Burgeronomy: What is the Big Mac Index and why is it needed?

On the Internet and on television, one can often find references to the “Big Mac Index” in relation to the economic situation of a particular country. We decided to understand how this index arose and what it is actually used for.

Story

The “Big Mac Index” first appeared in September 1986 in an article by Pem Woodall for The Economist magazine. Initially, it was a half-joking example of a tool for assessing the currency market.

The index is based on the theory of purchasing power parity, that is, the equal value of a basket of goods in different countries. In this case, a set of products was replaced by a popular burger from the McDonald's menu. The index has become so popular that it continues to be updated and published until now.

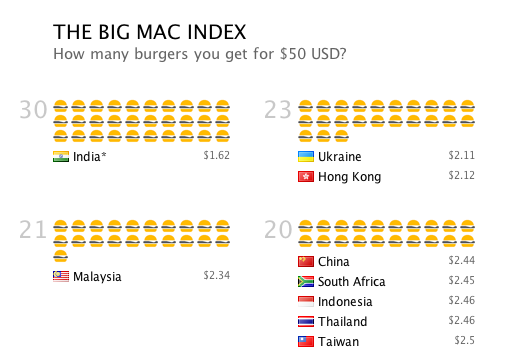

For example, if a set of the same goods costs 10 euros in Germany and 5 pounds in the UK, their ratio should be 2: 1, that is, the fair exchange rate will be two euros per pound, if we conditionally omit the transportation costs. If in some cases this ratio does not agree with real indicators, it means that the rate of the chosen currency is undervalued or overvalued. How many burgers can be bought for $ 50 in a particular country (full picture will open on click) McDonald's restaurants are in many countries of the world, so the authors of the index chose Big Mac with a universal composition of products as one of the most common and suitable benchmarks for assessing the exchange rate ratio.

Why is all this necessary?

In 1967, 47 cents were asked for by Big Mac. In 1968, it spread across the United States and cost 49 cents. By the time the index was compiled by The Economist, the cost of the Big Mac was already $ 1.6.

The first McDonald's in Moscow opened in 1990 on Pushkin Square, while the Big Mac cost 3 rubles 75 kopecks or $ 6 18 cents at the official rate. In the US, a popular burger was worth $ 2 at the time.

Since then, economists have suggested using Big Macs to estimate gross domestic product (GDP) and its share per person. This led to the emergence of a playful section of the economy - “burgeronomy”.

Despite the advantages of the “Big Mac Index,” it has some limitations. In many developing countries, eating in an international fast food chain like McDonald's is relatively expensive compared to local establishments, so the demand for Big Macs is small.

Fast food chains apply different strategies, adapting to a specific region, customer behavior and capabilities, respectively, the prices for the same product can vary greatly.

The cost of the menu McDonald's is influenced by many factors: from the cost of production, delivery and rental to advertising costs, so this index is not suitable for assessing the economies of all countries in the world. And the burger itself during its existence has repeatedly changed in size and weight.

In addition, the number of countries eligible for evaluation depends directly on the presence of McDonald's there. For example, in Africa there is a “KFC index”, it is used for countries where the McDonald’s network is not represented, but you can purchase a brand chicken bucket from its competitor.

Every year, The Economist presents the results of its index. For example, in 2011, Big Mac cost 78 rubles (2.7 dollars) in Russia, and 4.07 dollars in the United States. This means that the ruble was undervalued by 34 percent, and the dollar should have cost 18.5 rubles.

Since 2011, the problem has been solved with the calculation of the index in India. Hindus do not eat beef, which is part of the "Big Mac", a cow for them is a sacred animal. But according to the compilers of the index compilers, the price of meat is only 10 percent of the total cost, therefore, the Maharaja Mac was chosen for the calculations.

In July 2016, The Economist updated the index again. According to the newspaper, the average price of "Big Mac" in the United States in July was 5.04 dollars, while in Russia it was 130 rubles or 2.05 dollars. That is, the ruble exchange rate is undervalued by 60 percent, and in fact the dollar should cost 25.79 rubles.

Thus, the ruble is among the three most undervalued currencies in the world, yielding to the Ukrainian hryvnia and Malaysian ringitta. Also in the list of the most undervalued are the currencies of South Africa, Taiwan, Indonesia, Mexico, India, Poland and Hong Kong. According to the degree of "undervalued" according to the Big Mac index, the ruble is far from being a champion. If in the US, a big Mac costs $ 5.04, then in Ukraine in terms of dollars at the official exchange rate, its price is $ 1.57. Consequently, the hryvnia is undervalued by 68.8% and for the dollar should not give 24.8, but only 7.74 hryvnia.

In the other part of the rating there are overvalued currencies, the Swiss franc is above all, according to the Big Mac index it is overestimated by 30.8 percent, the top three also includes the Norwegian and the Swedish krona.

“Burgeronomy” has never been conceived as an accurate way to measure currencies, but rather as a tool to simplify the understanding of the theory of purchasing power parity. But the “Big Maca Index” has become a world standard, is used in scientific papers, and economists have made other “food” indices in its likeness.

The Big Mac Index does not indicate what currency exchange rates will be tomorrow. The real purpose of such indices is to be an indicator of what is happening in the economy, to simplify the understanding of exchange rates and point out possible changes in the distant future.

Other materials on the topic of stock trading from ITinvest :

- Analytical materials from ITinvest experts

- Structured Products - What It Is and How It Works

- Trading on the exchange in questions and answers: accounts, insurance and comparison with banks

- Selection: 50+ materials for understanding the stock market

- Exchange or bank: we compare the possibilities of currency exchange and saving funds

- Training and seminars for novice traders