System Business Basis - Basic Analytics

One day a man was driving on a motorway in his car ... There was fog everywhere. As they say, I was driving "on intuition" ... Okay, fog, so also a car without headlights, speedometer, only wheels, steering wheel and body ... Bang! Wall, accident, repair, broken fortunes, expenses.

The story is fantastic, isn't it? Then why are 90% of companies moving absolutely the same blindly? Counting only on intuition and without understanding what is really happening in the company?

Many founders, entrepreneurs and startups have heard about the essence and benefits of “digitizing” a business, and seeing key indicators. Many have heard and are aware of RoiStat, SmallData, BigData and so on.

But at the same time, either all this is not implemented, or is not used 100%. And it often happens that there are many indicators, but in fact they are not used. Moreover, the online broadcasts of two energetic guys who “beautifully” convey all these meanings from the stage become a mass cause of unconscious implementation. Or just "it's fashionable."

Result: some indicators are coming, they seem to be understandable, but "how to use them all in practice?"

I share a simple practical model with examples.

So, here are 2 typical problems in the market:

1) There is no business analytics at all

2) BA is, but not used in practice

The whole point is in the simple thesis “conscious understanding and application of analytics”.

Catch examples:

1 story.One company we worked with was engaged in the manufacture of blinds, and worked on a wide advertising front. One of the channels is TV advertising, which at one time gave brilliant results. As time passed, advertising directions and budgets grew. The company's profit grew. And “out of habit” (keyword) - ads continued to be placed on local channels.

We set up business analytics - it became obvious that TV expenses do not correlate with profit growth, unlike in previous periods. That is, the TV ad simply “ate” 100,000 rubles a month. And so it went on for 5-6 months.

Just by transferring the same budgets to a “context” with an ROI (return on investment) of about 400% (each invested ruble brought 4 rubles), one could get an amazing result:

4 x 100,000 rubles = 400,000 rubles of revenue (every month).

Of course, there are nuances with the volume of requests for contextual advertising and there are a number of other criteria, and the result would be much better.

2 story. Everything is simple. How we grew 4 months in a row (from the history of our company).

1 month , start, first sales - 38,000 rubles of net profit.

2 months - 55,000 rubles

3 months - 119,000 rubles

4 months - 220,000 rubles

True, 5 months - 58,000 rubles

Although this is just because of laziness)) But, thanks to well-established business analytics, we learned to identify only 20% from the numbers actions that give 80% of the result.

That is, with less workload, get more return. The average time spent for 4 months of work is 16 working hours per week.

Otherwise, this is an opportunity to see and evaluate the situation not subjectively, at the level of intuition, but objectively, at the level of numbers.

The simplest, most basic, set of indicators for analysts includes 5 main figures and their product equal to the net profit of the enterprise (often for the main indicator here is EBITDA (from the English Earnings before interest, taxes, depreciation and amortization ")), it is called" The main equation business. "

Number of calls - the total number of incoming calls, applications, company visitors for a selected period of time, for example, for 1 month. Example: 200 hits for January.

Conversion to deals- the ratio of the number of customers who paid in the company to the number of calls in percentage terms, also for the selected period of time. It is important to note that the first payments also include customers who have previously made purchases in the company outside the selected period of time (if the client has already completed a transaction in January and again completed it in February - this is considered 1 payment).

Example: 60 first-timers / 200 calls = 30% (conversion rate).

The average check is the ratio of the amount of the company's revenue received during the reporting period to the number of all transactions for the same period of time. Example: 300,000 rubles / 90 transactions ~ 3,333 rubles.

Number of repeat purchases- coefficient of the ratio of purchases (actual payments) repeatedly to the first payments within the selected period of time. Example: 60 purchases were made for the first time this month, 30 people purchased products again this month. Coefficient 30/60 + 1 = 1.5.

Profitability -% of the company's total revenue, amounting to net profit. Calculated: (revenue - (fixed + variable expenses)) / revenue x 100%

Example: 200 (calls) x 30% (conversion) x 3 333 rubles (average check) x 1.5 (repeat purchases) x 30% (profitability ) = 89,991 rubles (net profit).

By acting on each figure individually, net profit is growing. For example, by adding additional positions to the basket of the online store with the “they also take this module” module, the average check has doubled. With the same value of the remaining indicators and the average bill of 6,666 rubles, profit has become equal to about 180,000 rubles.

As a result, it is much easier to do conscious, systematic targeted actions.

This basic model is universal and suitable for almost any company. The model is maximally simplified and divided into separate criteria, acting on each individual, the size of the company's net profit changes.

After all, many are familiar with this model, but for some reason, even such a simple system is not implemented in fact. Because the system “yes, I know that!” Turns on.

3 story. Familiar to many. Right now, you, the reader of this article, have a fan of great ideas, “hypotheses” and assumptions in your head — and each of them is “sound.”

But for one reason or another, these ideas are not being implemented.

- “It’s time to start a normal site!”

- “It’s time to implement CRM”

- “Where are 2 of our new sales managers?”

And you often put them off. Why?

Because their business benefits are "not obvious." It’s hard to evaluate it with numbers.

1) Which of the 5 main indicators will your “hypothesis” influence when it will be executed (directly or indirectly)? On the increase in conversion, on the growth of the average check?

2) And on what specific volume will the indicator change? How many hits will a site with contextual advertising give? Complex issue? Then first answer or puzzle the contractor.

Here's what it might look like:

In wordstate, 20,000 key queries x 5% CTR (average click through rate from experience) x 7% conversion from site to visitor x 30% conversion from order to transaction x 10,000 rubles average bill x 30% (business profitability) = 63,000 rubles

This amount can potentially bring the launch of this hypothesis, monthly. Naturally, there is an investment of time and money to launch. Plus, the budget for clicks per month is deducted from the amount of profit. But now, with this model, you can compare several models with each other. These calculations will take no more than 1 hour. But you can save a lot of time and money.

Now it will be much less “empty" actions, because now you have a certain "filter". Make the “main equation of your business” at least in the last 3 months and you will “see clearly”.

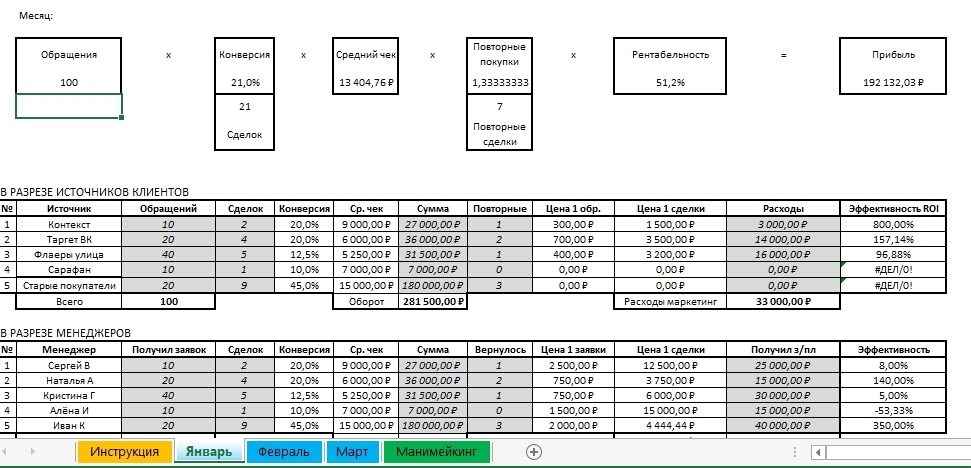

PS A more detailed file for basic analytics may look like this (in our company):

PPSFrom the implementation experience, the most difficult indicator for accounting is getting the “Number of hits”. If the topic is useful to you - in the following posts I will talk about this in more detail.

The story is fantastic, isn't it? Then why are 90% of companies moving absolutely the same blindly? Counting only on intuition and without understanding what is really happening in the company?

Many founders, entrepreneurs and startups have heard about the essence and benefits of “digitizing” a business, and seeing key indicators. Many have heard and are aware of RoiStat, SmallData, BigData and so on.

But at the same time, either all this is not implemented, or is not used 100%. And it often happens that there are many indicators, but in fact they are not used. Moreover, the online broadcasts of two energetic guys who “beautifully” convey all these meanings from the stage become a mass cause of unconscious implementation. Or just "it's fashionable."

Result: some indicators are coming, they seem to be understandable, but "how to use them all in practice?"

I share a simple practical model with examples.

So, here are 2 typical problems in the market:

1) There is no business analytics at all

2) BA is, but not used in practice

The whole point is in the simple thesis “conscious understanding and application of analytics”.

Catch examples:

1 story.One company we worked with was engaged in the manufacture of blinds, and worked on a wide advertising front. One of the channels is TV advertising, which at one time gave brilliant results. As time passed, advertising directions and budgets grew. The company's profit grew. And “out of habit” (keyword) - ads continued to be placed on local channels.

We set up business analytics - it became obvious that TV expenses do not correlate with profit growth, unlike in previous periods. That is, the TV ad simply “ate” 100,000 rubles a month. And so it went on for 5-6 months.

Just by transferring the same budgets to a “context” with an ROI (return on investment) of about 400% (each invested ruble brought 4 rubles), one could get an amazing result:

4 x 100,000 rubles = 400,000 rubles of revenue (every month).

Of course, there are nuances with the volume of requests for contextual advertising and there are a number of other criteria, and the result would be much better.

2 story. Everything is simple. How we grew 4 months in a row (from the history of our company).

1 month , start, first sales - 38,000 rubles of net profit.

2 months - 55,000 rubles

3 months - 119,000 rubles

4 months - 220,000 rubles

True, 5 months - 58,000 rubles

Although this is just because of laziness)) But, thanks to well-established business analytics, we learned to identify only 20% from the numbers actions that give 80% of the result.

That is, with less workload, get more return. The average time spent for 4 months of work is 16 working hours per week.

Now the "meat"

The goal of business analytics is to interpret a large amount of data, focusing only on key performance factors, simulating the outcome of various options for action, tracking the results of decision-making in measured indicators.- Wikipedia

Otherwise, this is an opportunity to see and evaluate the situation not subjectively, at the level of intuition, but objectively, at the level of numbers.

The simplest, most basic, set of indicators for analysts includes 5 main figures and their product equal to the net profit of the enterprise (often for the main indicator here is EBITDA (from the English Earnings before interest, taxes, depreciation and amortization ")), it is called" The main equation business. "

Number of calls - the total number of incoming calls, applications, company visitors for a selected period of time, for example, for 1 month. Example: 200 hits for January.

Conversion to deals- the ratio of the number of customers who paid in the company to the number of calls in percentage terms, also for the selected period of time. It is important to note that the first payments also include customers who have previously made purchases in the company outside the selected period of time (if the client has already completed a transaction in January and again completed it in February - this is considered 1 payment).

Example: 60 first-timers / 200 calls = 30% (conversion rate).

The average check is the ratio of the amount of the company's revenue received during the reporting period to the number of all transactions for the same period of time. Example: 300,000 rubles / 90 transactions ~ 3,333 rubles.

Number of repeat purchases- coefficient of the ratio of purchases (actual payments) repeatedly to the first payments within the selected period of time. Example: 60 purchases were made for the first time this month, 30 people purchased products again this month. Coefficient 30/60 + 1 = 1.5.

Profitability -% of the company's total revenue, amounting to net profit. Calculated: (revenue - (fixed + variable expenses)) / revenue x 100%

Example: 200 (calls) x 30% (conversion) x 3 333 rubles (average check) x 1.5 (repeat purchases) x 30% (profitability ) = 89,991 rubles (net profit).

By acting on each figure individually, net profit is growing. For example, by adding additional positions to the basket of the online store with the “they also take this module” module, the average check has doubled. With the same value of the remaining indicators and the average bill of 6,666 rubles, profit has become equal to about 180,000 rubles.

As a result, it is much easier to do conscious, systematic targeted actions.

This basic model is universal and suitable for almost any company. The model is maximally simplified and divided into separate criteria, acting on each individual, the size of the company's net profit changes.

Now let's be honest

After all, many are familiar with this model, but for some reason, even such a simple system is not implemented in fact. Because the system “yes, I know that!” Turns on.

3 story. Familiar to many. Right now, you, the reader of this article, have a fan of great ideas, “hypotheses” and assumptions in your head — and each of them is “sound.”

But for one reason or another, these ideas are not being implemented.

- “It’s time to start a normal site!”

- “It’s time to implement CRM”

- “Where are 2 of our new sales managers?”

And you often put them off. Why?

Because their business benefits are "not obvious." It’s hard to evaluate it with numbers.

Just 2 simple questions

1) Which of the 5 main indicators will your “hypothesis” influence when it will be executed (directly or indirectly)? On the increase in conversion, on the growth of the average check?

2) And on what specific volume will the indicator change? How many hits will a site with contextual advertising give? Complex issue? Then first answer or puzzle the contractor.

Here's what it might look like:

In wordstate, 20,000 key queries x 5% CTR (average click through rate from experience) x 7% conversion from site to visitor x 30% conversion from order to transaction x 10,000 rubles average bill x 30% (business profitability) = 63,000 rubles

This amount can potentially bring the launch of this hypothesis, monthly. Naturally, there is an investment of time and money to launch. Plus, the budget for clicks per month is deducted from the amount of profit. But now, with this model, you can compare several models with each other. These calculations will take no more than 1 hour. But you can save a lot of time and money.

Now it will be much less “empty" actions, because now you have a certain "filter". Make the “main equation of your business” at least in the last 3 months and you will “see clearly”.

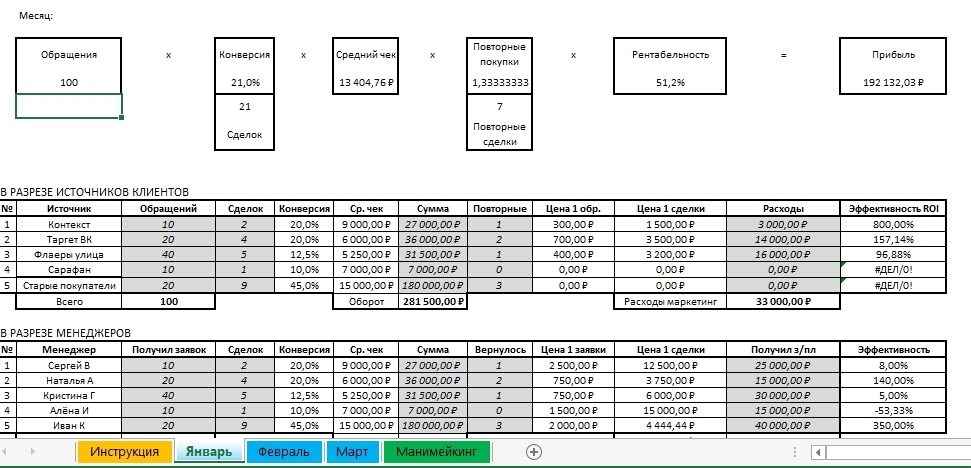

PS A more detailed file for basic analytics may look like this (in our company):

PPSFrom the implementation experience, the most difficult indicator for accounting is getting the “Number of hits”. If the topic is useful to you - in the following posts I will talk about this in more detail.