Book of Flies for $ 23,698,655.93

- Transfer

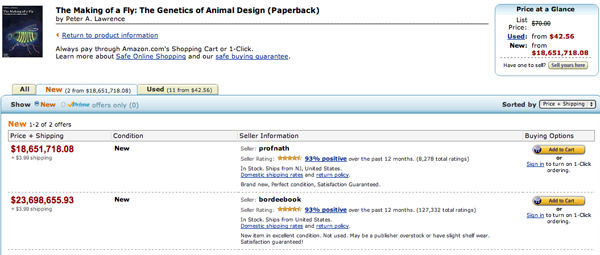

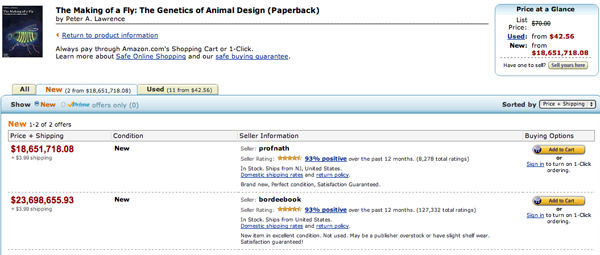

A few weeks ago, one doctor from my laboratory went to Amazon to buy a copy of Peter Lawrence’s book The Making of a Fly - a classic developmental biology work that we - and other biologists working with Drosophila - check regularly. The book, published in 1992, is no longer republished. But on Amazon 17 copies were on sale: 15 used from $ 35.54 and two new ones, from $ 1,730,045.91 (+ $ 3.99 for delivery).

I sent a screenshot to the author of the book - who was very surprised and intrigued. But I think even he would not insist that the book is SO expensive.

At first I thought it was someone’s joke - some sort of former student who has nowhere to go. But there were two on sale

copies, each for more than a million dollars. And the two sellers looked not only quite honest, but also quite well-known (more than 8,000 and 125,000 ratings over the past year, respectively). Prices looked random - they looked like they were set by a computer. But how did they reach such values?

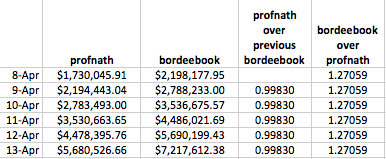

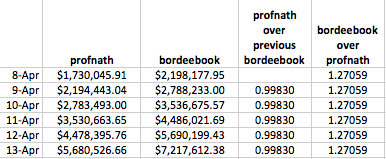

To my surprise, when I reloaded the page the next day, prices went up even more! Each book cost almost $ 2.8 million, the price difference was less than $ 5000. Now I became interested in the situation, and began to closely monitor the page. By the end of the day, a more expensive copy went up even further. Now it was worth $ 3,536,675.57. Finally, the overall picture began to emerge.

That day when we discovered multimillion-dollar prices, a copy from a bordeebook cost 1.270589 times more expensive than a copy fromprofnath . And now a copy of bordeebook was more expensive than a copy of profnath In 1.270589. Obviously, at least one of the participants set the price automatically in response to another price change. I continued to observe and soon understood the whole process.

Once a day, profnath set the price at 0.9983 times the price of bordeebook. Prices remained in this position for several hours until the bordeebook “noticed” the profnath price change and raised its price 1.270589 times from the maximum profnath price. In that order, events continued in the same order for the next week.

But two more questions remained. Why did they do this and how long will it last until someone notices? While I was surprised to observe the daily price increase, I learned that sellers on Amazon are increasingly using price setting algorithms (Amazon itself does the same on a much larger scale), with several companies offering sellers services / algorithms to determine the best price. Both profnath and bordeebook explicitly used automatic pricing - while using algorithms that did not have a built-in "sanity" check on the price set. But these sellers obviously used different strategies.

Profnath behavior is easy to understand. They most likely have a new copy of the book, and they want to be sure that their price is the lowest, but not much different from the next ($ 9.98 versus $ 10.00). Why did bordeebok bid higher? Since the system shows the prices of all sellers, it looked like they were guaranteed no sales. But perhaps this is not entirely true - they have a huge number of positive reviews, much more than other sellers. And some buyers are surely willing to pay a few extra dollars for the confidence that the purchase will indeed be successful. Anyway, this is a rather strange and risky strategy to rely on - most people probably don’t act like that - and the book will collect dust on the shelf all this time. Naturally, except when you actually do not have a book ...

My explanation for the behavior of the bordeebook is that they don’t actually have a book. Instead, they noticed that someone else put up the same volume for sale, and put it up too - hoping for more reviews to attract customers. Naturally, if someone orders a book, they will have to get it - so they had to set their price more - for example, 1.27059 times more - the price at which they would buy this book from another seller.

Most of all in this situation, the endless amount of possible chaos and problems is surprising. It is unlikely that we came across a single example of a constantly rising spiral of prices - and all that was required for it was two sellers who change their price in accordance with the price of the other in proportion, which ultimately leads to a general increase in price. And although it can be harder to calculate, you can come up with other strange scenarios that can happen if the number of participating sellers becomes more than two. When I realized what exactly was happening, I and some people I spoke to began to think of ways to use our ability to predict the seller’s setting of prices with an accuracy of five decimal places - especially when the price was set without checking.

However, soon someone noticed a problem. The price peaked on April 18, but already on April 19, the price of profnath fell to $ 106.23 and the borderbook soon set a predictable price of $ 106.23 * 1.27059 = $ 134.97. But Peter Lawrence can now calmly boast that one of the largest and most respected companies on Earth valued his book at $ 23,698,655.93 (plus $ 3.99 for delivery).

copies, each for more than a million dollars. And the two sellers looked not only quite honest, but also quite well-known (more than 8,000 and 125,000 ratings over the past year, respectively). Prices looked random - they looked like they were set by a computer. But how did they reach such values?

To my surprise, when I reloaded the page the next day, prices went up even more! Each book cost almost $ 2.8 million, the price difference was less than $ 5000. Now I became interested in the situation, and began to closely monitor the page. By the end of the day, a more expensive copy went up even further. Now it was worth $ 3,536,675.57. Finally, the overall picture began to emerge.

That day when we discovered multimillion-dollar prices, a copy from a bordeebook cost 1.270589 times more expensive than a copy fromprofnath . And now a copy of bordeebook was more expensive than a copy of profnath In 1.270589. Obviously, at least one of the participants set the price automatically in response to another price change. I continued to observe and soon understood the whole process.

Once a day, profnath set the price at 0.9983 times the price of bordeebook. Prices remained in this position for several hours until the bordeebook “noticed” the profnath price change and raised its price 1.270589 times from the maximum profnath price. In that order, events continued in the same order for the next week.

But two more questions remained. Why did they do this and how long will it last until someone notices? While I was surprised to observe the daily price increase, I learned that sellers on Amazon are increasingly using price setting algorithms (Amazon itself does the same on a much larger scale), with several companies offering sellers services / algorithms to determine the best price. Both profnath and bordeebook explicitly used automatic pricing - while using algorithms that did not have a built-in "sanity" check on the price set. But these sellers obviously used different strategies.

Profnath behavior is easy to understand. They most likely have a new copy of the book, and they want to be sure that their price is the lowest, but not much different from the next ($ 9.98 versus $ 10.00). Why did bordeebok bid higher? Since the system shows the prices of all sellers, it looked like they were guaranteed no sales. But perhaps this is not entirely true - they have a huge number of positive reviews, much more than other sellers. And some buyers are surely willing to pay a few extra dollars for the confidence that the purchase will indeed be successful. Anyway, this is a rather strange and risky strategy to rely on - most people probably don’t act like that - and the book will collect dust on the shelf all this time. Naturally, except when you actually do not have a book ...

My explanation for the behavior of the bordeebook is that they don’t actually have a book. Instead, they noticed that someone else put up the same volume for sale, and put it up too - hoping for more reviews to attract customers. Naturally, if someone orders a book, they will have to get it - so they had to set their price more - for example, 1.27059 times more - the price at which they would buy this book from another seller.

Most of all in this situation, the endless amount of possible chaos and problems is surprising. It is unlikely that we came across a single example of a constantly rising spiral of prices - and all that was required for it was two sellers who change their price in accordance with the price of the other in proportion, which ultimately leads to a general increase in price. And although it can be harder to calculate, you can come up with other strange scenarios that can happen if the number of participating sellers becomes more than two. When I realized what exactly was happening, I and some people I spoke to began to think of ways to use our ability to predict the seller’s setting of prices with an accuracy of five decimal places - especially when the price was set without checking.

However, soon someone noticed a problem. The price peaked on April 18, but already on April 19, the price of profnath fell to $ 106.23 and the borderbook soon set a predictable price of $ 106.23 * 1.27059 = $ 134.97. But Peter Lawrence can now calmly boast that one of the largest and most respected companies on Earth valued his book at $ 23,698,655.93 (plus $ 3.99 for delivery).