, when Intel showed $ 90 billion, and Microsoft had $ 80 billion. But there it was the result of blowing off the bubble, and here - a crisis out of the blue!

Facebook is not the only company that suddenly started having problems. Intel, which showed excellent results in all respects, lost $ 20 billion on July 27. A few days before, Netflix came out with its numbers, and immediately collapsed on the stock exchange, despite a sixfold increase in profits. Experts believe that a global problem is emerging in the technology sector. The market is oversaturated, and estimates of the value of companies are bloated.

Just exceeding expectations is no longer enough. Of the 36 technical firms that came out with quarterly reports, 35 beat analysts' predictions. But over the next five days, their shares on average lost 3.5%. It would seem - where is the logic? However, IT companies in the States are beginning to be treated in a new way. Investors fear that they are overvalued, and are beginning to show a slowdown in growth. As a result, technology stocks in the US are now the worst of all (and best of all, industry and medicine, where money goes off on exchanges). In 2018, the market for software and computers is expected to grow by an average of 18% - while other companies from the S & P 500 index will grow by 21%.

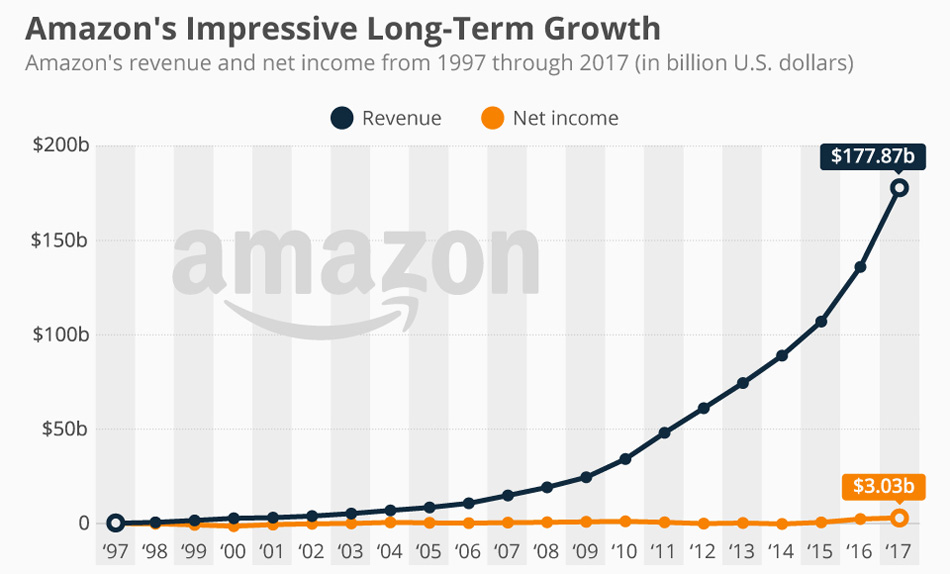

Bezos plan

Amazon to the last trudge far behind Apple, and even inferior to Microsoft and Alphabet. But 2018 turned out to be incredibly successful for the company - at least financially. Since the beginning of the year, Amazon shares have grown by 55%, showing a stunning rally. Over the past 4 years, the company's shares have grown 4 times. And Jeff Bezos, who was on the Forbes list below Zuckerberg and Bryn, suddenly became the world's top billionaire . Now his fortune exceeds $ 150 billion, he is the richest man in modern history, and Bill Gates, standing under No. 2, was left far behind with his $ 94 billion.

Amazon’s success this year is largely due to Prime Day, a special July day of discounts, invented by Bezos to boost sales in the summer along the lines of November’s Black Friday. All Prime subscribers can take hundreds of thousands of products 10-40% cheaper that day. Prime Day, which this year was held on July 16, exceeded all expectations. In one day, store users made over 100 million purchases. Plus - several million (exact figures are not disclosed) have become new Prime subscribers to get access to such a variety of discounts. On such news, the store has reached a cost of $ 900 billion, and Bezos’s fortune has increased by $ 12 billion in one day (although Zuckerberg, of course, has an anti-record still better).

Now Amazon needs a push of only 13% so that the company can be the first to cross the line at $ 1 trillion. Amazon needs another Prime Day. And that's all. A couple of successful numbers, or any mistake from Apple - and we may have a photo-finish.

Moreover, some experts expect the company to go $ 2 trillion and more. Amazon’s share in many of the industries it deals with is still small. It is just beginning its development with Amazon Go and a dozen other initiatives. And that means there remains the potential for growth. Even the online store itself, despite the fact that it is the largest and most famous in the world, can still grow - especially in Europe and India . Bezos even threatens to bypass Google and Facebook in terms of online advertising- although it is still very distant plans. So far, if Amazon just continues to grow at its pace, by October it is guaranteed to go for $ 1 trillion. And as it grows, it becomes more and more profitable: new warehouses are even closer to users, delivery is getting faster and faster, and there are fewer reasons to contact other sellers. With the purchase of Whole Foods for $ 13.5 billion, Amazon wants to enter the food market, and here too, the bigger you are and the more points you have, the more profitable it is to do business.

Most analysts bet that Apple will cross the first line of $ 1 trillion, but there are also those who are confident about the victory of Amazon due to its growth dynamics. Among the main advantages of Apple and Amazon, which allowed companies to become leaders in the final stage of the race, they say that they care about users directly. The business model of both companies does not depend on the state of third organizations. They do not need, like Google or Facebook, to worry about what advertisers or other third parties will say (see YouTube’s “adpokalipsis” and Zuckerberg’s recent giant problems). You can only think about what your end users want, and what could make their impressions better. A (sad) stories of Facebook, Twitter and others show what happens when companies begin to prioritize the interests of advertisers, not users.

Dark horses

There are other potential leaders who can intercept the baton at the last moment. The probability of this is almost zero, there must come from somewhere big problems for both Amazon and Apple, but still ...

On the way to $ 1 trillion, for example, Google is now . Alphabet is now worth $ 885 billion, and continues to grow due to the very good financial results of this year. It brought a profit of $ 34 billion in the last quarter, + 26% compared with 2017, and, more importantly, the growth rate increases (in 2017, growth was + 21%). The company is almost on par with Amazon, but, of course, its growth rate is not in any comparison with the online store. The huge fine that Google recently imposed on Europe did not shake the state of the company in the markets, which showed its stability and gave additional confidence to investors. The only worrying thing is that cloud services have been showing the main growth for a long time, and not the company's main business related to advertising.

Another candidate is Microsoft . She was the first to break through the $ 500 billion mark, back in 1999 (Apple moved for $ 500 billion only in 2012). And for the past fiscal year, the company earned more than $ 100 billion for the first time, having exceeded its previous result by 14% due to cloud services and software subscription sales. Financial analysts believe that according to the results of 2018, the capitalization of Microsoft will almost certainly exceed $ 1 trillion. The question is whether she can do it faster than competitors.

It’s fun to watch the race, but it probably doesn’t bear that much importance that journalists and market analysts attach to it. In fact, Apple would have been above $ 1 trillion long ago if it had not bought its shares from the market itself (9 of the 20 largest buybacks from Apple over the past 5 years).

Before the trillionth mark in 2007, another company had already reached the domestic Chinese stock market, PetroChina — although its shares fell sharply the next day and dropped two times in a few months, so it's hard to count as “real” capitalization manipulations. But Saudi Aramco oil, a kind of Rosneft Saudi Arabia, could really cost $ 4.2 trillion if it was traded in the markets.

True, Aramco exists only at the expense of natural resources and is fully controlled by the state. And the new leaders reaching the trillion are created by private entrepreneurs and are based on new technologies, which makes their achievements a bit more impressive.