How we reduced loan issuance to 2 clicks

Weeks, months - such a period comes to mind when they talk about obtaining a loan. Our product “Credit Online” was supposed to radically change the situation, reducing the entire procedure to a few clicks. Impossible? The developers of Promsvyazbank managed to turn this “torment” into a convenient “magic wallet”.

The idea of creating the product was born in 2016, it was then that someone came up with the idea that in the age of ubiquitous digitalization, it is somehow not good to torment customers when issuing loans, it is time to transfer the whole process to online. They began to think through ideas on how to refuse documents, looked at risk models - they connected colleagues from several departments to the brainstorming session. As a result, we managed to find a combination of conditions under which we were ready to lend to our customers, whose turnovers were clear to us, and the field of activity was transparent.

When the project was just beginning, there were fears that this service would scare people away. The audience of small and medium-sized businesses grew at a time when, in the field of lending, they deceived everyone right and left, everyone was afraid of hidden commissions, enslaving conditions in small print in the agreement on 115 pages. Therefore, we did not set any sky-high indicators before online lending. We thought that the most savvy customer enthusiasts would take advantage of the product, and we will hone our modern digital approaches - it would already be nice.

The business requirements were taken up in November-December 2016. Already by March, a prototype was ready, which could be tested on a combat system. First, they tested at the bank with colleagues: try, poke, convenient / inconvenient. Then they gave it to selected customers. Of course, at the first stage everything was manual, then there was still no talk about the bigdate, I had to grope for that niche with which to work.

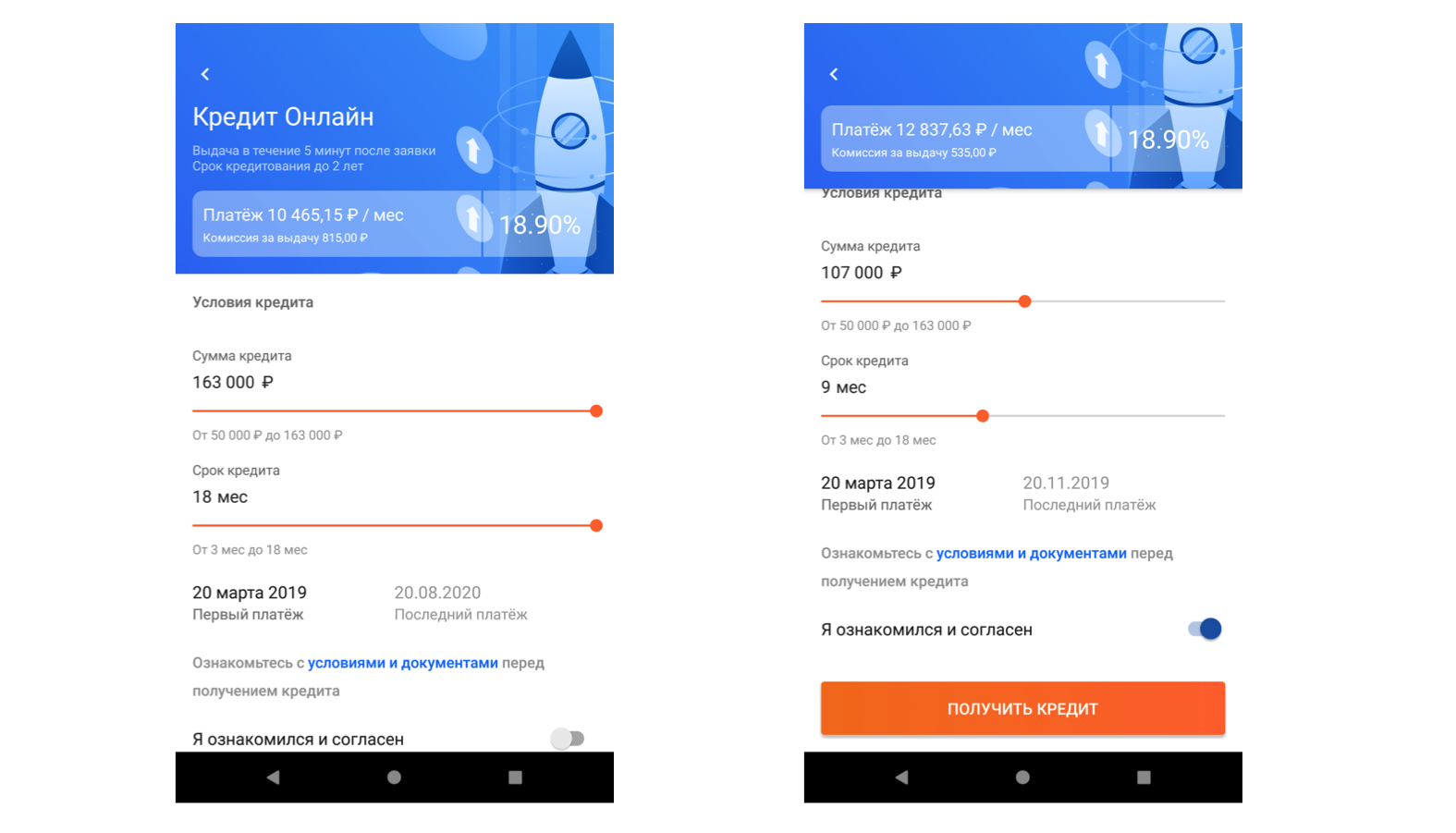

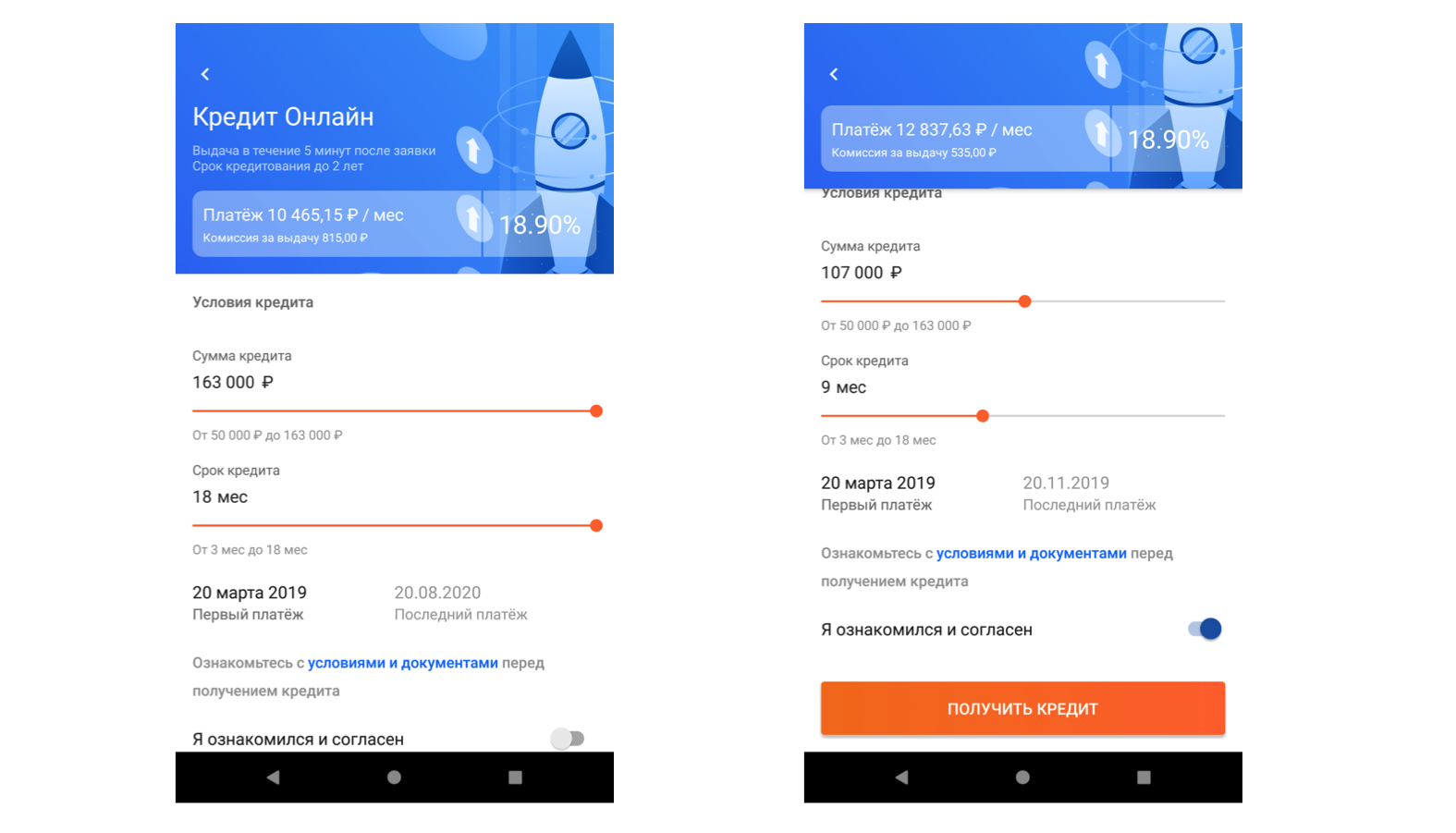

In April 2017, the product started, the first real customers went. We collected feedback from the first hundred, everyone was delighted, no one believed that it was possible so quickly: I went in, made two or three clicks, got a loan.

Getting a loan according to the classical scheme takes a month, two or three. This is very long and often unacceptable to customers. Their business suffers, accountants prepare documents and take the time to take them to the bank, and more than once.

For standard lending, SMB-client provides a large amount of financial and other information characterizing its activities. The application goes to the analyst, who can sit for a month and consider accounting documents, accounting, pledges, security. As a result, the deal comes out highly structured and, as a rule, inconvenient for customers.

We began to look for opportunities to simplify and expedite this procedure.

In the first versions of the product, we also requested documents from customers, but only in electronic form. Clients uploaded these files to us on a form, and they even enthusiastically accepted this option.

Having assessed the risks, having seen from customers the responsible attitude to monthly payments, we realized that we can go further. As a result, in the summer of 2017, it was decided to completely abandon the collection of documents.

As a further sales funnel showed, we guessed with this solution, customers began to use it in large quantities. The response was pleasing, especially when we introduced a new approach, replacing the applicative model with Machine Learning tools.

Working with big data allowed us to create a portrait of an ideal client and process behavioral information. We have learned to automatically find those customers who need lending, and whom we can safely lend. As a result, the time from clicking on the button “Get a loan” to live money in the account was reduced to a few minutes.

We started with a small number of tested, now their number goes to thousands. The product shows a high percentage of those who used the loan, paid off and takes again. In general, everyone who tried such a loan noted its convenience: even if you do not need a loan yet, it’s nice to know that you have a backup solution, a “magic wallet” that you can use at any time.

At the moment, we have issued more than 4300 loans, the total portfolio has reached several billion rubles. It is clear that on a bank scale this is a small amount. One deal in a large corporate segment can immediately block everything. It is important that two years ago no one could have thought that the project would grow at such a fast pace in terms of portfolio and the number of transactions. At first, the plan was almost 500 transactions in a year and a half. We immediately took this bar in the first six months after the start.

The most important component of a successful service was the use of machine learning tools. Especially for online lending, we made a model based on the demonstrated customer behavior on external and internal data sources. Priority for financing are companies with stable business connections, having no problems with government agencies, competently conducting their financial activities, and actively using current accounts.

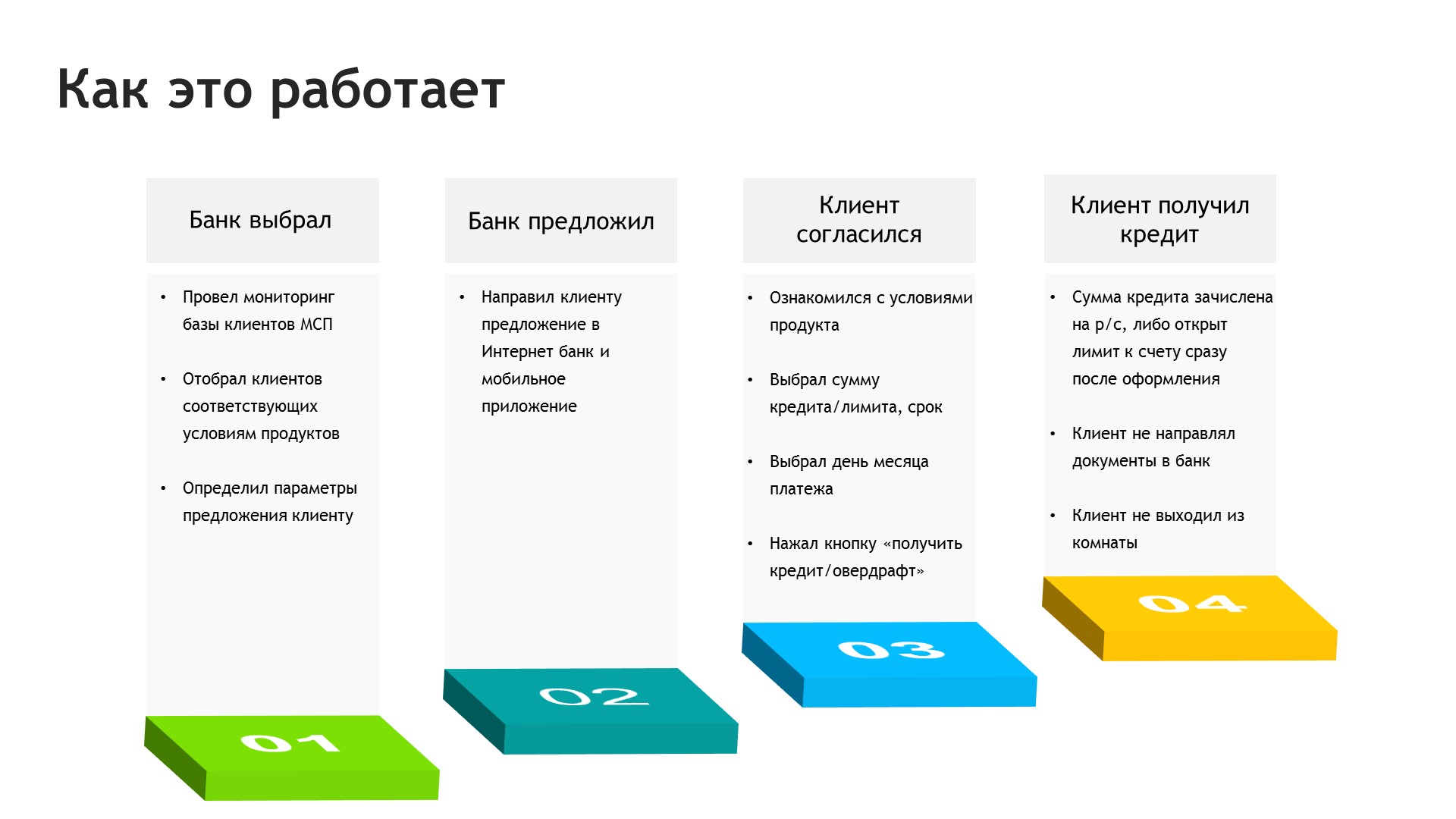

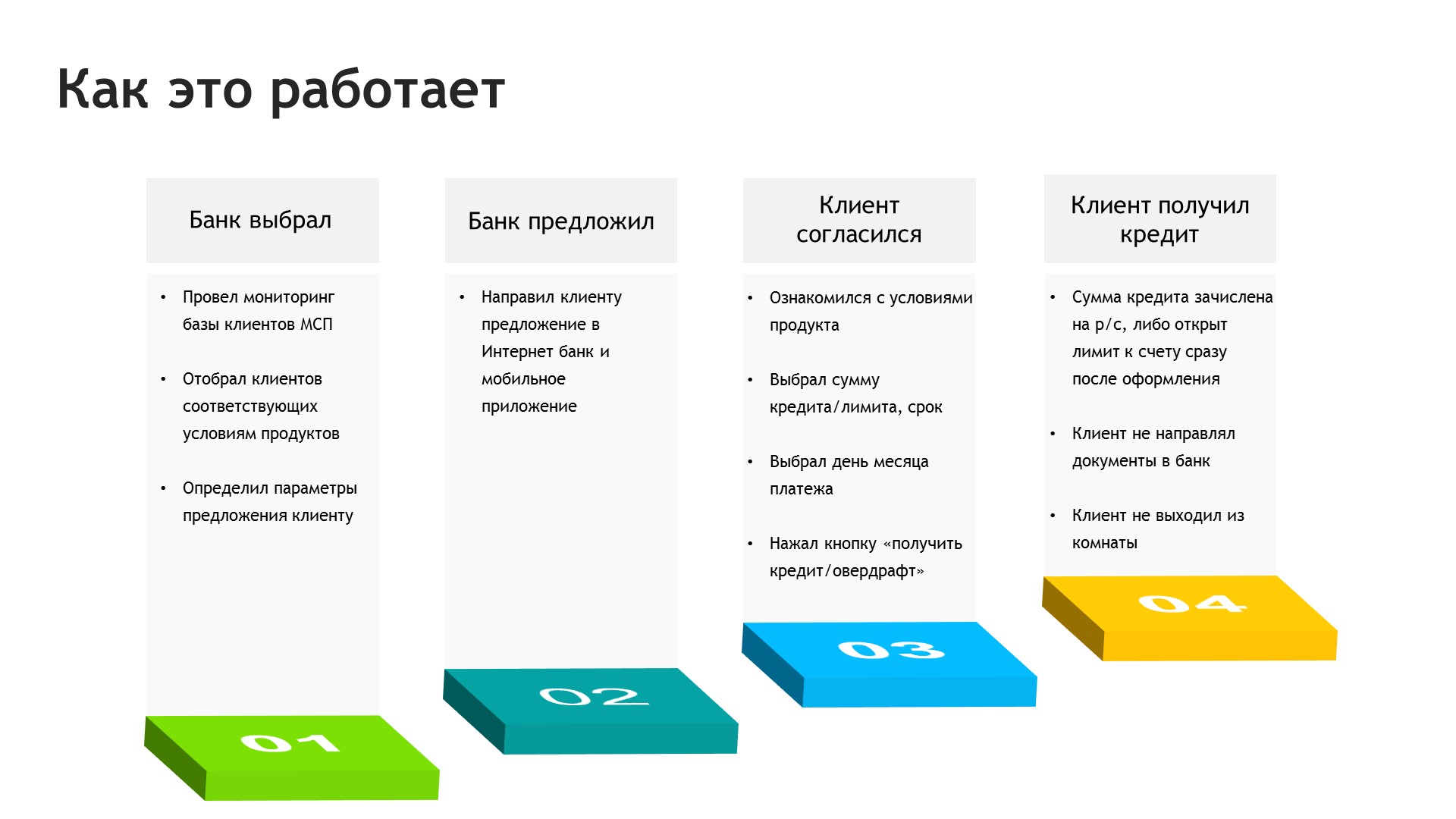

Machine learning tools select the right customers, make a test selection to make sure the results are correct, and the automatic sending of the proposal starts.

In addition to using machine learning in scoring, we use this tool to create targeted personalized offers for customers who are likely to need this product.

In parallel with the loan, a similar offer was launched - Overdraft Online. This is a loan product of a slightly different kind. Its main difference is that money can be taken in any amount within the limit, at any time and for any specified period.

An agreement is immediately concluded with the client for a period of 5 years, during this period we give him the opportunity to go into overdraft within the agreed amount. At the same time, he manages the money as he wants. It took money - took borrowed funds. Funds have been credited to the bank account - the overdraft is automatically extinguished. In the case of a loan, there is a clear agreed schedule when and how much to pay.

We started with a million rubles, then increased the limit to two. Gradually, we began to make customers more and more advantageous offers: we lower rates, increase terms, and increase amounts. Now they have reached 5 million rubles both in overdraft and in loans.

There is no limit to perfection, we continue to improve this product. While we are working with the visual part, especially with the mobile and new Internet banking in terms of usability, to make the client even easier, more convenient to use them. We will try to increase the maximum loan amount. Perhaps we’ll come up with new credit logic, new products. We will begin to ask customers questions for what purposes they need a loan, and based on the answers we will formulate a suitable offer. There are a lot of ideas.

There are ideas for creating online products for the foreign market. About a month later, the PSB product “Everything is simple!” will enter a wide market. The client may not even be served in our bank. He simply attaches information on his turnover and consent to the processing of data on a special landing page, and the application goes to our work. In general, we think what else is pleasant to surprise our customers.

From idea to product

The idea of creating the product was born in 2016, it was then that someone came up with the idea that in the age of ubiquitous digitalization, it is somehow not good to torment customers when issuing loans, it is time to transfer the whole process to online. They began to think through ideas on how to refuse documents, looked at risk models - they connected colleagues from several departments to the brainstorming session. As a result, we managed to find a combination of conditions under which we were ready to lend to our customers, whose turnovers were clear to us, and the field of activity was transparent.

When the project was just beginning, there were fears that this service would scare people away. The audience of small and medium-sized businesses grew at a time when, in the field of lending, they deceived everyone right and left, everyone was afraid of hidden commissions, enslaving conditions in small print in the agreement on 115 pages. Therefore, we did not set any sky-high indicators before online lending. We thought that the most savvy customer enthusiasts would take advantage of the product, and we will hone our modern digital approaches - it would already be nice.

The business requirements were taken up in November-December 2016. Already by March, a prototype was ready, which could be tested on a combat system. First, they tested at the bank with colleagues: try, poke, convenient / inconvenient. Then they gave it to selected customers. Of course, at the first stage everything was manual, then there was still no talk about the bigdate, I had to grope for that niche with which to work.

In April 2017, the product started, the first real customers went. We collected feedback from the first hundred, everyone was delighted, no one believed that it was possible so quickly: I went in, made two or three clicks, got a loan.

The origins of "going through torment"

Getting a loan according to the classical scheme takes a month, two or three. This is very long and often unacceptable to customers. Their business suffers, accountants prepare documents and take the time to take them to the bank, and more than once.

For standard lending, SMB-client provides a large amount of financial and other information characterizing its activities. The application goes to the analyst, who can sit for a month and consider accounting documents, accounting, pledges, security. As a result, the deal comes out highly structured and, as a rule, inconvenient for customers.

We began to look for opportunities to simplify and expedite this procedure.

Documents are superfluous

In the first versions of the product, we also requested documents from customers, but only in electronic form. Clients uploaded these files to us on a form, and they even enthusiastically accepted this option.

Having assessed the risks, having seen from customers the responsible attitude to monthly payments, we realized that we can go further. As a result, in the summer of 2017, it was decided to completely abandon the collection of documents.

As a further sales funnel showed, we guessed with this solution, customers began to use it in large quantities. The response was pleasing, especially when we introduced a new approach, replacing the applicative model with Machine Learning tools.

Working with big data allowed us to create a portrait of an ideal client and process behavioral information. We have learned to automatically find those customers who need lending, and whom we can safely lend. As a result, the time from clicking on the button “Get a loan” to live money in the account was reduced to a few minutes.

The path to billions

We started with a small number of tested, now their number goes to thousands. The product shows a high percentage of those who used the loan, paid off and takes again. In general, everyone who tried such a loan noted its convenience: even if you do not need a loan yet, it’s nice to know that you have a backup solution, a “magic wallet” that you can use at any time.

At the moment, we have issued more than 4300 loans, the total portfolio has reached several billion rubles. It is clear that on a bank scale this is a small amount. One deal in a large corporate segment can immediately block everything. It is important that two years ago no one could have thought that the project would grow at such a fast pace in terms of portfolio and the number of transactions. At first, the plan was almost 500 transactions in a year and a half. We immediately took this bar in the first six months after the start.

Smart scoring

The most important component of a successful service was the use of machine learning tools. Especially for online lending, we made a model based on the demonstrated customer behavior on external and internal data sources. Priority for financing are companies with stable business connections, having no problems with government agencies, competently conducting their financial activities, and actively using current accounts.

Machine learning tools select the right customers, make a test selection to make sure the results are correct, and the automatic sending of the proposal starts.

In addition to using machine learning in scoring, we use this tool to create targeted personalized offers for customers who are likely to need this product.

Overdraft online

In parallel with the loan, a similar offer was launched - Overdraft Online. This is a loan product of a slightly different kind. Its main difference is that money can be taken in any amount within the limit, at any time and for any specified period.

An agreement is immediately concluded with the client for a period of 5 years, during this period we give him the opportunity to go into overdraft within the agreed amount. At the same time, he manages the money as he wants. It took money - took borrowed funds. Funds have been credited to the bank account - the overdraft is automatically extinguished. In the case of a loan, there is a clear agreed schedule when and how much to pay.

We started with a million rubles, then increased the limit to two. Gradually, we began to make customers more and more advantageous offers: we lower rates, increase terms, and increase amounts. Now they have reached 5 million rubles both in overdraft and in loans.

Further development

There is no limit to perfection, we continue to improve this product. While we are working with the visual part, especially with the mobile and new Internet banking in terms of usability, to make the client even easier, more convenient to use them. We will try to increase the maximum loan amount. Perhaps we’ll come up with new credit logic, new products. We will begin to ask customers questions for what purposes they need a loan, and based on the answers we will formulate a suitable offer. There are a lot of ideas.

There are ideas for creating online products for the foreign market. About a month later, the PSB product “Everything is simple!” will enter a wide market. The client may not even be served in our bank. He simply attaches information on his turnover and consent to the processing of data on a special landing page, and the application goes to our work. In general, we think what else is pleasant to surprise our customers.