Inadequate Startups - Rule or Exception

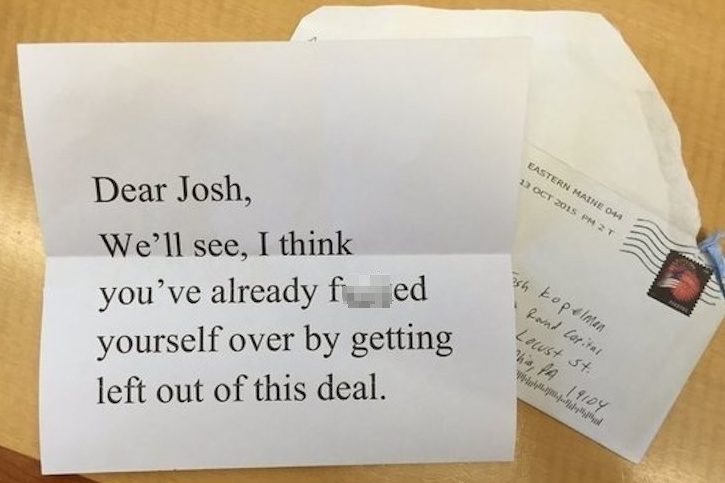

Source: Josh Kopelman.

Maybe startups really "go crazy" - each in its own way? Someone loses an adequate perception of reality along with profit and hope for a brighter future, sliding into a debt hole. This situation is more reminiscent of the realities of our country, unfortunately.

And someone is rowing the investment with a “shovel” and cannot stop - like a gambler who has been lucky all evening. Such a startup makes you "play" with him all in a row and does not pay attention to objections and arguments. Not getting what he wants, he falls into a rage. This "style" of doing business, as it turns out, is increasingly found in the United States. Well, in Silicon Valley there are all conditions for such a "gambling" to reach its zenith.

In the context of the Western investment climate, technology startups have never been easier to attract investment. According to one Silicon Valley investor, many founders complained in all seriousness that they were only able to attract $ 1 million in seed investment.

Business Insider on Friday told how one startup organized an attraction of unprecedented audacity. Josh Kopelman, partner of First Round Capital, shared this story with the publication. By the way, he ranks fourth among the most successful venture investors in the Forbes ranking .

Kopelman posted a post on Twitter (see image at the beginning of the article) with a letter from the founder, who received another refusal.First Round Capital in the person of Josh Kopelman refused (apparently, repeatedly) to participate in the round of financing an angry startup. The content of the letter boils down to the fact that the startup in obscene form hints that, having refused to participate in the round, Kopelman “punished” himself and missed a cool project.

It turned out further that not only First Round Capital, but also the Menlo Ventures fund became a victim of the bounty hunter of investors :

Hey @joshk I got one too! No doubt the next Google - boy, am I kicking myself. pic.twitter.com/AxakByMow5

- davidcowan (@davidcowan) October 22, 2015How many more investors received such letters is unknown.

And as if according to the law of paired events, on October 24, the Firrma publication published material describing one of the aspects of communication between Russian founders and investors. Alexander Chachava,

managing partner of the LETA Capital fund, cites a case from personal business practice on his Facebook page. He concludes the post with undisguised irony, alluding to bizarre stereotypes and, to put it mildly, strange methods of negotiating with American investors.