Customers from abroad: how to do everything legally

Due to the falling ruble exchange rate, many freelancers have long been working for foreign clients. Among them, not everyone wants to cooperate with ordinary individuals: large customers require a contract and pay for work in foreign currency. To cover a new market, you will have to register as an entrepreneur and comply with serious currency laws. We tried to tell about all these rules in clear words.

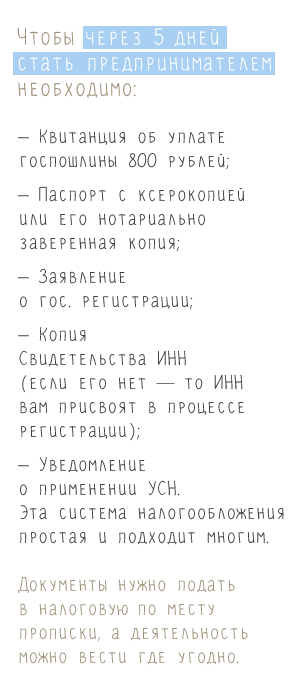

Register IP

With the registration of a business, an obligation appears to keep accounting. At IPshnik it is simple, so at first it’s better not to look in the direction of LLC.

With the registration of a business, an obligation appears to keep accounting. At IPshnik it is simple, so at first it’s better not to look in the direction of LLC. The LLC attracts start-up businessmen with a limited liability: it is believed that in the event of bankruptcy you risk only the authorized capital. But this is not so - the state provided for subsidiary liability. If the company turns out to be bankrupt, then both directors and founders can be forced to pay off debts (the list of persons who can be held accountable for the organization’s activities is, in fact, open). Personal property can be saved only if there is evidence that they acted in the interests of the organization. The logic of the lawmakers is simple: the owners themselves allowed bankruptcy, so they will have to make mandatory payments.

Open currency account

For settlements in foreign currency with large customers, you will need a foreign currency account. When choosing a bank, in addition to such obvious advantages as reliability, cost of service and speed of payments, pay attention to the convenience of online banking, the ability to provide documents online and the adequacy of specialists in the currency control department. When the first income in foreign currency arrives, these advantages will greatly facilitate your life.

The package of documents for opening a foreign currency account is very similar to the opening of a regular IP settlement account. Each bank has its own requirements for documents, so check the information in advance at the branch or on the bank's website. If you open an account in the same bank where you already have a ruble account, the whole procedure is greatly simplified.

After completing all the formalities, the bank will open a foreign currency account, and to it another transit account. Why two accounts: receipts from abroad must undergo currency control, so initially all the money will be credited to a special transit account. At this point, you can not yet manage the income. As soon as the experts of the currency control are convinced of the legality of the proceeds, the money can be withdrawn to the current currency account or immediately sell the currency. Otherwise, the amount will be returned to your payer.

Is it possible to work with Paypal and Payoneer so as not to bother with currency control?

We knew that you would ask such a question and prepared in advance. Freelancers love working with these sites, so we’ll tell you more about them in terms of law.

We knew that you would ask such a question and prepared in advance. Freelancers love working with these sites, so we’ll tell you more about them in terms of law. In 2013, Paypal received a license from the Central Bank of the Russian Federation and provided users with the opportunity to withdraw money to accounts with Russian banks. For business, you can legally use only a corporate account in Paypal, which is tied to a ruble bank account. All payments from abroad in foreign currency are automatically converted into rubles on the side of the Paypal payment system, therefore there will be no currency control (you receive crediting in rubles, not in foreign currency).

Of the minuses:

- you can be paid only from the account of an individual; according to the law, settlements between individuals and organizations are prohibited;

- Paypal users complain about the unfavorable conversion rate of foreign currency earnings into rubles.

Payoneer works differently: a foreign bank issues a card to you. In our legislation, this is considered as opening an account with a bank outside the Russian Federation, and this should be reported to the tax office. In addition, since 2015, a duty has been established to submit reports on the movement of money in an account with foreign banks. Now the procedure and form for such reporting has not been established, but this cannot be ruled out in the near future. Of the minuses, cardholders note an unprofitable commission for cashing money and a daily limit on card payments and cash withdrawals.

Contract with a foreign customer

Most often, the contract is executed in two languages: in Russian and in English. By agreement with the customer, instead of a full-fledged contract, you can issue an invoice in which all the terms of the transaction will be agreed (like the Russian invoice). Payment from the customer will be confirmation that the terms of the transaction are accepted.

Most often, the contract is executed in two languages: in Russian and in English. By agreement with the customer, instead of a full-fledged contract, you can issue an invoice in which all the terms of the transaction will be agreed (like the Russian invoice). Payment from the customer will be confirmation that the terms of the transaction are accepted. When drafting a contract, pay special attention to the payment term, which is very important for currency control. When passing control, you must inform the bank about the maximum deadline for receiving payment. If the customer transfers the money later than the deadline specified in the contract, disputes may arise with foreign exchange control specialists.

The Code of Administrative Offenses punishes non-receipt of foreign currency on time - fine1/150 refinancing rate of the Central Bank of the Russian Federation (in force during the delay) from the amount of money credited in violation of the term for each day of delay and (or) from 3/4 to one amount of the amount of money not credited to the account. Although there is a case law with a position where a delay in payment due to the fault of the customer is not a violation, it is better to prevent the dispute in advance.

Think about how to indicate a payment term in a contract. Perhaps it’s better not to set it at all or to significantly increase the maximum border. But then you have to be on the alert and influence the counterparty so that he does not delay payment, taking the opportunity. And do not forget to stipulate in advance who will incur the costs of bank transfer fees in order to avoid disagreements.

And the last clue on the contract: in order not to put out closing documents, stipulate in the contract a condition that the services are considered to be provided and the work accepted after a certain period of time from the date of payment by the customer.

If the amount of the contract is more than 50,000 US dollars, a transaction passport is required.

It is necessary for currency control, so care is in advance. For its registration, provide the completed form with the application of supporting documents. Typically, the bank helps to cope with all the papers for an additional fee.

Currency control

We’ll warn you in advance: currency control should be taken seriously, because fines for violations can reach the entire amount under the contract.

We’ll warn you in advance: currency control should be taken seriously, because fines for violations can reach the entire amount under the contract. When the money arrives in the transit account, the bank will immediately notify you. To pass the currency control, within 15 working days from the receipt of money to the transit account, provide a certificate of currency transactions with the supporting documents: a contract or transaction passport. Together with the transaction passport, acts, invoices and a certificate of supporting documents are provided . In order not to study the procedure for filling out all of these certificates, you can again contact the bank for help.

If you want to get to the truth, the bank or tax have the right to ask you for documents on foreign exchange transactions for currency control and verification. Keep contracts, transaction passports and all documents confirming your foreign exchange transactions. The law has a complete list that you may be asked.

How to pay taxes from this

At the end of all paperwork, you will finally be free to dispose of. But first you need to put an end to the legal red tape - to calculate income tax in foreign currency.

At the end of all paperwork, you will finally be free to dispose of. But first you need to put an end to the legal red tape - to calculate income tax in foreign currency. Taxes are always calculated in rubles, so recalculate the amount of income at the rate of the Central Bank of the Russian Federation, which is set on the date of receipt of money in a transit account. The current rate of the Central Bank of the Russian Federation can be viewed on the website cbr.ru. Revenues in foreign currency are always taken into account on the date of receipt of money in a transit account.

And what to do with the exchange rate difference?

Most often, this refers to a change in the exchange rate while it is stored in the account. Oddly enough, for the STS tax, such a difference does not matter. Only the exchange rate difference that arises when selling foreign currency at a rate higher than the Central Bank rate on the day the currency is sold should be taken into account. In such cases, you have a benefit with which you will have to pay tax. Negative exchange differences in the costs of the simplified tax system are not taken into account.

Finally, recall that Elba helps in working with foreign currency accounts. It is enough for you to import a bank statement, and for tax purposes, the system will automatically convert the income in foreign currency into rubles and calculate the exchange rate difference.