This is not “real work, but better” for you: how Crossover hiring policy allows you to pay employees above the market

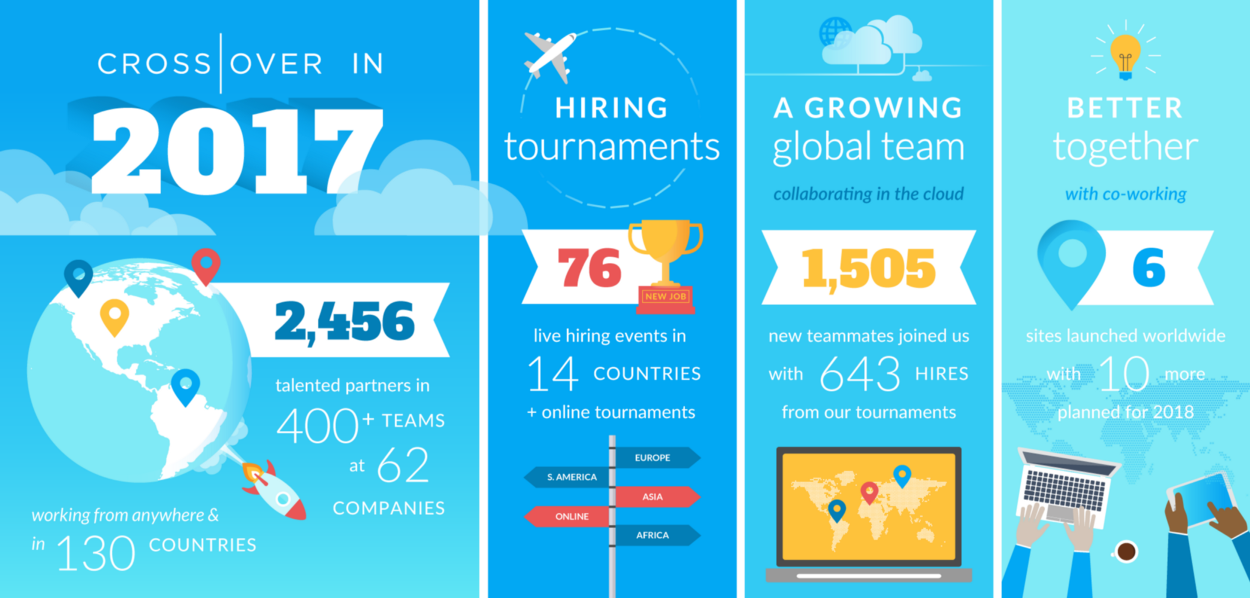

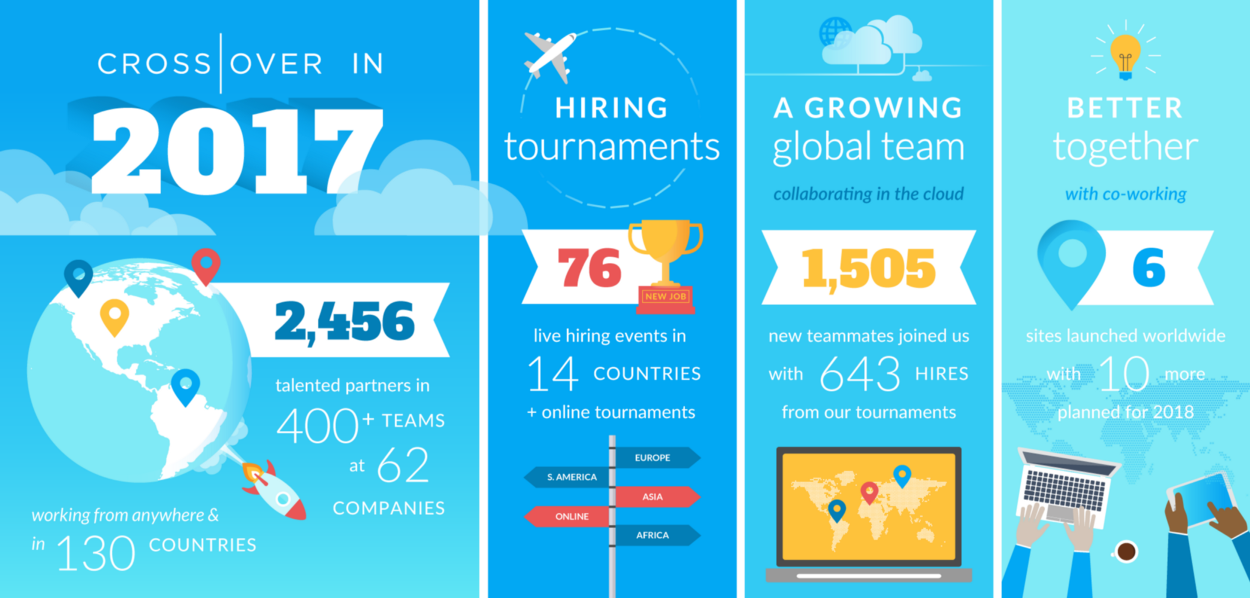

The global Crossover community now has over 4,000 developers and professionals in other specialties in 138 countries.. Of these, more than 400 people live and work in Russia. And this means that the Russian economy thanks to Crossover received four hundred individual entrepreneurs (IP). And then you say: “Stop, where did the IP come from?” The fact is that Crossover in Russia has neither an office, nor even a legal entity - like anywhere else in the world, with the exception of its headquarters in Austin, Texas. All company employees work completely remotely. The fact is that Crossover in Russia does not hire employees, but cooperates with local individual entrepreneurs. Does it sound unusual? Probably yes. Maybe we just have not yet appreciated all the possibilities of this format of work, and yet he has a whole wagon of advantages over traditional hiring. However, like a small cart of shortcomings, which we will also talk about.

Imagine that one of the Crossover tournaments, which was already discussed in detail last time , was left behind for the applicant: with an excellent passing score, he appeared on the Crossover storefront, a market place where he soon received a concrete offer to work in one of the companies of ESW Capital holding - Aurea, Versata, DevFactory, 3seventy, Ignite Technologies, etc.

Now, in order to begin his duties, he needs to register as an individual entrepreneur. This interaction model was not chosen by chance: instead of opening hundreds of physical offices and representative offices around the world, Crossover interacts with employees completely remotely and has a decentralized structure. From the point of view of geography, this is a definite plus. A developer can physically be at least in Moscow, even beyond the Arctic Circle: the main thing is that he has access to the Internet. Otherwise, only his immediate skills influence his chances of getting a job, but not his place of birth and / or residence. This allows you to attract talented people to projects without requiring them to move, as well as significantly save on offices, rents and other expenses associated with the maintenance of premises.

So what about registration as an IP? Since cooperation with Crossover and other companies of the parent holding ESW Capital takes place in the form of a contractual relationship between two legal entities, a “complete set” of documents will be required.

The company always helps each specialist with registration in the form of consultations and memos - even if you have always walked your tax office a mile away, you don’t know anything about taxation and don’t navigate all the intricacies of paperwork at the registration stage, you will not be left alone in trouble. Specifically for Russia, special instructions have been developed that outline a step-by-step action plan. With such an instruction, it will be easier to avoid pits and potholes on the bureaucratic road to the IP.

And now in more detail.

It all starts with registration as an individual entrepreneur. Now this is being done very simply, it is enough to appear once in the tax office, the processing time is up to 3 business days. Our instructions will tell you which documents to submit and how to choose and draw up a suitable taxation system (this must be done immediately upon registration). On the Internet, you can pre-read detailed tutorials on registering IP , but our instructions are already adapted to the upcoming activities.

Next - filling out a bank account, which will receive payments. Everything is clear here and additionally does not make sense to paint.

The agreement with Crossover is concluded without an end date and is executed in electronic form, and the agreement itself is accepted by the IP on the basis of a public offer.

Since Crossover is essentially an American company, part of the Texas holding ESW Capital, it has an American pay model in which the advance and salary that is customary for our latitudes are replaced with weekly payments. In general, all work will revolve around a 40-hour work week, instead of a larger and more variable in terms of the duration of the "month".

Payments are organized through the international payment service Payoneeralready familiar to many freelancers. It will not work to receive money for Poison, QIWI or Webmoney: these options are, in principle, poorly suited for cross-border settlements. You can bind the account number to your Payoneer account and set up automatic withdrawal, i.e. use it as a “gateway”. Initially, payments occur in dollars, but you can choose to automatically convert to Russian rubles. True, you will have to pay 2% commission for this conversion.

In addition to bookkeeping and self-payment of taxes, the shoulders of IP also have the rationing of their own working day, vacation planning and the accumulation of those same “vacation pay”.

In the case of the organization of labor in Crossover a little easier than other piecework-remote work. It is expected that in cooperation with the company, the developer or manager will work out 40 hours per calendar week. If the workflow does not require close interaction with other team members, then the distribution of these 40 hours remains solely at the discretion of the employee and his manager. So, you can stretch the "pleasure" for all seven calendar days and work without days off, or you can "squeeze" the work week to four days.

In general, the schedule is consistent with the team manager and some kind of comfortable parity is sought for all interested parties. Therefore, even if it is necessary to work out 40 hours, this does not mean work “from 9 to 18”, but there are positions, such as Customer Support Architect , when you have to adapt to the time of mandatory presence.

As for vacation. If you pay attention to the form of remuneration in the section " Vacancies ", you can see that the remuneration for the year is calculated on the basis of 50 working weeks, not 52. Two weeks of vacation per year are already included in the annual payment. A longer vacation is made out already by agreement with the manager in the form of a break in cooperation - at the expense of the individual entrepreneur, but the level of payment at Crossover implies that he can afford it.

Approximately the same principle of coordination of absence applies in case of illness. In cases of mild illnesses that “knock out” for a couple of days, you can agree with the manager to reduce the number of hours or “shift” labor activity relative to the usual approved schedule (if you don’t want to lose it in money). This takes into account the specifics of the project and the position in which you work. The same Customer Support Architect has a clear schedule, he needs an urgent replacement, and where there is no such dependence on hours of presence, the approach is more flexible. If you need more time to improve your health, a temporary break in work is agreed (just like with a vacation). Inquiries, respectively, also do not need to draw up.

And now it's time to move on to what people need all this for: actual income.

For clarity, we compare two situations using the example of the entry-level position QA Manual Tester , which offers $ 20,000 a year at Crossover (1,145,000 rubles at today's rate). According to the vacancies on hh.ru in Moscow, the average salary for this position is 40-60 thousand, in the regions - from 20 thousand rubles a month.

Suppose a certain LLC “Normal Software Company” allocated the same $ 20,000 per year in its budget for a similar position of a tester / specialist in manual testing, having it able to start searching for an employee for a salary of not more than 73400 ₽ per month, because 30% is on top already laid on compulsory medical and pension contributions for an employee. At the same time, accounting will take upon itself the hassle of paying income tax for an employee.

Total on hand: ~ 64 000₽ .

IP, of course, is surrounded in this sense by far less concern. He receives all the earned funds in full, responsible for paying taxes and contributions on his own. Is it worth it? Let's get a look. An individual entrepreneur working under a contract with Crossover will receive all $ 20,000 a year into his bank account - 1,122,000 rubles a year , taking into account conversion. We add to the bank expenses the contents of the account itself - its cost varies from bank to bank, but on average you can focus on 12 000 rubles per year . As for taxes and contributions, then the individual entrepreneur can decide for himself how it is more profitable for him:

By choosing to work on a simplified taxation system (STS) with a payment of 6% of income, which in this example, already taking into account insurance pension and medical contributions, will make, rounded up, 76,000 rubles per year. Leaving our QA Manual Tester in our hands ~ 1 034 000₽ per year.

Total on hand: ~ 86 000₽ .

By acquiring a fixed patent for a year. The patent tax system was introduced only in 2015 and allows replacing the “postpaid” tax payment procedure with a “prepaid” one, in the form of purchasing a patent at a fixed price for a year. In this case, in addition to the patent itself, only the final pension contribution of 1% of earnings over 300,000 rubles per year will remain on the individual entrepreneur.

The cost of patents can change dozens of times depending on the type of activity and the region in which the IP conducts commercial activities. For example, in St. Petersburg, a patent for those involved in the development of computer software costs 60,000 rubles for 2018. And in Moscow - already 300 thousand. And in the Moscow region - and at all 12500₽. It hasnever been so profitable to live in Khimki. This can still be beneficial, but already with annual earnings of more than 5 million rubles - for example, as a QA Software Engineer Manager , to whom Crossover offers $ 100,000 (5.7 million rubles) per year. But the QA Manual Tester , working in St. Petersburg on a patent, could have left itself this year already 1,041,000 rubles.

Total on hand: ~ 87 000₽ .

On this, of course, the nuances do not end there. But among them - a lot of pleasant, like tax holidays for newly made entrepreneurs. For example, in the Leningrad Region, where Chief Software Architect Ruslan Peshchuk lives, opening IPs are exempt from tax for the first two years of work:

“IPs have more opportunities to manage their finances and choose a tax system. I have been working since July 2017, and I have just a tax break. ”

Judging by the growing number of professionals working with Crossover, which has doubled over the past two years in Russia and the CIS, the proposed work scheme is quite viable.

Moreover, for many talented specialists this turned out to be the last opportunity to develop professionally and earn decent money without the need to “flow away” abroad.

If until now all of the above seems somehow suspicious, then the executive director of the Union of Entrepreneurs KROO Elena Ivanovna Dugina will not agree with you: the Crossover system of work is absolutely legal, although not very common in Russia. Moreover, increasing the number of individual entrepreneurs is one of the priority current tasks in the development of the Russian economy. As is the case with the suspension of brain drain, Crossover’s policy is once again, albeit unintentionally, in the mainstream of being state-run.

In general, you can create a portrait of an “average” specialist who works with Crossover. These are specialists:

And yet, as one study showed, for more than half of those who left Crossover, the next stage of development is already their own business, and most often - without moving from their region. This contributes to the fact that, in addition to professional skills, a person also gets experience in interacting with the tax, accounting and, of course, the opportunity to accumulate start-up capital over several years (with an income of about $ 100,000 / year and above, this is a perfectly feasible task). But the main thing here is still not this.

The main thing was noted by Chief Software Architect Evgeny Konurbaev:

For those who are ready for such changes - all doors are open. And many of them are opened by Crossover.

How is cooperation with Crossover organized?

Imagine that one of the Crossover tournaments, which was already discussed in detail last time , was left behind for the applicant: with an excellent passing score, he appeared on the Crossover storefront, a market place where he soon received a concrete offer to work in one of the companies of ESW Capital holding - Aurea, Versata, DevFactory, 3seventy, Ignite Technologies, etc.

Now, in order to begin his duties, he needs to register as an individual entrepreneur. This interaction model was not chosen by chance: instead of opening hundreds of physical offices and representative offices around the world, Crossover interacts with employees completely remotely and has a decentralized structure. From the point of view of geography, this is a definite plus. A developer can physically be at least in Moscow, even beyond the Arctic Circle: the main thing is that he has access to the Internet. Otherwise, only his immediate skills influence his chances of getting a job, but not his place of birth and / or residence. This allows you to attract talented people to projects without requiring them to move, as well as significantly save on offices, rents and other expenses associated with the maintenance of premises.

So what about registration as an IP? Since cooperation with Crossover and other companies of the parent holding ESW Capital takes place in the form of a contractual relationship between two legal entities, a “complete set” of documents will be required.

- Registration IP.

- Registration with the tax office.

- The choice of taxation system.

- Bank account.

- A contract with a counterparty represented by Crossover.

The company always helps each specialist with registration in the form of consultations and memos - even if you have always walked your tax office a mile away, you don’t know anything about taxation and don’t navigate all the intricacies of paperwork at the registration stage, you will not be left alone in trouble. Specifically for Russia, special instructions have been developed that outline a step-by-step action plan. With such an instruction, it will be easier to avoid pits and potholes on the bureaucratic road to the IP.

And now in more detail.

It all starts with registration as an individual entrepreneur. Now this is being done very simply, it is enough to appear once in the tax office, the processing time is up to 3 business days. Our instructions will tell you which documents to submit and how to choose and draw up a suitable taxation system (this must be done immediately upon registration). On the Internet, you can pre-read detailed tutorials on registering IP , but our instructions are already adapted to the upcoming activities.

Next - filling out a bank account, which will receive payments. Everything is clear here and additionally does not make sense to paint.

The agreement with Crossover is concluded without an end date and is executed in electronic form, and the agreement itself is accepted by the IP on the basis of a public offer.

Salary

Since Crossover is essentially an American company, part of the Texas holding ESW Capital, it has an American pay model in which the advance and salary that is customary for our latitudes are replaced with weekly payments. In general, all work will revolve around a 40-hour work week, instead of a larger and more variable in terms of the duration of the "month".

Payments are organized through the international payment service Payoneeralready familiar to many freelancers. It will not work to receive money for Poison, QIWI or Webmoney: these options are, in principle, poorly suited for cross-border settlements. You can bind the account number to your Payoneer account and set up automatic withdrawal, i.e. use it as a “gateway”. Initially, payments occur in dollars, but you can choose to automatically convert to Russian rubles. True, you will have to pay 2% commission for this conversion.

Schedule, vacation, sick leave

In addition to bookkeeping and self-payment of taxes, the shoulders of IP also have the rationing of their own working day, vacation planning and the accumulation of those same “vacation pay”.

In the case of the organization of labor in Crossover a little easier than other piecework-remote work. It is expected that in cooperation with the company, the developer or manager will work out 40 hours per calendar week. If the workflow does not require close interaction with other team members, then the distribution of these 40 hours remains solely at the discretion of the employee and his manager. So, you can stretch the "pleasure" for all seven calendar days and work without days off, or you can "squeeze" the work week to four days.

In general, the schedule is consistent with the team manager and some kind of comfortable parity is sought for all interested parties. Therefore, even if it is necessary to work out 40 hours, this does not mean work “from 9 to 18”, but there are positions, such as Customer Support Architect , when you have to adapt to the time of mandatory presence.

As for vacation. If you pay attention to the form of remuneration in the section " Vacancies ", you can see that the remuneration for the year is calculated on the basis of 50 working weeks, not 52. Two weeks of vacation per year are already included in the annual payment. A longer vacation is made out already by agreement with the manager in the form of a break in cooperation - at the expense of the individual entrepreneur, but the level of payment at Crossover implies that he can afford it.

Approximately the same principle of coordination of absence applies in case of illness. In cases of mild illnesses that “knock out” for a couple of days, you can agree with the manager to reduce the number of hours or “shift” labor activity relative to the usual approved schedule (if you don’t want to lose it in money). This takes into account the specifics of the project and the position in which you work. The same Customer Support Architect has a clear schedule, he needs an urgent replacement, and where there is no such dependence on hours of presence, the approach is more flexible. If you need more time to improve your health, a temporary break in work is agreed (just like with a vacation). Inquiries, respectively, also do not need to draw up.

And now it's time to move on to what people need all this for: actual income.

A bit of fun tax math

For clarity, we compare two situations using the example of the entry-level position QA Manual Tester , which offers $ 20,000 a year at Crossover (1,145,000 rubles at today's rate). According to the vacancies on hh.ru in Moscow, the average salary for this position is 40-60 thousand, in the regions - from 20 thousand rubles a month.

Suppose a certain LLC “Normal Software Company” allocated the same $ 20,000 per year in its budget for a similar position of a tester / specialist in manual testing, having it able to start searching for an employee for a salary of not more than 73400 ₽ per month, because 30% is on top already laid on compulsory medical and pension contributions for an employee. At the same time, accounting will take upon itself the hassle of paying income tax for an employee.

Total on hand: ~ 64 000₽ .

IP, of course, is surrounded in this sense by far less concern. He receives all the earned funds in full, responsible for paying taxes and contributions on his own. Is it worth it? Let's get a look. An individual entrepreneur working under a contract with Crossover will receive all $ 20,000 a year into his bank account - 1,122,000 rubles a year , taking into account conversion. We add to the bank expenses the contents of the account itself - its cost varies from bank to bank, but on average you can focus on 12 000 rubles per year . As for taxes and contributions, then the individual entrepreneur can decide for himself how it is more profitable for him:

By choosing to work on a simplified taxation system (STS) with a payment of 6% of income, which in this example, already taking into account insurance pension and medical contributions, will make, rounded up, 76,000 rubles per year. Leaving our QA Manual Tester in our hands ~ 1 034 000₽ per year.

Total on hand: ~ 86 000₽ .

By acquiring a fixed patent for a year. The patent tax system was introduced only in 2015 and allows replacing the “postpaid” tax payment procedure with a “prepaid” one, in the form of purchasing a patent at a fixed price for a year. In this case, in addition to the patent itself, only the final pension contribution of 1% of earnings over 300,000 rubles per year will remain on the individual entrepreneur.

The cost of patents can change dozens of times depending on the type of activity and the region in which the IP conducts commercial activities. For example, in St. Petersburg, a patent for those involved in the development of computer software costs 60,000 rubles for 2018. And in Moscow - already 300 thousand. And in the Moscow region - and at all 12500₽. It has

Total on hand: ~ 87 000₽ .

On this, of course, the nuances do not end there. But among them - a lot of pleasant, like tax holidays for newly made entrepreneurs. For example, in the Leningrad Region, where Chief Software Architect Ruslan Peshchuk lives, opening IPs are exempt from tax for the first two years of work:

“IPs have more opportunities to manage their finances and choose a tax system. I have been working since July 2017, and I have just a tax break. ”

The last frontier on brain drain

Judging by the growing number of professionals working with Crossover, which has doubled over the past two years in Russia and the CIS, the proposed work scheme is quite viable.

Moreover, for many talented specialists this turned out to be the last opportunity to develop professionally and earn decent money without the need to “flow away” abroad.

The entry threshold in terms of professional requirements for the Crossover community is quite high, and English is also a necessary requirement. In fact, we are talking about high-level specialists; in addition, the IT environment is progressively minded people who do not hold on to old habits. From the point of view of finance and development, to go abroad for them is a logical option, especially in small cities, where often there are simply no cool employers. Crossover collects the best minds of those who could potentially leave, and creates an opportunity for them to stay in their hometown and country, receive significant amounts for their work and spend the money received in their region, which supports the domestic economy.

- Vladimir Yeronin, Director of Crossover in Russia and the CIS

In the name of the state

If until now all of the above seems somehow suspicious, then the executive director of the Union of Entrepreneurs KROO Elena Ivanovna Dugina will not agree with you: the Crossover system of work is absolutely legal, although not very common in Russia. Moreover, increasing the number of individual entrepreneurs is one of the priority current tasks in the development of the Russian economy. As is the case with the suspension of brain drain, Crossover’s policy is once again, albeit unintentionally, in the mainstream of being state-run.

Who are these people choosing Crossover?

In general, you can create a portrait of an “average” specialist who works with Crossover. These are specialists:

- A variety of profiles (engineers, developers, testers, managers, analysts, as well as high-level managers), but always - the highest class.

- No age restrictions. Once a middle-aged mature team (senior and senior employees overstepped the mark of 30 years) is now getting younger due to the emergence of new junior and middle level positions.

- Which fell into their position in one of two ways: either by successfully passing the remote testing, as in the history of VP of Engineering slavakulakov , or by collecting a passing score in an offline tournament, the principles of organization of which we talked about only last week (by the way, on April 7 we will hold the next tournament in Moscow! ).

- They speak English at least at a level sufficient for interaction in an international team (intermediate and above). This is an inevitable condition for working in an internationally distributed team. Two customers collecting Russian-speaking teams are an exception; all other teams communicate in English.

- Which are distinguished by a high level of self-organization. Without this, there is simply no way - with any remote location, self-control is required, and the individual entrepreneur must be attentive not only to the content of his work, but also to its formal side (interaction with government agencies, timely payment of taxes and contributions).

- Which are scattered in different regions of Russia. Only a few vacancies are tied to a certain city due to the specifics of work, for example, recently we had a position of VP of Engineering in Dubai, but the remaining 99% are available for specialists from any region of Russia (or from anywhere in the world).

- Those who firmly decided to take responsibility for their working time, rest time and illness for themselves, choose higher earnings instead of less responsibility, get a couple more bonuses in the appendage. This is an improvement in their own English due to the constant work with both foreigners and native speakers, saving time spent on travel to the office and improving their own professional skills.

The last half-step "from uncle"

And yet, as one study showed, for more than half of those who left Crossover, the next stage of development is already their own business, and most often - without moving from their region. This contributes to the fact that, in addition to professional skills, a person also gets experience in interacting with the tax, accounting and, of course, the opportunity to accumulate start-up capital over several years (with an income of about $ 100,000 / year and above, this is a perfectly feasible task). But the main thing here is still not this.

The main thing was noted by Chief Software Architect Evgeny Konurbaev:

Sometimes I worked on trips, and sometimes I postpone work on the weekend, if you need to do something on weekdays. You need to organize yourself, manage your time. For those who want to develop, this is a plus. For someone who is not ready to leave the comfort zone, this, of course, is a minus.

For those who are ready for such changes - all doors are open. And many of them are opened by Crossover.