Peter Thiel: competition is for the losers

- Transfer

Stanford course CS183B: How to start a startup . Started in 2012 under the leadership of Peter Thiel. In the fall of 2014, a new series of lectures by leading entrepreneurs and experts of Y Combinator took place:

Second part of the course

First part of the course

- Sam Altman and Dustin Moskowitz: How and why to create a startup?

- Sam Altman: How to build a startup team and culture?

- Paul Graham: An Illogical Startup ;

- Adora Chung: Product and honesty curve ;

- Adora Chyung: Rapid startup growth ;

- Peter Thiel: Competition is the lot of the losers ;

- Peter Thiel: How to build a monopoly?

- Alex Schulz: Introduction to growth hacking [ 1 , 2 , 3 ];

- Kevin Hale: Subtleties in working with user experience [ 1 , 2 ];

- Stanley Tang and Walker Williams: Start Small ;

- Justin Kahn: How to work with specialized media?

- Andressen, Conway and Conrad: What the investor needs ;

- Andressen, Conway and Conrad: Seed Investment ;

- Andressen, Conway and Conrad: How to work with an investor ;

- Brian Chesky and Alfred Lin: What is the secret of company culture?

- Ben Silberman and the Collison Brothers: Nontrivial Aspects of Teamwork [ 1 , 2 ];

- Aaron Levy: B2B Product Development ;

- Reed Hoffman: About Leadership and Leaders ;

- Reed Hoffman: On Leaders and Their Qualities ;

- Keith Rabois: Project Management ;

- Keith Rabois: Startup Development ;

- Ben Horowitz: Dismissals, promotions and transfers ;

- Ben Horowitz: Career Tips, Westing and Options ;

- Emmett Shire: How to conduct interviews with users;

- Emmett Shire: How Twitch talks to users ;

- Hossein Rahman: How hardware products are designed at Jawbone;

- Hossein Rahman: The Design Process at Jawbone.

Sam Altman: Have a nice day, Peter Til is playing today. Peter is the founder of PayPal, Palantir, and the Founders Fund, who has invested in many Silicon Valley technology companies. He will talk about strategy and competition. Thanks for coming, Peter.

Peter Thiel: Cool Sam, thank you for inviting me.

I have a kind of “fix idea” - [the topic of startups] is incredibly attractive to me from a business point of view: if you are creating a company, if you are its founder, entrepreneur, you should always aim at creating a monopoly and strive to avoid competition. And since competition is the destiny of the losers, today we will talk about it.

I would like to start with a few words about the basic idea that underlies the creation of a company, about how you are going to provide its (company) value. What makes a business valuable?

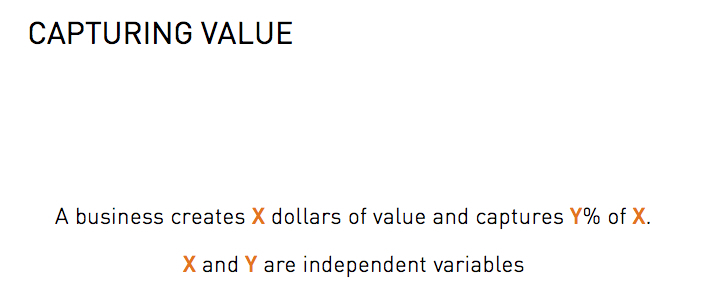

I dare to suggest that the formula for answering this question is quite simple. If your company has value, then two statements are true for you: firstly, the company's value for the world is expressed in a certain amount of money (X), and secondly, some part of this amount (Y) goes to you. People constantly lose sight of the fact that X and Y are completely independent variables, so even if X is a relatively large sum, the value of Y can be very small. Or X may be medium-sized, which with a sufficiently large value of Y allows your company to remain a large business.

Therefore, in order to create a company with high value, you need to do something valuable on the one hand, and to keep a part of this value on the other. To illustrate the difference between the two, let me give you an example: try comparing the US airline travel industry with an Internet search company like Google. If you measure the volume of these industries (in terms of revenue), you will conclude that air travel is much more important than search.

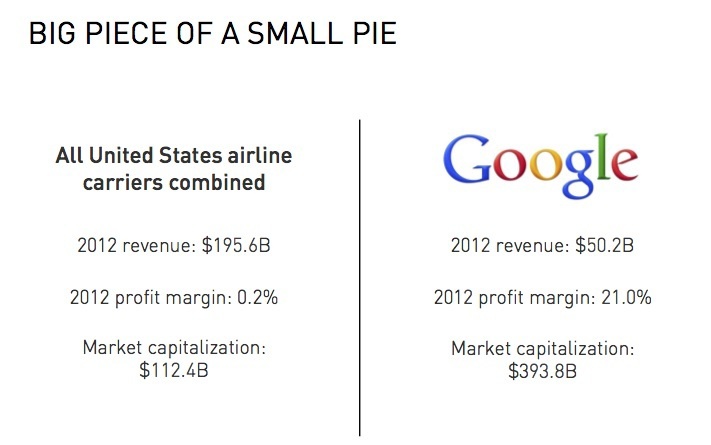

In 2012, air carriers earned $ 195 billion on domestic flights, while Google earned only $ 50 billion over this period. And of course, if you were given the choice and offered to refuse either air travel or search engines, intuition would tell you that travel is more important than web search (I give the figures only for the USA).

If you look at the figures for the world as a whole, you will see that the airline business is much larger than the business of web search engines, the Google business, but the profitability of airlines is slightly less. The air transportation business was profitable in 2012, but in my opinion over the entire century-long history of the airline industry, the cumulative profit of air carriers in the United States was approximately zero. Companies make money, occasionally go bankrupt, reorganize their capital structure, and the whole cycle repeats again.

This is reflected in the total capitalization of the airline market, which is about a quarter of Google’s capitalization. Therefore, web search, being a much smaller industry compared to air travel, generates great value. This example, in my opinion, reflects the very differences in the assessment of indicators X and Y.

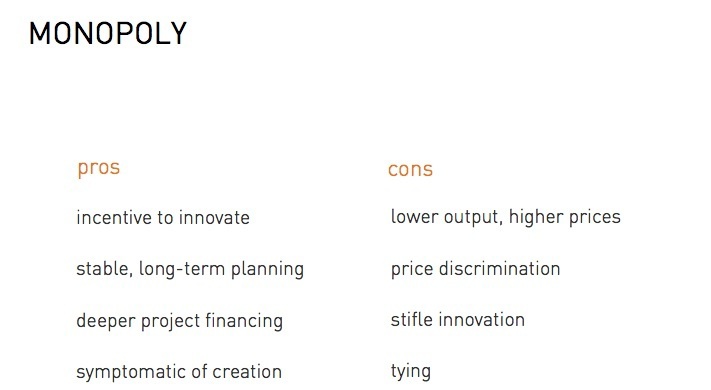

If you take perfect competition, then it has its pros and cons. In a general sense, this is what you study in the framework of the basic course of the economy, this is a state that is very easy to model - that's why teachers of economics like to talk about perfect competition. In some ways, it is effective - especially in a world where things are static, because any company in such a system can satisfy growing demand.

In addition, politicians tell us that perfect competition is good for society: they say that we need competition, and therefore it is useful. Of course, it has many shortcomings - as a rule, work in an extremely competitive market affects the business adversely, because in this case it most likely does not work. I will come back to this.

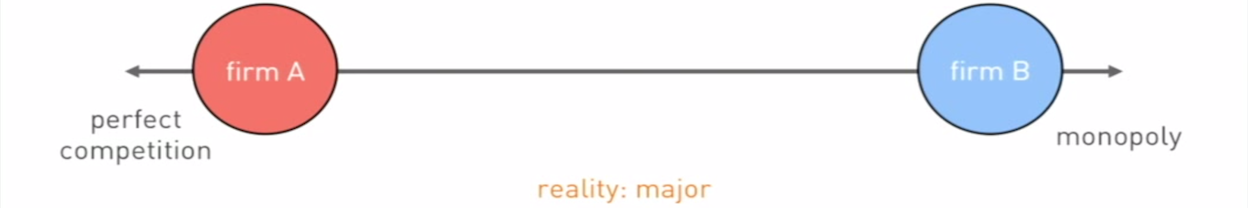

So, in one part of the spectrum, you have industries in which perfect competition flourishes, and in the other, monopolies that are much more stable in terms of long-term business development and generate more capital. And if you create a creative monopoly for the invention of new products, in addition, you will inevitably generate something valuable.

I am convinced that in terms of dividing everything into black and white (I always emphasize this) in the world there are only two types of companies. There are businesses in the perfect competition market and there are monopoly companies. A strikingly small number of companies are somewhere between these two extremes.

And this dichotomy is quite difficult to realize, because people constantly lie, talking about the nature of the business in which they are involved. In my understanding, this is not necessarily the most important part of the business, but in my opinion the idea that there are only two types of companies is something that people really do not understand.

Now I want to tell what people are lying about. If you imagine that there is a whole range of companies: from perfect competition to a monopoly, then the external differences between the companies within this spectrum will be insignificant, because those who manage the monopolies pretend that this is not so. You will never admit that you are leading a monopoly because you do not want the guys from the antimonopoly service to come for you, and the government has begun monitoring your company.

Therefore, everyone who has a monopoly will pretend to be in incredible competition. On the other hand, if you are in a highly competitive environment, in a company that can hardly make money, you will have to resist the temptation to lie on the exact opposite topic: you will say that your product is unique, that you work in a less competitive market than in the actual because you want to stand out, raise capital, or something like that.

So, if monopolists pretend that their companies are not monopolies, but non-monopolists, on the contrary, the visible differences between them will be insignificant, while the real ones will be very significant. The distortion of the real state of affairs in business arises from the fact that people lie about the state of their companies, while the lies of some are directly opposite to the lies of others.

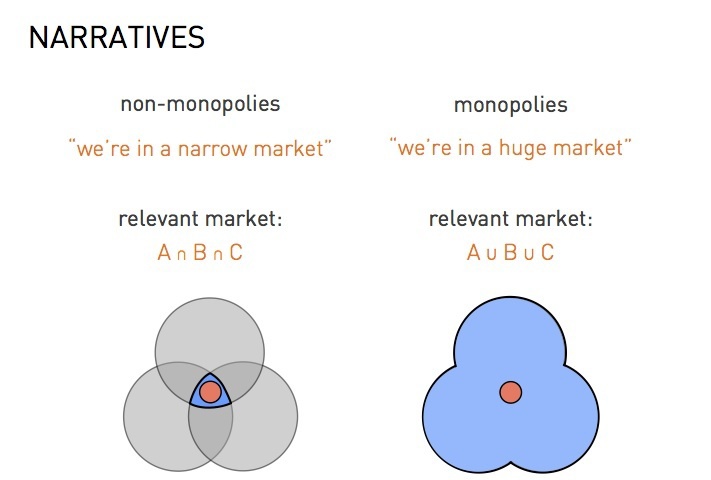

I want to delve into the description of how this lie works. So, if you are not a monopolist, you will first begin to say that you work in a very small market. Otherwise, you will say that your market is much larger than it seems.

So, if we express this in the form of theoretical conditions, the monopolist will say that his business operates on a large number of disparate markets, and the non-monopolist will insist that it is at their intersection. As a result, the non-monopolist will describe his market as super-small, as if he is the only player in it. And the monopolist will say that his market is extremely large, and many competing firms operate on it.

Here are some examples of how this works in practice. I always talk about restaurants when I want to give an example of a terrible [highly competitive] business. There is an idea that capital accumulation and competition are antonyms. If someone accumulates capital, then in the world of perfect competition, all of it goes to ensure competitiveness.

Therefore, when you open a restaurant, nobody wants to invest in you, and for the sake of raising funds you think up some story that will help you show your personality, for example, the story that “Your restaurant is the only institution with British cuisine in Palo Alto ".

So, you are a British restaurant in Palo Alto, and your market looks really small, because you can go right up to Mountain View or even Menlo Park and not meet a single person who would eat exclusively British dishes (if you don’t take calculation of those who have long died). This is an example of a deliberately low market valuation.

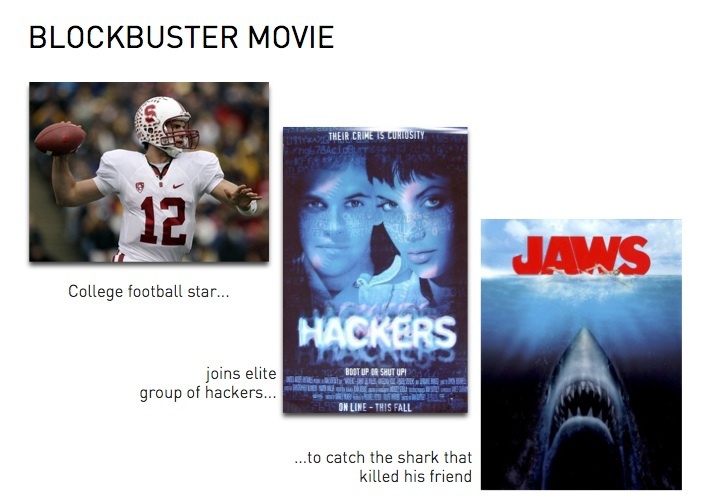

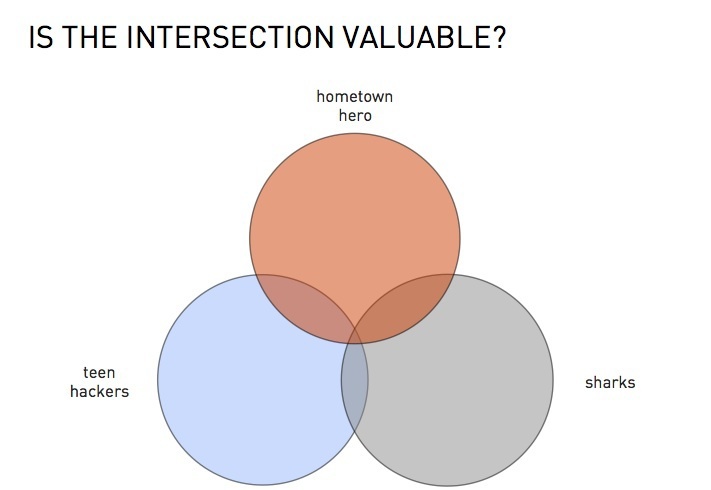

An example of such an approach is in Hollywood - this is how decisions are always made to launch new films. Suppose we are talking about a picture in which the best player of the university's American football team ... joins a group of elite hackers ... to catch the shark that killed his friend. The film has not yet been shot, but the question arises: “Is this a suitable option? Or is it just one of many other films? ” This is a super competitive environment in which it is incredibly difficult to make money. No one in Hollywood makes money from making films - it's very, very difficult.

You probably want to know if there really can be anything at the intersection of films about hackers, soccer players and horror movies with sharks? Does that make sense? Does such a project have value?

Of course, there are similar examples in the world of startups - and in the worst case it’s just a heap of "buzzwords", such as sharing, mobile, social networks - and you juggle them to get some kind of story. Regardless of whether it is real business or not, this is a bad sign.

It's like pattern recognition - if you see a similar description or a similar type of intersection, know that they usually do not work.

“Something like X, but only for Y” - it's just “nothing”: if you create Stanford, but in North Dakota, and at the same time one-of-a-kind, then this is not Stanford.

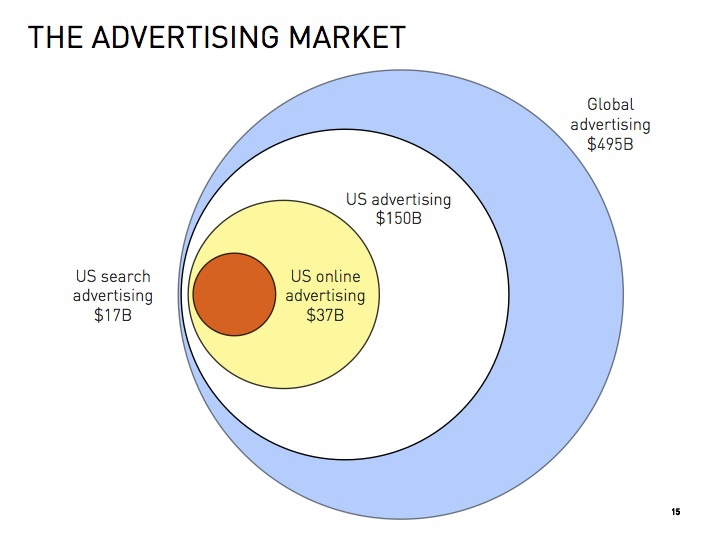

Let's take a look at the opposite version of lies - take, for example, one company that deals with web search, is located not far from here, occupies a good 66% of the market and a dominant position in its segment. Google now hardly speaks of itself as a search engine, on the contrary, they use completely different descriptions: sometimes, for example, Google says that they are engaged in advertising. But if this is still a search engine, then the company's share in this market is simply fantastic, it is a powerful monopoly, much more powerful than Microsoft in its best years, and that is probably why it makes so much money.

If you look at the advertising market, you will see the following: the market for advertising in search results is estimated at $ 17 billion, and is just one option for advertising on the Internet. And advertising on the Web, in turn, is only a fraction of the US advertising market as a whole, not to mention the global advertising market, which is estimated at about $ 500 billion - from this point of view, Google occupies only 3.5% of the market - this is a tiny fraction .

If you do not like being an advertising company, you can always be called a technology company. The technology market as a whole is estimated at about a trillion dollars, and in this case, Google will "legally" compete with all companies that develop drone cars, with Apple TV and iPhone, with Facebook, with Microsoft in the "office" application market, with Amazon in the cloud services industry: this is a huge technology market where competitors are approaching you from all sides - and there’s no question of any monopoly, so the state certainly has nothing to worry about. It seems to me that you should always be on the alert - there are always reasons to somehow distort the nature of these markets.

Evidence of the existence of small markets within the technology industry is that all major technology companies: Apple, Google, Microsoft, Amazon, accumulate capital year after year and achieve stunningly high profitability. I would say that one of the reasons that the technology industry in the United States has been financially successful for so many years is because it helped create essentially monopolistic companies. This is confirmed by the fact that all these companies accumulate so much money that after a certain moment they no longer understand what to do with them.

[ The second part of the translation of Peter’s lecture ]