10 Billion For Your Startup: A Seed-DB Review

- Transfer

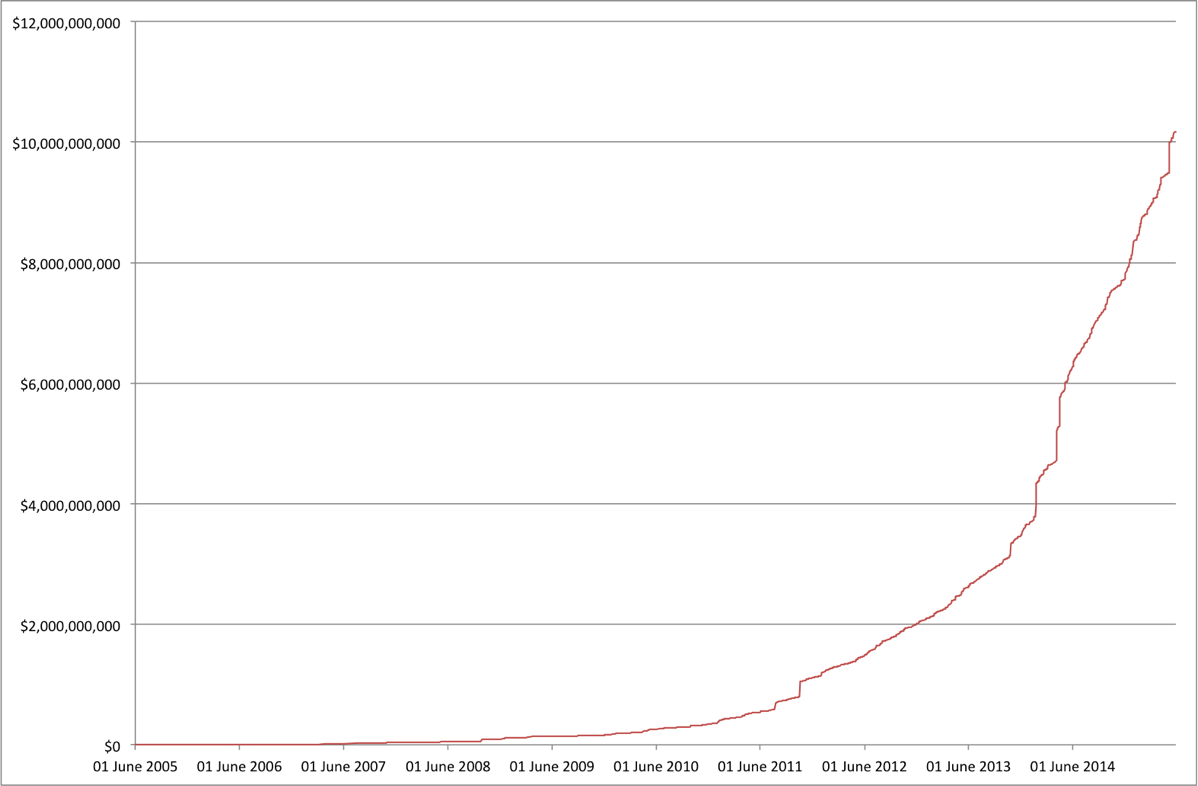

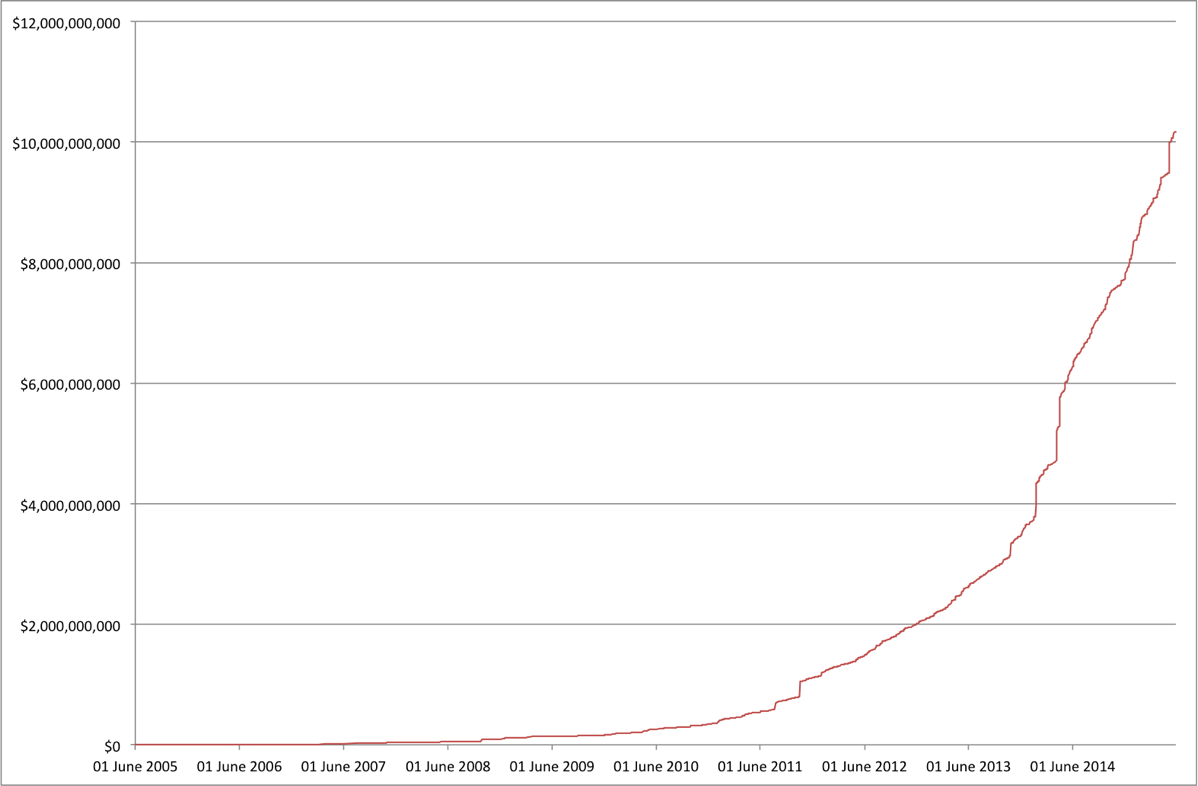

According to Seed-DB statistics , more than $ 10 billion has been invested in startups over the 10 years since the launch of the first business accelerator model. Over 200 acceleration programs around the world have been funded by more than 5,000 companies.

Having sold their stakes in more than 300 companies, the accelerators collectively earned more than $ 3.5 billion for them. The total estimated value of the accelerated companies has reached tens of billions of dollars. And if you think that business accelerators are not the best way to get financing for the creation and development of technology companies ... then you are deeply mistaken.

A bit of history

The world's first accelerator, Y Combinator, was created just 10 years ago. It was followed by Techstars in 2007, DreamIT Ventures in 2008, AngelPad in 2010, and 500startups in 2011. Most of them started with financing from less than a dozen companies.

The first accelerators launched a powerful mechanism to attract investment in promising startups. And since in modern conditions mature developing companies may receive financing in excess, rounds of financing for ever larger amounts at this stage become commonplace [see chart above].

At the moment, the leading accelerators themselves are brands, and the fact that the company got into the accelerator and gained access to its contact networks already gives it significance. Despite the fact that the total funding of 10 billion is very impressive, accelerated companies make up only a small fraction of the total number of funded startups. So the accelerators have something to strive for.

Leading Acceleration Programs

76% of the total venture capital of business accelerators is invested in companies in only five acceleration programs: Ycombinator, Techstars, 500startups, Angelpad and DreamIT Ventures. The key to this success is three components: quality, quantity and vitality of [start-up graduates].

In order to help its companies attract investment, the accelerator must provide services of adequate quality. The accelerator must fund a relatively large number of startups in order to have a significant impact [on the industry] as a whole. (This happens either due to an increase in annual funding, or due to the gradual formation of a portfolio of the most outstanding projects). The longer the program runs, the greater the chance for participating companies to succeed.

This does not mean that new programs have no chance to break into the ranks of leaders ... they just need more time.

Financing is a power law in action

If you plug into the search engine the terms [venture capital] and [power law], you will see that venture capital, as an industry, is known for obeying the power law ... and power laws cover phenomena such as the “long tail” and the Pareto principle (known as well as the principle of 20/80). This also applies to business accelerators.

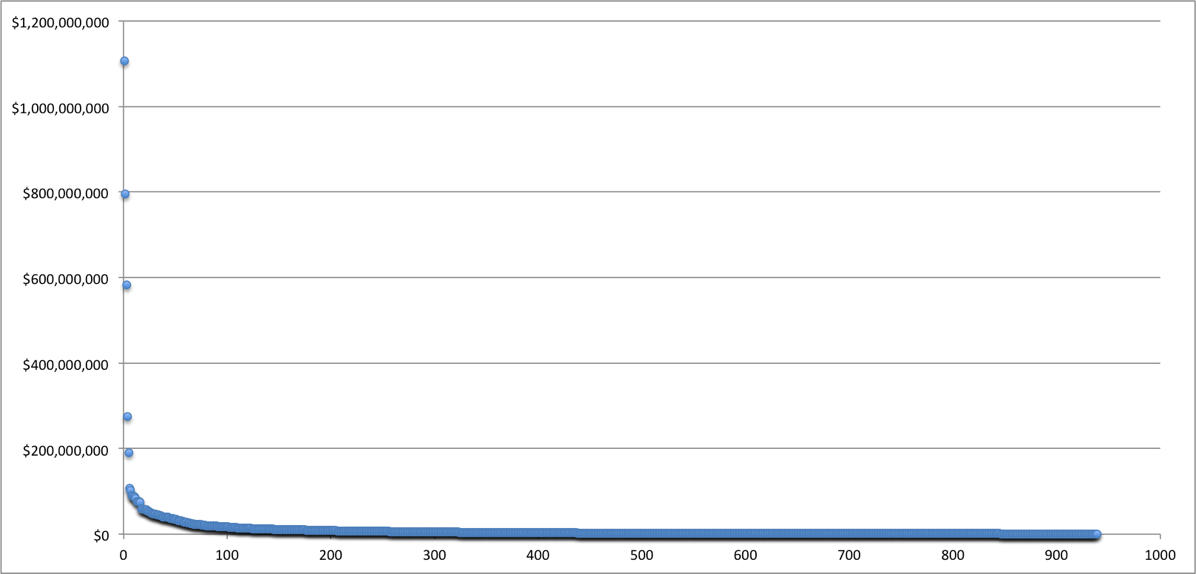

The diagram below shows data on the financing of 939 companies that attracted the largest possible amount of venture capital after undergoing an acceleration program (this is approximately 20% of all companies that have passed acceleration).

This is the extreme manifestation of the power law. More than $ 1 billion was invested in Dropbox alone, but only hundreds of $ 1 to $ 10 million were invested in hundreds of other companies. (And thousands more companies received an initial investment of less than $ 1 million). Let's see what happens when we check the real power law by rearranging the graph on a logarithmic scale.

As a result, we get a line close to a straight line, which shows that venture financing of companies participating in acceleration programs is nothing more than a power dependence. Mathematically, this is rather difficult to prove, and this is not the purpose of my post.

Disclaimer: data

All company finance information is taken from the Crunchbase online database. However, information on financing of some companies is not presented there, while others do not have a Crunchbase page at all; based on this, the total amount of funding should be even greater.

In addition, a number of accelerators known to me have funded companies that are not yet included in the Seed-DB database ; I constantly work with programs to verify the accuracy and reliability of the data, but in any case, information on many companies will remain unaccounted for.

In addition, the data that I used to write this article is no longer relevant due to the fact that a new round of financing was closed this week. For example, three Techstars companies announced financing in excess of $ 100 million in the first 48 hours of this week.

Note: Just the other day, 10 companies from Europe raised a total of $ 310 million in financing. Most of them are projects from the UK and Germany, and their support by venture funds is evidence that in Europe, even the traditionally “poor for big deals” mid-summer is quite an active time for startups and venture funds.