How does the success of altkoyna

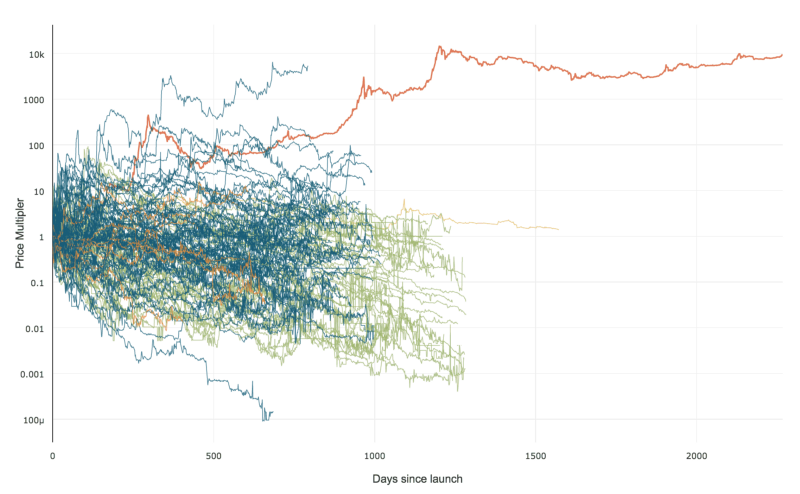

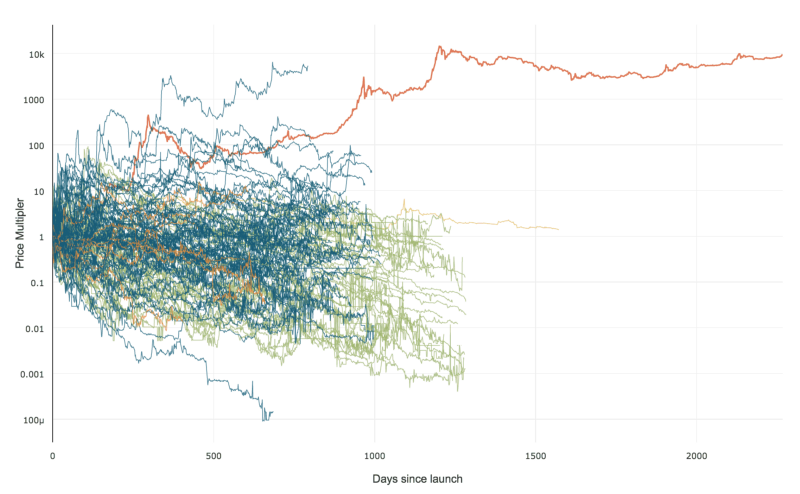

In our culture, success is often measured by indicators of economic growth, and the world of cryptocurrency without hesitation adopted this feature. But when you have only a hammer in your hands, any problem looks like a nail. Will we be able to understand the subtleties of the question a little better, or at least slightly shift the angle of perception? The X axis is the days since the launch, the Y axis is the price multiplier;

Crypto blogger Willy Wu recently posted a post.

with a good analysis of 118 different Altcoins (Altcoin is an “alternative to Bitcoin”, any cryptocurrency except Bitcoin), which managed to reach a market capitalization of $ 250,000 or more and compared their growth charts with a Bitcoin growth chart. The graph on a logarithmic scale shows the change in the value of each cryptocurrency since the start of trading. Bitcoin was first publicly traded in July 2010 on MtGox (a bright memory to her). After 1300 days from the start, it was trading at a price 10,000 times higher than the original price. The bubble burst along with MtGox itself, and only now Bitcoin is approaching the same level again.

Of all the 188 altcoins, only one currency is located on the graph above Bitcoin - gamecredits . The project, launched three years ago and intended to simplify the input of money into virtual economies and withdrawal. GAME is actually an appcoin, or CAT (Later we will write a large detailed article about CATs). The author considers this funny fact to be nothing more than an accident: “All my friends ask: is the strip over bitcoin, is it Ethereum? Sorry, no, this is GAME, I don’t know how it happened, most likely this is a statistical deviation - someone just got lucky. If you tilt your head to the side and look at the graph, it will all look like a rocket jet, so let's write everything down on the laws of thermodynamics. ”

All other cryptocurrencies do not reach Bitcoin, and the longer the currency lives, the greater the gap becomes. What does analysis tell us about the situation with the long-term development of altcoins, especially about projects like Waves , to which I have a particular interest.

First of all, it is worth recalling the maxim often used in the financial world: "Indicators in the past do not say anything about indicators in the future." The fact that no one has surpassed bitcoin does not mean that this will never happen. It only means that so far this has not happened. However, this is unlikely to convince the holders of altcoins, who are looking at the chart and wondering what will happen to their cryptocurrency portfolio in the next few months and years.

Fortunately, all is not easy. As you wish, just not easy.

The graph uses only one metric to compare 118 altcoins, which are completely incomparable in nature. Interestingly, the author puts Ethereum on a par with gamecredit, given that these two projects are ideal for illustrating differences. And what factors are we talking about:

Completely different initial situations. Bitcoin in 2009 appeared in a completely empty niche, where before him there was nothing like that. For subsequent cryptocurrency, bitcoin became a model and a kind of reference for investors. This allowed them to make more operational and informed decisions.

Different trade cultures.Bitcoin went up for auction in July 2010, approximately 18 months after Satoshi launched the protocol. At the early stage, bitcoin was almost never bought or sold. The pricing has already occurred within the framework of over-the-counter transactions, including the payment for several pizzas, which would now be valued at several million dollars. The first bubble - the first burst of real speculative interest - appeared in April 2011, two months after the launch of Silk Road. For comparison, for all other alternative cryptocurrencies, the first (and often the only) bubble appears on the launch day, when they are used for the purpose of “pumping and dumping” with manipulators holding a significant part of the reserves. In other words, here we are dealing with a completely different distribution of growth.

Bitcoin is traded in Fiat currencies, mainly in USD and CNY, while Alt-Coins are most often traded in Bitcoins. This sets fundamentally different schemes, because everything that affects bitcoins affects altcoins. The growth of bitcoin in the market leads to the sale of alternative cryptocurrency, and in the fall of bitcoin, alt-coins often take back positions. But other things being equal, a change in the Bitcoin rate is reflected in the value of the Altcoins, which are traded in BTC. Therefore, “growth” can be measured by two different criteria for BTC and altcoins; however, the graph uses only one criterion.

And a few more points:

The exchange rate on the first day sets the overall potential for further growth.If the currency starts at the price of 1 satoshi, it has only one development option. For her to achieve growth of 10,000 times is much easier than for the same Zcash, which started with a course higher than 1 BTC. Then, on this chart, cryptocurrencies would not start from one position, they would have a spread of several orders of magnitude. An illustrative example - gamecredits has shown growth of more than 5000 times, but in terms of market capitalization, it is still three orders of magnitude behind Bitcoin.

Produced currencies and entering the market at ICO (with a starting offer) are not the same thing.It depends on how cryptocurrencies begin their life cycle. Take, for example, Waves, which received $ 16 million in funding from the ICO. At the start of trading, the currency was trading in the area of its market capitalization. The majority of crowdfunding altcoins start in a similar way or with some multiplication factor. The main point is that you have at least a rough idea of the reasonable starting price of the currency. This money provided the Waves a great start. The project did not have to worry about finding money for marketing and development. On the other hand, this implies a certain limitation in growth prospects. Bitcoin has managed to increase its value tens of thousands of times since it was launched on Gox. With the same deal, the Waves would have cost 160 billion dollars today, ahead of bitcoin in order. This is more than the capitalization of IBM and close to New Zealand's GDP. The extracted currencies, in turn, such as bitcoin and gamecredits, do not have any objective indicators of the price at the time of the start of trading.

Completely different ways to attract interest. Bitcoin had Silk Road, and then a few more applications, including other black markets. Some altcoins have clearly defined application plans, including real-world clients. Other Alt-Coins offer nothing but empty promises. It is hardly worth explaining who is doing better.

In other words, dumping all altcoins into one basket, and then measuring them with a single measure, does not make much sense. This is good for a general review. And this demonstrates that, other things being equal, it is not easy to beat bitcoin. But this graph cannot be used as a real tool for forecasting future growth. Imagine that you bought Apple stocks at the very beginning, in the 70s, and then compared them with a random set of stocks that you purchased shortly before 2000, and you will understand what the problem is. Ethereum - admittedly a successful project in terms of the trading course. He collected 31,000 BTC or about $ 15 million in 2014 and showed 100-fold growth in just one year. Now it is trading at around 50 times the price from ICO. Impressive, but unlikely in the near future it will grow by an order of magnitude.

To summarize, look at the similarities and differences between GAME, which has surpassed bitcoin, and Waves.

If you look back over the list of criteria that we gave, GAME will be incredibly similar to bitcoin. It is also a mined currency (Litecoin clone) that you need to mine. GAME began its zero-funded way and grew slowly, unlike cryptocurrencies, which collected funding and were launched through the ICO. The debut was fairly quiet. Without funds received through ICO, for quite a long time the cryptocurrency was trading in small volumes and at a low price, which again is very similar to the history of Bitcoin. What is curious, despite the fact that the cryptocurrency is now being traded at BTC, there was a moment in its history when a fairly large amount was traded in fiat currencies, like bitcoin. With a market capitalization of about 10 million dollars, gamecredit had about the same cost, as bitcoin at the same time, on the graph - around April 2011. Given that for this cryptocurrencya working usage scenario is being prepared (integration by a large gaming company, and not the fate of the main currency of the world's first online black market), GAME is potentially ready for development in the mainstream market in bitcoin style.

At the same time, the Waves project has not reached GAME growth rates of 5,000 times (due to the fact that the history of Waves has only a few months so far and the market capitalization figure of 80 billion dollars would be really impressive), but it has reached comparable market capitalization orders , which means all other things being equal (which, of course, will not be like this) has a close growth potential. This cryptocurrency also has serious prospects for use in the mainstream due to different application options, including Incent, ChronoBank, etc. Both currencies have evolved very differently, but currently they are generally in a similar position in terms of market capitalization and attracting attention.

One of the conclusions that we can make when comparing GAME and WAVES is as follows: the option when cryptocurrency is traded directly in fiat currency is not only highly desirable, but also necessary for long-term growth, since it opens up access to a larger liquidity pool, and At the same time, it solves the problem associated with Bitcoin volatility. Here, discussions about the exchange of altcoins come onto the scene: without an exchange for fiat currencies, the possibilities for cryptocurrency growth are limited.

What conclusion can we draw from all this? We are at a rather interesting stage in the development of cryptocurrency history. The first options for large-scale use of cryptocurrency will be implemented very soon. Time cannot be reversed, and today it is no longer possible to invest in Bitcoin under the same conditions and with the same prospects as in 2011. But if you need a similar alternative in terms of quality and quality, there are definitely options.

Wu summarizes the above as follows: “Apparently, the Alt-Coin is the best of the remaining options for trading because of its volatility, but very risky as an option for investing. The situation may change in the coming years, but today, out of more than 700 cryptocurrencies in my database, no more than 5 are trying to do something interesting. This all reminds me of the initial stage of investing in startups. ”

And, perhaps, he is right. The catch is to correctly pick up your top five.

with a good analysis of 118 different Altcoins (Altcoin is an “alternative to Bitcoin”, any cryptocurrency except Bitcoin), which managed to reach a market capitalization of $ 250,000 or more and compared their growth charts with a Bitcoin growth chart. The graph on a logarithmic scale shows the change in the value of each cryptocurrency since the start of trading. Bitcoin was first publicly traded in July 2010 on MtGox (a bright memory to her). After 1300 days from the start, it was trading at a price 10,000 times higher than the original price. The bubble burst along with MtGox itself, and only now Bitcoin is approaching the same level again.

Of all the 188 altcoins, only one currency is located on the graph above Bitcoin - gamecredits . The project, launched three years ago and intended to simplify the input of money into virtual economies and withdrawal. GAME is actually an appcoin, or CAT (Later we will write a large detailed article about CATs). The author considers this funny fact to be nothing more than an accident: “All my friends ask: is the strip over bitcoin, is it Ethereum? Sorry, no, this is GAME, I don’t know how it happened, most likely this is a statistical deviation - someone just got lucky. If you tilt your head to the side and look at the graph, it will all look like a rocket jet, so let's write everything down on the laws of thermodynamics. ”

All other cryptocurrencies do not reach Bitcoin, and the longer the currency lives, the greater the gap becomes. What does analysis tell us about the situation with the long-term development of altcoins, especially about projects like Waves , to which I have a particular interest.

The secret of success"

First of all, it is worth recalling the maxim often used in the financial world: "Indicators in the past do not say anything about indicators in the future." The fact that no one has surpassed bitcoin does not mean that this will never happen. It only means that so far this has not happened. However, this is unlikely to convince the holders of altcoins, who are looking at the chart and wondering what will happen to their cryptocurrency portfolio in the next few months and years.

Fortunately, all is not easy. As you wish, just not easy.

The graph uses only one metric to compare 118 altcoins, which are completely incomparable in nature. Interestingly, the author puts Ethereum on a par with gamecredit, given that these two projects are ideal for illustrating differences. And what factors are we talking about:

Completely different initial situations. Bitcoin in 2009 appeared in a completely empty niche, where before him there was nothing like that. For subsequent cryptocurrency, bitcoin became a model and a kind of reference for investors. This allowed them to make more operational and informed decisions.

Different trade cultures.Bitcoin went up for auction in July 2010, approximately 18 months after Satoshi launched the protocol. At the early stage, bitcoin was almost never bought or sold. The pricing has already occurred within the framework of over-the-counter transactions, including the payment for several pizzas, which would now be valued at several million dollars. The first bubble - the first burst of real speculative interest - appeared in April 2011, two months after the launch of Silk Road. For comparison, for all other alternative cryptocurrencies, the first (and often the only) bubble appears on the launch day, when they are used for the purpose of “pumping and dumping” with manipulators holding a significant part of the reserves. In other words, here we are dealing with a completely different distribution of growth.

Bitcoin is traded in Fiat currencies, mainly in USD and CNY, while Alt-Coins are most often traded in Bitcoins. This sets fundamentally different schemes, because everything that affects bitcoins affects altcoins. The growth of bitcoin in the market leads to the sale of alternative cryptocurrency, and in the fall of bitcoin, alt-coins often take back positions. But other things being equal, a change in the Bitcoin rate is reflected in the value of the Altcoins, which are traded in BTC. Therefore, “growth” can be measured by two different criteria for BTC and altcoins; however, the graph uses only one criterion.

And a few more points:

The exchange rate on the first day sets the overall potential for further growth.If the currency starts at the price of 1 satoshi, it has only one development option. For her to achieve growth of 10,000 times is much easier than for the same Zcash, which started with a course higher than 1 BTC. Then, on this chart, cryptocurrencies would not start from one position, they would have a spread of several orders of magnitude. An illustrative example - gamecredits has shown growth of more than 5000 times, but in terms of market capitalization, it is still three orders of magnitude behind Bitcoin.

Produced currencies and entering the market at ICO (with a starting offer) are not the same thing.It depends on how cryptocurrencies begin their life cycle. Take, for example, Waves, which received $ 16 million in funding from the ICO. At the start of trading, the currency was trading in the area of its market capitalization. The majority of crowdfunding altcoins start in a similar way or with some multiplication factor. The main point is that you have at least a rough idea of the reasonable starting price of the currency. This money provided the Waves a great start. The project did not have to worry about finding money for marketing and development. On the other hand, this implies a certain limitation in growth prospects. Bitcoin has managed to increase its value tens of thousands of times since it was launched on Gox. With the same deal, the Waves would have cost 160 billion dollars today, ahead of bitcoin in order. This is more than the capitalization of IBM and close to New Zealand's GDP. The extracted currencies, in turn, such as bitcoin and gamecredits, do not have any objective indicators of the price at the time of the start of trading.

Completely different ways to attract interest. Bitcoin had Silk Road, and then a few more applications, including other black markets. Some altcoins have clearly defined application plans, including real-world clients. Other Alt-Coins offer nothing but empty promises. It is hardly worth explaining who is doing better.

In other words, dumping all altcoins into one basket, and then measuring them with a single measure, does not make much sense. This is good for a general review. And this demonstrates that, other things being equal, it is not easy to beat bitcoin. But this graph cannot be used as a real tool for forecasting future growth. Imagine that you bought Apple stocks at the very beginning, in the 70s, and then compared them with a random set of stocks that you purchased shortly before 2000, and you will understand what the problem is. Ethereum - admittedly a successful project in terms of the trading course. He collected 31,000 BTC or about $ 15 million in 2014 and showed 100-fold growth in just one year. Now it is trading at around 50 times the price from ICO. Impressive, but unlikely in the near future it will grow by an order of magnitude.

Growth potential

To summarize, look at the similarities and differences between GAME, which has surpassed bitcoin, and Waves.

If you look back over the list of criteria that we gave, GAME will be incredibly similar to bitcoin. It is also a mined currency (Litecoin clone) that you need to mine. GAME began its zero-funded way and grew slowly, unlike cryptocurrencies, which collected funding and were launched through the ICO. The debut was fairly quiet. Without funds received through ICO, for quite a long time the cryptocurrency was trading in small volumes and at a low price, which again is very similar to the history of Bitcoin. What is curious, despite the fact that the cryptocurrency is now being traded at BTC, there was a moment in its history when a fairly large amount was traded in fiat currencies, like bitcoin. With a market capitalization of about 10 million dollars, gamecredit had about the same cost, as bitcoin at the same time, on the graph - around April 2011. Given that for this cryptocurrencya working usage scenario is being prepared (integration by a large gaming company, and not the fate of the main currency of the world's first online black market), GAME is potentially ready for development in the mainstream market in bitcoin style.

At the same time, the Waves project has not reached GAME growth rates of 5,000 times (due to the fact that the history of Waves has only a few months so far and the market capitalization figure of 80 billion dollars would be really impressive), but it has reached comparable market capitalization orders , which means all other things being equal (which, of course, will not be like this) has a close growth potential. This cryptocurrency also has serious prospects for use in the mainstream due to different application options, including Incent, ChronoBank, etc. Both currencies have evolved very differently, but currently they are generally in a similar position in terms of market capitalization and attracting attention.

One of the conclusions that we can make when comparing GAME and WAVES is as follows: the option when cryptocurrency is traded directly in fiat currency is not only highly desirable, but also necessary for long-term growth, since it opens up access to a larger liquidity pool, and At the same time, it solves the problem associated with Bitcoin volatility. Here, discussions about the exchange of altcoins come onto the scene: without an exchange for fiat currencies, the possibilities for cryptocurrency growth are limited.

What conclusion can we draw from all this? We are at a rather interesting stage in the development of cryptocurrency history. The first options for large-scale use of cryptocurrency will be implemented very soon. Time cannot be reversed, and today it is no longer possible to invest in Bitcoin under the same conditions and with the same prospects as in 2011. But if you need a similar alternative in terms of quality and quality, there are definitely options.

Wu summarizes the above as follows: “Apparently, the Alt-Coin is the best of the remaining options for trading because of its volatility, but very risky as an option for investing. The situation may change in the coming years, but today, out of more than 700 cryptocurrencies in my database, no more than 5 are trying to do something interesting. This all reminds me of the initial stage of investing in startups. ”

And, perhaps, he is right. The catch is to correctly pick up your top five.