CME Group: The History of Chicago's Largest World Exchange

In our blog, we already wrote about the history of the emergence of such derivative financial instruments as futures and examined the development of high-frequency trading technologies from the 18th century to the present day. Today we’ll talk about how the competition among two exchanges from Chicago, which lasted more than a hundred years, led to the emergence of the largest derivatives market in the world CME Group.

In our material, the story is from trading in grain, oil and eggs, to more than 12 million transactions using electronic trading systems per day.

Why did the exchange come about in Chicago

In order to understand the prerequisites for the emergence of exchange platforms in Chicago, one should go to this city of the 19th century. In 1848, a canal was dug from the Great Lakes to the Mississippi, which caused a real economic boom in Chicago - the city turned into a transshipment point between the agricultural West and the densely populated areas of East America. As a result, it was here that grain merchants flocked with goods in search of buyers.

At the same time, it was not so easy to bring grain to Chicago and from the city to consumers - most of the year it was almost impossible to drive along dirt roads due to snowfalls and rains. It was too expensive to transport grain on toll roads (then they had a wooden coating). At the same time, it was not so easy to store goods (for example, grain) in the city - there were very few good and inexpensive warehouses.

All this led to the fact that traders and farmers began to practice the conclusion of contracts with deferred delivery of goods. This allowed us to reduce risks to all sides of the trading process - for example, a merchant could purchase grain and store it until spring, until the river or canal is cleared of ice, and then delivered to processors. In order not to lose out in the event of a price fall during this time, futures contracts were concluded with processors who committed to buy the goods at a pre-agreed price, even if the price fell by that time.

Chicago Board of Trade

In 1848, Chicago Board of Trade (CBOT) was founded in Chicago to centralize the process of concluding such transactions. First, forward contracts appeared in 1851, and then - in 1865, futures trading began.

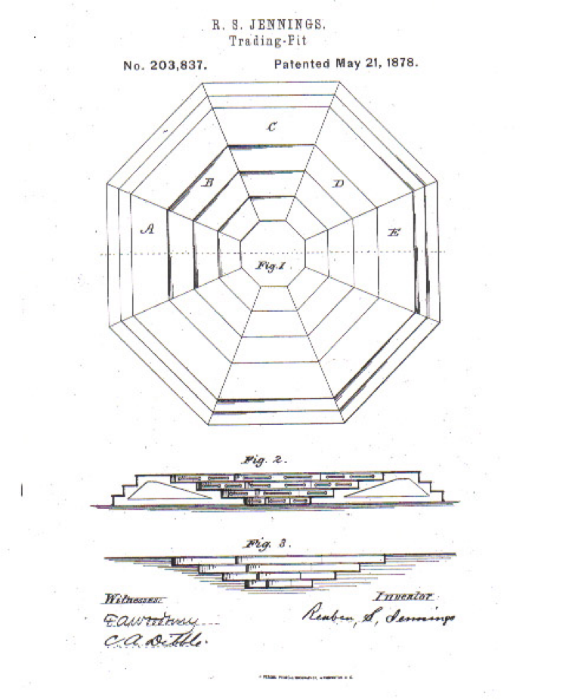

The symbol of CBOT was the trading pit - a multi-stage octagon, in which traders were located. The first stock pit was patented by Ruben S. Jennings in 1878, and soon the Chicago Board of Trade began to build all sorts of pits without paying fees to Jennings. The inventor tried to sue the Chicago Board of Trade, but lost, and his patent was invalidated by the judges. Jennings designed the stock pit so that one trader could see and hear the other in the best way.

For this reason, pits have several steps; a trader sitting at the highest level has a better overview, and also has an advantage in the ability to easily see and hear colleagues, and therefore, to carry out transactions faster, traders located in the middle and lower parts of the pit. The speed of trade was of great importance even then.

Traders trading supply contracts for a specific month (for example, September) are going to the steps of one of the 8 sectors of the pit. Trades trading October contracts, in turn, are on the steps of the neighboring sector. So the trading process was most effective.

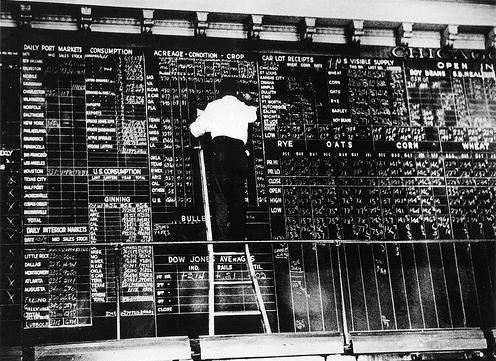

For many years of the existence of the Chicago Board of Trade, it traded primarily in cereals - wheat, corn, oats and soy. However, later, trading in other financial instruments started, as it began in 1969, when silver futures trading started.

Chicago Mercantile Exchange

Another exchange in Chicago was founded in 1898 - originally it was called The Chicago Butter and Egg Board (Chicago Butter and Egg Chamber). Exchange participants traded on it futures contracts for agricultural products - for example, eggs or oil. In 1919, the Chamber turned into the Chicago Mercantile Exchange and a company was created to deal with clearing of transactions.

Later, already in the 60s of the twentieth century, for the first time in the world, they began to trade in futures for frozen pork and even live cattle. In the 1970s, trade began in futures for world currencies, in the early eighties - futures for the well-known American index S&P 500.

In 1992, it was at CME that they created the first global electronic trading platform Globex - trading on it took place around the clock with an hour break for five days a week. In addition, electronic mini-contracts (e-mini) have been introduced. They differ from “ordinary” ones only in nominal value, which made it possible to trade them with less investment and opened up access to the stock market for a huge number of people.

In 1999, the Chicago Mercantile Exchange introduced weather futures. It sounds rather unusual, but such contracts fulfill an important function for the economy. For example, there are cooling futures in different regions of the world (for example, Canada or Europe), snowfalls, rains and even hurricanes. Their use allows to reduce price risks in agriculture and energy in those industries that may suffer from the vagaries of the weather.

Competition

The Chamber of Commerce and the Commodity Exchange have been competitors for over a hundred years. To see all its acuity, just look at the list of key events of the two trading floors.

This race was won by a younger, but also more technological platform - that is, CME. As a result, in 2007 the two exchanges were merged into one - this is how the CME Group, the largest and most diversified global trading platform, appeared. The deal amounted to $ 8 billion.

The CME also includes a subsidiary of the New York Mercantile Exchange NYMEX Holdings and COMEX. Trading on CME is carried out both on the traditional platforms of the exchanges included in it, and through the Internet. Traders can trade futures, options based on interest rates, stock indices, foreign exchange, energy resources, agricultural products, precious metals, etc. According to 2010 data, 12.2 million transactions were completed on the CME per day.

Conclusion

The CME Group example shows how the combination of two organizations competing for hundreds of years can give them the opportunity to take a leading position in their market in the world. And Chicago, thanks to this association, finally became one of the world financial centers along with New York and London.

In our next topics on Habrahabr and Geektimes, we will talk about how trades are organized at the sites of the CME group and describe the technologies used there.

Thanks for attention! do not forget to subscribe to our blog and follow the news on the site !