Investor School Y Combinator: Ron Conway

- Transfer

“Now I understand in 5 minutes: I like an entrepreneur or not. Previously, it was necessary to sit another hour in a meeting to figure out whether the founder is suitable for us or not, whether it is reliable. But, first - a man, then - an idea. "

- Ron Conway

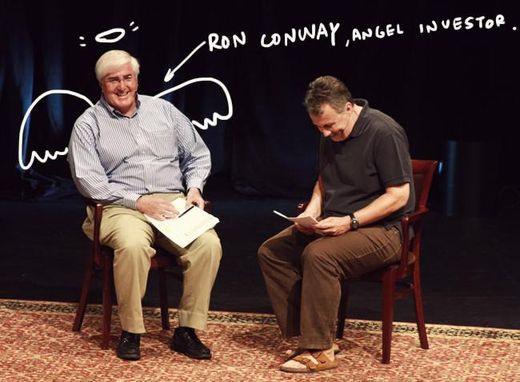

Jeff Ralston: I think it was a great review, a brief summary of how to think in order to “become a good investor.” In general, Paul Graham devoted a whole essay to what it means to be a good investor , the main character of which was Ron Conway ...

Ron Conway (laughs): Became a guinea pig!

Jeff Ralston:Yeah, the test rabbit ... so I think that a conversation with Ron would complete this course perfectly. Unfortunately, his time is limited, and he will not be able to linger. In this regard, you are not lucky, because I learned most of what I know about investing business angels from either observing Ron or talking to him. He is an incredible source ... but there are others that Ron advises to read. The site will contain a list of references on the topic “how to become an investor,” which is recommended by business angels and Ron.

Ron Conway: Get yourself educated.

Jeff Ralston: Exactly! So, since I'm collecting quotes, I have a Ron saying. Ron once said (about entrepreneurs): “you cannot learn to be purposeful and active”. I always remember this phrase when talking with entrepreneurs. I think they can all achieve a high level. But, if you think that: “perhaps they themselves are aware of this need and will begin to make more active efforts,” you are mistaken. Ron became a business angel even before many of you were born. Before I myself thought what an investment is. Can you talk about how you do it?

Ron Conway:Of course. I am glad to be here today. I was born in San Francisco, raised children in Atherton, and then returned to San Francisco. My first job was at National Semiconductor. A couple of guys left there, and with them, and I. Then I founded the computer company Altos. It was a microcomputer in the late 70s that radically changed the entire industry. Innovation is always triggered by (disruptive) changes. You are breaking ("undermining" / disrupt) someone's usual way of life ... Our leading member of the board and investor was Don Valentine, who is also the founder of the venture fund Sequoia Capital. We got along well with him, and after we sold Atos to Acer, Don suggested that I go to the board meeting with him and advise the founders, and then think about joining business angel investment activities. Honestly, I liked giving advice and not working. In Altos, I realized that I don’t like managing people, it’s much better to be a mentor. And so, in 1994, I decided to devote all my time to investing. The best investment decision I have ever made was to invest only Internet software in 1994. Another 2 years before Netscape. Today you can see for yourself how extensive the software industry is.

Jeff Ralston: How did you come to this? I mean, at that time no one invested in semiconductors, hardware, in corporate software ... What kind of mystical insight came to you and prompted you to choose this particular area?

Ron Conway: I started working with Ben Rosen. At the time, he headed Compaq. All we did then was pondering which industry would be the most (disruptive) innovation, which would grow by 1000% per year. No matter what it will be for the industry, we want to be part of it. That is, we were interested in growth. Growth is the lifeblood of innovation.

Jeff Ralston: Many of those present asked questions like: How did you start? Where does the flow of deals come from? Where did you find the flow of deals at the beginning?

Ron Conway: Yes, it's pretty simple. Only one Internet company appeared per month. Therefore, we literally searched for at least some company. For 2 years we contacted each of them.

Jeff Ralston: How many angels were there at the time?

Ron Conway: Then ... I think about 50. By the way, Jeeves and PayPal were the first companies in which we invested. We were, of course, encouraged by the fact that we are sort of laying the new trend. And even then we started investing in the anti-spam company Brightmail ...

Jeff Ralston: Yes, I remember ... And what was so about AskJeeves and PayPal that you decided to write them a check?

Ron Conway:All four companies represent SV Angel. In turn, this always gives the founders a certain reputation. First of all, we invest in the founder, in the second - in the idea. We were impressed by the founders of these companies. It's all about intuition. Now I understand in 5 minutes: I like an entrepreneur or not. Previously, it was necessary to sit another hour in a meeting to figure out whether the founder is suitable for us or not, whether it is reliable. But, first - a man, then - an idea.

Jeff Ralston: You talked a lot about what you value in the founders. I know you have a whole point on this. Let's go back to the time when you needed more time. When you were sitting alone, either with Ben, or perhaps you made your own decision about investing ... What did you outweigh? What was the decisive factor for you?

Ron Conway:What really mattered was the founder’s determination. At the beginning of their journey they are not experienced. It is incredibly difficult to establish a company, so we have special respect for them and we support them in every possible way. If the founder is determined, we know that he or she will complete the job, try all the known ways to build a large company and hire the best team of specialists. This requires tremendous fortitude. So in many ways, passion and initiative are important. The qualities that we think they possess at an early stage. But the main indicators: determination (determinaion) and purposefulness (purpose driven). For example, we met Mark Zuckerberg when he was only 19. That summer he came here, but then he had to return to Harvard. He did not return. He was incredibly inspired and fascinated by metrics and user interaction algorithms. He did not need fame or anything like that. These are the people who create successful companies.

Jeff Ralston: By the way, since we have limited time, feel free to raise your hand to ask a question. We will try to answer them. (Addressing Ron) If you recall the hundreds and hundreds of decisions made, thousands of investments made, some of which were successful and some were not, without naming names, what were the mistakes? For example, you looked at the founder and thought: “I will take him to the fund of SV angel” and it was wrong, why?

Ron Conway: Yes, there is one point that I would like to draw attention to. From 40 to 60% of invested companies go out of business. Losses are part of the angel's business model.

Jeff Ralston (laughs): 40% is not that bad yet, is it?

Ron Conway:This is the average loss rate for our 25 years of work. At first, your failure rate may exceed 50%. An integral part of the business model, should not be upset because of this. You know, many angels cease their activities, they all give up after the first failure. But, what are we talking about? Oh failure! Failure is part of the experience.

Jeff Ralston: So, we all understood: writing a check, get ready that you most likely will never see this money again. They will disappear forever.

Ron Conway: Yes, so the winners are obliged to win big, because they need to cover previous losses. This is how business angels work. And now I forgot what you asked me about.

Jeff Ralston:So, there were many cases when you made an investment with the thought that you need to take a chance, but as time passed, you already thought: “it was necessary to foresee”. Remembering your working methods at the beginning of your career, what were the mistakes? Maybe the evaluation criteria were not the ones or you did a wrong calculation or something else ...

Ron Conway: Out of 750 of our investments, only in three cases did we deal with fraudsters. Literally. They were serving a term.

Jeff Ralston: Does the criminal past have a negative effect on a deal?

Ron Conway:This happens very rarely. Rather, it happens that the co-founders do not get along with each other. In most cases, we did not foresee a conflict, and it was necessary to prevent it. Usually one of the co-founders is forced to leave. This is hard to predict. But now we are more attentive to what kind of relationship between the co-founders. I do not want to be a divorce lawyer and interfere in the company.

Jeff Ralston: Ridiculous situation, huh?

Ron Conway: You have to do this too. Again, part of our work experience.

Jeff Ralston: How to determine that the founders will maintain a good relationship?

Ron Conway:Just watch them interact during their first presentation. Carefully observe whether everyone has their own space, to whom that is interesting. Is it possible that the engineer once decides to go into marketing. Then it can make life difficult for the company.

Jeff Ralston: This is not the case when a business angel needs to get acquainted with the whole team?

Ron Conway:Of course! At the constituent assembly you meet with two or three representatives, but you need to get to know each. When I came to Google, I met Larry and Sergey there. At our meeting there were only 5 people, but there was another guy from the team behind the door. It was Salar. He developed a business model. The guy completely created a model for AdWords and by that time was engaged in system development. I met him at the door. He looked so young. We sat down and I asked him: "Do your parents know where you are?" To which he replied: "No." “Where do you study?” - “Medical at Stanford.” Then I said, "Boy, they will be mad." He never finished his studies, did not get a degree ... Definitely, when you know everyone in the building, you are familiar with every assistant, you feel the atmosphere of the company as a whole, you make a much more confident investment.

Jeff Ralston: We have a question about the post-investment period (repeats the question from the audience) what was the biggest investment you made in your portfolio companies?

Ron Conway: In addition to general coaching, first of all we introduce them to other team members. As soon as the company begins to rise, it has to hire engineers, marketers, sales specialists. Helping them build this management team is the most that you can do. If they need partnerships to increase traffic, if they need distribution, we bring them together with our contact persons from Apple, Facebook, Google. The whole point is that we helped gain momentum for very many companies. For example, someone introduced to a representative of Google.

Often it turns out that this representative is the one whom we once arranged on Google. Founders need help in building a team, distributing their product.

In addition to daily counseling, to which we devote most of our time, lately we also motivate them to finally get up from the couch, make a decision and realize their plan. Now the start-up site is covered by a wave of procrastination. It just drives me crazy! Sensitive subject. Therefore, if you notice that the founder is starting to hang, put it off until later, push it, saying, “Hey! You will not build a big company if you take the time! You need to make decisions, even if they are wrong. Send your ship ahead! ”I spend a lot of time reading a sort of notation to companies, many of which get a billion dollars in sales. But they could get 10 billion, if solved faster.

Jeff Ralston:Doing everything on time is really important. I remember how I once held a similar conversation with Ron, and someone asked a question. My answer was from the category, as I would have acted in this situation. Something like this: “You know, if I were a manager, I would cut working time. If you run a company, do the same. ” Ron looked at it all and, when I finished my small exhortation, said: "You know, as an investor, I try to give the founders the opportunity to lead the company."

Ron Conway: I usually speak of either moving forward or making decisions.

Jeff Ralston:Right. So, you should carefully give advice, because you are not the head of the company. And if you think that you will still be the manager, most likely nothing good will come of it, because it’s not a fact that you will devote a lot of time to this. How did you start working with YC?

Ron Conway:Quite an interesting story. Chris Sakka brought me to Y Combinator. At first, I even had to be convinced, because then I said: “Oh, another business incubator.” But when I first visited YC, it was 10 years ago, and met with Paul and Jessica ... It's all about the people! People in this life decide everything! Paul and Jessica were well versed in people, they were well tested by the founders. The advice they gave them was so flawless that all doubts about the success of their group of founders fell away. Therefore, Y Combinator is much higher than other business incubators. The second in the ranking of the best incubators is ten steps behind them. And all thanks to the founder selection system, counseling and mentoring work.

Jeff Ralston: He wasn't paid to say that.

Ron Conway:But this is true.

Jeff Ralston: We have a lot of investors here. Some just want to make an investment ... If you were asked to give a little advice to a novice investor, for example, if your child decided to invest (although you have very little time), what would you say to him?

Ron Conway:I am for the portfolio approach. Choose an area that you like. It is desirable area in which you have expert knowledge, because then you will be able to increase the efficiency of the investee company. I would invest some money, say, 25 thousand in five or ten companies to form my investment portfolio. Many business angels I know invest in 3 companies a year, one of them goes out of business, and “oh my god! lost a third of the portfolio! Hell, I don't want to deal with this anymore. ” The fact is that three investments are not enough. This is a risky business. You have to cover ten companies with investments of 25 thousand each, in the hope that one of them will shoot, and then you will have enough money won until the end of your career. In principle, this is how I work.

Jeff Ralston: This is our goal.

Ron Conway: Start small and grow to the point where you will be managing only the proceeds.

Jeff Ralston (repeats the question from the audience): How long did it take for you to understand that you are good at your work? Did you have any criteria for evaluating your work?

Ron Conway: There were no criteria. We just invested, but within 2 years, when AskJeeves was presented, we, of course, felt success ...

Jeff Ralston (smiles): Yes, that's the indicator ...

Ron Conway:Yes, success is an indicator. Without a doubt. You aspire to it. If you manage the profits from the investment, you have more opportunity to concentrate on the development of the founder, support it and no longer worry about losses. The luck of SV Angel lies in the fact that even in the times when we were just starting, we could correctly determine when there would be a peak of each of our investments. Investors could remain in ignorance, but we were confident that everything would be fine with capital, a profitable business. So let's just do business, benefit and help the founders.

Jeff Ralston:You have just answered this question, but I would like to return to it again. Briefly about where we started. Paul wrote about Ronco's principle, taking you as a model, and noting that magnanimity was not a personality trait, but a strategy of behavior. What does it mean to be generous to you?

Ron Conway:I think that the return of debt to society and participation in public life is an integral part of a community member. And today, more than ever, we must be socially active. While we are engaged in investments, you can do 2 things at once. You can motivate founders to take part in society at the local level, and with the current situation - at the national level. The students who are now in Parkland, Florida, charge me with enormous energy. This group of 17-year-old young people can change the country. (applause) Thank you. No need to clap, thanks! I know that this applause is addressed to students. These students can change the country. They will have an impact. I hope they solve the problem of carrying weapons. And then they will solve many other issues, as they are going to take part in the voting. And this is awesome! We must follow their example. I hope everyone here is going to march on March 24th. I'm flying to Washington to take part in the main march, but more than 500 marches will take place. And I support it. Every student in America talks about this with his parents and grandparents. This movement can really make a difference and bring Trump and his buddies to life.

Jeff Ralston: Not an easy task. Well, sorry, we have no more time for questions. Ron needs to hurry. Finally: everyone here receives a virtual invitation to win the demo days of 2018. Until now, I have not got used to saying demo days instead of demo day. And 10 guests will receive an invitation in person. Do you have any small advice goodbye to people who will go on a demonstration day?

Ron Conway: Take a lot of notes, the pace is very fast. I would sit in front and listen carefully ...

Jeff Ralston: It will not work this way, all the companies represented there will be just heard ...

Ron Conway:I see ... You cannot listen remotely ... Take lots of notes and be determined. I would try to choose an area in which you will specialize. It would be nice if you were already well acquainted with her, and did not take everything and had to study everything at once, in order to assist the founders from many different areas. Now of particular interest is the blockchain and the cryptocurrency space. I think this is Web 3.0. I guess this is a new stage in the development of the Internet. Quite a fascinating area, but extremely difficult to work with, because you will need to study this whole workflow from and to, explore all the space.

Jeff Ralston: Thank you very much, Ron, for visiting us.

Ron Conway: I was glad.

Jeff Ralston: So almost everything. I would like to make a brief review of what we have said here. We started with ... I do not remember where, for a long time it was. We started with why doing this. I think Sam had an amazing conversation about what your motivation might be to start investing, how you should think about what you are investing and where you are investing. Then we talked a little about the investment mechanism and in detail about security. Raise your hand if you think you know how to be safe. Raise your hand if you tried it out. Those of you who have not tried, but think you know how its mechanisms work, are mistaken. You do not know. In fact, we did not focus on why we needed security. Because we want everything to happen quickly, easily, cheaply and simply. It turns out that every time you do something, undesirable consequences arise. Therefore, we tried to rectify the situation by creating tools so that people could understand what was going on. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. when you do something, undesirable consequences arise. Therefore, we tried to rectify the situation by creating tools so that people could understand what was going on. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. when you do something, undesirable consequences arise. Therefore, we tried to rectify the situation by creating tools so that people could understand what was going on. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. Therefore, we tried to rectify the situation by creating tools so that people could understand what was going on. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. Therefore, we tried to rectify the situation by creating tools so that people could understand what was going on. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. which is fairly easy to model), understand what you are doing, how it works and how this transformation works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. which is fairly easy to model), understand what you are doing, how it works and how this transformation works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something.

We talked about how to get a flow of deals; talked about how to get started. We listened to angels a lot, some of them became superangels, some became professionals. Some of them continue to be angels, some still invest their own money. We talked about how to make an appointment with the company, how to make a key investment decision. We talked about how to turn it all into a serious matter. In fact, it means a lot to me. I have been doing this for years without being serious enough. I do not want to say how much I got up. I paid a lot. (laughs) We talked a little about what the situation today, and a little about what to expect in the future. I personally believe that the investments of angels, in the form about which we spoke about this here, will exist for a long time. Capital may evaporate and disappear for good in the future, but this will definitely not happen in the near future. In this I do not believe. I think that ISEAL will become part of our world, and we will have to take this into account when making decisions, but also business angels will have to take this into account.

I would like to repeat one of the key points to keep it in mind when we talked about what it means to be good and generous. No need to be, I repeat, petty or, conversely, wasteful. Be a good investor. The last words, before we go communicate, eat and drink. Let's work together to improve the ecosystem, ensure its integrity and preserve integrity. We can all do our part and win everything from it. Venture capitalists often suffer from reputation. This is probably due to the fact that in the past they have not always acted honestly. But all is not so. You listened a lot, especially about the initial stage. There is no win for you and no win for companies, and no win for the entire ecosystem. Aaron talked about this. We both wrote about it.

I published a post “Transparency and investment in a startup”. I think this was partly due to the way in which people basically raised their capital at an early stage. But we should not give up on transparency. If you convert, you must indicate what your conversion price is and how it was calculated. And you should check it out. And you must be provided with the information necessary for verification. I suggested the form, the numbers now do not matter. The form is in the post, you can send it. When you receive a letter asking: "Please sign these documents within two hours" and 400 pages of the document are attached, send them back with this form with the words: "Of course, just fill out this form for me and I will immediately sign everything." And it is quite legitimate, high quality and reliable.

I mentioned that we would like to get feedback on this course. I’m sure we have more work to do. I hope you tell us what can be changed, and how next time we can do it better and more useful for you and for others.

Video:

- Ron Conway

Jeff Ralston: I think it was a great review, a brief summary of how to think in order to “become a good investor.” In general, Paul Graham devoted a whole essay to what it means to be a good investor , the main character of which was Ron Conway ...

Ron Conway (laughs): Became a guinea pig!

Jeff Ralston:Yeah, the test rabbit ... so I think that a conversation with Ron would complete this course perfectly. Unfortunately, his time is limited, and he will not be able to linger. In this regard, you are not lucky, because I learned most of what I know about investing business angels from either observing Ron or talking to him. He is an incredible source ... but there are others that Ron advises to read. The site will contain a list of references on the topic “how to become an investor,” which is recommended by business angels and Ron.

Ron Conway: Get yourself educated.

Jeff Ralston: Exactly! So, since I'm collecting quotes, I have a Ron saying. Ron once said (about entrepreneurs): “you cannot learn to be purposeful and active”. I always remember this phrase when talking with entrepreneurs. I think they can all achieve a high level. But, if you think that: “perhaps they themselves are aware of this need and will begin to make more active efforts,” you are mistaken. Ron became a business angel even before many of you were born. Before I myself thought what an investment is. Can you talk about how you do it?

Ron Conway:Of course. I am glad to be here today. I was born in San Francisco, raised children in Atherton, and then returned to San Francisco. My first job was at National Semiconductor. A couple of guys left there, and with them, and I. Then I founded the computer company Altos. It was a microcomputer in the late 70s that radically changed the entire industry. Innovation is always triggered by (disruptive) changes. You are breaking ("undermining" / disrupt) someone's usual way of life ... Our leading member of the board and investor was Don Valentine, who is also the founder of the venture fund Sequoia Capital. We got along well with him, and after we sold Atos to Acer, Don suggested that I go to the board meeting with him and advise the founders, and then think about joining business angel investment activities. Honestly, I liked giving advice and not working. In Altos, I realized that I don’t like managing people, it’s much better to be a mentor. And so, in 1994, I decided to devote all my time to investing. The best investment decision I have ever made was to invest only Internet software in 1994. Another 2 years before Netscape. Today you can see for yourself how extensive the software industry is.

Jeff Ralston: How did you come to this? I mean, at that time no one invested in semiconductors, hardware, in corporate software ... What kind of mystical insight came to you and prompted you to choose this particular area?

Ron Conway: I started working with Ben Rosen. At the time, he headed Compaq. All we did then was pondering which industry would be the most (disruptive) innovation, which would grow by 1000% per year. No matter what it will be for the industry, we want to be part of it. That is, we were interested in growth. Growth is the lifeblood of innovation.

Jeff Ralston: Many of those present asked questions like: How did you start? Where does the flow of deals come from? Where did you find the flow of deals at the beginning?

Ron Conway: Yes, it's pretty simple. Only one Internet company appeared per month. Therefore, we literally searched for at least some company. For 2 years we contacted each of them.

Jeff Ralston: How many angels were there at the time?

Ron Conway: Then ... I think about 50. By the way, Jeeves and PayPal were the first companies in which we invested. We were, of course, encouraged by the fact that we are sort of laying the new trend. And even then we started investing in the anti-spam company Brightmail ...

Jeff Ralston: Yes, I remember ... And what was so about AskJeeves and PayPal that you decided to write them a check?

Ron Conway:All four companies represent SV Angel. In turn, this always gives the founders a certain reputation. First of all, we invest in the founder, in the second - in the idea. We were impressed by the founders of these companies. It's all about intuition. Now I understand in 5 minutes: I like an entrepreneur or not. Previously, it was necessary to sit another hour in a meeting to figure out whether the founder is suitable for us or not, whether it is reliable. But, first - a man, then - an idea.

Jeff Ralston: You talked a lot about what you value in the founders. I know you have a whole point on this. Let's go back to the time when you needed more time. When you were sitting alone, either with Ben, or perhaps you made your own decision about investing ... What did you outweigh? What was the decisive factor for you?

Ron Conway:What really mattered was the founder’s determination. At the beginning of their journey they are not experienced. It is incredibly difficult to establish a company, so we have special respect for them and we support them in every possible way. If the founder is determined, we know that he or she will complete the job, try all the known ways to build a large company and hire the best team of specialists. This requires tremendous fortitude. So in many ways, passion and initiative are important. The qualities that we think they possess at an early stage. But the main indicators: determination (determinaion) and purposefulness (purpose driven). For example, we met Mark Zuckerberg when he was only 19. That summer he came here, but then he had to return to Harvard. He did not return. He was incredibly inspired and fascinated by metrics and user interaction algorithms. He did not need fame or anything like that. These are the people who create successful companies.

Jeff Ralston: By the way, since we have limited time, feel free to raise your hand to ask a question. We will try to answer them. (Addressing Ron) If you recall the hundreds and hundreds of decisions made, thousands of investments made, some of which were successful and some were not, without naming names, what were the mistakes? For example, you looked at the founder and thought: “I will take him to the fund of SV angel” and it was wrong, why?

Ron Conway: Yes, there is one point that I would like to draw attention to. From 40 to 60% of invested companies go out of business. Losses are part of the angel's business model.

Jeff Ralston (laughs): 40% is not that bad yet, is it?

Ron Conway:This is the average loss rate for our 25 years of work. At first, your failure rate may exceed 50%. An integral part of the business model, should not be upset because of this. You know, many angels cease their activities, they all give up after the first failure. But, what are we talking about? Oh failure! Failure is part of the experience.

Jeff Ralston: So, we all understood: writing a check, get ready that you most likely will never see this money again. They will disappear forever.

Ron Conway: Yes, so the winners are obliged to win big, because they need to cover previous losses. This is how business angels work. And now I forgot what you asked me about.

Jeff Ralston:So, there were many cases when you made an investment with the thought that you need to take a chance, but as time passed, you already thought: “it was necessary to foresee”. Remembering your working methods at the beginning of your career, what were the mistakes? Maybe the evaluation criteria were not the ones or you did a wrong calculation or something else ...

Ron Conway: Out of 750 of our investments, only in three cases did we deal with fraudsters. Literally. They were serving a term.

Jeff Ralston: Does the criminal past have a negative effect on a deal?

Ron Conway:This happens very rarely. Rather, it happens that the co-founders do not get along with each other. In most cases, we did not foresee a conflict, and it was necessary to prevent it. Usually one of the co-founders is forced to leave. This is hard to predict. But now we are more attentive to what kind of relationship between the co-founders. I do not want to be a divorce lawyer and interfere in the company.

Jeff Ralston: Ridiculous situation, huh?

Ron Conway: You have to do this too. Again, part of our work experience.

Jeff Ralston: How to determine that the founders will maintain a good relationship?

Ron Conway:Just watch them interact during their first presentation. Carefully observe whether everyone has their own space, to whom that is interesting. Is it possible that the engineer once decides to go into marketing. Then it can make life difficult for the company.

Jeff Ralston: This is not the case when a business angel needs to get acquainted with the whole team?

Ron Conway:Of course! At the constituent assembly you meet with two or three representatives, but you need to get to know each. When I came to Google, I met Larry and Sergey there. At our meeting there were only 5 people, but there was another guy from the team behind the door. It was Salar. He developed a business model. The guy completely created a model for AdWords and by that time was engaged in system development. I met him at the door. He looked so young. We sat down and I asked him: "Do your parents know where you are?" To which he replied: "No." “Where do you study?” - “Medical at Stanford.” Then I said, "Boy, they will be mad." He never finished his studies, did not get a degree ... Definitely, when you know everyone in the building, you are familiar with every assistant, you feel the atmosphere of the company as a whole, you make a much more confident investment.

Jeff Ralston: We have a question about the post-investment period (repeats the question from the audience) what was the biggest investment you made in your portfolio companies?

Ron Conway: In addition to general coaching, first of all we introduce them to other team members. As soon as the company begins to rise, it has to hire engineers, marketers, sales specialists. Helping them build this management team is the most that you can do. If they need partnerships to increase traffic, if they need distribution, we bring them together with our contact persons from Apple, Facebook, Google. The whole point is that we helped gain momentum for very many companies. For example, someone introduced to a representative of Google.

Often it turns out that this representative is the one whom we once arranged on Google. Founders need help in building a team, distributing their product.

In addition to daily counseling, to which we devote most of our time, lately we also motivate them to finally get up from the couch, make a decision and realize their plan. Now the start-up site is covered by a wave of procrastination. It just drives me crazy! Sensitive subject. Therefore, if you notice that the founder is starting to hang, put it off until later, push it, saying, “Hey! You will not build a big company if you take the time! You need to make decisions, even if they are wrong. Send your ship ahead! ”I spend a lot of time reading a sort of notation to companies, many of which get a billion dollars in sales. But they could get 10 billion, if solved faster.

Jeff Ralston:Doing everything on time is really important. I remember how I once held a similar conversation with Ron, and someone asked a question. My answer was from the category, as I would have acted in this situation. Something like this: “You know, if I were a manager, I would cut working time. If you run a company, do the same. ” Ron looked at it all and, when I finished my small exhortation, said: "You know, as an investor, I try to give the founders the opportunity to lead the company."

Ron Conway: I usually speak of either moving forward or making decisions.

Jeff Ralston:Right. So, you should carefully give advice, because you are not the head of the company. And if you think that you will still be the manager, most likely nothing good will come of it, because it’s not a fact that you will devote a lot of time to this. How did you start working with YC?

Ron Conway:Quite an interesting story. Chris Sakka brought me to Y Combinator. At first, I even had to be convinced, because then I said: “Oh, another business incubator.” But when I first visited YC, it was 10 years ago, and met with Paul and Jessica ... It's all about the people! People in this life decide everything! Paul and Jessica were well versed in people, they were well tested by the founders. The advice they gave them was so flawless that all doubts about the success of their group of founders fell away. Therefore, Y Combinator is much higher than other business incubators. The second in the ranking of the best incubators is ten steps behind them. And all thanks to the founder selection system, counseling and mentoring work.

Jeff Ralston: He wasn't paid to say that.

Ron Conway:But this is true.

Jeff Ralston: We have a lot of investors here. Some just want to make an investment ... If you were asked to give a little advice to a novice investor, for example, if your child decided to invest (although you have very little time), what would you say to him?

Ron Conway:I am for the portfolio approach. Choose an area that you like. It is desirable area in which you have expert knowledge, because then you will be able to increase the efficiency of the investee company. I would invest some money, say, 25 thousand in five or ten companies to form my investment portfolio. Many business angels I know invest in 3 companies a year, one of them goes out of business, and “oh my god! lost a third of the portfolio! Hell, I don't want to deal with this anymore. ” The fact is that three investments are not enough. This is a risky business. You have to cover ten companies with investments of 25 thousand each, in the hope that one of them will shoot, and then you will have enough money won until the end of your career. In principle, this is how I work.

Jeff Ralston: This is our goal.

Ron Conway: Start small and grow to the point where you will be managing only the proceeds.

Jeff Ralston (repeats the question from the audience): How long did it take for you to understand that you are good at your work? Did you have any criteria for evaluating your work?

Ron Conway: There were no criteria. We just invested, but within 2 years, when AskJeeves was presented, we, of course, felt success ...

Jeff Ralston (smiles): Yes, that's the indicator ...

Ron Conway:Yes, success is an indicator. Without a doubt. You aspire to it. If you manage the profits from the investment, you have more opportunity to concentrate on the development of the founder, support it and no longer worry about losses. The luck of SV Angel lies in the fact that even in the times when we were just starting, we could correctly determine when there would be a peak of each of our investments. Investors could remain in ignorance, but we were confident that everything would be fine with capital, a profitable business. So let's just do business, benefit and help the founders.

Jeff Ralston:You have just answered this question, but I would like to return to it again. Briefly about where we started. Paul wrote about Ronco's principle, taking you as a model, and noting that magnanimity was not a personality trait, but a strategy of behavior. What does it mean to be generous to you?

Ron Conway:I think that the return of debt to society and participation in public life is an integral part of a community member. And today, more than ever, we must be socially active. While we are engaged in investments, you can do 2 things at once. You can motivate founders to take part in society at the local level, and with the current situation - at the national level. The students who are now in Parkland, Florida, charge me with enormous energy. This group of 17-year-old young people can change the country. (applause) Thank you. No need to clap, thanks! I know that this applause is addressed to students. These students can change the country. They will have an impact. I hope they solve the problem of carrying weapons. And then they will solve many other issues, as they are going to take part in the voting. And this is awesome! We must follow their example. I hope everyone here is going to march on March 24th. I'm flying to Washington to take part in the main march, but more than 500 marches will take place. And I support it. Every student in America talks about this with his parents and grandparents. This movement can really make a difference and bring Trump and his buddies to life.

Jeff Ralston: Not an easy task. Well, sorry, we have no more time for questions. Ron needs to hurry. Finally: everyone here receives a virtual invitation to win the demo days of 2018. Until now, I have not got used to saying demo days instead of demo day. And 10 guests will receive an invitation in person. Do you have any small advice goodbye to people who will go on a demonstration day?

Ron Conway: Take a lot of notes, the pace is very fast. I would sit in front and listen carefully ...

Jeff Ralston: It will not work this way, all the companies represented there will be just heard ...

Ron Conway:I see ... You cannot listen remotely ... Take lots of notes and be determined. I would try to choose an area in which you will specialize. It would be nice if you were already well acquainted with her, and did not take everything and had to study everything at once, in order to assist the founders from many different areas. Now of particular interest is the blockchain and the cryptocurrency space. I think this is Web 3.0. I guess this is a new stage in the development of the Internet. Quite a fascinating area, but extremely difficult to work with, because you will need to study this whole workflow from and to, explore all the space.

Jeff Ralston: Thank you very much, Ron, for visiting us.

Ron Conway: I was glad.

Jeff Ralston: So almost everything. I would like to make a brief review of what we have said here. We started with ... I do not remember where, for a long time it was. We started with why doing this. I think Sam had an amazing conversation about what your motivation might be to start investing, how you should think about what you are investing and where you are investing. Then we talked a little about the investment mechanism and in detail about security. Raise your hand if you think you know how to be safe. Raise your hand if you tried it out. Those of you who have not tried, but think you know how its mechanisms work, are mistaken. You do not know. In fact, we did not focus on why we needed security. Because we want everything to happen quickly, easily, cheaply and simply. It turns out that every time you do something, undesirable consequences arise. Therefore, we tried to rectify the situation by creating tools so that people could understand what was going on. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. when you do something, undesirable consequences arise. Therefore, we tried to rectify the situation by creating tools so that people could understand what was going on. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. when you do something, undesirable consequences arise. Therefore, we tried to rectify the situation by creating tools so that people could understand what was going on. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. Therefore, we tried to rectify the situation by creating tools so that people could understand what was going on. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. Therefore, we tried to rectify the situation by creating tools so that people could understand what was going on. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. If you are going to make a reliable investment, so, we do not yet, but we are going to create it, but we are going to create a spreadsheet that you can use for modeling (you can also use Angelcalc, which is quite easy to model), understand what you are doing how it works and how this conversion works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. which is fairly easy to model), understand what you are doing, how it works and how this transformation works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something. which is fairly easy to model), understand what you are doing, how it works and how this transformation works. You can see the formula, perform the calculations, make out everything. We may set up security to eliminate some confusion. Only we are 100% sure that unintended consequences will only aggravate everything. Therefore, although we doubt, but most likely, we will do something.

We talked about how to get a flow of deals; talked about how to get started. We listened to angels a lot, some of them became superangels, some became professionals. Some of them continue to be angels, some still invest their own money. We talked about how to make an appointment with the company, how to make a key investment decision. We talked about how to turn it all into a serious matter. In fact, it means a lot to me. I have been doing this for years without being serious enough. I do not want to say how much I got up. I paid a lot. (laughs) We talked a little about what the situation today, and a little about what to expect in the future. I personally believe that the investments of angels, in the form about which we spoke about this here, will exist for a long time. Capital may evaporate and disappear for good in the future, but this will definitely not happen in the near future. In this I do not believe. I think that ISEAL will become part of our world, and we will have to take this into account when making decisions, but also business angels will have to take this into account.

I would like to repeat one of the key points to keep it in mind when we talked about what it means to be good and generous. No need to be, I repeat, petty or, conversely, wasteful. Be a good investor. The last words, before we go communicate, eat and drink. Let's work together to improve the ecosystem, ensure its integrity and preserve integrity. We can all do our part and win everything from it. Venture capitalists often suffer from reputation. This is probably due to the fact that in the past they have not always acted honestly. But all is not so. You listened a lot, especially about the initial stage. There is no win for you and no win for companies, and no win for the entire ecosystem. Aaron talked about this. We both wrote about it.

I published a post “Transparency and investment in a startup”. I think this was partly due to the way in which people basically raised their capital at an early stage. But we should not give up on transparency. If you convert, you must indicate what your conversion price is and how it was calculated. And you should check it out. And you must be provided with the information necessary for verification. I suggested the form, the numbers now do not matter. The form is in the post, you can send it. When you receive a letter asking: "Please sign these documents within two hours" and 400 pages of the document are attached, send them back with this form with the words: "Of course, just fill out this form for me and I will immediately sign everything." And it is quite legitimate, high quality and reliable.

I mentioned that we would like to get feedback on this course. I’m sure we have more work to do. I hope you tell us what can be changed, and how next time we can do it better and more useful for you and for others.

Video:

Give it back. No one becomes a lot of luck. Giving back creates a virtuous cycle.

- Ron Conway

About #philtech

#philtech (технологии + филантропия) — это открытые публично описанные технологии, выравнивающие уровень жизни максимально возможного количества людей за счёт создания прозрачных платформ для взаимодействия и доступа к данным и знаниям. И удовлетворяющие принципам филтеха:

1. Открытые и копируемые, а не конкурентно-проприетарные.

2. Построенные на принципах самоорганизации и горизонтального взаимодействия.

3. Устойчивые и перспективо-ориентированные, а не преследующие локальную выгоду.

4. Построенные на [открытых] данных, а не традициях и убеждениях

5. Ненасильственные и неманипуляционные.

6. Инклюзивные, и не работающие на одну группу людей за счёт других.

Акселератор социальных технологических стартапов PhilTech — программа интенсивного развития проектов ранних стадий, направленных на выравнивание доступа к информации, ресурсам и возможностям. Второй поток: март–июнь 2018.

Чат в Telegram

Сообщество людей, развивающих филтех-проекты или просто заинтересованных в теме технологий для социального сектора.

#philtech news

Телеграм-канал с новостями о проектах в идеологии #philtech и ссылками на полезные материалы.

Подписаться на еженедельную рассылку

#philtech (технологии + филантропия) — это открытые публично описанные технологии, выравнивающие уровень жизни максимально возможного количества людей за счёт создания прозрачных платформ для взаимодействия и доступа к данным и знаниям. И удовлетворяющие принципам филтеха:

1. Открытые и копируемые, а не конкурентно-проприетарные.

2. Построенные на принципах самоорганизации и горизонтального взаимодействия.

3. Устойчивые и перспективо-ориентированные, а не преследующие локальную выгоду.

4. Построенные на [открытых] данных, а не традициях и убеждениях

5. Ненасильственные и неманипуляционные.

6. Инклюзивные, и не работающие на одну группу людей за счёт других.

Акселератор социальных технологических стартапов PhilTech — программа интенсивного развития проектов ранних стадий, направленных на выравнивание доступа к информации, ресурсам и возможностям. Второй поток: март–июнь 2018.

Чат в Telegram

Сообщество людей, развивающих филтех-проекты или просто заинтересованных в теме технологий для социального сектора.

#philtech news

Телеграм-канал с новостями о проектах в идеологии #philtech и ссылками на полезные материалы.

Подписаться на еженедельную рассылку