Promotions: the first serious experience

My first investment experience happened at school, we already had dial-up, and after a while the first companies offering to trade on Forex. The attitude at that moment to all this trading was exclusively gambling - I made transactions without much analysis, using the simplest level indicators on the price chart. Years later, I came to the "adult exchange".

After a few months of playing in currencies, I noticed that the schedule regularly “slows down”, and applications for the sale or purchase of currency are executed with a delay and always not in my favor. Having sorted out the issue, I found out that most of the companies connecting themselves with Forex actually do not conduct operations in the real market and at best accept bets on changes in the exchange rate of the currency of the same market. Having played enough, I fastened.

I have nothing to do with finances and therefore only in 2014 returned to trade, began to read articles and books on this topic. My interest was dictated by the desire to learn not only to save money, but also to protect them from inflation and many other scary words.

Very soon, I learned that in reality everything is not so complicated, and the amount of basic knowledge necessary for the rational management of personal money is small.

There are two ways to invest in securities: you can go to a specialized company, choose a portfolio (a set of different stocks, bonds and derivatives) for a certain amount of money and, having signed an agreement with the company, transfer the necessary amount of money.

The second way is to conclude an agreement with a broker to trade personally in the market. To do this, you will have to open your personal investment account, replenish it with money, establish a trading terminal.

In the first case, they simply invest in a fixed product. The company has already thought over the possible risks and decided on the type of securities, based on their profitability. Most often, such investments are clearly limited in time.

Positive side: in many products the maximum possible loss is fixed.

In the second case, additional risks fall on us - we ourselves must understand how much the shares actually cost and at what price they are currently sold on the exchange, whether their value will increase after a while, how much and when the dividend will be paid.

Positive side: you can withdraw money at any time, we independently choose the portfolio composition from all available securities.

I decided to gain access to the stock exchange and complete my first securities transactions myself. To do this, for several weeks I chose a broker - a company with a specialized license necessary for transactions in the markets and providing access to exchanges to my clients.

The selection process was delayed, because there are a lot of offers on the market and each of them raises different concerns, and I was in no hurry to trust some strange companies with my hard-earned earnings.

First of all, I came across the management company Alfa Capital”, Since I was already a client of Alfa-Bank. I will briefly talk about possible options for working with Alpha, as they are typical of most banks.

Mutual funds are a ready-made investment tool in the stock market. The entry threshold is from 5 thousand rubles, but you can invest only for a fixed time, from 6 months.

Alfa-profit is actually a finished product with 100% capital protection.

The minimum investment amount is 50 thousand rubles. The minimum investment period is 3 years.

Structural products - a group of finished products, one of the instruments of which are derivative financial instruments, such as futures, forwards, options, etc. Here, too, I will not be able to touch the exchange and transactions, and the instruments themselves are too complicated for me now.

Trust management - a broker will do all transactions for me. Entry threshold of 15 million rubles. When I become super-busy and rich, I will definitely return to this service.

Individual solutions are strategies implemented exclusively for the needs of a unique client. Interestingly, the entry threshold is from 50 million rubles. Pension

management - in short, you can transfer your pension from the Pension Fund of the Russian Federation to the specialized Alfa Capital fund, about this another time.

Having walked through this wonderful list of offers from a well-known investment company, I did not find a suitable offer for me, but I was able to formulate a brief set of conditions for myself:

- The ability to trade independently.

- The minimum entry threshold is 30 thousand rubles.

- Minimum commission for services and transactions.

- The ability to take your money at any time.

- Trade only with your own money, without credit (leverage).

Realizing this list, I started looking for a broker who will become my guide to the exchange, in fact, a provider.

The second company was BCS . They have a lot of advertising, in it they often declare themselves as a market leader. I looked through their conditions and found a suitable option for myself - the company is ready to provide access to the exchange, I have arranged a minimum amount.

The first thing I encountered in BCS was a huge package of documents of several tens of pages in small print, which had to be signed to get started.

I never sign documents without looking, and nobody warned me about their quantity in advance, so I was stuck in studying papers for more than half an hour.

Second: the service itself. At first, I had to wait a very long time for the manager at his empty table, and while working with me, he was solving some difficult situation with another client.

When signing the contract, I was asked for the details of my regular account to withdraw money to it if necessary. I don’t like to produce a million accounts so as not to encounter various related expenses such as account maintenance fees, so I provided the details of an existing account with another bank.

After signing, I was asked to proceed to the cashier desk to make the minimum amount for opening an account - 30 thousand rubles, but since the paperwork and the manager’s waiting in total took more than an hour, the lunch break expired, I already had to go back to work, and I decided to deposit the money the other day.

After a couple of days, I returned to lunch at lunchtime, this time without an appointment, since the last time she had no effect and I still had to wait for the manager. And what do you think? Of the two cash desks, only one works, the cashier is not in place, so I was asked to wait. After 10 minutes, a nice woman came, who smelled very seductively of borsch, and invited me to the cashier.

When I tried to deposit cash at the cash desk, I found out an amazing thing - it is impossible to deposit money directly into the investment account in BCS, for this you first need to open a regular ruble account of an individual.

I returned to the manager again, filled up a bunch of papers again. I was already in the BCS customer database, so this time I only signed the annexes to the contract. Back to the cashier; contributed money by spending another lunch; went to the office.

A few days later, I logged in to the personal account of BCS Bank to transfer money from a regular account to an investment one. I executed the transfer according to the details specified in one of the million appendices to the contract. And the money "fell into my brokerage account."

Trading platform selection

And here the most interesting thing began - an attempt to understand how exactly to complete the first deal. BCS has no ready-made clear instructions. Other brokers are also complicated, usually it all comes down to the offer to call the hotline and get instructions there.

It was possible to find out that BCS supports two trading platforms: MetaTrader and QUIK . Supported Operating Systems:

There are no working exchange terminals for iMac. Gorgeous. If you have an iMac at work and a MacBook at home, you have nothing to do in the securities market. It didn’t stop me and this, I had to put a virtual machine, and QUIK on it. I made a choice in his favor because I was familiar with MetaTrader since the days of Forex, and, according to reviews on brokerage forums, “professionals are using QUIK,” so it’s better to learn from it immediately than to relearn later.

We trade in QUIK

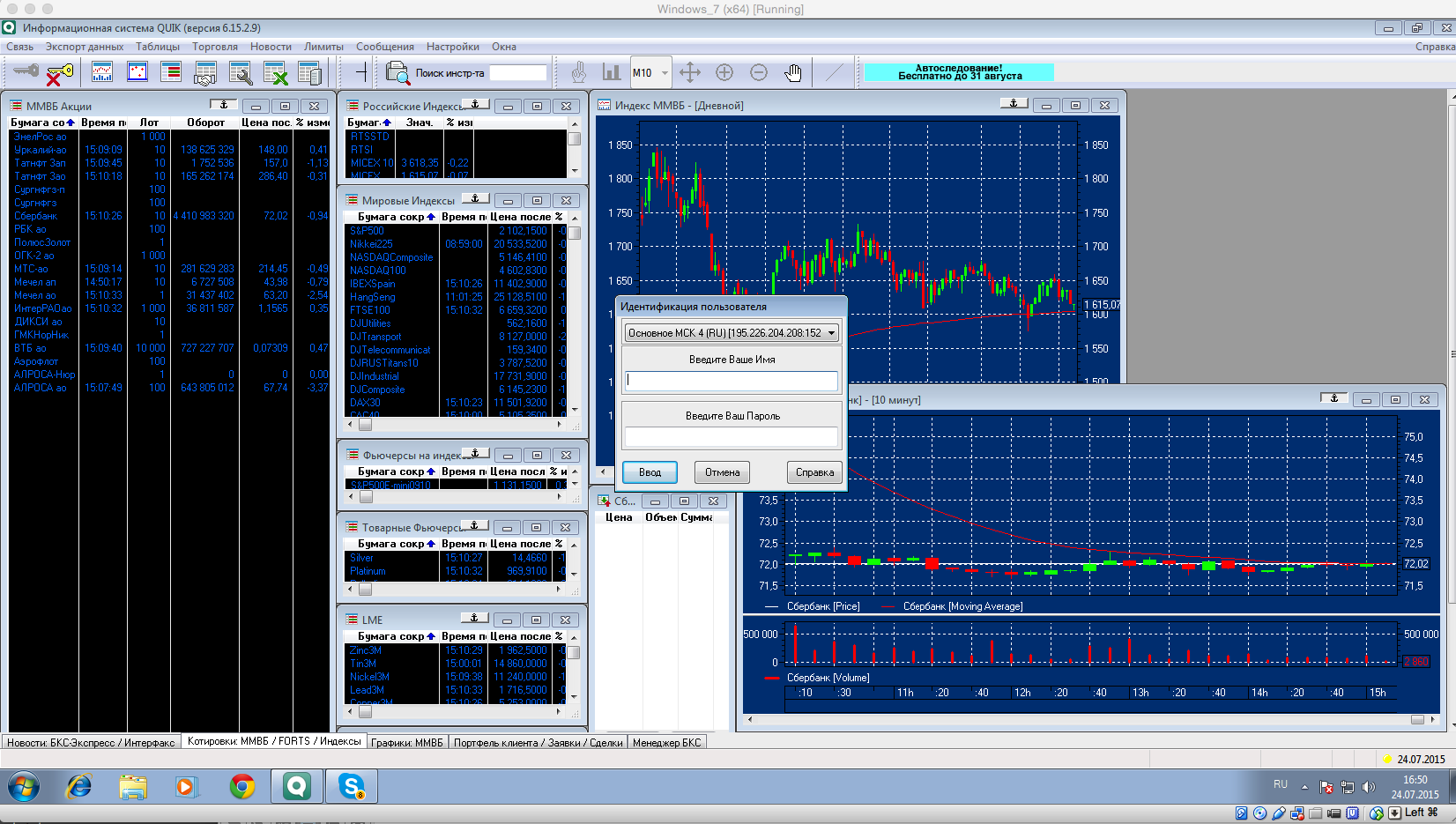

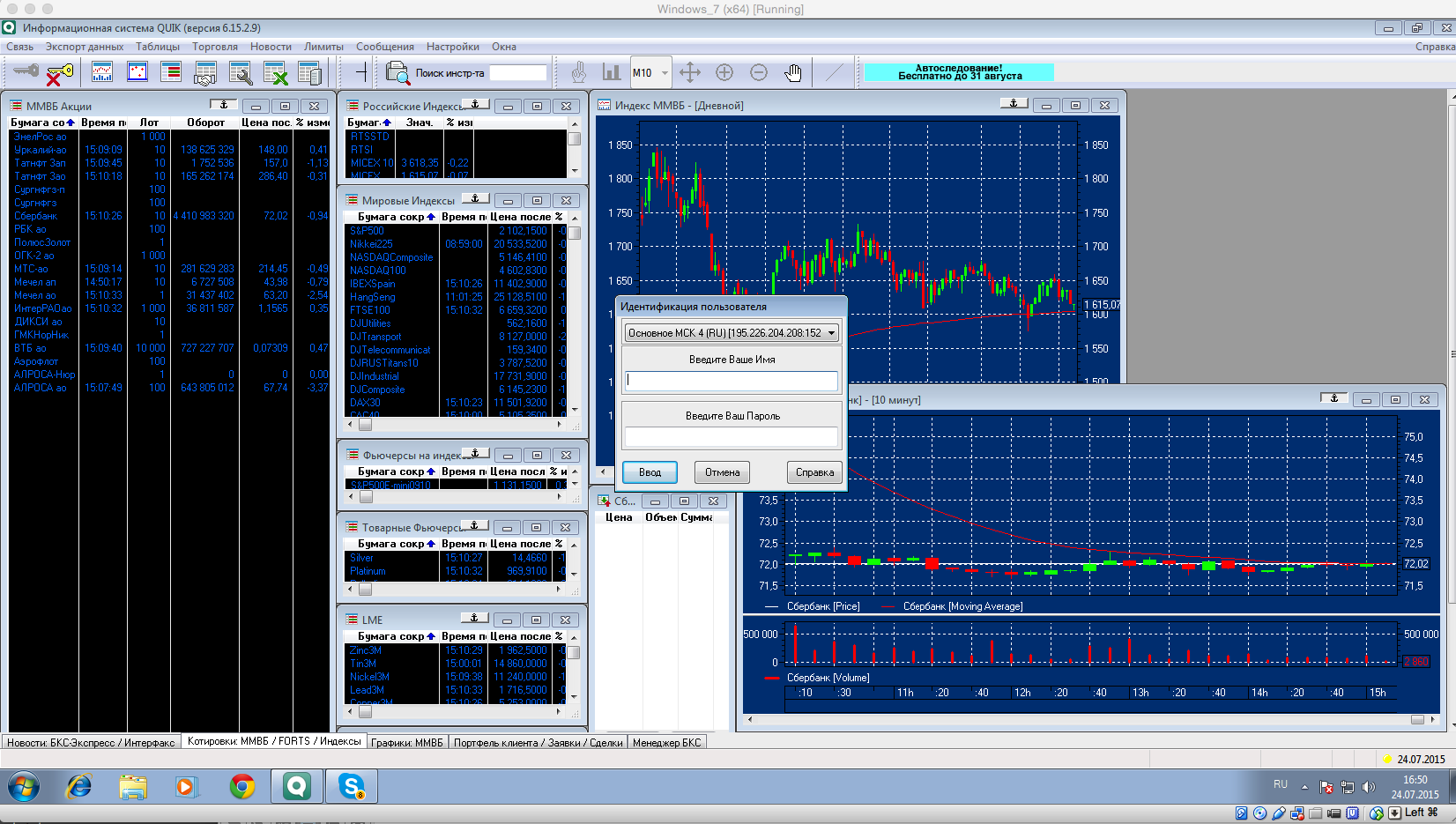

Guys, QUIK is something. When I first saw it, the interface led me into a stupor, and when the aftertaste passed, I wanted to tear my eyes out so that I could never see this hell again. In the blue window to the bottom right is the text of the news. News, Karl!

QUIK. News interface.

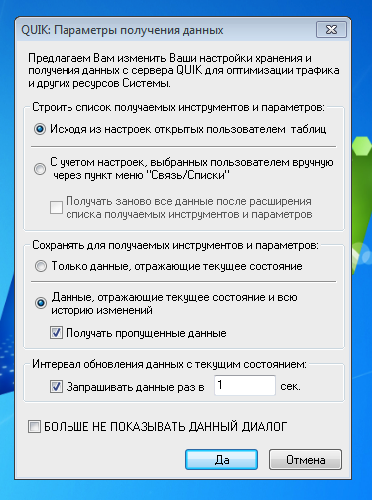

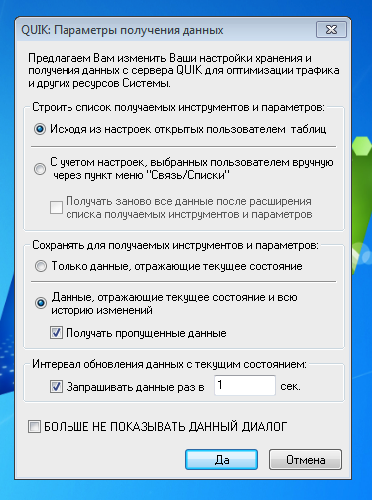

The best way to inspire a newbie is to ask him a million strange questions before the launch of the trading platform.

QUIK is so poor software that it is not even able to remember your username after a restart.

QUIK is the only program in my life where, at the time of logging in, you must specify your last name and first name in Cyrillic with spaces. Despite the fact that in the login window you are asked to enter “Your Name”, and the password, by the way, is in Latin.

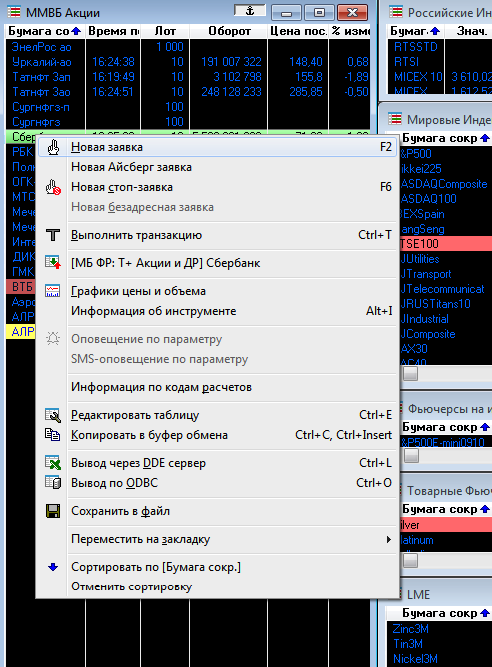

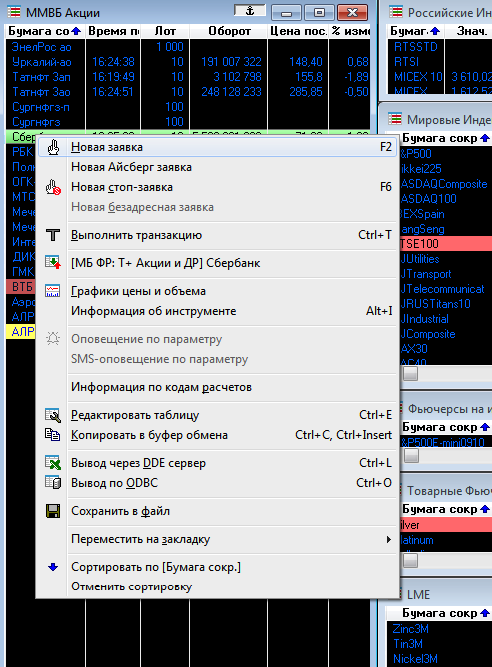

QUIK. Just a context menu.

QUIK is one of the few programs that I can’t log in the first time even after six months of use.

After successful authorization, QUIK continues to delight - the product philosophy implies a huge number of interface settings. Up to the position of the windows.

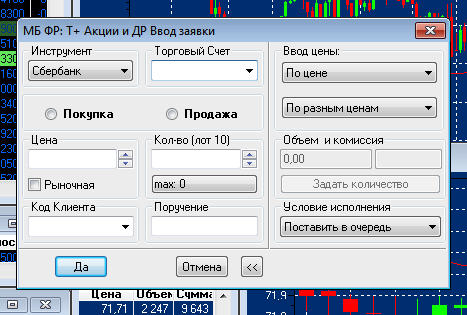

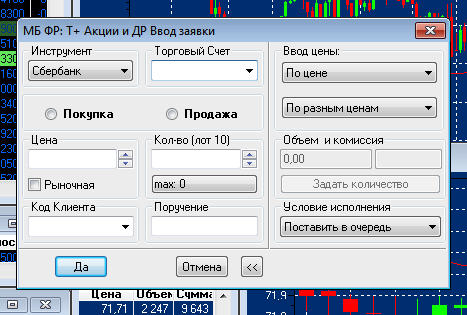

QUIK. Transaction interface.

By the way, in the "Trading Account" field you must specify one of your trading accounts, but every time after restarting QUIK the drop-down list is cleared. It is necessary to rummage through the settings, first add all available trading accounts to the list of displayed ones, only after that they will appear in the drop-down list of the deals window. To find out, I spent half a day.

QUIK. Portfolio section interface.

By the way, while I was writing this article, my portfolio fell 2.63% (–4883.2 rubles), but since I currently work in long positions, such fluctuations, although unpleasant, are acceptable.

Back to trade

A strange psychological effect: after a few months I began to freely operate with the amount of 30 thousand rubles. And I got bored. Financial result: I periodically lost money on poorly thought-out transactions, but since I tried to buy different securities, some transactions brought me profit and some lost.

After two months of work, I completed a hundred transactions totaling several million rubles. In fact, I earned only a few thousand rubles, and if you compare the risks with a classic deposit, this is a very dangerous game, but on the other hand, it is satisfactory for a beginner in the first month of work.

I decided to bring a larger amount to the brokerage account in order to feel the results of my work and again to feel responsibility.

Since childhood, I hate to rewrite payment details from a piece of paper. What prevents banks from registering a new customer to send him by email his details in electronic form is a mystery to me.

I waited four days for the result of the transfer, but the money never came. For an interbank transfer, this is an awfully long time, and I started searching.

It turned out that during the intra-bank transfer I did not indicate the number of my general agreement and its date in the payment purpose. The managers asked me to provide a corrective letter. There are three ways to do this:

So, I again went to the BCS office, handed over, filled out, after some time the money arrived in the account, and I continued trading.

In the dry residue:

At BCS, I noticed one important plus - all system errors can be solved with the help of people. It is important to find the right employee and he will try to help you overcome difficulties.

I was already lucky to see a historical moment - how the dollar rose to 100 rubles and how several times in one day trading on the Moscow Exchange was suspended.

I began to look straight lines with V. Putin, his every word creates something terrible with shares of Russian companies on the Moscow Exchange. From a market perspective, this is terrible, but the show is unimaginable!

My experience is individual, someone does not sit on OS X and calmly reacts to Norton Commander-style interfaces, someone will not be rejected by specific QUIK settings, and someone will be more lucky with the quality of a broker, but the fact remains - To start trading in Russia on a real exchange, you need to be astubborn stubborn samurai.

After a few months of playing in currencies, I noticed that the schedule regularly “slows down”, and applications for the sale or purchase of currency are executed with a delay and always not in my favor. Having sorted out the issue, I found out that most of the companies connecting themselves with Forex actually do not conduct operations in the real market and at best accept bets on changes in the exchange rate of the currency of the same market. Having played enough, I fastened.

I have nothing to do with finances and therefore only in 2014 returned to trade, began to read articles and books on this topic. My interest was dictated by the desire to learn not only to save money, but also to protect them from inflation and many other scary words.

Very soon, I learned that in reality everything is not so complicated, and the amount of basic knowledge necessary for the rational management of personal money is small.

There are two ways to invest in securities: you can go to a specialized company, choose a portfolio (a set of different stocks, bonds and derivatives) for a certain amount of money and, having signed an agreement with the company, transfer the necessary amount of money.

The second way is to conclude an agreement with a broker to trade personally in the market. To do this, you will have to open your personal investment account, replenish it with money, establish a trading terminal.

In the first case, they simply invest in a fixed product. The company has already thought over the possible risks and decided on the type of securities, based on their profitability. Most often, such investments are clearly limited in time.

Positive side: in many products the maximum possible loss is fixed.

In the second case, additional risks fall on us - we ourselves must understand how much the shares actually cost and at what price they are currently sold on the exchange, whether their value will increase after a while, how much and when the dividend will be paid.

Positive side: you can withdraw money at any time, we independently choose the portfolio composition from all available securities.

I decided to gain access to the stock exchange and complete my first securities transactions myself. To do this, for several weeks I chose a broker - a company with a specialized license necessary for transactions in the markets and providing access to exchanges to my clients.

The selection process was delayed, because there are a lot of offers on the market and each of them raises different concerns, and I was in no hurry to trust some strange companies with my hard-earned earnings.

First of all, I came across the management company Alfa Capital”, Since I was already a client of Alfa-Bank. I will briefly talk about possible options for working with Alpha, as they are typical of most banks.

Mutual funds are a ready-made investment tool in the stock market. The entry threshold is from 5 thousand rubles, but you can invest only for a fixed time, from 6 months.

Alfa-profit is actually a finished product with 100% capital protection.

The minimum investment amount is 50 thousand rubles. The minimum investment period is 3 years.

Structural products - a group of finished products, one of the instruments of which are derivative financial instruments, such as futures, forwards, options, etc. Here, too, I will not be able to touch the exchange and transactions, and the instruments themselves are too complicated for me now.

Trust management - a broker will do all transactions for me. Entry threshold of 15 million rubles. When I become super-busy and rich, I will definitely return to this service.

Individual solutions are strategies implemented exclusively for the needs of a unique client. Interestingly, the entry threshold is from 50 million rubles. Pension

management - in short, you can transfer your pension from the Pension Fund of the Russian Federation to the specialized Alfa Capital fund, about this another time.

Having walked through this wonderful list of offers from a well-known investment company, I did not find a suitable offer for me, but I was able to formulate a brief set of conditions for myself:

- The ability to trade independently.

- The minimum entry threshold is 30 thousand rubles.

- Minimum commission for services and transactions.

- The ability to take your money at any time.

- Trade only with your own money, without credit (leverage).

Realizing this list, I started looking for a broker who will become my guide to the exchange, in fact, a provider.

The second company was BCS . They have a lot of advertising, in it they often declare themselves as a market leader. I looked through their conditions and found a suitable option for myself - the company is ready to provide access to the exchange, I have arranged a minimum amount.

The first thing I encountered in BCS was a huge package of documents of several tens of pages in small print, which had to be signed to get started.

I never sign documents without looking, and nobody warned me about their quantity in advance, so I was stuck in studying papers for more than half an hour.

Second: the service itself. At first, I had to wait a very long time for the manager at his empty table, and while working with me, he was solving some difficult situation with another client.

When signing the contract, I was asked for the details of my regular account to withdraw money to it if necessary. I don’t like to produce a million accounts so as not to encounter various related expenses such as account maintenance fees, so I provided the details of an existing account with another bank.

After signing, I was asked to proceed to the cashier desk to make the minimum amount for opening an account - 30 thousand rubles, but since the paperwork and the manager’s waiting in total took more than an hour, the lunch break expired, I already had to go back to work, and I decided to deposit the money the other day.

After a couple of days, I returned to lunch at lunchtime, this time without an appointment, since the last time she had no effect and I still had to wait for the manager. And what do you think? Of the two cash desks, only one works, the cashier is not in place, so I was asked to wait. After 10 minutes, a nice woman came, who smelled very seductively of borsch, and invited me to the cashier.

When I tried to deposit cash at the cash desk, I found out an amazing thing - it is impossible to deposit money directly into the investment account in BCS, for this you first need to open a regular ruble account of an individual.

I returned to the manager again, filled up a bunch of papers again. I was already in the BCS customer database, so this time I only signed the annexes to the contract. Back to the cashier; contributed money by spending another lunch; went to the office.

A few days later, I logged in to the personal account of BCS Bank to transfer money from a regular account to an investment one. I executed the transfer according to the details specified in one of the million appendices to the contract. And the money "fell into my brokerage account."

Trading platform selection

And here the most interesting thing began - an attempt to understand how exactly to complete the first deal. BCS has no ready-made clear instructions. Other brokers are also complicated, usually it all comes down to the offer to call the hotline and get instructions there.

It was possible to find out that BCS supports two trading platforms: MetaTrader and QUIK . Supported Operating Systems:

There are no working exchange terminals for iMac. Gorgeous. If you have an iMac at work and a MacBook at home, you have nothing to do in the securities market. It didn’t stop me and this, I had to put a virtual machine, and QUIK on it. I made a choice in his favor because I was familiar with MetaTrader since the days of Forex, and, according to reviews on brokerage forums, “professionals are using QUIK,” so it’s better to learn from it immediately than to relearn later.

We trade in QUIK

Guys, QUIK is something. When I first saw it, the interface led me into a stupor, and when the aftertaste passed, I wanted to tear my eyes out so that I could never see this hell again. In the blue window to the bottom right is the text of the news. News, Karl!

QUIK. News interface.

The best way to inspire a newbie is to ask him a million strange questions before the launch of the trading platform.

QUIK is so poor software that it is not even able to remember your username after a restart.

QUIK is the only program in my life where, at the time of logging in, you must specify your last name and first name in Cyrillic with spaces. Despite the fact that in the login window you are asked to enter “Your Name”, and the password, by the way, is in Latin.

QUIK. Just a context menu.

QUIK is one of the few programs that I can’t log in the first time even after six months of use.

After successful authorization, QUIK continues to delight - the product philosophy implies a huge number of interface settings. Up to the position of the windows.

QUIK. Transaction interface.

By the way, in the "Trading Account" field you must specify one of your trading accounts, but every time after restarting QUIK the drop-down list is cleared. It is necessary to rummage through the settings, first add all available trading accounts to the list of displayed ones, only after that they will appear in the drop-down list of the deals window. To find out, I spent half a day.

QUIK. Portfolio section interface.

By the way, while I was writing this article, my portfolio fell 2.63% (–4883.2 rubles), but since I currently work in long positions, such fluctuations, although unpleasant, are acceptable.

Back to trade

A strange psychological effect: after a few months I began to freely operate with the amount of 30 thousand rubles. And I got bored. Financial result: I periodically lost money on poorly thought-out transactions, but since I tried to buy different securities, some transactions brought me profit and some lost.

After two months of work, I completed a hundred transactions totaling several million rubles. In fact, I earned only a few thousand rubles, and if you compare the risks with a classic deposit, this is a very dangerous game, but on the other hand, it is satisfactory for a beginner in the first month of work.

I decided to bring a larger amount to the brokerage account in order to feel the results of my work and again to feel responsibility.

Since childhood, I hate to rewrite payment details from a piece of paper. What prevents banks from registering a new customer to send him by email his details in electronic form is a mystery to me.

I waited four days for the result of the transfer, but the money never came. For an interbank transfer, this is an awfully long time, and I started searching.

It turned out that during the intra-bank transfer I did not indicate the number of my general agreement and its date in the payment purpose. The managers asked me to provide a corrective letter. There are three ways to do this:

- In the nearest branch of BCS.

- By fax.

- Through your bank.

So, I again went to the BCS office, handed over, filled out, after some time the money arrived in the account, and I continued trading.

In the dry residue:

- There is a lot of information, but it is fragmented and very complex.

- To come "from the street" to the stock market is very difficult.

- Even the largest brokers in Russia have a disgusting level of service, and the number of “holes” in customer service is huge.

At BCS, I noticed one important plus - all system errors can be solved with the help of people. It is important to find the right employee and he will try to help you overcome difficulties.

I was already lucky to see a historical moment - how the dollar rose to 100 rubles and how several times in one day trading on the Moscow Exchange was suspended.

I began to look straight lines with V. Putin, his every word creates something terrible with shares of Russian companies on the Moscow Exchange. From a market perspective, this is terrible, but the show is unimaginable!

My experience is individual, someone does not sit on OS X and calmly reacts to Norton Commander-style interfaces, someone will not be rejected by specific QUIK settings, and someone will be more lucky with the quality of a broker, but the fact remains - To start trading in Russia on a real exchange, you need to be a