Analysis of consumer check: what they buy on Amazon

- Transfer

In 2009, consumers began to use the phrase “ whole salary ” to ironically describe the price shock after shopping at Whole Foods, a grocery store chain with high-quality natural products that Amazon acquired in June 2017 for $ 13.7 billion.

In 2018, this phrase can safely describe the share of consumer spending and retail sales in general, which Amazon won along with the expansion of its ecosystem.

Of course, there is a difference: the Whole Foods network caused such a response because of its high prices, while purchases at Amazon win most of the salaries of consumers due to the acceptable cost of goods, fast delivery and excellent service. In other words, shoppers love Amazon.

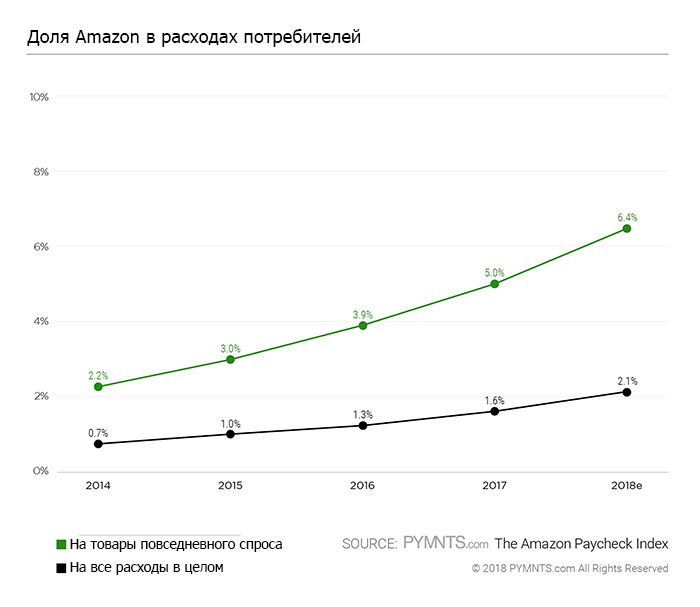

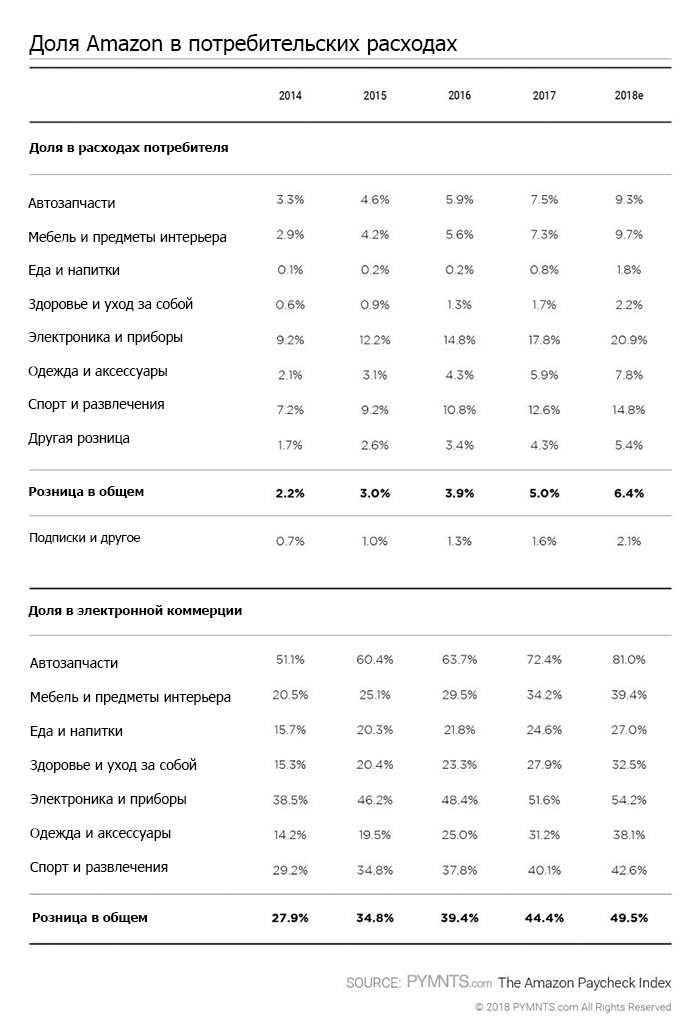

The analytic group PYMNTS conducted a detailed study and determined that consumers spend on purchases at Amazon on average up to 2.1% of annual salary. For example, a family earning about $ 63,000 a year donates $ 1,320 to Amazon. Indicators of average annual expenditures in 2018 are predicted based on data from the US Bureau of Labor Statistics for 2014–2017.

This is mainly due to the fact that consumers are more likely to purchase consumer goods through Amazon. The cost of food, clothing, electronics, furniture and goods for health care occupy up to 31% of the total amount of purchases.

According to analysts, today, purchases at Amazon account for 1,243 (or 6.4%) of the $ 19,556 spent by the average American family on the products listed.

Over the past four years, this figure has tripled - from 2.2% in 2014 to 6.4% in 2018, and the average annual growth rate was 30.7%.

Despite the fact that 2.1% is a small figure, it is impossible not to note its rapid growth rates. In addition, behind this modest indicator is a whole world of e-commerce, and in some categories of Amazon products, it provides the lion's share of all purchases.

Boring details

When people talk about the “ Amazon effect, ” they most often talk about the impact of the company's operations on the economy of traditional retail and how the site influenced the transition from offline to online and made free shipping an integral part of modern commerce.

But the effects of the Amazon effect go much further.

Jeff Bezos’s approach is to systematically build a marketplace — a new ecosystem that takes into account not only the desire of consumers to purchase a particular item, but also the reasons for buying it.

Amazon started with books because it was a very popular product. Further, for the same reasons, music was added to the virtual directory. The range of products has expanded as consumer behavior has been studied both at the company's site and abroad, and the Amazon range has grown. Some products of daily demand such as diapers and batteries, the company began to produce under its own brand, literally crushing these categories for themselves.

Amazon’s expansion over the past four years has affected the categories of goods and services that are ordered to order online and use them in the real world: home or business services, food delivery from Amazon Restaurants, subscription to the Amazon Fashion catalog, home goods from Amazon Home and even mattresses .

In the study, analysts decided to study the effect of the Amazon effect on how much consumer spending falls on purchases through the company's site.

The participants of the analytical group PYMNTS studied information from sources leading statistics on retail sales and consumer spending. The result of several months of work was the Amazon Check Index.

To study sales in various categories of consumer spending, including retail sales, researchers used survey data and information from the US Bureau of Labor Statistics on family consumer spending. To calculate the total retail sales figures for the product category, eMarketer data is taken. And the annual financial report of Amazon 10-K made it possible to get company sales and growth figures in various categories.

Based on this information, analysts built a data model, then used statistical methods to refine it and extrapolated the figures for the whole 2018, based on conservative assumptions. Researchers have tested and improved the model, and argue that it provides a vivid picture of consumer spending at the Amazon site.

Amazon shares

A two percent (2.1%) share of spending on purchases at Amazon looks plausible. Over the past four years, the company's market has taken over the leadership in many key retail sales categories where retail offline stores once dominated.

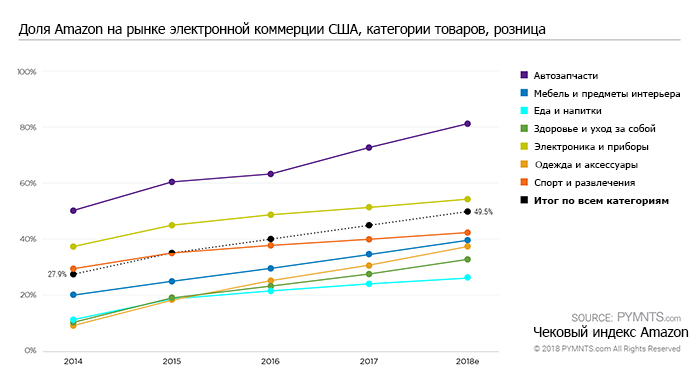

Today, the company has a 20% share in electronics, 9.7% in household goods, 9.3% in auto parts, 7.8% in clothing and 5.4% in goods for sports and entertainment (books, music, hobbies).

In the e-commerce market, the company's performance is significantly higher: 54.2% for electronics, 39.4% for household goods, 81% for auto parts, 38.1% for clothes and 14.8% for goods for sports and entertainment.

According to analysts, by the end of 2018, Amazon will have 49.5% of all e-commerce sales.

Amazon's share in retail sales (% of total sales) in different segments

It is worth noting that these figures are not related to the lack of consumer choice and the ability to buy in other places. Amazon does not offer the best prices every time. It's all about convenience. For many consumers, the company's marketplace is a starting point for finding products or stores where they can be purchased.

Convenience as a reason for increasing Amazon’s share of consumer check

Most of all attention is attracted by the tremendous growth in company sales over the past 4 years in virtually every category of consumer goods.

Sales of clothing, accessories and goods for health grew annually by 43%, furniture and household goods - by 42%. Today, Amazon is the largest online auto parts dealer in the United States. Annual growth in this segment is 32.7%.

Since 2014, the company has expanded the range of products supplied by third-party vendors, added new bonuses for Prime members, and made Amazon Pay buttons even more accessible outside of its site.

Initially, Prime subscription granted free shipping. By 2018, the list of its privileges has expanded. Free delivery has added a lot of nice bonuses: access to streaming services, discounts on other services, and even a branded Chase / Visa card with a 5% cashback.

Obviously, the growth in the share of Amazon is directly related to the convenience of making purchases on the company's online site. However, the online retail giant can boast of achievements in the offline segment.

Over the past four years, food and beverage sales at Amazon have increased by 106%. Much of this growth is associated with the acquisition of Whole Foods in 2017. Buying food is a powerful consumer spending driver in retail, and Amazon managed to double its food and beverage sales from 2017 to 2018 after a fourfold increase a year earlier. In the opinion of researchers, food is the category with the greatest potential for growth in consumer spending over the next few years.

The company has already opened Amazon Go stores in some cities to increase sales and strengthen its position in competition with local minimarkets. There is information that in the coming years it is planned to open another 3 thousand of such stores.

Amazon also opened a sales outlet in SoHo, New York, whose product range is based on trends in the popularity of online purchases and top-rated products.

All these stores have special offers for Prime members.

In four years, Amazon has achieved results of a different nature. This implies massive popularization of voice commerce using Alexa virtual assistant . Unveiled in November 2014, Alexa has appeared in a variety of voice devices and services from Amazon and other vendors.

Alexa ubiquity in consumers' homes, their carsand wherever people can take it with them, it also influenced consumer desire to shop at Amazon. This emphasizes the importance of voice interaction as an incentive to commerce.

The path to the "whole salary"

Analyzing the degree of “penetration” of Amazon into American family checks, it is impossible not to note the fact that approximately 45% of purchases in it (about 29 thousand dollars) belong to segments with which the company has not even started working.

In addition to purchases, approximately 36% of US consumer wages are spent on housing issues (18.5%) and health care (17%), while the remaining 12.6% is spent on insurance (2.9%) and financial services (5.1% ), telecommunications (2.7%) and transport (1.9%).

However, there is an important but. Amazon is already investing or building partnerships with key players in its unoccupied segments to expand the scope of its services. In the health sector, the company was noted in a joint project.with JPMorgan Chase and Berkshire Hathaway. In the housing sector, Amazon has invested in Plant Prefab , which designs and builds houses from prefabricated factory structures. In the insurance industry, the company together with Travelers Companies recently opened a digital showcase of insurance services right on its site .

Consumer confidence and convenience of shopping at Amazon, having a simple payment method, bonuses to the Prime program and access to a voice assistant who can even deal with insurance can give the company a decisive advantage in further advancing the American consumer spending structure.

Amazon and services like Alexa or Pay simplify the selection of products, as well as their convenient and safe purchase in segments with a large selection.

And you can not wait until Amazon announces its plans for the future. It’s enough just to monitor consumer spending patterns and Amazon’s share of these costs.