US technology startups face new state control measures in 2019

- Transfer

This year, new protection measures introduced by the US government to limit the exchange of critical technologies with foreign entities will affect a large number of startups, as well as related investments, mergers and acquisitions. Since the law applies to all foreign citizens, whether exchanges take place abroad or in the United States, companies with investors, partners or customers who are in the United States but are not US citizens will feel the innovations in full.

As long as the requirements come into force, venture capitalists and technology companies, especially start-ups, should be aware of the protocols for meeting these requirements.

It is not entirely clear what technologies fall under the new protection. In August of last year, when the Government updated the National Security Act , which prohibited American companies from sharing critical technologies with foreigners, it obliged them to cover several new unspecified “emerging technologies”.

The translation was made with the support of EDISON Software, which is professionally engaged in the development and testing of software .

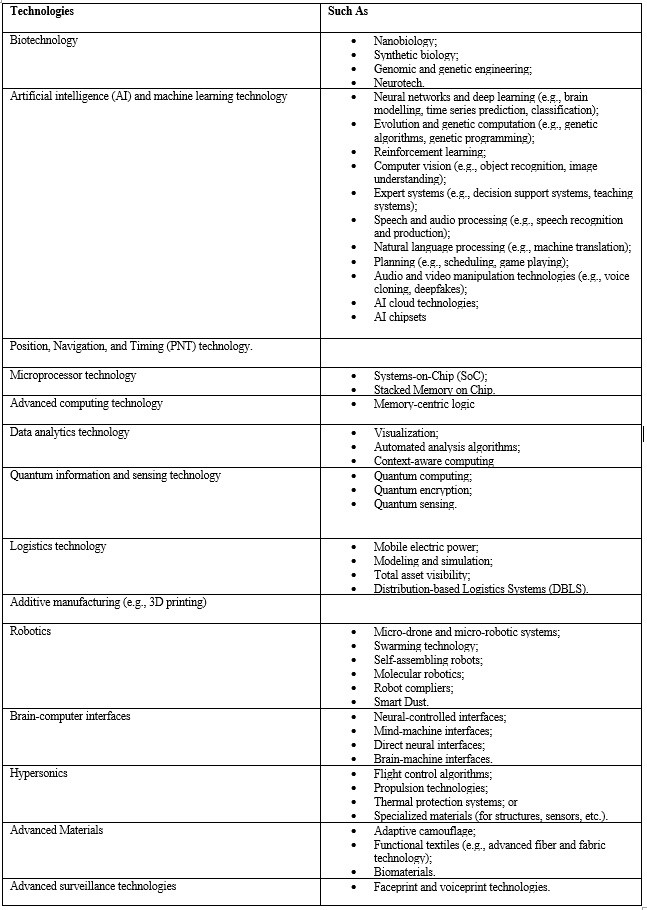

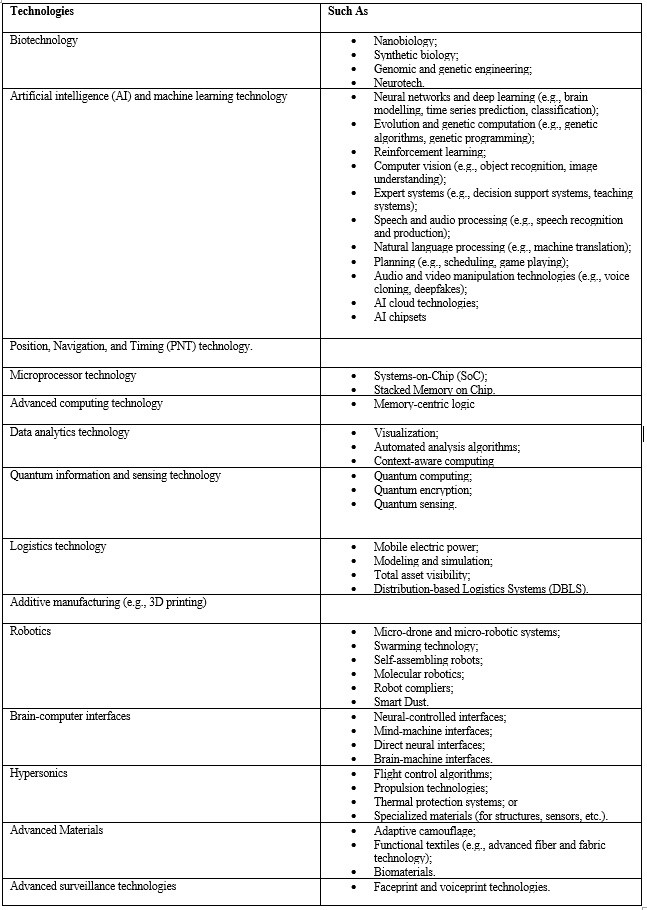

However, in November, the Ministry of Commerce for the first time gave an idea of what technologies might be affected. The Federal Registration Service noticegave the following list of technologies that are being considered for inclusion in the new definition of emerging technologies (see above).

We can expect the Department of Commerce to complete the list of affected new technologies sometime this year. By this time, US companies producing these technologies will be subject to increased control and will face new restrictions in accordance with export control laws.

If a startup has or will have any foreign property and is involved in the production, design, testing, manufacturing or development of critical technology related to one of the 27 target industries (from aircraft manufacturing to nanotechnology development), it will have to pass this information to the Committee foreign investment in the USA (CFIUS), if a foreign organization has:

This shift in rules is important because it means that there will be new restrictions on who can buy, work for a company, or invest in a technology company in the USA. The requirement to submit CFIUS for 27 target industries became law at the end of 2018 , so start-ups will need to take this into account when evaluating financing options.

In addition, if a startup has critical technologies in its business, it must determine if it can share technology with foreign organizations outside the United States and with foreign entities in the United States. With the upcoming expansion of the list of technologies identified as “critical,” the Government will also establish export controls on a larger number of technologies.

If these changes may affect your startup, you are responsible for the following:

In addition, all US companies must ensure that they do not deal with any persons on the Special Category and Prohibited Persons (SDN) List, other persons subject to restrictions, or with persons in an embargoed territory. .

Obviously, this requirement is especially important for companies with special items and technologies. To make sure that your company does not cooperate with any subject of restrictions or a country subject to the embargo, you will need a compliance program to reduce your risks.

Information technology investors also need to understand these changes to ensure that their leading companies are aware of the related issues of settlement.

Technology companies commented on the proposed definition through the Ministry of Commerce process. Some of these comments express concern that export controls on artificial intelligence will stifle future US research and development in this industry. Many companies are hesitant to bring their technology to the attention of the agency.

As long as the requirements come into force, venture capitalists and technology companies, especially start-ups, should be aware of the protocols for meeting these requirements.

It is not entirely clear what technologies fall under the new protection. In August of last year, when the Government updated the National Security Act , which prohibited American companies from sharing critical technologies with foreigners, it obliged them to cover several new unspecified “emerging technologies”.

The translation was made with the support of EDISON Software, which is professionally engaged in the development and testing of software .

However, in November, the Ministry of Commerce for the first time gave an idea of what technologies might be affected. The Federal Registration Service noticegave the following list of technologies that are being considered for inclusion in the new definition of emerging technologies (see above).

We can expect the Department of Commerce to complete the list of affected new technologies sometime this year. By this time, US companies producing these technologies will be subject to increased control and will face new restrictions in accordance with export control laws.

Why new definitions matter

If a startup has or will have any foreign property and is involved in the production, design, testing, manufacturing or development of critical technology related to one of the 27 target industries (from aircraft manufacturing to nanotechnology development), it will have to pass this information to the Committee foreign investment in the USA (CFIUS), if a foreign organization has:

- control of the company or

- access to any “Material non-public technical information” of a US business or

- membership, appointment or rights of an observer on the board or

- participation in making decisions regarding the use, development, acquisition or release of critical technologies.

This shift in rules is important because it means that there will be new restrictions on who can buy, work for a company, or invest in a technology company in the USA. The requirement to submit CFIUS for 27 target industries became law at the end of 2018 , so start-ups will need to take this into account when evaluating financing options.

In addition, if a startup has critical technologies in its business, it must determine if it can share technology with foreign organizations outside the United States and with foreign entities in the United States. With the upcoming expansion of the list of technologies identified as “critical,” the Government will also establish export controls on a larger number of technologies.

What to do

If these changes may affect your startup, you are responsible for the following:

- You need to self-classify or obtain export classifications for products and technologies — you need to determine whether your company's technology is considered “critical.”

- It is necessary to determine whether there is a “intended export” or export control applicable to your product / technology. Estimated exports are the provision of controlled technology to a foreigner in the United States.

- It is necessary to determine whether foreigners own a stake in your company and whether investors will (directly or indirectly) control the company; or will have access to any critical technology or relevant “Material non-public technical information”; whether there will be a seat on the board, either observer rights, or the right to appoint members of the board whether they will have any part in the decision-making of the company (except through property rights).

- You need to ensure that your legal advisers understand this area of the law or can help you find someone who knows. This can interfere, and perhaps even kill, the exchange, if you don’t know in advance that you owned critical technologies that could limit your ability to conduct business in the global economy.

In addition, all US companies must ensure that they do not deal with any persons on the Special Category and Prohibited Persons (SDN) List, other persons subject to restrictions, or with persons in an embargoed territory. .

Obviously, this requirement is especially important for companies with special items and technologies. To make sure that your company does not cooperate with any subject of restrictions or a country subject to the embargo, you will need a compliance program to reduce your risks.

Information technology investors also need to understand these changes to ensure that their leading companies are aware of the related issues of settlement.

Technology companies commented on the proposed definition through the Ministry of Commerce process. Some of these comments express concern that export controls on artificial intelligence will stifle future US research and development in this industry. Many companies are hesitant to bring their technology to the attention of the agency.