Paper money - when and why they appeared

Paper money appeared much later than metallic. One of the reasons is the development of paper production and printing. It seems that Chinese were the first to create paper money, since paper production originated in China. Attempts to replace metal money with some other kind of Chinese were made thousands of years ago. Back in the 1st century BC they created the equivalent of money from deer skin. These "banknotes" looked like quadrangular plates. Seals and special marks were applied to the skin.

The inhabitants of the Celestial Empire engaged in the manufacture of real paper money at the beginning of the 9th century AD. However, only in the X-XI centuries, paper money became part of the official economic policy of the state. Up to this point, the notes did not occupy a significant place in monetary policy. The first paper money was called "flying" because of its lightness in relation to standard metal coins. These were, rather, certificates, the solvency of which was ensured by the Dajiang (farmsteads) of the authorities of the capital.

By the way, at the very beginning it is worth explaining the concept of fiduciary (from latin fiducia - trust) or fiatny (from latin fiat - decree, an indication, "so be it") money or credit money . This is money, the nominal value of which is established and guaranteed by the state regardless of the value of the material from which the money is made or stored in a bank (unsecured money). Often, fiduciary money functions as a means of payment on the basis of state laws obliging to accept them at par. The value of fiduciary money is supported by the belief of people that they can exchange them for something valuable.

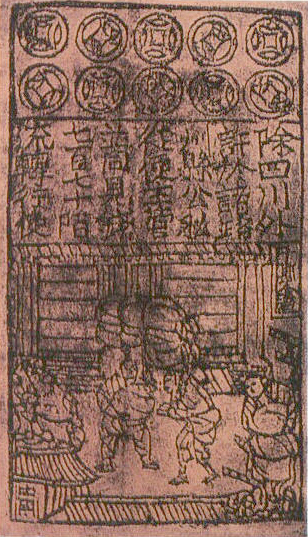

The earliest paper note to be known to historians

At that time, the most popular currency of the country was copper money, which was carried in bundles. The weight of the bundle was about 3 kilograms, so the surprise of ordinary Chinese, who saw paper money for the first time, can be understood. Paper certificates were introduced at the beginning of the 9th century, when trade between certain regions of China intensified. It was difficult for merchants to transport hundreds of kilograms of money across the country, so the government found a replacement for the metal. In addition to the fact that copper money was inconvenient, copper at that time was also the most valuable material that it was decided to use in other industries.

Already in 1050, the paper equivalent of money in China looked very good.

The process of obtaining paper money by the merchant was as follows. The Chinese merchant handed over copper money to the authorities, and instead received a paper receipt, a certificate that allowed him to exchange it again for copper money in almost any region of China. The regional authorities were allowed to keep the copper money at home, and not to take everything to the imperial farmstead. Banknotes (of course, as they were called hundreds of years later and not Chinese at all) were mainly issued for large sums, since there was no point in making a certificate for small sums. Upon receipt of the certificate and its transfer to cash, the merchant eventually received a little less money than he invested - the state took a certain percentage. When it was increased to 10%, traders almost stopped using certificates, finding the cost of using paper too high,

By the way, already in Russia, many hundreds of years later, the term “fake” appeared to refer to market rates of bank notes, bills, and other securities compared to the nominal value . Hence the modern “crap”.

Copper money in ancient China

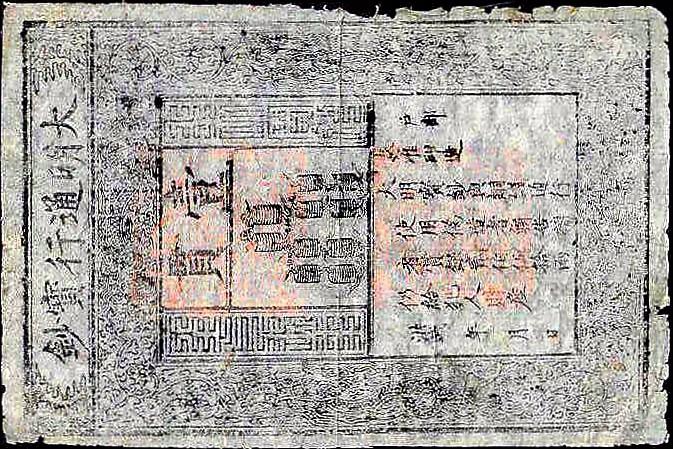

Historians believe that the first real paper money in China replaced the certificate checks in the X century. Moreover, they released their private, not government enterprises. At the end of the 10th century, the Chinese authorities allowed several banks to issue banknotes of a certain denomination. After several decades, with the development of printing and typography, high-quality drawings were put on paper notes: buildings, trees, people. Moreover, printers used inks of different colors (mainly red and black inks, and later added blue), as well as special signs and seals. To forge them already then was not easy. Traders began to use paper money more willingly than previous checks.

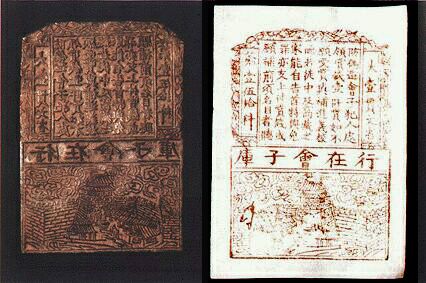

Clichés used by the Chinese to print paper notes

After some time, the Chinese government decided to introduce a monetary monopoly, and the imperial bank of China began to be responsible for issuing bills. The money issued by this bank had a limited duration - only three years. A release date was placed on each bill, in order for the users of paper money to know when the expiration date of the banknote comes. Over time, the counterfeiters learned how to make paper notes, so the state had to complicate the printing process over and over again, adding different elements and changing the structure of the paper. This is one of the reasons why the third color was added - blue.

In the XII century, two types of banknotes were issued into circulation: the equivalent of 10,000 coins and the equivalent of 700 coins. There was already another period of validity - not three years, but seven. True, the government has ceased to ensure that the banknotes were provided with something, and inflation began, which was aggravated by the intensified forgery of money by enterprising counterfeiters.

Already in the XIII century, the Yuan dynasty ordered another money issue with the creation of banknotes of various denominations - from two coins to two bundles of coins (in each bundle - 1000 coins). Mongolian Khan Kubilay also began to use paper money, and his descendants worked with them.

The constant increase in the issue of money and the counterfeiting of money led to the fact that the value of the paper equivalent of copper money was constantly decreasing. The authorities even had to issue new banknotes and carry out something like a devaluation, converting old money to new ones in a five-to-one ratio. Interestingly, the method of printing banknotes has changed. Printing machines began to equip copper plates, which came to replace wooden blocks.

Unfortunately, the new bills quickly depreciated all for the same reason: nobody thought about providing banknotes with a metal equivalent. For half a century, paper money has depreciated by 1000%.

After some time, paper notes began to be used to a limited extent outside of China. The reason for this is the conquests of the Mongols and their attempts to introduce their usual means of payment in the new lands. One of these attempts was made in Iran in the 90s of the XIII century, in the city of Tabriz. This has led to nothing but inflation and the rejection of paper as a means of payment.

At the end of the XIV century, the Ming dynasty issued notes of a single denomination, which were used for two hundred years. In parallel, the circulation of copper coins was permitted. Gradually, paper money began to be withdrawn from circulation. In the 17th century, the Chinese made an attempt to return paper money, but the story of inflation repeated itself, and paper bills were forgotten. Only in the XIX century, the Chinese authorities began to work with paper again, when the development of the monetary system began in accordance with Western models.

At the end of the XIV century, the Ming dynasty issued notes of a single denomination, which were used for two hundred years. In parallel, the circulation of copper coins was permitted. Gradually, paper money began to be withdrawn from circulation. In the 17th century, the Chinese made an attempt to return paper money, but the story of inflation repeated itself, and paper bills were forgotten. Only in the XIX century, the Chinese authorities began to work with paper again, when the development of the monetary system began in accordance with Western models.In Japan, paper money appeared in the XIV century, the Japanese took over from the Chinese. True, paper was generally recognized as a means of payment only in the 17th century. It was not money in the modern sense of the term, but the same receipts that replaced silver coins. In Japan, this system gradually became more and more popular, and eventually gained recognition as a currency of national importance. The Japanese authorities were able to make the paper system stable, and it gradually developed, becoming the prototype of modern bank notes of the Bank of Japan.

Paper money in Europe and the USA

The first mention of paper money in Europe refers to the Spanish siege of Leiden (Netherlands) in 1574. Then the residents of the besieged city did not have any metal coins or leather, which was sometimes used to replace metal money. Therefore, the townspeople decided to use the paper from which they made a temporary replacement of metallic money.

A few decades later, paper money appeared in Sweden. Here, too, copper coins were issued, which were too heavy for the normal operation of the same merchants. In addition, they quickly depreciated. Johann Palmstruh ( of Johan Palmstruch), the founder of the Stockholm Bank, proposed to put into circulation the credit paper, replacing the metallic money. Unfortunately, the depreciation story repeated itself and this time - there were too many bills issued, so the bank had problems, and the cost of loan documents equaled the cost of the paper on which they were printed.

In England, the banknotes were issued in the form of debt obligations of British jewelers. Such notes were believed to be exchanged for gold, although in many cases this was not the case. Bills became popular, and after several decades, the Restriction Act established a certain course of banknotes, which, in fact, became paper money.

Norway's first paper money

In Norway, paper money was tried in 1695. Entrepreneur Thor Molen with the permission of the government released into circulation several thousand bills with wax seals on them. After the issue, the banknotes quickly returned to the Molena Bank, since the citizens of the country did not understand what it was and why they should use paper instead of precious metal.

In Denmark, paper money appeared in circulation in 1713.

In France, Louis XIV began printing money. Paper money was immediately assigned a firm, compulsory exchange rate, so that they immediately became money, not bills of exchange. It happened in 1703. In 1797, the paper money was canceled, and all again began to use metal money. Then, already in the 19th century, paper banknotes were again introduced in this country, then they were canceled and re-introduced. Paper money finally became money in France in 1871.

In North America, paper money appeared at the end of the 17th century. In 1690, the Massachusetts colony issued paper money, which was used as the primary means of payment. After nearly a hundred years, the State Congress in 1775 decided to issue so-called "continental money."

Since they were printed without any regard for the provision of funds, then the rate of such money very quickly fell in relation to metal money. In 1780, "continental money" was removed. During the civil war, “greenbacks” were printed, which for several years depreciated by 2.5 times (which is not so much compared to some of the examples already mentioned above).

After the war, the authorities seized a large amount of paper money from circulation, thereby restoring the stability of the dollar. It is interesting that finally paper notes in the USA became the main means of payment only in 1933. Then Franklin Roosevelt issued a decree according to which any citizen of the country who holds more than 100 dollars in gold would face a fine of 10 thousand dollars or 10 years in prison. Thus, President Roosevelt untied the denomination of paper money from the gold equivalent. The reform was carried out immediately after the Great Depression , and was necessary because paper money after this crisis was not provided with real gold . And in 1944, the United States finally abandoned the "gold standard", prescribing the provisions of the new standards of monetary policy forBretton Woods Conference .

Russia

In Russia, paper money appeared for a number of reasons. The main - the lack of silver. Every year the country needed about 2 million silver rubles, which required much more silver than silver mines gave. In addition, the collection of taxes turned into an organization of caravans with a large number of carts and guards. The fact is that 500 rubles at that time is a whole cart of copper money. And taxes were paid mainly by copper money, so it required a lot of carts. In order to solve all these problems, in 1769 it was decided to issue paper money, banknotes.

Catherine II ordered to opentwo banks in Moscow and St. Petersburg, where 500 thousand rubles each were deposited with metal. For this amount, notes of 25, 50, 75 and 100 rubles were made. Thus, initially in Russia, paper money was provided with real funds.

1769 Year's Note

The notes were very poor quality, and a large number of counterfeiters appeared, who began to forge the “paper” of any value. A few years later, it was decided to withdraw such notes from circulation, replacing them with other, better ones. When replacing, new banknotes with denominations of 5 and 10 rubles were also printed. And again, thanks to the uncontrolled emission, the depreciation of paper money began. In 1797, banknotes amounting to about 6 million rubles were withdrawn from circulation - this was an attempt to avoid their further depreciation. But the war demanded money, and the printing presses began to work even more actively. It is clear that this led to a rapid significant fall in the ruble rate of paper against metal money. Of the original 100 metal kopecks per ruble, the rate dropped to 25 kopecks per ruble by 1810.

Assignment of 1802

Despite this, after five years the rate of the paper ruble had already dropped to 20 kopecks. At the same time, it was decided to replace the banknotes with special high-quality banknotes. For their production was built a small town with a paper mill, printing house, workshops and apartments for employees and workers. Expedition State securities procurement opened in 1818.

In 1839, the silver ruble became the main means of payment, and in 1843 the manifesto “On the replacement of banknotes and other banknotes with credit tickets” was issued.

Gradually, paper money became the main means of payment in most countries of the world. Paper is now beginning to be replaced with plastic, so it is quite possible that in the near future, citizens of some countries will begin to use only plastic banknotes.

Or, in general, paper money will be superseded by electronic. True, waiting for this moment is still very long.