Domestic venture capital funds - do they even relate to the startup industry?

To write me this column was motivated by the post of Alexander Zhurba, co-founder of the new Venture Fund Genezis Capital, the creation of which we wrote .

Here is the text of Alexander "without cuts":

Here is this post on Facebook. He hurt me for one reason - in fact, the requirements for a startup are the same as for ordinary business. Well, the item “has already made a product and even started selling - the rating is still ZERO” is generally without comment.

Let me remind you of the definition of the word "startup": startup (from the English. Start-up - run) - a company with a short history of operating activities. As a rule, such companies were created recently, are in the development stage or research of promising markets .

I highlighted, as it seems to me the main thing, what distinguishes an Internet startup from a small business is the presence of an unverified business model.

Alexander Zhurba - co-founder of the new venture capital fund. Let me remind you the definition of the word "venture fund":venture fund (eng. venture - a risky enterprise) - an investment fund focused on working with innovative enterprises and projects (startups). Venture capital funds invest in securities or shares of enterprises with a high or relatively high degree of risk in anticipation of extremely high returns. As a rule, 70-80% of projects do not bring returns, but the profit from the remaining 20-30% pays for all losses.

Those. in fact, a venture fund is different from a regular investment fund in that it is itself a company that invests in risky and untested business projects. No wonder it is written about the approximate proportions of the return. But for this he gets a share in the project, and often rather big.

If an investment fund invests in small, medium and large businesses, based on the business planning of more or less sustainable projects, then the venture fund is supposed to give money to potentially attractive projects.

This of course does not mean that you need to give out right and left. All funds have their own specialists who evaluate incoming project applications. And it is they who, it seems to me, should seek out startups that are potentially attractive for investment.

But this also does not mean that all startups should be considered from the point of view of ordinary investment companies. Startup is a risk. If you want to take risks, to get a lot of money - create a venture fund. If you just want to invest money or protect against inflation - make an investment fund. And select projects for investment where you will almost 100% make a profit.

In addition, the venture investor brings not only money to the project, but also expertise and communications. Those. there may be a good startup with poor salespeople (or their absence at all) or a slightly (strongly) wrong business model and the investor’s task is to discern the potential by investing in the project not only money but also your knowledge. It seems to me that it should be ideally.

By the way, Twitter for 3 years was unprofitable, from 2006 to 2009. And only in 2009 the service showed its first and small profit. It turns out that if this project appeared with us, it would simply not exist.

In addition, Alexander’s point touched me: “an ideal team, but it’s not clear where the money is in the next 2 years - a ZERO estimate”. Those. the fund, represented by Alexander, does not consider the team an asset. Although many representatives of the funds repeatedly talk about the importance of the team, it turns out that the team has no value at all.

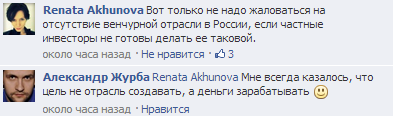

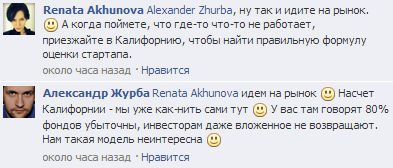

Alexander and I had a short conversation in the comments to the post:

Alexey Bozhin:Alexander, everything that you described is all right. For ordinary business. But you want a stake in the project, you are a venture investor. And venture capital investments are always risky. You value a business. Those. you are just an investor. With startups and venture capital investments, it has nothing to do.

Alexander Zhurba: Alexei, if the risks of investing are high, then why should I also overpay for the asset? I do not understand the logic.

Alexey Bozhin: You want to pay for a working project that brings money. This has the same relation to startups as a regular online store has. That is, no, this is purely business. Business project. Will you find a startup definition yourself?

Alexander Zhurba:Yes, I want to be part of ongoing projects. But incl. invest in startups that should (lo and behold) become working businesses. And when I buy something, I want to know the price of this something. The price of any startup is zero, there is nothing besides plans and assumptions.

Conclusion - the assessment is determined only by how much the team will be motivated by the share that it will have. Everything else is the erotic fantasies of the market and startups.

Alexey Bozhin: Alexander, why are you such a startup? It is more profitable for him to take a stupid loan than to communicate with you. He has a turnover, the model is verified. Why do you need him? You need to give a share.

Alexander Zhurba:Now, this is a matter of fact. Credit is of course good, but not everyone is given it, not on those conditions, not always, not as much as necessary, etc., etc. Plus, the bank will not make connections, will not sit on the board of directors, think about what to do with the project. The bank will not then sell the business with the founder. Something like this. Renata Akhunova , the only Russian on the list of women venture investors and business angels published by Forbes.com,

joined the conversation . Managing Partner at Formula.VC Venture Fund. I constantly communicate with investors and startups. Both sides have claims to each other and some requirements. But personally, I was struck by such a statement of the question. The fund does not want risks, but wants to invest in startups.

This is very strange for me, the whole startup industry is built on the risks of both parties, and when one of the parties decides to transfer its risk to the other, this is wrong.

I personally relate to Alexander normally, I have heard good reviews more than once. But the position he voiced is, it seems to me, a step backward for the entire industry.

I will give a simple example. Someone in the corridors of power thought that it was not necessary to allocate money for science. It does not bring direct profit. Why say they spend money on scientists. Maybe they won’t invent anything? Maybe nothing practical will work out? What we have in the end is probably not necessary to explain. Almost nothing is being produced with us - we are importing everything from somewhere. Machine tools, combines, electrical engineering, etc. Almost all.

And here I see an analogy with startups. Nobody is forcing to invest in startups? If you came to this market, then invest just like a venture, and not just a fund. Striving to have super profitability is not a crime, everyone has such desires. But at the same time, the fund does not want to have extra risks, counting on extra profits.

Another example is Aviasales. A successful company, high turnover, a solid part of the market - things are going well. But if we ask its founder Konstantin Kalinin about investors, we can hear what we hear (our report on Habré from his master class):

Do you understand?

Analyst experts who work on the incoming flow of startups - can only weed out frankly delusional projects. And potentially good ones are very difficult to recognize.

I contacted Alexander and asked him to give an additional comment. Maybe I misunderstood something. Here is what he added (style retained):

I also contacted Renata Akhunova, here is what she commented on:

What do you think?

Here is the text of Alexander "without cuts":

“How to evaluate startups realistically?” Very simple, there is a method of "TRUTH"

P = P * A * B - D + A, where the

correct assessment of the company.

The real profit of the company per month (cash that can be withdrawn, and the company will not get worse over the long term).

Aptimistic :) the period for which this profit can be predicted in months (no more than 24).

The likelihood that the scenario will be no worse than the forecast (from 0 to 1, where 1 is a traditional existing monopolistic business with an energetic team with 10 years of industry experience).

Debts, pledges, etc., for which it will be necessary to pay, incl. in case of liquidation of the company.

Company assets (money in the account, liquid securities, property which can be sold without the participation of the company, ...).

Conclusions for startups:

- there is not even revenue and assets - a rating of ZERO.

- horseradish team - score ZERO.

- you do not know how to sell - a rating of ZERO.

- invented / programmed a megaproduct that there is no one to sell - a ZERO rating.

- invested 100500 million in development, but you can’t sell it to anyone, including as a patent - a rating of ZERO.

- Do you think how to sell Instagram to a strategist without revenue - how many projects have you personally personally sold without revenue? - score ZERO.

- an ideal team, but it is not clear where the money is in the next 2 years - a ZERO score

- in the industry everything changes every day - a ZERO score.

- there is nothing but an idea - a rating of ZERO.

- already made a product and even started selling - the rating is still ZERO.

- you think that I'm an asshole and your project costs $ 2 million at the prototype stage - the assessment is still ZERO (and the investor who gives the money would be better to go to the casino to play). ”

Here is this post on Facebook. He hurt me for one reason - in fact, the requirements for a startup are the same as for ordinary business. Well, the item “has already made a product and even started selling - the rating is still ZERO” is generally without comment.

Let me remind you of the definition of the word "startup": startup (from the English. Start-up - run) - a company with a short history of operating activities. As a rule, such companies were created recently, are in the development stage or research of promising markets .

I highlighted, as it seems to me the main thing, what distinguishes an Internet startup from a small business is the presence of an unverified business model.

Alexander Zhurba - co-founder of the new venture capital fund. Let me remind you the definition of the word "venture fund":venture fund (eng. venture - a risky enterprise) - an investment fund focused on working with innovative enterprises and projects (startups). Venture capital funds invest in securities or shares of enterprises with a high or relatively high degree of risk in anticipation of extremely high returns. As a rule, 70-80% of projects do not bring returns, but the profit from the remaining 20-30% pays for all losses.

Those. in fact, a venture fund is different from a regular investment fund in that it is itself a company that invests in risky and untested business projects. No wonder it is written about the approximate proportions of the return. But for this he gets a share in the project, and often rather big.

If an investment fund invests in small, medium and large businesses, based on the business planning of more or less sustainable projects, then the venture fund is supposed to give money to potentially attractive projects.

This of course does not mean that you need to give out right and left. All funds have their own specialists who evaluate incoming project applications. And it is they who, it seems to me, should seek out startups that are potentially attractive for investment.

But this also does not mean that all startups should be considered from the point of view of ordinary investment companies. Startup is a risk. If you want to take risks, to get a lot of money - create a venture fund. If you just want to invest money or protect against inflation - make an investment fund. And select projects for investment where you will almost 100% make a profit.

In addition, the venture investor brings not only money to the project, but also expertise and communications. Those. there may be a good startup with poor salespeople (or their absence at all) or a slightly (strongly) wrong business model and the investor’s task is to discern the potential by investing in the project not only money but also your knowledge. It seems to me that it should be ideally.

By the way, Twitter for 3 years was unprofitable, from 2006 to 2009. And only in 2009 the service showed its first and small profit. It turns out that if this project appeared with us, it would simply not exist.

In addition, Alexander’s point touched me: “an ideal team, but it’s not clear where the money is in the next 2 years - a ZERO estimate”. Those. the fund, represented by Alexander, does not consider the team an asset. Although many representatives of the funds repeatedly talk about the importance of the team, it turns out that the team has no value at all.

Alexander and I had a short conversation in the comments to the post:

Alexey Bozhin:Alexander, everything that you described is all right. For ordinary business. But you want a stake in the project, you are a venture investor. And venture capital investments are always risky. You value a business. Those. you are just an investor. With startups and venture capital investments, it has nothing to do.

Alexander Zhurba: Alexei, if the risks of investing are high, then why should I also overpay for the asset? I do not understand the logic.

Alexey Bozhin: You want to pay for a working project that brings money. This has the same relation to startups as a regular online store has. That is, no, this is purely business. Business project. Will you find a startup definition yourself?

Alexander Zhurba:Yes, I want to be part of ongoing projects. But incl. invest in startups that should (lo and behold) become working businesses. And when I buy something, I want to know the price of this something. The price of any startup is zero, there is nothing besides plans and assumptions.

Conclusion - the assessment is determined only by how much the team will be motivated by the share that it will have. Everything else is the erotic fantasies of the market and startups.

Alexey Bozhin: Alexander, why are you such a startup? It is more profitable for him to take a stupid loan than to communicate with you. He has a turnover, the model is verified. Why do you need him? You need to give a share.

Alexander Zhurba:Now, this is a matter of fact. Credit is of course good, but not everyone is given it, not on those conditions, not always, not as much as necessary, etc., etc. Plus, the bank will not make connections, will not sit on the board of directors, think about what to do with the project. The bank will not then sell the business with the founder. Something like this. Renata Akhunova , the only Russian on the list of women venture investors and business angels published by Forbes.com,

joined the conversation . Managing Partner at Formula.VC Venture Fund. I constantly communicate with investors and startups. Both sides have claims to each other and some requirements. But personally, I was struck by such a statement of the question. The fund does not want risks, but wants to invest in startups.

This is very strange for me, the whole startup industry is built on the risks of both parties, and when one of the parties decides to transfer its risk to the other, this is wrong.

I personally relate to Alexander normally, I have heard good reviews more than once. But the position he voiced is, it seems to me, a step backward for the entire industry.

I will give a simple example. Someone in the corridors of power thought that it was not necessary to allocate money for science. It does not bring direct profit. Why say they spend money on scientists. Maybe they won’t invent anything? Maybe nothing practical will work out? What we have in the end is probably not necessary to explain. Almost nothing is being produced with us - we are importing everything from somewhere. Machine tools, combines, electrical engineering, etc. Almost all.

And here I see an analogy with startups. Nobody is forcing to invest in startups? If you came to this market, then invest just like a venture, and not just a fund. Striving to have super profitability is not a crime, everyone has such desires. But at the same time, the fund does not want to have extra risks, counting on extra profits.

Another example is Aviasales. A successful company, high turnover, a solid part of the market - things are going well. But if we ask its founder Konstantin Kalinin about investors, we can hear what we hear (our report on Habré from his master class):

We tried to look for investments. Well, like "we", I tried to look for investments. All investors laughed: “what are you? This is some kind of garbage, it will not work, I will not participate in this. Who needs this? This is some kind of nonsense. Here is Anywayanyday, here is Pososhok, which is 10 years old. There is a DAVS, which is some kind of an ancient one; it has 50 sales offices there all over the country. Here they are well done, but you don’t understand nichrome at all. ”

Do you understand?

Analyst experts who work on the incoming flow of startups - can only weed out frankly delusional projects. And potentially good ones are very difficult to recognize.

I contacted Alexander and asked him to give an additional comment. Maybe I misunderstood something. Here is what he added (style retained):

"My opinion is global - in venture there is a huge bubble of erotic fantasies based on the fact that" this is not the same as before, it is different. " Previously, they hired or gave a bonus, now they give millions of bucks for 10% of companies and consider it a good deal.

Investors overpay in the early stages - this is my opinion. The difference between the ordinary Vasya, who is being hired, and Vasya, who is an entrepreneur — only that Vasya can be an entrepreneur (if possible) will make 10 rubles. And for this, he will be paid a salary and a half-virtual million bucks.

It is clear that motivation is important, but you need to call a spade a spade. Hello, I’m Vasya, I don’t have any fucking besides the ability to set tasks and plow myself, give me a million for 40% of the company, otherwise after 2 years I will dump you from you.

It’s honest, not that a business costs a million bucks on Round A for Valley practices. ”

I also contacted Renata Akhunova, here is what she commented on:

“This is a dead end path when a foreign business requiring development becomes your business and you cease to be a venture investor. Therefore, initially you need to decide on concepts and your own desires: “I am a satellite” or “I am a center”.

If the company of interest agrees with a low rating, venture investors have a number of other methods for effectively managing such a company than simply snatching a bigger and cheaper piece. After all, the value of a venture investor is to consider a potential in a young company, sometimes invisible even to the company itself.

The culture of venture capital business is to invest in companies to which you, the investor, can give additional value, and this is not the same as money. I intentionally use the English term here, because you can translate it in different ways - additional meaning, value, virtues - and all these options are equally true, in this case.

A rare company is worth zero. It is more important that the additional value of the investor is not equal to "zero". It is better to think about the value of the company, looking at the graph of exponential growth - it will help to find an adequate estimate. The investor pays for the part of the value that can give an exponential growth when its value increases due to the additional value of such an investor.

And this growth does not depend on how much the investor managed to lower the company's valuation, but on how much he increased it with his participation. The formula is generally much more complicated than that given in the discussion, and certainly such a formula should reflect the interdependence of the parties, and not shift all responsibility to the company, freeing the investor from risk. ”

What do you think?