Fintech digest: legalization of the blockchain, reduction of branches in favor of IT

Fintech hello, reader!

The outgoing week was full of cryptocurrency related news. As Bitcoin partners recoup the January losses, banks around the world have banned the purchase of cryptocurrencies using credit cards. A wave of prohibitions reached as far as the motherland of the kangaroo, where the other day Commonwealth Bank of Australia was noted . Since the beginning of the year, Lloyds, Bank of Scotland, Halifax, MBNA, Bank of America, Citigroup, Capital One, Discover, JP Morgan and Virgin Money joined the list of bitcoin investment fighters.

It is worth clarifying that you can’t only buy with credit cards, and if you are concerned about issuing a debit card, you can safely spend at least all the money in the account. But the problem is that a significant part of the customers of Western banks did not have such a card. Debit if any, then nameless and issued by organizations as an alternative to cash. Therefore, joining the world of cryptocurrencies turns into a rather intricate quest that an unprepared person may not pass. And the prepared ones will circumvent any banking barriers.

Meanwhile, the Polish central bank was caught ordering video bloggers videosdiscrediting investments in crypto. The local Youtube star received an integration of 30 thousand dollars for one, as it is now fashionable to say. In the video, a scene is played out, how a young man loses absolutely everything because of a damned bitcoin, and can not even pay for dinner in a restaurant, disgracing himself in front of a girl. It would be funny to find out if the blogger has invested all the fees in something like XRP.

In early 2018, one after another, reports of Western banks on very successful results of 2017 were released. So, Wells Fargo reported a 17% increase in net profit in the fourth quarter, Lloyds grew by 24% (before taxes) and the rest of the grain, in general, did not lag. And in synchrony with peppy reports, the next program to reduce staff and branches was announced. The same Wells Fargo promised to close as many as 900 offices by 2020.

In Europe, it is more difficult to cut people, because unions are actively opposing this. It’s even a little strange when a bank miraculously saved by state funds sincerely wants to cut costs, but they’re not allowing it. Yet the earned PSD2 directive, forcing banks to give out API of their services, suggest quite clear thoughts. No, banks will not go anywhere, but the day will come when customers will not even know which one they are currently using.

Bank aggregators can become as commonplace as taxi aggregators. Earn money on commissions without wasting effort on attracting customers - isn't that a dream? Yes, and people need much less ... In general, according to incoming dataOver the next three years, Lloyds will invest £ 3 billion in its digital infrastructure, while hoping to cut spending by $ 8 billion by 2020. This, of course, is in addition to the existing IT costs. The amount of the latter has not been disclosed, but we know that business colleagues at Deutsche Bank spend on IT 4.1 billion euros per year, and JP Morgan Chase 7.4 billion dollars.

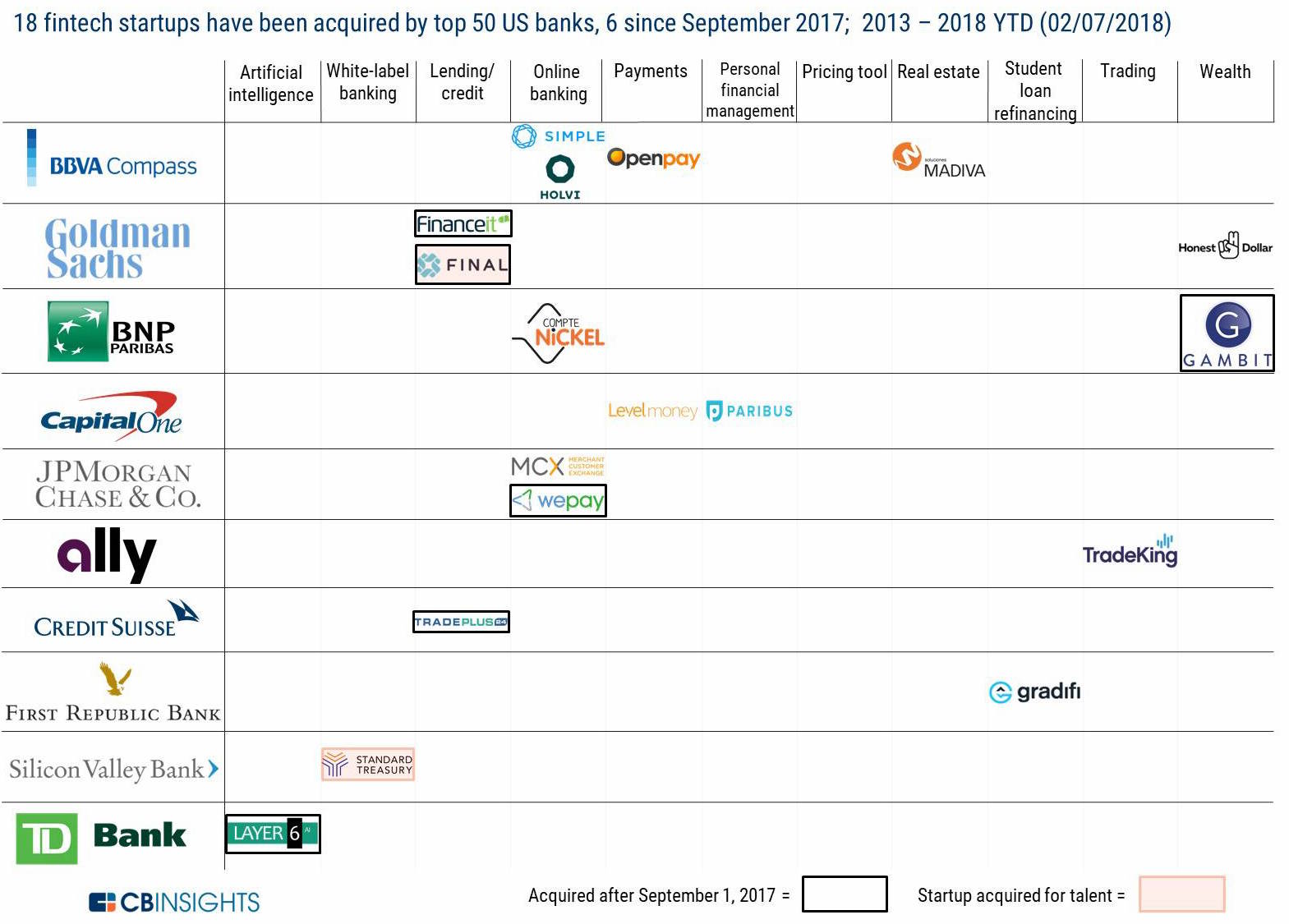

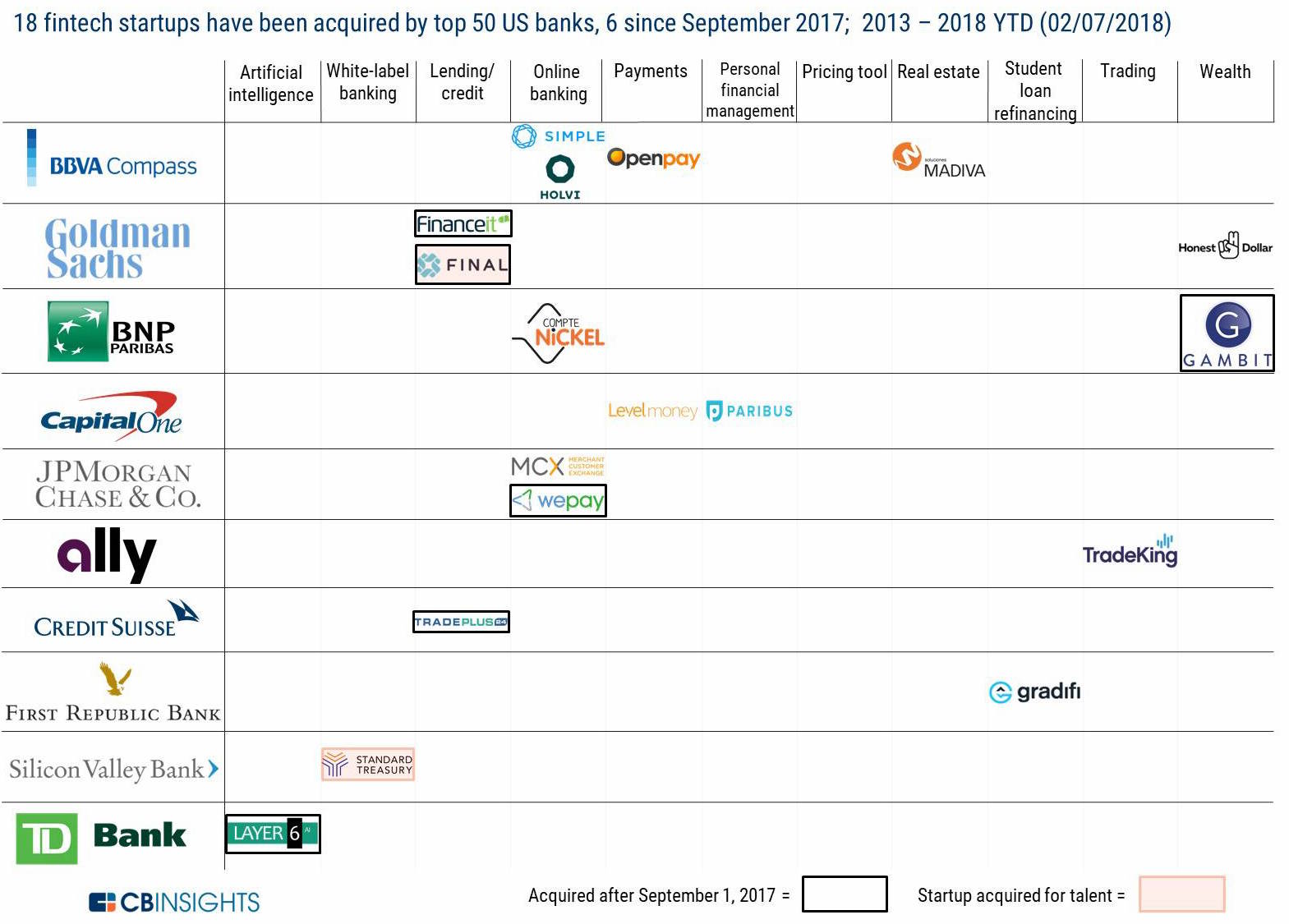

The cost of buying fintech startups is also increasing. The other day, a study came out according to which the largest American banks have bought only 18 start-ups since 2013.

CB insights

But 6 purchases were in the last six months. The reason, I think, is simple: banks began to realize that there was simply no time for leisurely creating their own factories of digital ideas. Yes, banks become IT companies, but the giants that were them initially do not hide the desire to manage the money of their users. Therefore, the only possible option is to buy ideas together with their creators. And by the way, this is not only in the States. In our country, absolutely similar processes are observed.

They have repeatedly told the world that the blockchain is ideal for storing sensitive information, and smart contracts are an excellent business tool. The only problem is that the state, which with the widespread use of the blockchain seems to be unnecessary, cannot consider these technologies within the legal field. That is, it is terribly cool to conduct a transaction on the purchase of real estate on the blockchain, but then you still have to duplicate it in the traditional way.

California Freedom Bill Filed No. 2658which contains a quiet revolution. If the bill passes, then the record on the blockchain will be equated to an electronic record, and an electronic signature protected by the blockchain will become a regular electronic signature from the point of view of the law. And, most probably, the most important thing - a smart contract is equated to a simple contract.

Interestingly, this is not the first initiative of lawmakers in the field, just California is a landmark. An inquisitive researcher will quickly find out that a similar bill was submitted a month ago in Florida, and in Arizona, blockchain entries and smart contracts were legalized last year.

This is how it will happen. First, parallel walking, then the final move. No one seems to seriously vouch for the future of cryptocurrencies on the blockchain, but the technology itself is omnipotent because it is true. Poor, poor notaries.

The outgoing week was full of cryptocurrency related news. As Bitcoin partners recoup the January losses, banks around the world have banned the purchase of cryptocurrencies using credit cards. A wave of prohibitions reached as far as the motherland of the kangaroo, where the other day Commonwealth Bank of Australia was noted . Since the beginning of the year, Lloyds, Bank of Scotland, Halifax, MBNA, Bank of America, Citigroup, Capital One, Discover, JP Morgan and Virgin Money joined the list of bitcoin investment fighters.

It is worth clarifying that you can’t only buy with credit cards, and if you are concerned about issuing a debit card, you can safely spend at least all the money in the account. But the problem is that a significant part of the customers of Western banks did not have such a card. Debit if any, then nameless and issued by organizations as an alternative to cash. Therefore, joining the world of cryptocurrencies turns into a rather intricate quest that an unprepared person may not pass. And the prepared ones will circumvent any banking barriers.

Meanwhile, the Polish central bank was caught ordering video bloggers videosdiscrediting investments in crypto. The local Youtube star received an integration of 30 thousand dollars for one, as it is now fashionable to say. In the video, a scene is played out, how a young man loses absolutely everything because of a damned bitcoin, and can not even pay for dinner in a restaurant, disgracing himself in front of a girl. It would be funny to find out if the blogger has invested all the fees in something like XRP.

Banks cut branches and employees, but increase IT costs

In early 2018, one after another, reports of Western banks on very successful results of 2017 were released. So, Wells Fargo reported a 17% increase in net profit in the fourth quarter, Lloyds grew by 24% (before taxes) and the rest of the grain, in general, did not lag. And in synchrony with peppy reports, the next program to reduce staff and branches was announced. The same Wells Fargo promised to close as many as 900 offices by 2020.

In Europe, it is more difficult to cut people, because unions are actively opposing this. It’s even a little strange when a bank miraculously saved by state funds sincerely wants to cut costs, but they’re not allowing it. Yet the earned PSD2 directive, forcing banks to give out API of their services, suggest quite clear thoughts. No, banks will not go anywhere, but the day will come when customers will not even know which one they are currently using.

Bank aggregators can become as commonplace as taxi aggregators. Earn money on commissions without wasting effort on attracting customers - isn't that a dream? Yes, and people need much less ... In general, according to incoming dataOver the next three years, Lloyds will invest £ 3 billion in its digital infrastructure, while hoping to cut spending by $ 8 billion by 2020. This, of course, is in addition to the existing IT costs. The amount of the latter has not been disclosed, but we know that business colleagues at Deutsche Bank spend on IT 4.1 billion euros per year, and JP Morgan Chase 7.4 billion dollars.

The cost of buying fintech startups is also increasing. The other day, a study came out according to which the largest American banks have bought only 18 start-ups since 2013.

CB insights

But 6 purchases were in the last six months. The reason, I think, is simple: banks began to realize that there was simply no time for leisurely creating their own factories of digital ideas. Yes, banks become IT companies, but the giants that were them initially do not hide the desire to manage the money of their users. Therefore, the only possible option is to buy ideas together with their creators. And by the way, this is not only in the States. In our country, absolutely similar processes are observed.

Blockchain legalization

They have repeatedly told the world that the blockchain is ideal for storing sensitive information, and smart contracts are an excellent business tool. The only problem is that the state, which with the widespread use of the blockchain seems to be unnecessary, cannot consider these technologies within the legal field. That is, it is terribly cool to conduct a transaction on the purchase of real estate on the blockchain, but then you still have to duplicate it in the traditional way.

California Freedom Bill Filed No. 2658which contains a quiet revolution. If the bill passes, then the record on the blockchain will be equated to an electronic record, and an electronic signature protected by the blockchain will become a regular electronic signature from the point of view of the law. And, most probably, the most important thing - a smart contract is equated to a simple contract.

Interestingly, this is not the first initiative of lawmakers in the field, just California is a landmark. An inquisitive researcher will quickly find out that a similar bill was submitted a month ago in Florida, and in Arizona, blockchain entries and smart contracts were legalized last year.

This is how it will happen. First, parallel walking, then the final move. No one seems to seriously vouch for the future of cryptocurrencies on the blockchain, but the technology itself is omnipotent because it is true. Poor, poor notaries.