Proof-Of-Work Effective

Hello, Habr! I present to you the translation of the article “PoW is Efficient” by Dan Held.

Most people think that the energy spent on Proof-Of-Work (PoW) is wasted. In this article I will explain why everything is based on energy, including money. And also why the assessment of energy consumption is subjective, and how to compare the cost of energy spent on PoW with other systems. This article contains the thoughts of many people from the field of cryptocurrencies, I just gathered everything together.

The idea that energy is needed to do the job came from the French mathematician Gaspard-Gustav de Coriolis. In those days, work was completely carried out by people. The fuel for work was food.

About a million years ago, a man made fire. As a result, the amount of energy available to a person increased, now a person could warm up with the help of fire, and not just thanks to the food eaten. Thus, this additional energy has improved the life of mankind.

Several thousand years ago, human energy consumption increased even more due to the domestication of animals. Animals did the work for man. Animals also required a lot of food, and this also contributed to further development.

Over the past few hundred years, man has made cars. Machines did the work, using the energy of water and wind first, subsequently using cheaper sources of energy, such as coal and gas. Currently, nuclear and thermonuclear energy is used. Both machines and nature do the work through the use of energy. The economy is not based on money, but on work and energy.

Everything in our life is closely related to the cost of energy. Water purification requires energy. The transport of goods requires energy. The production of goods requires energy. Cooking requires energy. Refrigerators and freezers require energy. In a free market, the price of any product largely depends on the amount of energy spent on its production. Since the market stimulates minimum prices for goods, the amount of energy used to produce energy is also minimized.

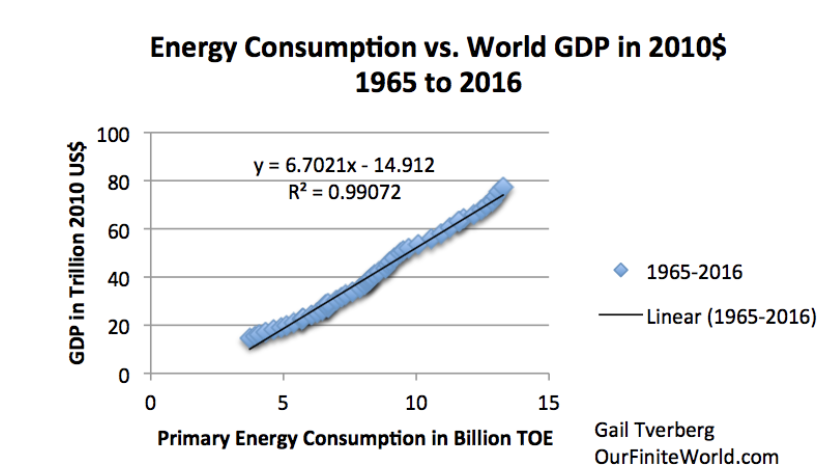

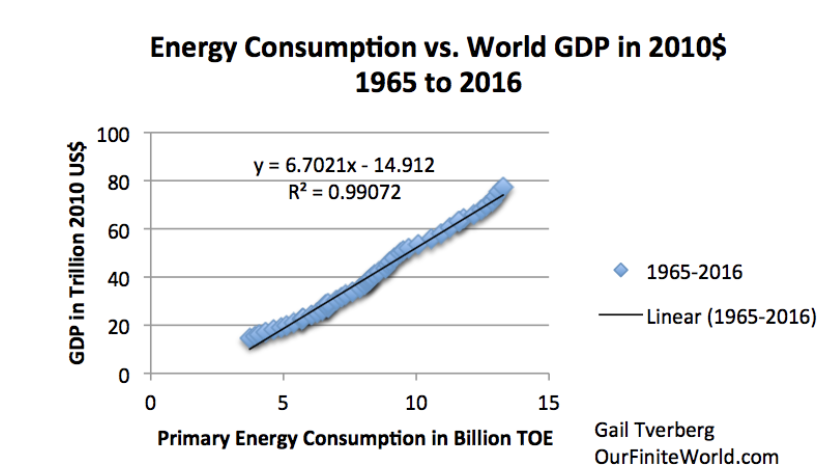

World GDP (according to the US Department of Agriculture) compared to world energy consumption (according to the BP report for 2014):

At the beginning of the 20th century, industry leaders Henry Ford and Thomas Addison considered replacing gold or the dollar with an “energy dollar,” or “unit of energy” (energy currency). The idea was popular, because such a currency had the characteristics of money: a clearly defined measure of settlement, easily measured, but difficult to fake, divisibility into smaller parts and interchangeability (any unit is equivalent to any other unit). However, there were drawbacks - it was difficult to transfer and store energy money.

Fast forward to October 31, 2008 - Satoshi published a paper on Bitcoin. The PoW method was originally invented to combat spam. Then Satoshi adapted this technology for use in electronic money. Mining uses special machines (ASICs) to convert electricity to bitcoins (as a reward for a mined block). Machines constantly perform hashing operations (assumptions / voices) until they find a solution to the cryptographic problem. A reward in bitcoins is paid for the solution found. The solution found proves that the miner spent energy in the form of an ASIC machine and electricity. Bitcoin is based on the capitalist principle of “risking money, you get a vote”, using energy and ASIC machines to calculate hashes (votes) - Hugo Nguyen.

When Satoshi designed the PoW method, he fundamentally changed the voting system from political votes to apolitical (hashes) using energy conversion. PoW serves as a check that energy has been spent. Why is it important? For the physical world, this is the easiest and fairest way to test anything in the digital world. PoW is about physics, not programs. Bitcoins are created from energy, the main product of the universe. PoW turns electricity into digital gold.

Bitcoin's transaction history can be unchanged only if it is costly to create. The need to use a large amount of resources for PoW is not a mistake, as it is intended. Until recently, protecting something meant building a thick physical wall around what was considered valuable. The new world of cryptocurrencies is strange and unusual - there are no physical walls protecting our money, no doors blocking the entrance to the store. The public history of bitcoin transactions is protected by aggregate computing power: the sum of all the energy spent on “building the wall”. Due to the cost, a comparable amount of energy is required to break it (unjustified high cost).

Cryptopocalypse is coming - Bitcoin's PoW is so terrible that it will destroy the world by 2020! You may have noticed that most of the “doomsday” articles use the results of an investigation by Alex de Rice, a “financier and blockchain specialist” who works for the PwC audit firm in the Netherlands. He also runs a Digiconomist blog. His findings were rightly criticized for the lack of accuracy in calculating energy consumption. The metric "energy consumption per transaction" used by him is deliberately misleading for several reasons:

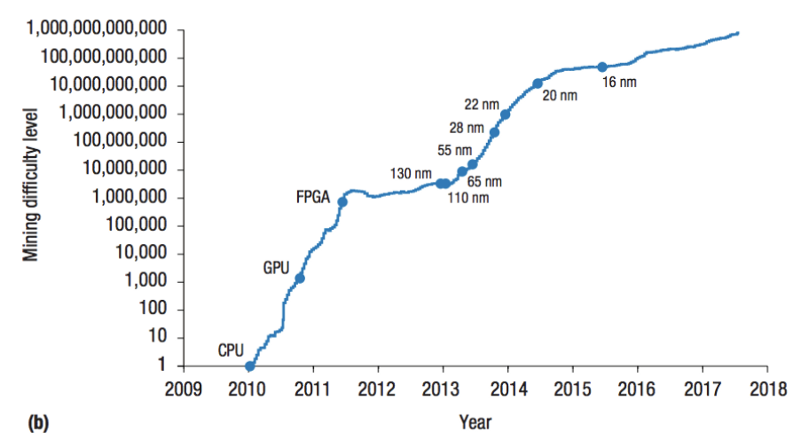

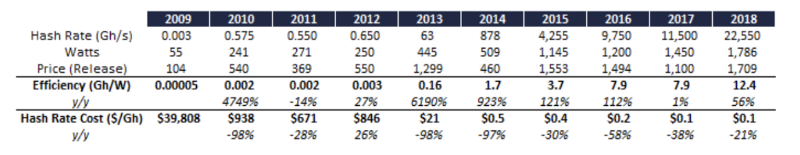

Now that we know that the right metric of efficiency is determined by the return on energy costs, let's look at the change in the price of energy spent on PoW.

The increase in efficiency of ASIC machines is reduced. Because profit decreases, we can expect increased competition among manufacturers of ASIC machines.

https://cseweb.ucsd.edu/~mbtaylor/papers/Taylor_Bitcoin_IEEE_Computer_2017.pdf

https://research.bloomberg.com/pub/res/d3bgbon7nESTWTzC1U9PNCxDVfQ

The total costs of mining will mainly consist of the cost of energy (operating costs), and not the cost of ASIC machines (capital costs). The physical location of the mining centers is not important for the bitcoin network, so miners tend to places with an excess of electricity, and, accordingly, its lower cost. In the long run, this may affect the efficiency of the electricity market. Bitcoin miners will act as an arbitrage of electricity between global centers. To mine bitcoins, excess electricity will be used. It can also help solve the problem of renewable energy sources with an excess capacity that is not consumed in any way, for example, hydroelectric power plants or burning of by-product gas during oil production. In the future, bitcoin mining may also use renewable energy with variable power. Electricity producers can connect mining machines, and save the excess power in bitcoins.

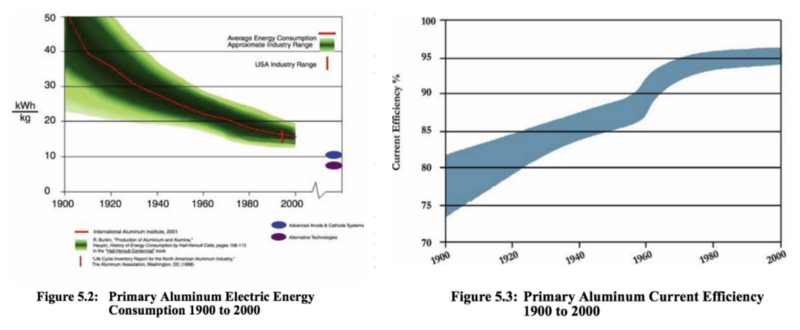

Aluminum was widely used as a means of exporting electricity from countries where there are many renewable sources of electricity, but there is no way to sell them (for example, Iceland). To melt bauxites (they are also aluminum ore) into aluminum, a huge amount of energy is required, and this is a one-way process (as well as hashing). The same arguments about the irrational use of energy were made for aluminum 40 years ago - in 1979 (including the danger of centralization). Aluminum smelting companies are constantly looking for cheap energy sources on the planet. As the development of aluminum production over decades, the specific energy consumption (kW per kilogram of aluminum produced) decreased.

https://www1.eere.energy.gov/manufacturing/resources/aluminum/pdfs/al_theoretical.pdf

Note: Bitcoin itself is extremely useful for society (otherwise mining would be disadvantageous), so it is irrational to ask miners to do side work, without much incentive.

Energy is used everywhere (the first law of thermodynamics). The opinion that the use of energy for some work is more wasteful than for another is completely subjective, because all users pay the market price for electricity.

In thermodynamics, the universe is a closed system. The use of excess electricity for mining bitcoins is an order of magnitude less than that used for existing fiat systems, which are based not only on the banking system that consumes electricity, but also on the existence of the armed forces and the political system. Using this electricity to protect the backbone of the financial system is beneficial. The table below compares with existing financial, military and political systems.

In the process of finding cheap energy sources, we will be able to use even more global opportunities. Thanks to the development of these energy sources, bitcoin not only brings us closer to a type I economy according to Kardashev, but also to a type I civilization according to Kardashev (while we are approximately at the level of 0.72 on the Kardashev scale). It may take significantly less time to reach T1, thanks to the incentive in the form of bitcoin mining. Several decades instead of 200 tons. Once Type I is achieved, there will be less need to limit energy consumption, and this will improve living conditions for all.

The incentive to find cheap electricity will accelerate the creation of fusion reactors. Nature tells you how, providing thermonuclear energy to the entire universe (stars). Humanity is in the process of creating such a mechanism through the construction of thermonuclear reactors. It is estimated that approximately $ 80 billion will be needed for research and development over several decades to learn how to use thermonuclear energy. Fuel for thermonuclear reactors (mainly deuterium) abound on Earth in the oceans. It is quite enough to provide humanity with energy for millions of years. Thermonuclear energy has most of the benefits of renewable energy, such as long-term energy production, no greenhouse gas emissions or air pollution. The density of thermonuclear energy is very high, and production is continuous. Another aspect of thermonuclear energy is that its cost does not increase in proportion to volumes. For example, the cost of the energy of water and wind increases as optimal locations for power plants are already used. The cost of thermonuclear energy will not increase much, even if many stations are built, because there are plenty of raw materials (sea water) in different places on the planet.

Thermonuclear energy and other cheap sources of energy will solve many problems, for example, the availability of fresh drinking water. We are surrounded by sea water, but desalination plants consume large amounts of energy. The cost of desalination of sea water is currently higher than the cost of water from wells, water treatment and storage.

The human desire to explore the highest mountain peaks, the deepest seas and oceans, the heart of the atom and the essence of space-time, should not be limited by energy. We will reach for the stars.

Is the annual volume worth $ 1.34 trillion? mutual settlements not based on trust, plus cheap energy for everyone, $ 4.5 billion spent on mining at the moment? I think the answer is sure yes.

Introduction

Most people think that the energy spent on Proof-Of-Work (PoW) is wasted. In this article I will explain why everything is based on energy, including money. And also why the assessment of energy consumption is subjective, and how to compare the cost of energy spent on PoW with other systems. This article contains the thoughts of many people from the field of cryptocurrencies, I just gathered everything together.

Work consists of energy

The idea that energy is needed to do the job came from the French mathematician Gaspard-Gustav de Coriolis. In those days, work was completely carried out by people. The fuel for work was food.

About a million years ago, a man made fire. As a result, the amount of energy available to a person increased, now a person could warm up with the help of fire, and not just thanks to the food eaten. Thus, this additional energy has improved the life of mankind.

Several thousand years ago, human energy consumption increased even more due to the domestication of animals. Animals did the work for man. Animals also required a lot of food, and this also contributed to further development.

Over the past few hundred years, man has made cars. Machines did the work, using the energy of water and wind first, subsequently using cheaper sources of energy, such as coal and gas. Currently, nuclear and thermonuclear energy is used. Both machines and nature do the work through the use of energy. The economy is not based on money, but on work and energy.

Everything in our life is closely related to the cost of energy. Water purification requires energy. The transport of goods requires energy. The production of goods requires energy. Cooking requires energy. Refrigerators and freezers require energy. In a free market, the price of any product largely depends on the amount of energy spent on its production. Since the market stimulates minimum prices for goods, the amount of energy used to produce energy is also minimized.

World GDP (according to the US Department of Agriculture) compared to world energy consumption (according to the BP report for 2014):

At the beginning of the 20th century, industry leaders Henry Ford and Thomas Addison considered replacing gold or the dollar with an “energy dollar,” or “unit of energy” (energy currency). The idea was popular, because such a currency had the characteristics of money: a clearly defined measure of settlement, easily measured, but difficult to fake, divisibility into smaller parts and interchangeability (any unit is equivalent to any other unit). However, there were drawbacks - it was difficult to transfer and store energy money.

Most of all I want what is hard to get - Mark Twain

Fast forward to October 31, 2008 - Satoshi published a paper on Bitcoin. The PoW method was originally invented to combat spam. Then Satoshi adapted this technology for use in electronic money. Mining uses special machines (ASICs) to convert electricity to bitcoins (as a reward for a mined block). Machines constantly perform hashing operations (assumptions / voices) until they find a solution to the cryptographic problem. A reward in bitcoins is paid for the solution found. The solution found proves that the miner spent energy in the form of an ASIC machine and electricity. Bitcoin is based on the capitalist principle of “risking money, you get a vote”, using energy and ASIC machines to calculate hashes (votes) - Hugo Nguyen.

When Satoshi designed the PoW method, he fundamentally changed the voting system from political votes to apolitical (hashes) using energy conversion. PoW serves as a check that energy has been spent. Why is it important? For the physical world, this is the easiest and fairest way to test anything in the digital world. PoW is about physics, not programs. Bitcoins are created from energy, the main product of the universe. PoW turns electricity into digital gold.

Bitcoin's transaction history can be unchanged only if it is costly to create. The need to use a large amount of resources for PoW is not a mistake, as it is intended. Until recently, protecting something meant building a thick physical wall around what was considered valuable. The new world of cryptocurrencies is strange and unusual - there are no physical walls protecting our money, no doors blocking the entrance to the store. The public history of bitcoin transactions is protected by aggregate computing power: the sum of all the energy spent on “building the wall”. Due to the cost, a comparable amount of energy is required to break it (unjustified high cost).

Power consumption

Cryptopocalypse is coming - Bitcoin's PoW is so terrible that it will destroy the world by 2020! You may have noticed that most of the “doomsday” articles use the results of an investigation by Alex de Rice, a “financier and blockchain specialist” who works for the PwC audit firm in the Netherlands. He also runs a Digiconomist blog. His findings were rightly criticized for the lack of accuracy in calculating energy consumption. The metric "energy consumption per transaction" used by him is deliberately misleading for several reasons:

- Energy is spent on blocks that may contain a different number of transactions. More transactions don't mean more energy

- The economic value of a bitcoin transaction is constantly increasing (using batch processing, Segwit, Lightning, etc.). As bitcoin increasingly plays the role of a net of settlements, more energy value per unit of energy

- The average transaction cost is not an adequate metric when evaluating the effectiveness of Bitcoin PoW. The metric should consider keeping transaction history. Energy is spent on maintaining a stock of bitcoins, the relative amount of which decreases along with inflation. Bitcoin summarizes the energy spent on the extraction of all blocks since the launch of the network. The LaurentMT researcher empirically determined that Bitcoin PoW actually becomes more effective over time. The increasing value is offset by the increasing even more valuable value of the coins stored in the system.

Now that we know that the right metric of efficiency is determined by the return on energy costs, let's look at the change in the price of energy spent on PoW.

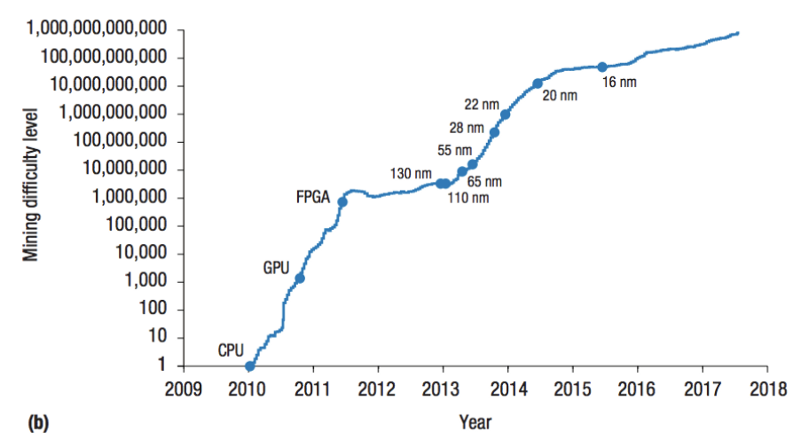

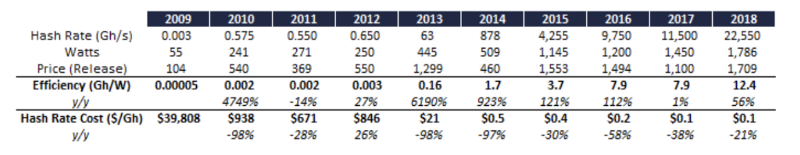

The increase in efficiency of ASIC machines is reduced. Because profit decreases, we can expect increased competition among manufacturers of ASIC machines.

https://cseweb.ucsd.edu/~mbtaylor/papers/Taylor_Bitcoin_IEEE_Computer_2017.pdf

https://research.bloomberg.com/pub/res/d3bgbon7nESTWTzC1U9PNCxDVfQ

The total costs of mining will mainly consist of the cost of energy (operating costs), and not the cost of ASIC machines (capital costs). The physical location of the mining centers is not important for the bitcoin network, so miners tend to places with an excess of electricity, and, accordingly, its lower cost. In the long run, this may affect the efficiency of the electricity market. Bitcoin miners will act as an arbitrage of electricity between global centers. To mine bitcoins, excess electricity will be used. It can also help solve the problem of renewable energy sources with an excess capacity that is not consumed in any way, for example, hydroelectric power plants or burning of by-product gas during oil production. In the future, bitcoin mining may also use renewable energy with variable power. Electricity producers can connect mining machines, and save the excess power in bitcoins.

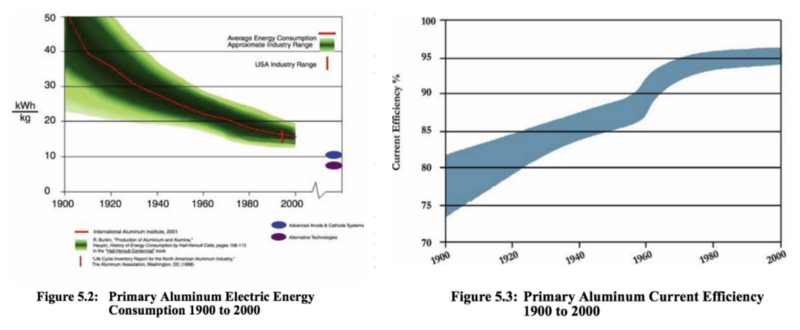

Aluminum was widely used as a means of exporting electricity from countries where there are many renewable sources of electricity, but there is no way to sell them (for example, Iceland). To melt bauxites (they are also aluminum ore) into aluminum, a huge amount of energy is required, and this is a one-way process (as well as hashing). The same arguments about the irrational use of energy were made for aluminum 40 years ago - in 1979 (including the danger of centralization). Aluminum smelting companies are constantly looking for cheap energy sources on the planet. As the development of aluminum production over decades, the specific energy consumption (kW per kilogram of aluminum produced) decreased.

https://www1.eere.energy.gov/manufacturing/resources/aluminum/pdfs/al_theoretical.pdf

The global energy network releases unused assets and creates new ones. Imagine a three-dimensional topographic map of the world, on which sources of cheap energy are represented by lowlands, and more expensive - by hills. I imagine mining bitcoins like a glass of water poured on this surface, filling any cavities and leveling the surface - Nick CarterBitcoin miners are reliable buyers of electricity. They stimulate the construction of new power plants to use additional energy sources that would not otherwise be used.

When will the increase in the amount of energy used for PoW stop? Exactly when enough power producers turn on PoW equipment, and the profit from the operation of this equipment equals the profit from the sale of electricity to consumers. Thus, the "additional profit" from the operation of mining equipment will be reduced to zero. I call this equilibrium the Nakamoto point. I assume that between 1 and 10% of global energy will be spent on PoW when equilibrium is reached. - Druv BansalThere is an idea that mining bitcoins does not do useful work, unlike the search for primes , for example. The idea of using PoW to perform some other task may seem good, but in fact it negatively affects network security. Sharing a reward can lead to a situation where it is more profitable to do secondary work than the main one. Even if the background work is harmless (a heater, for example), instead of income of $ 100 for X hashes, it turns out to be $ 100 + $ 5 (as heat) for X hashes. A heater with a mining function is just an example of increasing the efficiency of equipment, leading to an increase in complexity and, as a result, energy consumption for mining a block. Such a problem will never be in bitcoin, because PoW is used only to protect the network.

Note: Bitcoin itself is extremely useful for society (otherwise mining would be disadvantageous), so it is irrational to ask miners to do side work, without much incentive.

Cost comparison

Energy is used everywhere (the first law of thermodynamics). The opinion that the use of energy for some work is more wasteful than for another is completely subjective, because all users pay the market price for electricity.

If people find it profitable, electricity will be wasted. Those who spend electricity will be rewarded with bitcoins. - Saifedin Ammos

In thermodynamics, the universe is a closed system. The use of excess electricity for mining bitcoins is an order of magnitude less than that used for existing fiat systems, which are based not only on the banking system that consumes electricity, but also on the existence of the armed forces and the political system. Using this electricity to protect the backbone of the financial system is beneficial. The table below compares with existing financial, military and political systems.

Civilization type I

In the process of finding cheap energy sources, we will be able to use even more global opportunities. Thanks to the development of these energy sources, bitcoin not only brings us closer to a type I economy according to Kardashev, but also to a type I civilization according to Kardashev (while we are approximately at the level of 0.72 on the Kardashev scale). It may take significantly less time to reach T1, thanks to the incentive in the form of bitcoin mining. Several decades instead of 200 tons. Once Type I is achieved, there will be less need to limit energy consumption, and this will improve living conditions for all.

The incentive to find cheap electricity will accelerate the creation of fusion reactors. Nature tells you how, providing thermonuclear energy to the entire universe (stars). Humanity is in the process of creating such a mechanism through the construction of thermonuclear reactors. It is estimated that approximately $ 80 billion will be needed for research and development over several decades to learn how to use thermonuclear energy. Fuel for thermonuclear reactors (mainly deuterium) abound on Earth in the oceans. It is quite enough to provide humanity with energy for millions of years. Thermonuclear energy has most of the benefits of renewable energy, such as long-term energy production, no greenhouse gas emissions or air pollution. The density of thermonuclear energy is very high, and production is continuous. Another aspect of thermonuclear energy is that its cost does not increase in proportion to volumes. For example, the cost of the energy of water and wind increases as optimal locations for power plants are already used. The cost of thermonuclear energy will not increase much, even if many stations are built, because there are plenty of raw materials (sea water) in different places on the planet.

Water, water everywhere. But not a drop to drink. - Samuel Taylor Coleridge

Thermonuclear energy and other cheap sources of energy will solve many problems, for example, the availability of fresh drinking water. We are surrounded by sea water, but desalination plants consume large amounts of energy. The cost of desalination of sea water is currently higher than the cost of water from wells, water treatment and storage.

The human desire to explore the highest mountain peaks, the deepest seas and oceans, the heart of the atom and the essence of space-time, should not be limited by energy. We will reach for the stars.

Is the annual volume worth $ 1.34 trillion? mutual settlements not based on trust, plus cheap energy for everyone, $ 4.5 billion spent on mining at the moment? I think the answer is sure yes.