I sit high, I see everything: a test drive of the My Broker service

Perhaps each of us has heard of someone who “earned money on the exchange”, “rose on trading in the stock market”, etc. Indeed, working with stock instruments as a private investor is one way to generate income. Of course, with a share of risk. And for sure, someone wanted to see from the inside how everything works and is it true that hundreds of charts and numbers are running before the eyes of a novice investor who does not sleep day and night.

Most recently, BCS launched in beta mode the first in Russia simple and convenient service for trading - the My Broker application . Especially for Geektimes, we asked a former private investor to test the system from the perspective of his experience, share his impressions and at the same time tell a little about his path to the stock market. We give him the floor.

"Hi Gicktime!

My life ceased to be the same back in 2005. Then, I, a student of the Faculty of Finance with an average score of 5.0, took full advantage of the right to choose and voluntarily entered my name on the list of specializations “Financial Management”, without even knowing why classmates rushed to taxes and banking. Everything became clear in September: our small group of courageous were guaranteed two years of financial mathematics, the securities market, stock exchange business, in-depth economic analysis and statistics, probability theory and otherperversions of disciplines that you can’t skip without consequences. All this time, only one thought consoled: I will become a broker, then I will conquer Wall Street and take my place between Jordan Belfort and Bernard Madoff.

So, the introduction. I did not become a broker; I did not even try to conquer Wall Street. But the stock market and knowledge about it continued to beckon - I tried to make money on my own at exchange rates, and then I dreamed of succeeding in transactions with Gazprom shares. Dreams Come True. But somehow quite partly. As a result, the work completely distracted me from exchange affairs, but BCS’s offer to try My Broker and talk about it hurt me.

"My broker" provides an opportunity to buy and sell stocks, bonds, and other financial instruments; exchange currency on the exchange at the exchange rate (how to do this, already described in the BCS blog) in a simple and convenient way.

I’ll say right away to whom I would recommend this application.

Of the obvious advantages, I especially note the modern and very clear interface, the availability of an application for the iPhone (I’ll explain why this is cool below), the information content and the high speed of data updates. In general, the application works without a single hang, even with a weak connection. There is no Android app yet, but it will be available shortly. The web version is perfectly adapted for mobile devices, and on an 8-inch tablet everything suited me, but on 4.5 and 5 inches it’s not the same feeling.

Depending on experience, amount, currency and investment period, “My broker” forms a personal offer. Although I had experience in investing, to begin with, I lied a bit and chose, as it seems to me, the most starting set of conditions: there is no investment experience, the amount is 50,000 - 300,000, in rubles, the income is moderate. In general, My Broker offers options for the ratio of profitability and risk:

I deliberately refused a low level of risk, because I wanted to get an offer more interesting. Well, aspirations for high profitability for beginners should be avoided, since it is associated with risks that you need to be prepared for. Stress at the beginning of work with the stock market or exchange is not the best assistant, you need to delve into the work with financial instruments gradually. In addition, experience in financial transactions comes with a series of mistakes - starting with small experiments, you greatly reduce the price of this experience. For example, my first experience in 2008 cost me 30,000 rubles, two then salaries. And only further caution and balanced decisions helped me win back losses and even earn extra money.

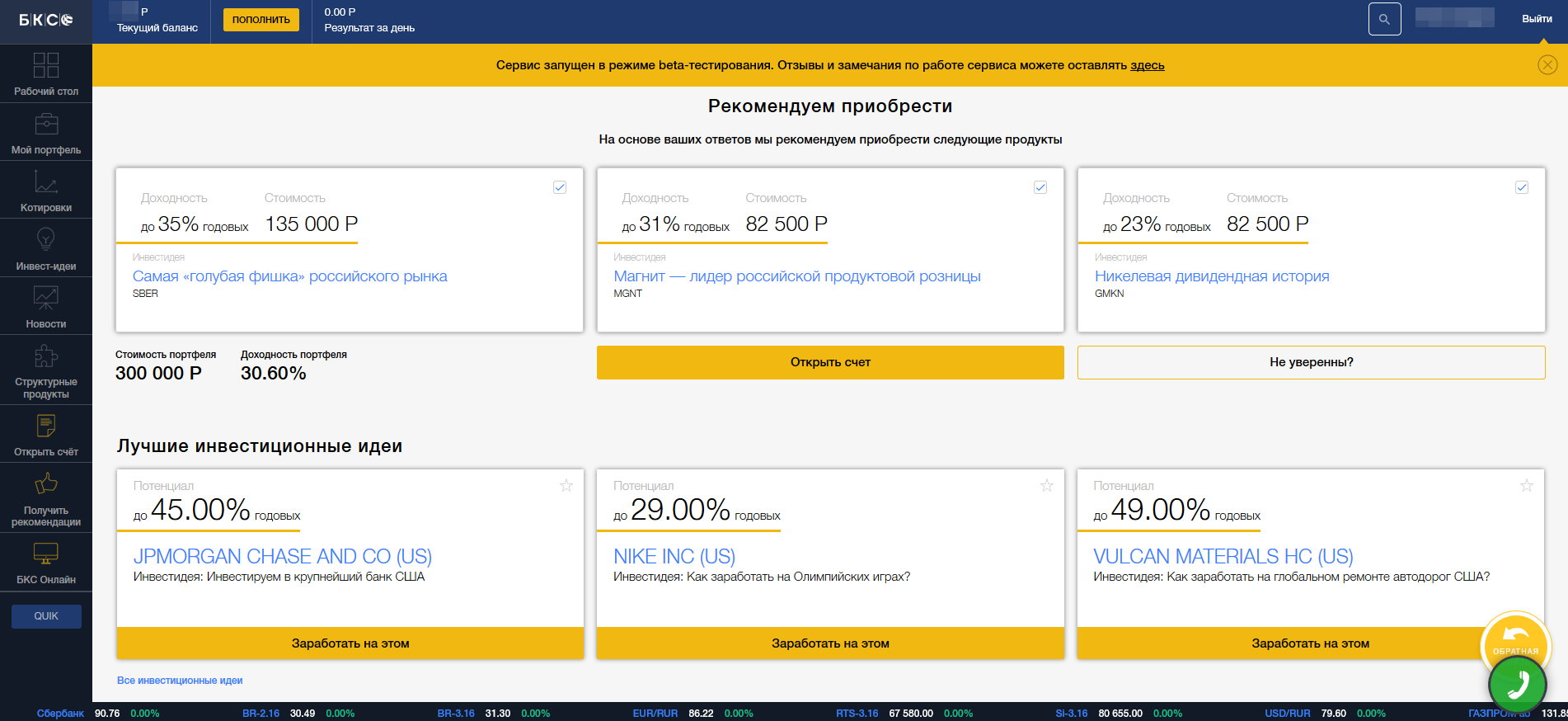

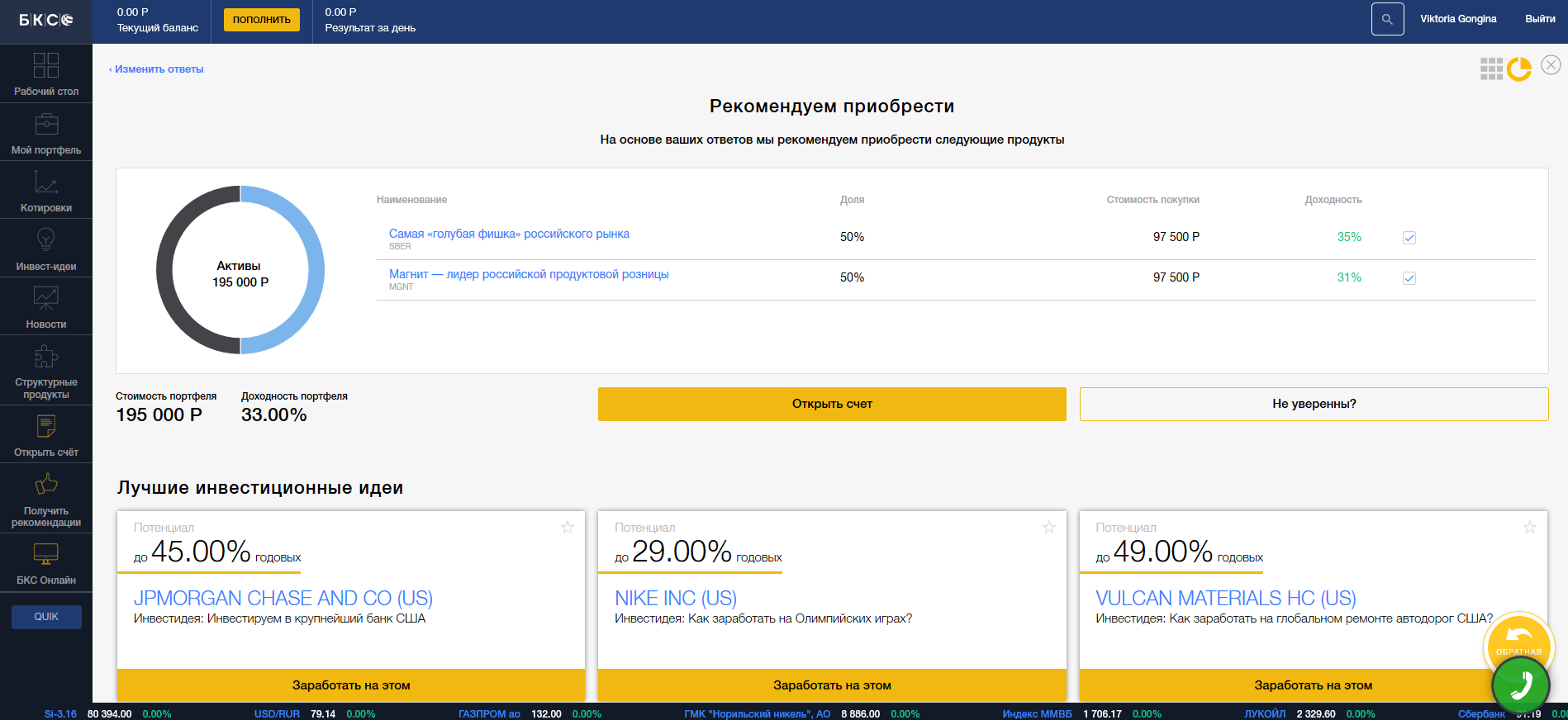

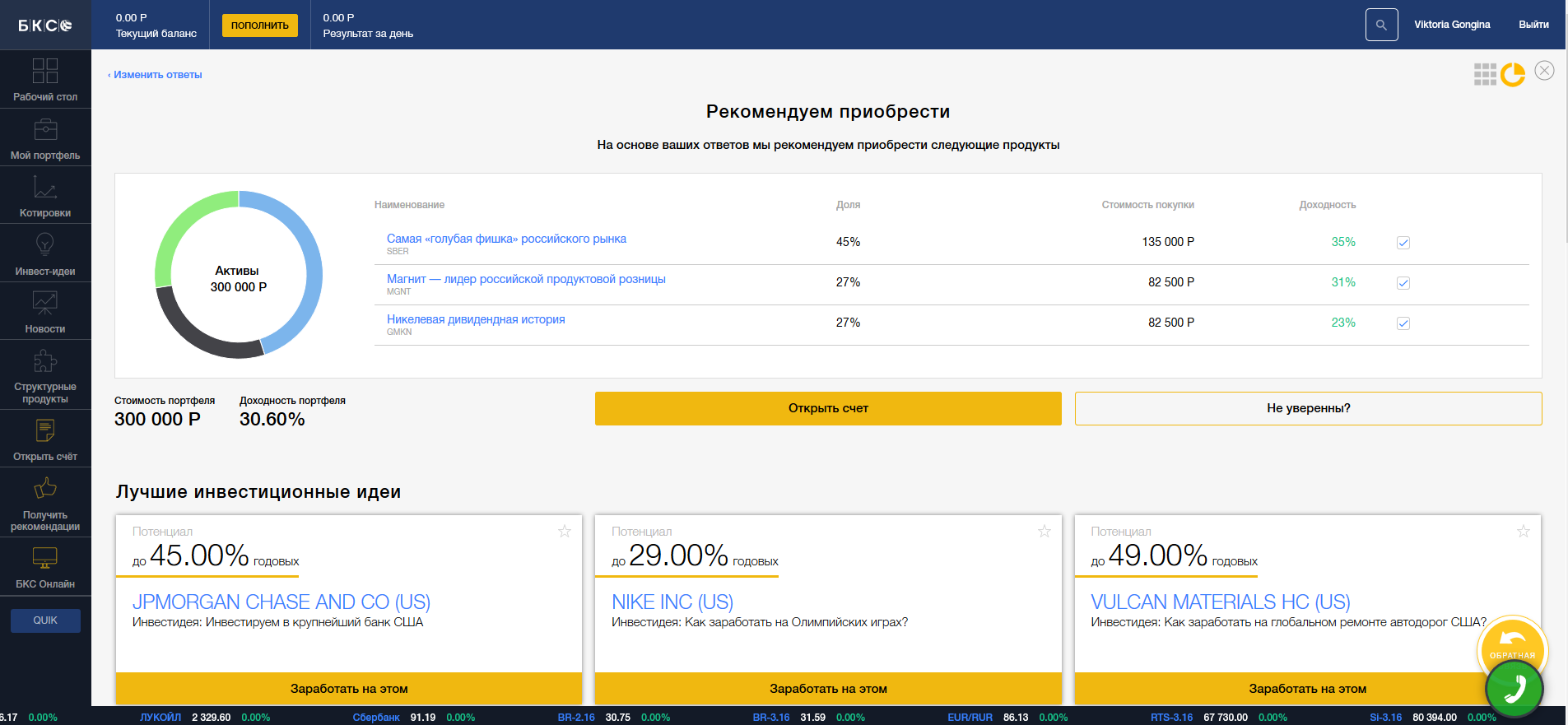

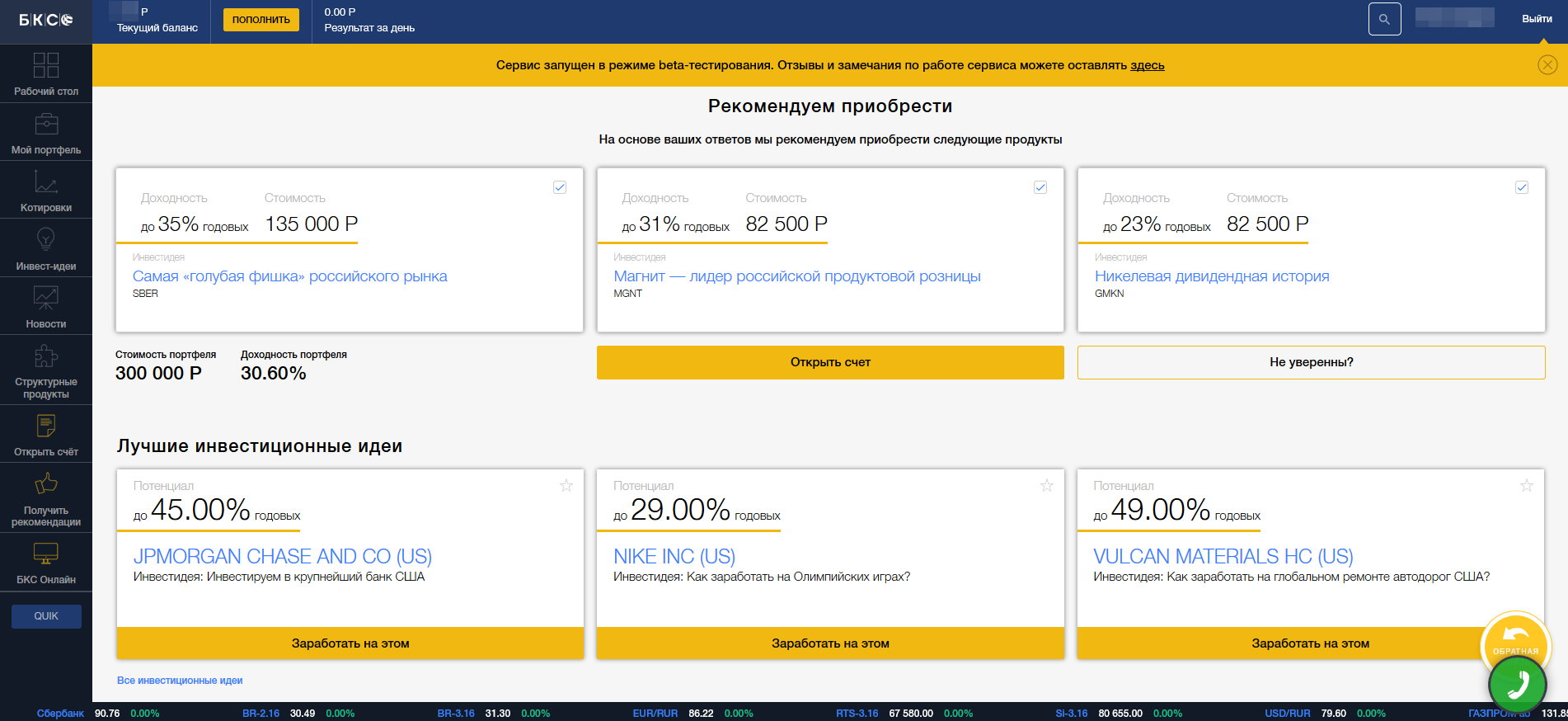

Let us return to the recommendations that I received in the “My broker” panel:

I am not indifferent to the financial markets, so even a cursory glance at the proposed case makes it clear that the portfolio is tailored exactly to the request and stable assets are offered. Especially for Geektimes we’ll check how good the companies that potentially fall into my portfolio are - we’ll look at the quotes in dynamics and inquire about the status of the proposed issuers.

Issuer No. 1. Sberbank

A strong bank that manages to grow even in times of crisis. Compare quotes for two dates:

10/27/2014 - closing price 76.23 p.

01/25/2016 - closing price 90.52 p.

Given the change in exchange rate and inflation, the situation looks stable. And this is despite the fact that Sberbank is sensitive to fluctuations in the ruble exchange rate and its assets are volatile. Sberbank news is also positive, so the asset is good.

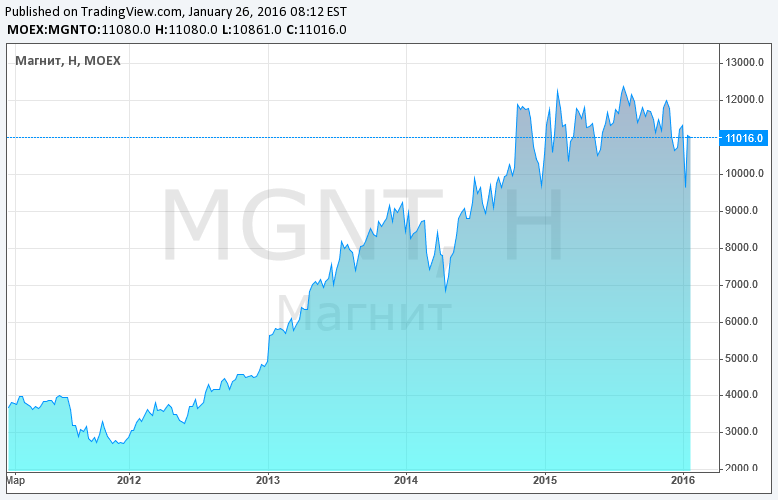

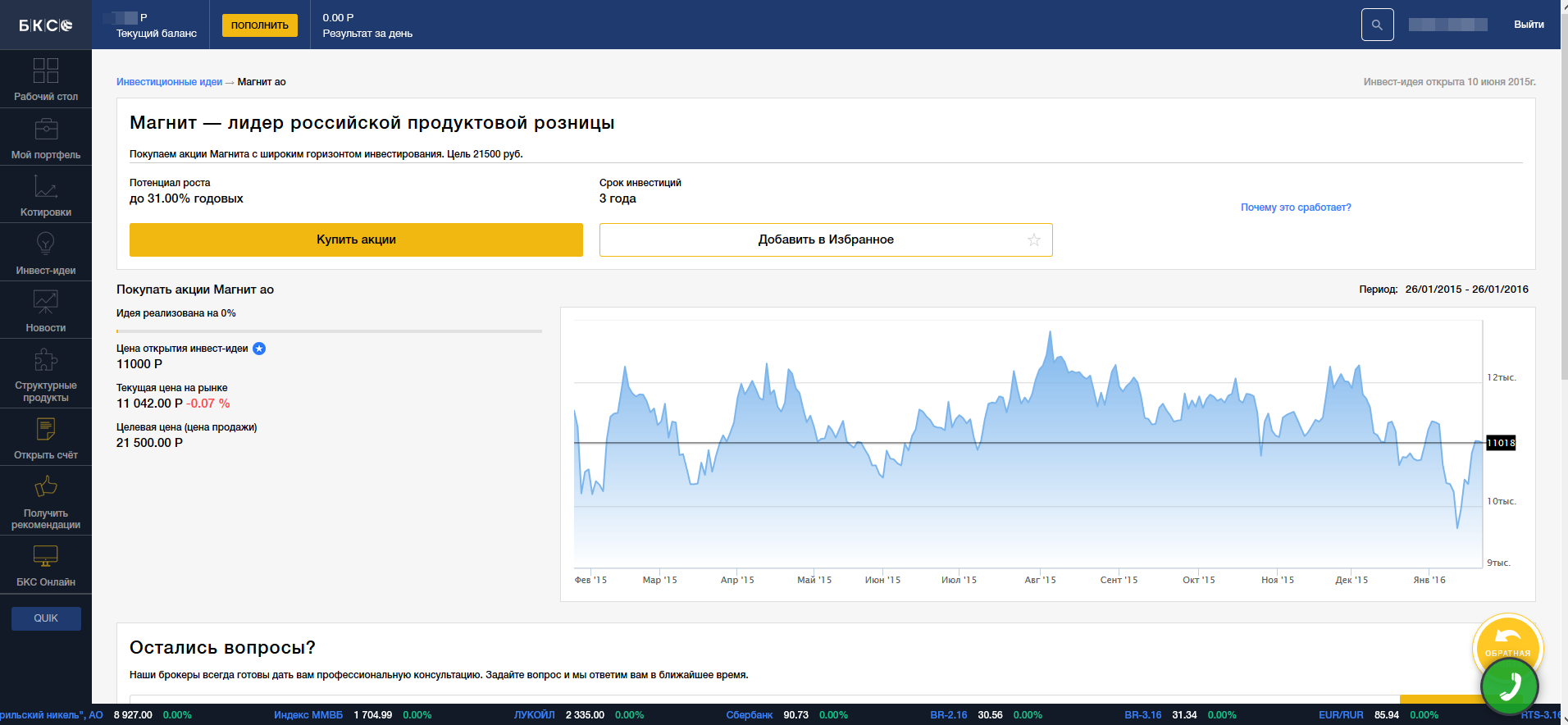

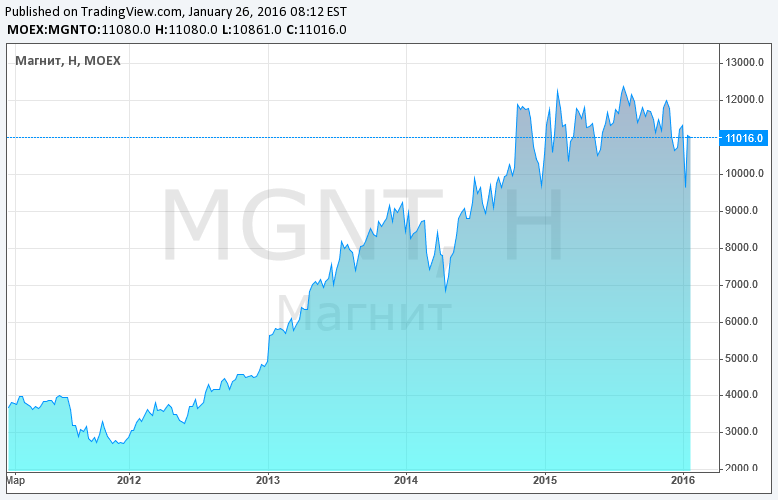

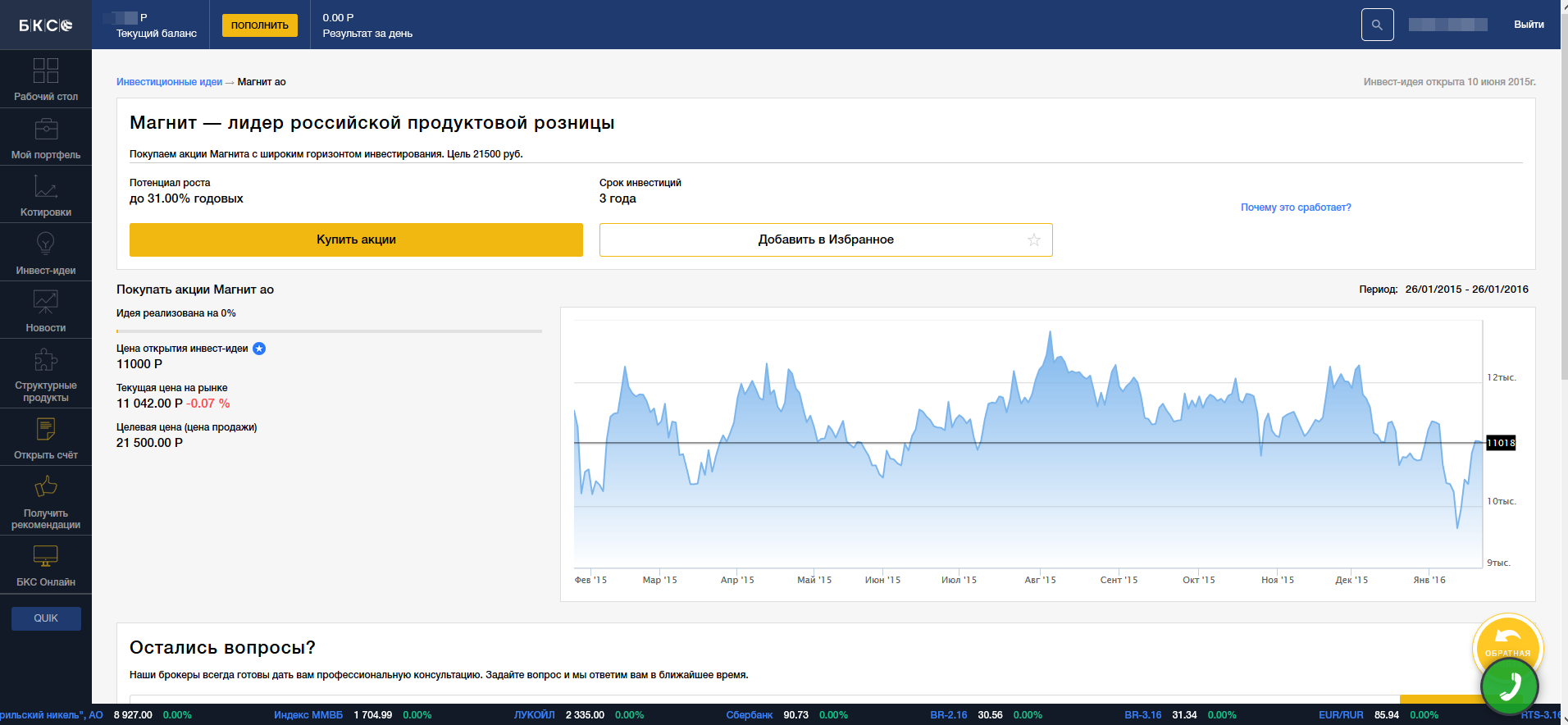

Issuer No. 2. Magnet.

This issuer is interested in many investors - a strong and fairly tenacious representative of Russian retail, showing a steady increase in profits. Compare quotes for two dates:

10/27/2014 - closing price 11 900 r.

01/25/2016 - closing price 10 952 p.

The magnet played almost a year of decline and shows good quotes. According to the results of 2015, revenue growth amounted to 24.3% (the retailer himself predicted an increase of 26%), in 2015 there were much fewer new stores, which in itself is not a warning signal - Magnit has an extensive network. Evaluating this issuer, one can even argue in a purely philistine way: the country is in crisis, people are starting to save and the Magnit store chain with its adequate (and in large stores low) prices remains in demand. So the asset is promising.

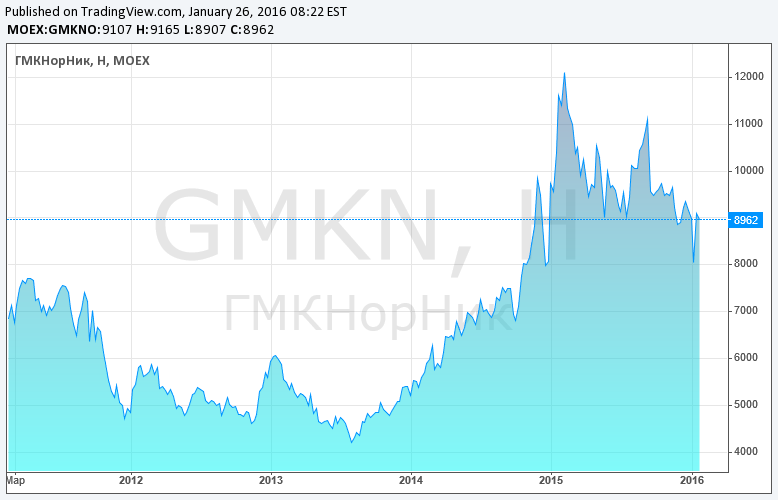

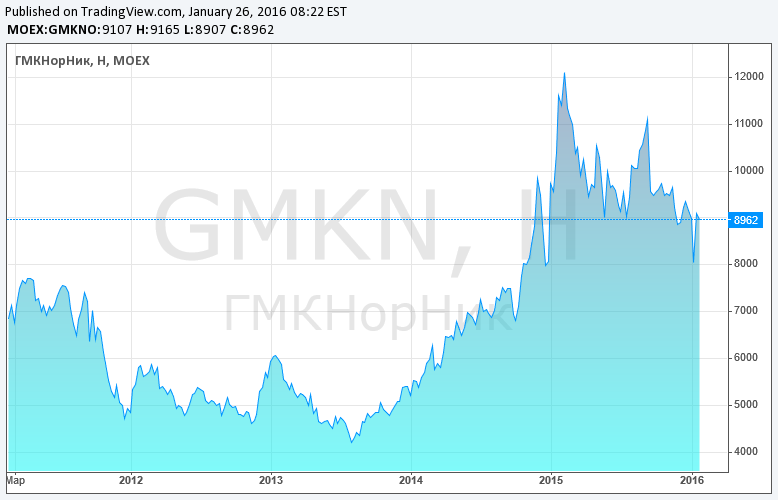

Issuer No. 3. MMC Norilsk Nickel.

Oil comes and goes, and we always need nickel. Seriously, nickel mining will always be in demand: it is used everywhere, from medicine (dentistry, prosthetics) to scientific research, mechanical engineering and coinage (many coins in the world are made using nickel). Compare quotes for two dates:

10.27.2014 - closing price 8033 p.

01/25/2016 - closing price 8944 p.

And one glance at the chart is enough to make sure the profitability of this asset.

So, we have received investment recommendations and can choose which issuers are of interest to us or add our assets. Why do I need multiple assets in my portfolio? This is diversification - if one of the assets does not work, the portfolio will work for the rest. This approach reduces risk. On the other hand, this does not mean that you need to form a portfolio of the maximum set of assets - small shares will not bring the desired income.

By the way, all basic information about the issuer or asset can be obtained by clicking on its name on the desktop - a detailed card will open:

And yet, let's try to play with the system and choose different strategies. If you look at strategies, you can get an offer to add a structural product to the asset portfolio: bonds, profitable barrels, investment notes, as well as interesting products based, for example, on changing indices of an unstable, but very economically and politically interesting Turkey.

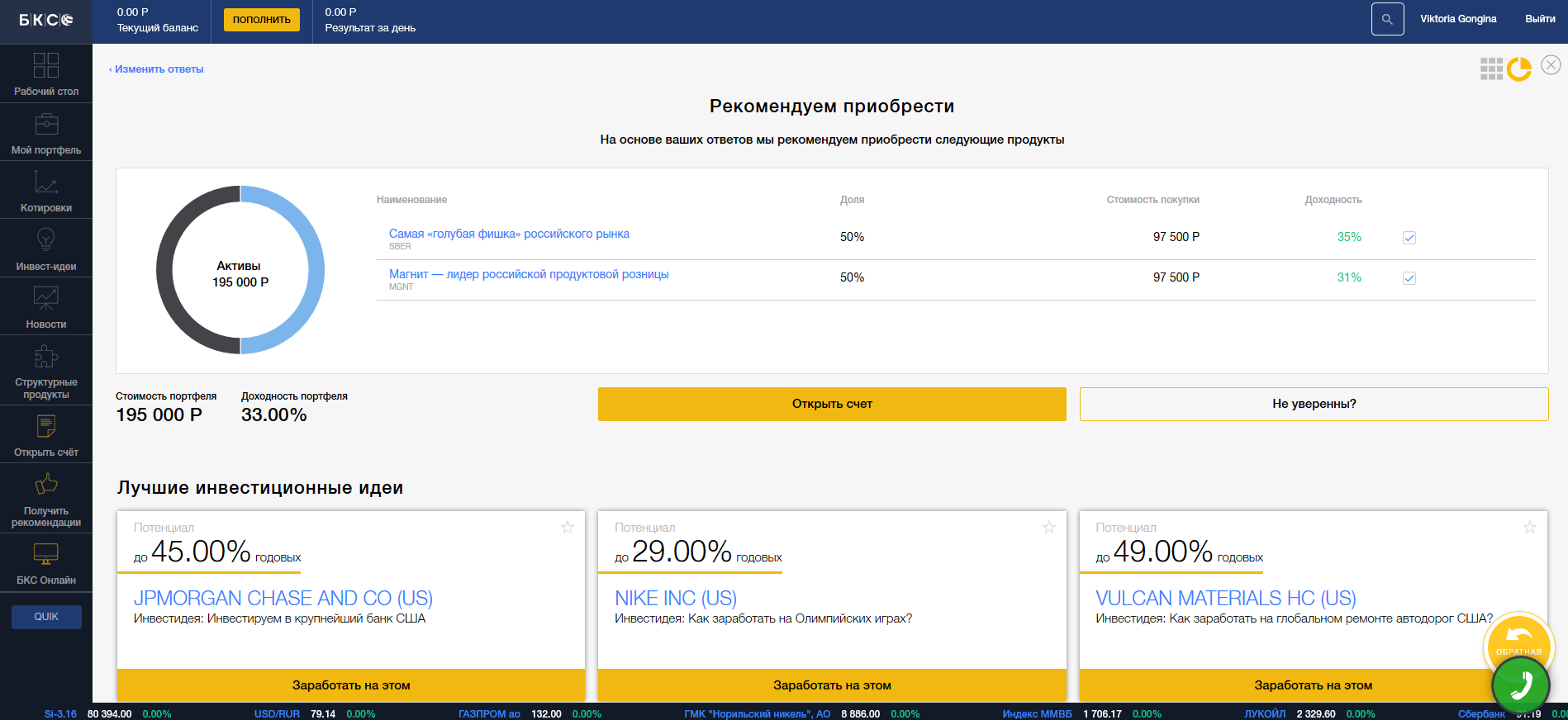

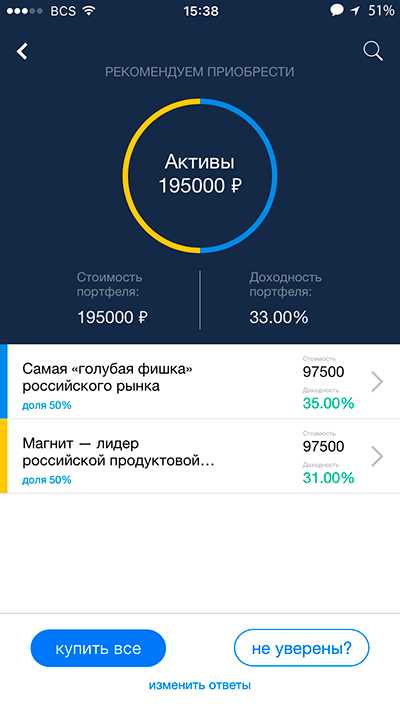

And what will happen if, for example, we choose all of our initial conditions, but different ratios of risk and profitability? “My broker” issues the same set: Sberbank, Magnet, MMC Norilsk Nickel. We close the beta notice and see the switch between the table structure and the pie chart view. We see that, in fact, the proposed strategies differ in the shares of the proposed assets. So, the most risky, but also the most profitable portfolio contains only two assets in equal shares.

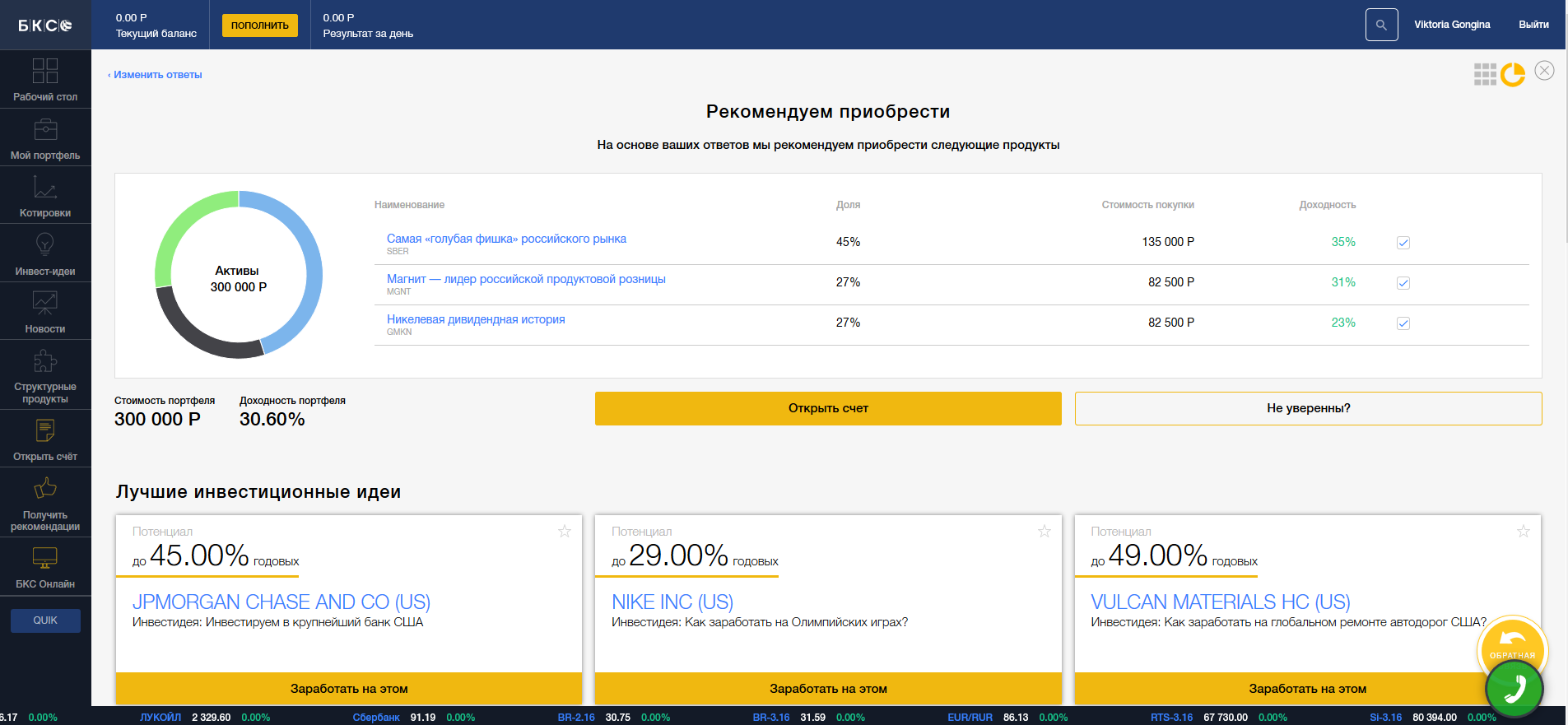

And this is a balanced strategy with moderate profitability chosen at the beginning:

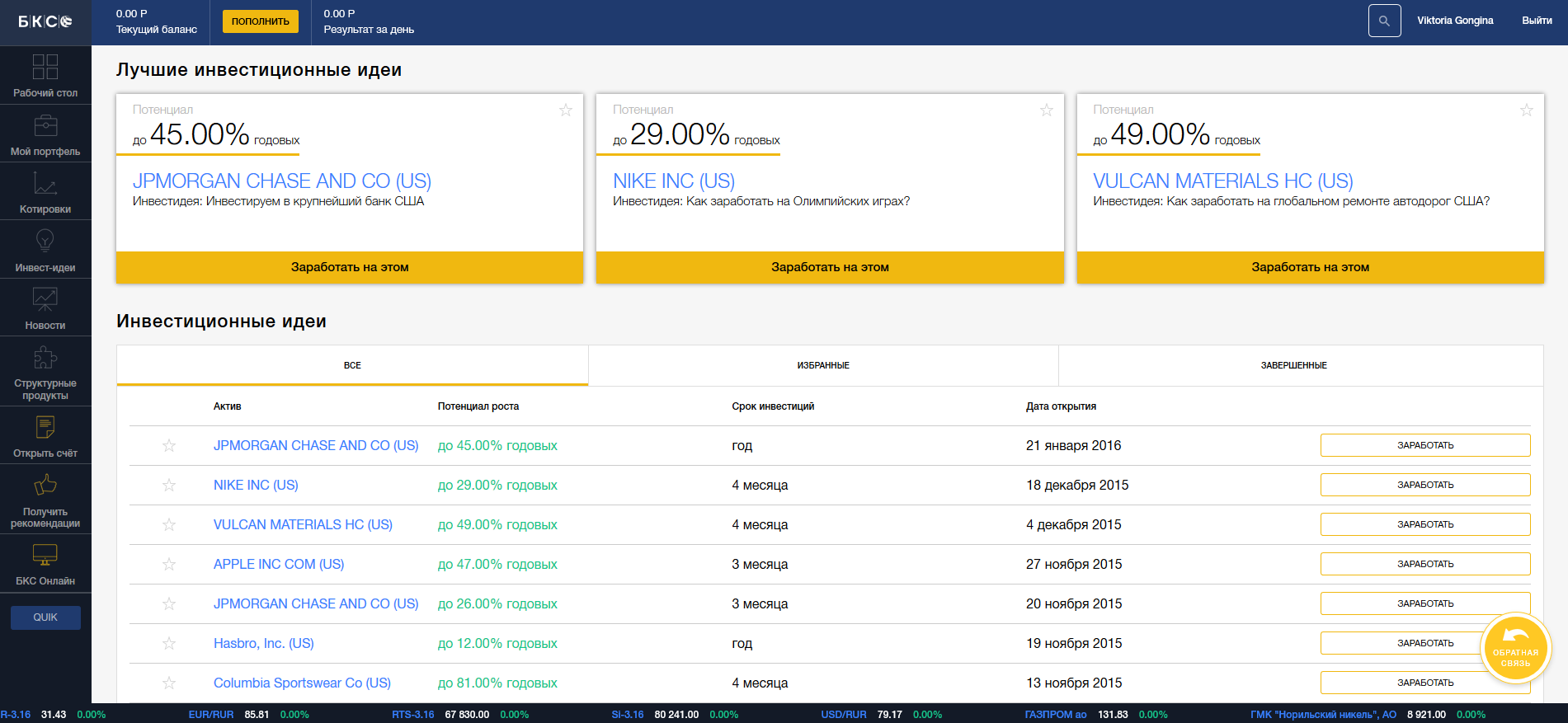

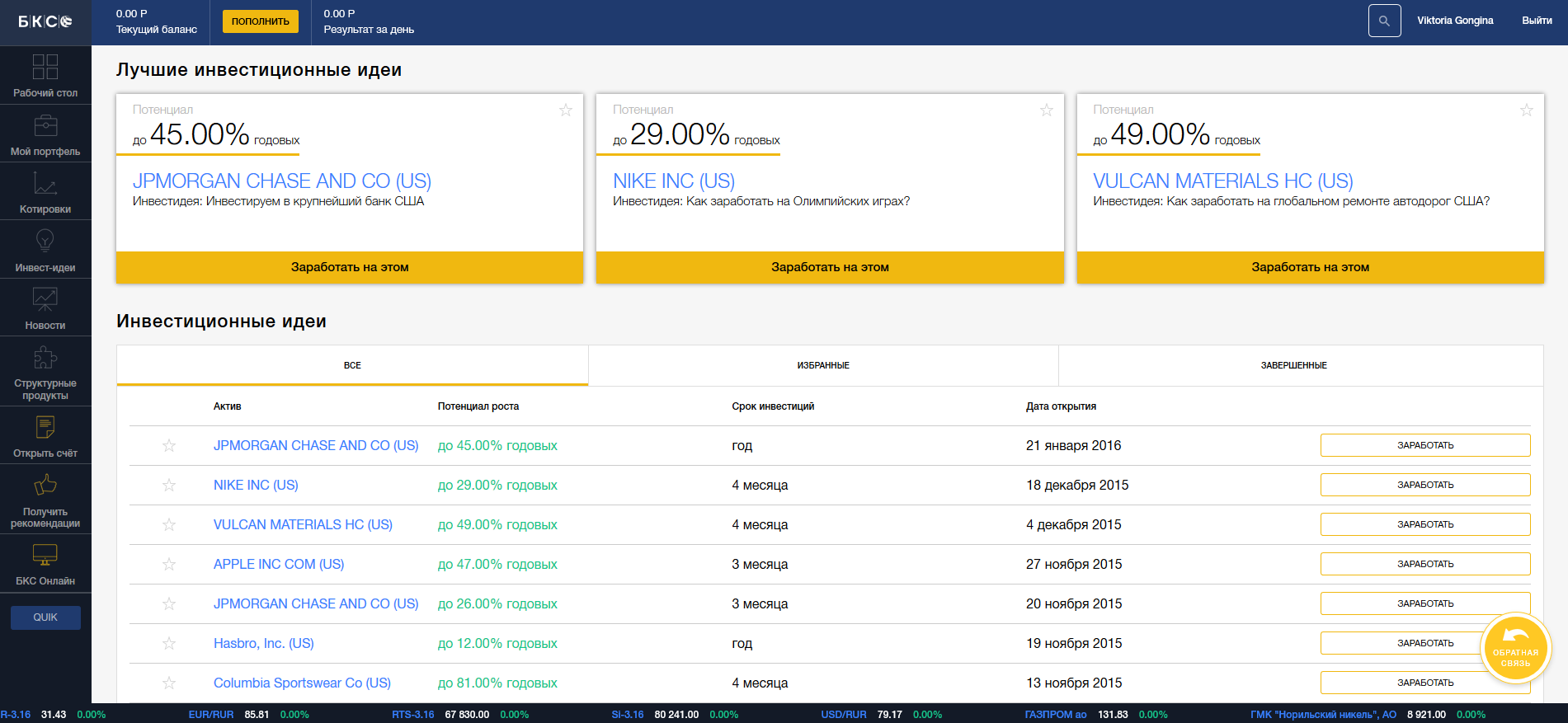

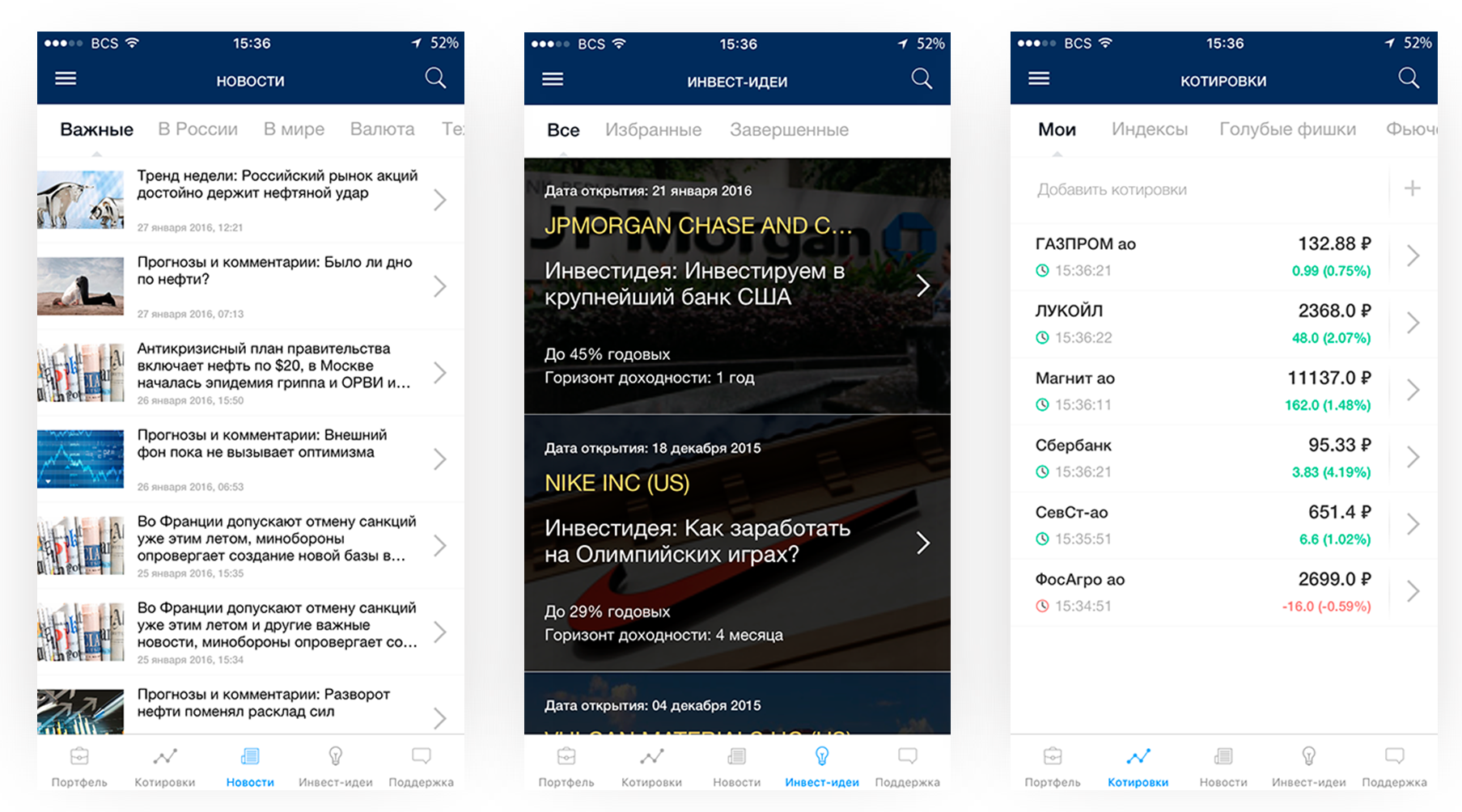

Let's see the rest of the proposed investment ideas:

Here, we are presented with ideas on buying shares of foreign companies with an indication of growth potential, investment term, opening date. For each recommendation, you can open a detailed card, get acquainted with the price, trading volume, dynamics and find out why the company is attractive. In the future, it will be possible to find out the issuer's news, which is important - even a small event in the company can significantly affect quotes. What can we say about serious milestones, which sometimes radically change the principles of the issuer's work or have a significant impact on it (the death of management, the departure of top managers, the release of new products, etc.).

In addition to investment strategies, My Broker includes several useful sections that help you track the dynamics of the return on a non-stop asset portfolio, and do not leave your computer monitor. Such an instrument is very important for an investor of any level - information on the state of the portfolio should be reliable, relevant and comprehensive.

The entire state of their assets can be monitored in the "My Portfolio" section. It displays the account, funds, profit, profitability, portfolio composition, asset allocation, profitability chart. Withdrawal of funds is also carried out in this section. That is, you always control your money and the value of your investment portfolio in real time, by asset type and by individual instrument. You will be able to track what profit has earned at the moment one or another securities.

In the “Quotes” section, you can follow the latest financial market news: selected assets, exchange rates, world indices, futures, see leaders of growth and fall, the situation with blue chips, observe commodity markets (including precious metals). All information on structural products is collected in a separate section.

My Broker aggregates news related to financial markets, various types of risks and issuers. As soon as you begin to consciously work with assets in the stock market, you realize that sometimes the most insignificant event can affect the exchange rate of currencies, stocks, and other securities. Therefore, a good broker and a competent private investor is always up to date with the latest economic and political news. Particularly advanced ones follow the news related to specific issuers: for example, Hasbro shareholders are not interested in the results of the Star Wars rental.

If you’re not at all times behind the monitor, then iTunes has already published a beta version of the My Broker application for the iPhone, which contains:

This is how it looks and works in life:

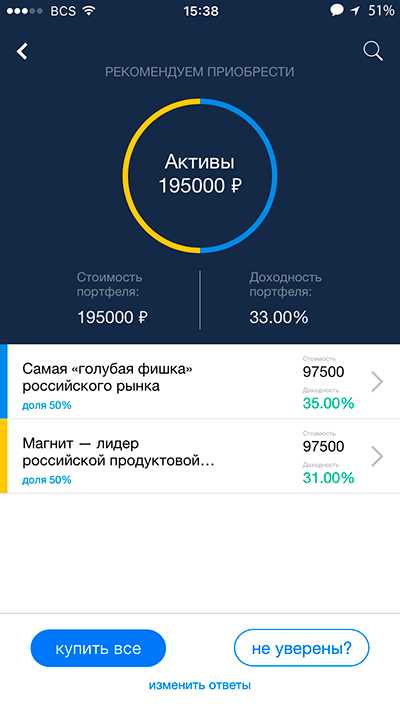

Let's repeat the experiment with forming a portfolio, but already in the mobile version:

We

get the same set of assets: You can add the securities you are interested in to your own tracking list and receive news and recommendations only on these tools. In general, twist the iPhone in your hands and watch how your papers work for you.

For those who need even more screenshots:

Since working with finances places high demands on security, BCS developers have taken care of this:

And finally, a few tips from me for your peace of mind.

It remains for us to add from BCS that all services are available in beta testing mode and are really useful for serious work and training. We will be glad to comments, criticism, questions, bug reports and any feedback.

Download the application in iTunes

Most recently, BCS launched in beta mode the first in Russia simple and convenient service for trading - the My Broker application . Especially for Geektimes, we asked a former private investor to test the system from the perspective of his experience, share his impressions and at the same time tell a little about his path to the stock market. We give him the floor.

"Hi Gicktime!

My life ceased to be the same back in 2005. Then, I, a student of the Faculty of Finance with an average score of 5.0, took full advantage of the right to choose and voluntarily entered my name on the list of specializations “Financial Management”, without even knowing why classmates rushed to taxes and banking. Everything became clear in September: our small group of courageous were guaranteed two years of financial mathematics, the securities market, stock exchange business, in-depth economic analysis and statistics, probability theory and other

So, the introduction. I did not become a broker; I did not even try to conquer Wall Street. But the stock market and knowledge about it continued to beckon - I tried to make money on my own at exchange rates, and then I dreamed of succeeding in transactions with Gazprom shares. Dreams Come True. But somehow quite partly. As a result, the work completely distracted me from exchange affairs, but BCS’s offer to try My Broker and talk about it hurt me.

"My broker" provides an opportunity to buy and sell stocks, bonds, and other financial instruments; exchange currency on the exchange at the exchange rate (how to do this, already described in the BCS blog) in a simple and convenient way.

I’ll say right away to whom I would recommend this application.

- Anyone who wants to "trade in the stock market" at low speeds. You can consider various tools and strategies, collect a portfolio and instruct the broker to purchase certain stocks, bonds and other assets for you. The entry threshold is very low - only 50,000 rubles. You can choose a lossless strategy with minimal risk and try to earn much more than is possible, for example, a bank deposit rate.

- Students of financial universities and anyone who wants to learn more about the stock market. A lot of information is available in My Broker, it is all well-structured and rich in details. After several hours of leisurely research “My broker”, you are guaranteed to have an understanding of what assets are, what can affect them, what is a portfolio and the structure of an investment portfolio.

- Unambiguously for those who already work / trade (here who calls it) on the stock exchange or is ready to direct part of their personal savings to the formation of an investment portfolio. You will be surprised by the simplicity and accessibility of the interface, a set of information, a list of suggested tools. I had to deal with personal accounts of other services - this one is, indeed, more modern and more convenient for a private investor.

- Those who are just dreaming or are already planning to become a professional stock market participant (for example, a broker). Working with “My broker” even in test mode without balance, you can see how the strategy is formed, the portfolio is diversified, depending on the needs of the client. In addition, it is good luck to see your work from a future client.

Of the obvious advantages, I especially note the modern and very clear interface, the availability of an application for the iPhone (I’ll explain why this is cool below), the information content and the high speed of data updates. In general, the application works without a single hang, even with a weak connection. There is no Android app yet, but it will be available shortly. The web version is perfectly adapted for mobile devices, and on an 8-inch tablet everything suited me, but on 4.5 and 5 inches it’s not the same feeling.

Let's try to trick the system

Depending on experience, amount, currency and investment period, “My broker” forms a personal offer. Although I had experience in investing, to begin with, I lied a bit and chose, as it seems to me, the most starting set of conditions: there is no investment experience, the amount is 50,000 - 300,000, in rubles, the income is moderate. In general, My Broker offers options for the ratio of profitability and risk:

- minimum risk: up to 25% return on capital, up to 0% possible reduction (loss)

- balanced strategy: up to 35% return on capital, up to 5% possible reduction

- maximum income: up to 65% return on capital, up to 15% possible reduction.

I deliberately refused a low level of risk, because I wanted to get an offer more interesting. Well, aspirations for high profitability for beginners should be avoided, since it is associated with risks that you need to be prepared for. Stress at the beginning of work with the stock market or exchange is not the best assistant, you need to delve into the work with financial instruments gradually. In addition, experience in financial transactions comes with a series of mistakes - starting with small experiments, you greatly reduce the price of this experience. For example, my first experience in 2008 cost me 30,000 rubles, two then salaries. And only further caution and balanced decisions helped me win back losses and even earn extra money.

Let us return to the recommendations that I received in the “My broker” panel:

I am not indifferent to the financial markets, so even a cursory glance at the proposed case makes it clear that the portfolio is tailored exactly to the request and stable assets are offered. Especially for Geektimes we’ll check how good the companies that potentially fall into my portfolio are - we’ll look at the quotes in dynamics and inquire about the status of the proposed issuers.

Issuer No. 1. Sberbank

A strong bank that manages to grow even in times of crisis. Compare quotes for two dates:

10/27/2014 - closing price 76.23 p.

01/25/2016 - closing price 90.52 p.

Given the change in exchange rate and inflation, the situation looks stable. And this is despite the fact that Sberbank is sensitive to fluctuations in the ruble exchange rate and its assets are volatile. Sberbank news is also positive, so the asset is good.

Issuer No. 2. Magnet.

This issuer is interested in many investors - a strong and fairly tenacious representative of Russian retail, showing a steady increase in profits. Compare quotes for two dates:

10/27/2014 - closing price 11 900 r.

01/25/2016 - closing price 10 952 p.

The magnet played almost a year of decline and shows good quotes. According to the results of 2015, revenue growth amounted to 24.3% (the retailer himself predicted an increase of 26%), in 2015 there were much fewer new stores, which in itself is not a warning signal - Magnit has an extensive network. Evaluating this issuer, one can even argue in a purely philistine way: the country is in crisis, people are starting to save and the Magnit store chain with its adequate (and in large stores low) prices remains in demand. So the asset is promising.

Issuer No. 3. MMC Norilsk Nickel.

Oil comes and goes, and we always need nickel. Seriously, nickel mining will always be in demand: it is used everywhere, from medicine (dentistry, prosthetics) to scientific research, mechanical engineering and coinage (many coins in the world are made using nickel). Compare quotes for two dates:

10.27.2014 - closing price 8033 p.

01/25/2016 - closing price 8944 p.

And one glance at the chart is enough to make sure the profitability of this asset.

So, we have received investment recommendations and can choose which issuers are of interest to us or add our assets. Why do I need multiple assets in my portfolio? This is diversification - if one of the assets does not work, the portfolio will work for the rest. This approach reduces risk. On the other hand, this does not mean that you need to form a portfolio of the maximum set of assets - small shares will not bring the desired income.

By the way, all basic information about the issuer or asset can be obtained by clicking on its name on the desktop - a detailed card will open:

And yet, let's try to play with the system and choose different strategies. If you look at strategies, you can get an offer to add a structural product to the asset portfolio: bonds, profitable barrels, investment notes, as well as interesting products based, for example, on changing indices of an unstable, but very economically and politically interesting Turkey.

And what will happen if, for example, we choose all of our initial conditions, but different ratios of risk and profitability? “My broker” issues the same set: Sberbank, Magnet, MMC Norilsk Nickel. We close the beta notice and see the switch between the table structure and the pie chart view. We see that, in fact, the proposed strategies differ in the shares of the proposed assets. So, the most risky, but also the most profitable portfolio contains only two assets in equal shares.

And this is a balanced strategy with moderate profitability chosen at the beginning:

Let's see the rest of the proposed investment ideas:

Here, we are presented with ideas on buying shares of foreign companies with an indication of growth potential, investment term, opening date. For each recommendation, you can open a detailed card, get acquainted with the price, trading volume, dynamics and find out why the company is attractive. In the future, it will be possible to find out the issuer's news, which is important - even a small event in the company can significantly affect quotes. What can we say about serious milestones, which sometimes radically change the principles of the issuer's work or have a significant impact on it (the death of management, the departure of top managers, the release of new products, etc.).

Gallop on “My Broker”

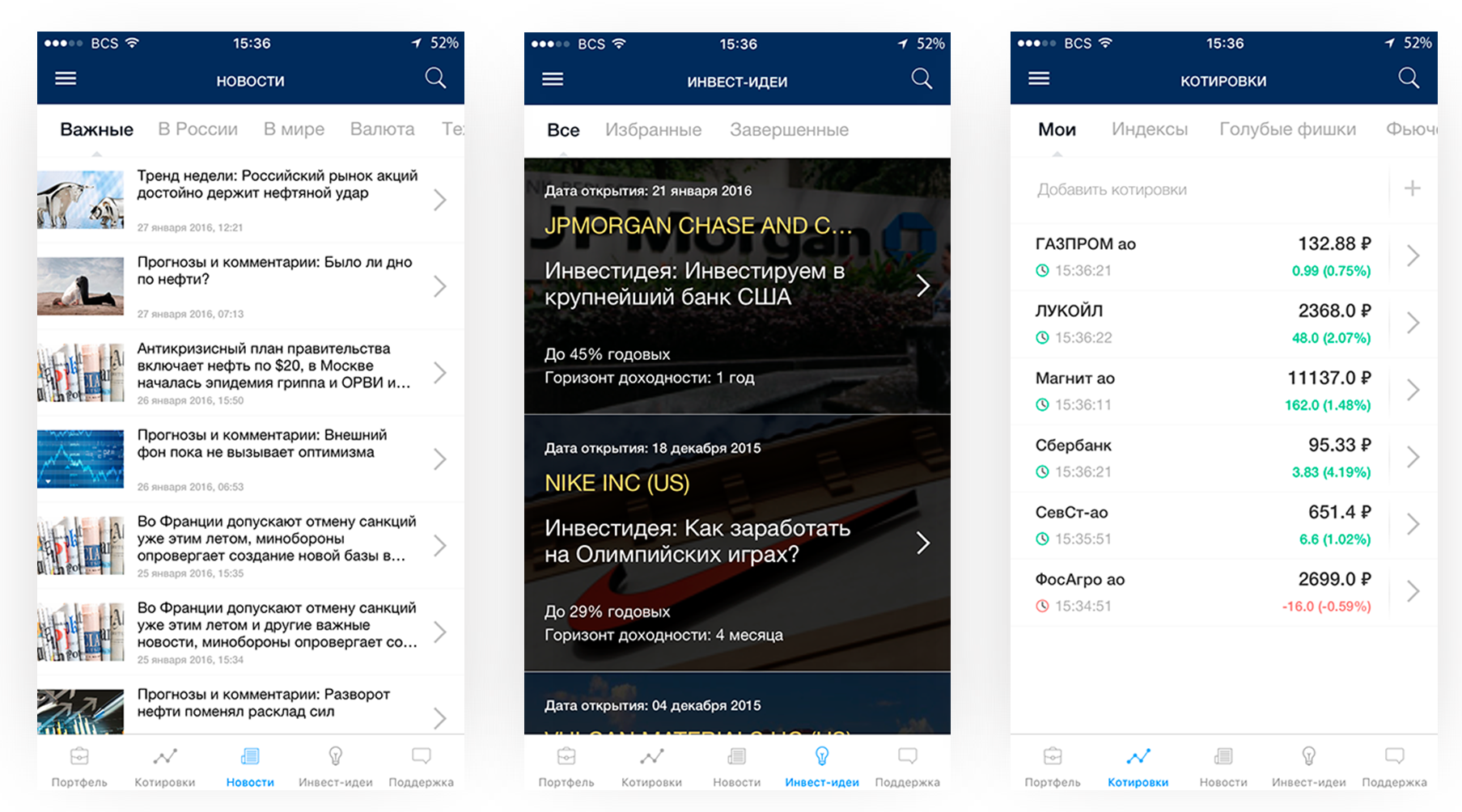

In addition to investment strategies, My Broker includes several useful sections that help you track the dynamics of the return on a non-stop asset portfolio, and do not leave your computer monitor. Such an instrument is very important for an investor of any level - information on the state of the portfolio should be reliable, relevant and comprehensive.

The entire state of their assets can be monitored in the "My Portfolio" section. It displays the account, funds, profit, profitability, portfolio composition, asset allocation, profitability chart. Withdrawal of funds is also carried out in this section. That is, you always control your money and the value of your investment portfolio in real time, by asset type and by individual instrument. You will be able to track what profit has earned at the moment one or another securities.

In the “Quotes” section, you can follow the latest financial market news: selected assets, exchange rates, world indices, futures, see leaders of growth and fall, the situation with blue chips, observe commodity markets (including precious metals). All information on structural products is collected in a separate section.

My Broker aggregates news related to financial markets, various types of risks and issuers. As soon as you begin to consciously work with assets in the stock market, you realize that sometimes the most insignificant event can affect the exchange rate of currencies, stocks, and other securities. Therefore, a good broker and a competent private investor is always up to date with the latest economic and political news. Particularly advanced ones follow the news related to specific issuers: for example, Hasbro shareholders are not interested in the results of the Star Wars rental.

If you’re not at all times behind the monitor, then iTunes has already published a beta version of the My Broker application for the iPhone, which contains:

- charts and quotes of Russian and foreign stocks and bonds, commodities, currencies and world indices;

- news and analytics about the market situation and expert forecasts;

- technical analysis every day;

- investment ideas and recommendations on transactions;

- consultation of the Financial Advisor;

- account operations history.

This is how it looks and works in life:

Let's repeat the experiment with forming a portfolio, but already in the mobile version:

We

get the same set of assets: You can add the securities you are interested in to your own tracking list and receive news and recommendations only on these tools. In general, twist the iPhone in your hands and watch how your papers work for you.

For those who need even more screenshots:

A few words about security in every sense

Since working with finances places high demands on security, BCS developers have taken care of this:

- all your information is protected by reliable encryption algorithms and is transmitted only through secure channels;

- to enter the system, use the username and password from the personal account of BKS-Online;

- Confirmation of operations for the purchase and sale of securities is carried out only with two-factor authorization via SMS for additional account protection.

And finally, a few tips from me for your peace of mind.

- The main tip is to diversify your portfolio by adding structural tools or combinations of assets. This reduces the risk and allows you to stay in the black even in the most uncomfortable scenario.

- No rash steps - be guided by common sense, the market situation, do not try to fish in troubled waters. If in doubt, it is best to contact a financial advisor.

- Do not deposit all the money that you have in your account. Investing has a period and in urgent need you will not have time to withdraw funds from the account. Personal finance also needs to be diversified.

- No euphoria. This is perhaps the most terrible threat: the first profitable transaction is dizzy and now you are ready to invest all that is. Wait, analyze, observe the score, correlate with environmental events, comprehend the basics of technical analysis. This will allow you to develop progressively, but efficiently.

- If you want to try yourself in the stock market - be sure to try it. And such applications as “My broker” will help you to be on the wave of your investments, monitor them and feel a little Belfort, and most importantly - a rational and thoughtful investor. ”

It remains for us to add from BCS that all services are available in beta testing mode and are really useful for serious work and training. We will be glad to comments, criticism, questions, bug reports and any feedback.

Download the application in iTunes