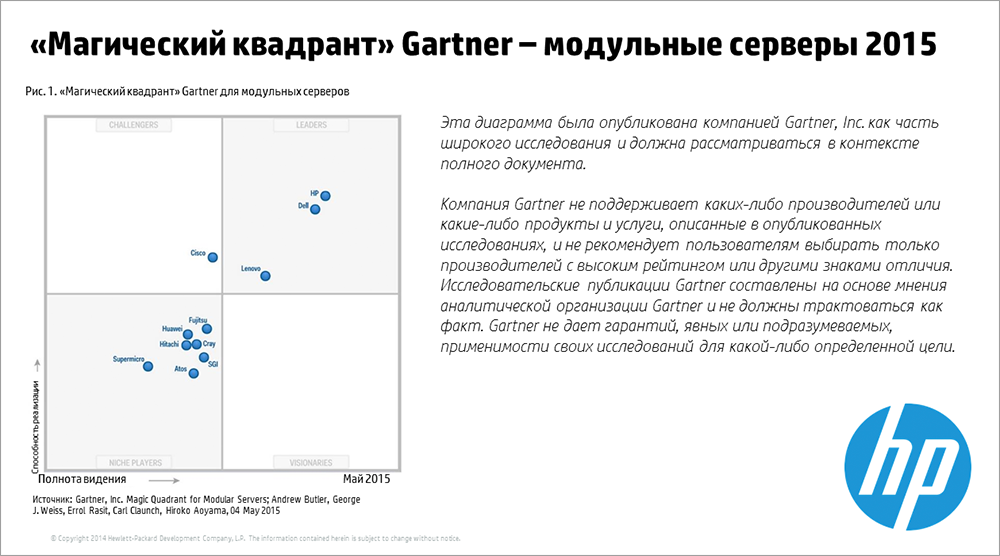

HP is Gartner's leader in the Magic Quadrant for Modular Servers

In a recent Gartner report, analysts named HP the world's leading manufacturer of modular servers. In the quadrant, it is ahead of Dell and by a wide margin - Lenovo. Download the report here .

In a recent Gartner report, analysts named HP the world's leading manufacturer of modular servers. In the quadrant, it is ahead of Dell and by a wide margin - Lenovo. Download the report here . The modular servers, to which Gartner analysts include blade and multisite systems, have a modular architecture with components in a common chassis. In addition to the main computing components, the modular server chassis can accommodate data storage devices and network components. From the point of view of Gartner, these servers are easy to manage, characterized by high performance and density.

In addition, they can handle the growing workloads in the cloud. The special design of modular servers allows you to install the required number of hardware components and a variety of infrastructure management software. Modular servers are suitable for combining and updating data centers, with their help you can create integrated systems. Today, the market has a large selection of modular servers that differ in type of CPU and memory size, data storage and switching technologies.

In 2014, the share of modular servers in server shipments was 26%, and the total sales of these systems reached $ 13.3 billion. According to Gartner forecasts, by 2018 the total revenue of players in this segment will reach $ 15.5 billion or 29% of the global server market. Large customer companies value this architecture for ease of use, equipment density, and ease of installation. Modular servers help reduce costs and increase business flexibility, provide IT services using simple, replicated system configurations.

HP has an extensive portfolio of modular servers that can meet various requirements and can be used in various scenarios. The company's most famous product line is BladeSystem Class C.

HP has an extensive portfolio of modular servers that can meet various requirements and can be used in various scenarios. The company's most famous product line is BladeSystem Class C. New platformHP Superdome X (based on Integrity blade servers powered by Intel Xeon processors) is a high-performance x86 system. HP is positioning it as the optimal solution for any x86 workload requiring eight or more processors.

For example, for working with databases and in-memory calculations. HP Superdome X lets you deploy systems with up to 16 processors and up to 12 TB of memory. Competing systems scale to only 8 processors.

HP also launches NonStop X, which delivers the smooth operation of mission-critical systems in industries such as transport management, financial services and manufacturing. In addition, the company offers a wide variety of modular servers for scalable workloads: Apollo platform (for high-performance computing clusters and processing large amounts of data), Moonshot (a system that blurs the boundaries between blade systems and multi-node servers and is designed for VDI infrastructure, web maintenance and workloads requiring extremely low power servers). The breadth of the HP portfolio allows the company to offer a solution for any load.

According to Gartner analysts, HP is a reliable supplier of blade servers and a market leader in many countries. The company has a wide portfolio of multi-node servers that can handle scalable workloads. As part of HP, there is a group whose employees are engaged in hyperscale systems and are well aware of the specifics of this market and the needs of customers. The older HP Superdome X and NonStop systems are optimal solutions for critical x86 workloads, including SAP HANA consolidation and migration from UNIX. Modular Server Magic Quadrant

Data center managers need modular servers that are suitable for specific workloads. As a rule, modular servers are designed for tasks with horizontal scaling and differ in a number of advantages from the point of view: optimal use of the area, excellent density, as well as the ability to replace components. Having determined the appropriate conditions for using modular servers, managers need to choose the type of device: a blade server or a multisite server. Blade servers are an ideal choice for virtualization tasks and also help upgrade data centers. This is evidenced by demand from companies that use hyper-scalable systems, and companies that deploy cloud computing, implementing data analysis tools and high-performance computing.

For a number of tasks, it is optimal to use quickly deployed convergent systems combining server, network components, storage systems and management software. The development of HP converged infrastructure is the so-called composable infrastructure, on the basis of which new HP servers will be developed. In such a tunable architecture, the rules and assembly order of components determine the purpose of the system, and components can be used both independently and as part of an integrated system. Flexible resource pools, software-defined logic and unified APIs help increase IT efficiency and accelerate service deployment.

Gartner Modular Server Quadrant Criteria

To qualify for the Magic Quadrant, the supplier must:

- Offer a server product with a chassis or chassis that allows you to quickly and easily add or replace server components.

- Offer a server product with publicly available SKUs, so “private” SKUs and user systems created for one company or a limited group of companies are excluded.

- Sell servers under your own brand. Thus, suppliers who sell products manufactured by other companies are excluded.

- Have an income of at least $ 50 million from sales of modular servers.

- Actively sell your modular servers in at least two countries.

- Have modular servers working in the production environment of customers.

- Have customer reviews.

The vendor is evaluated across the entire portfolio of products and services, migration strategies, virtualization support, and scalability issues are also taken into account. The overall financial condition of the vendor, the likelihood of continued investment in products and the expansion of the portfolio of solutions, the market strategy of the vendor and its partners, interaction with potential customers and the ability to offer the best solution are taken into account.

In addition, it takes into account the ability of the vendor to respond to the market situation, change the strategy in accordance with the needs of customers and the dynamics of the market, as well as the impact of the vendor on the market with regard to key trends. The vendor must have the fullness of a vision - understand the future market conditions and be prepared for them, anticipate the future and embody new ideas in their plans and products. The vendor’s investments in R&D for the implementation of key innovations, as well as the vendor’s investments in new technologies that contribute to the further development of the business and the market, are taken into account. The key factor is vendor innovations in the technological fields that best meet the needs of the market.

Gartner analysts study the quality and efficiency of processes, systems, methods and procedures by which various suppliers achieve the desired results in the market and in production, and also seek to increase profits and gain customer confidence. Ultimately, it concludes that suppliers are able to profit from their vision.

The leaders

Leaders (where HP takes first place) demonstrate their readiness to meet changing requirements, have the ability to shape the market, and maintain strong ties with trading partners and customers. Modular server market leaders offer services that can be adapted for different companies, and also set high goals. Their level of service is always at their best, they occupy a stable position in the market and have an impressive base of satisfied customers. Since the boundary between the blade and multi-node server markets is not clearly defined, leaders offer different types of services. Wherein

they may not have extensive experience in all areas, they may not be the best in absolutely all sectors, maybe they do not offer some services at all. But when the main part of the market is interested in multi-node servers, leaders will be able to satisfy any customer needs.

Applicants

Applicants demonstrate stable work in the market, have a clear strategy, but do not form a market. Applicants offer services that are in demand in the market at a given time. They serve a certain circle of customers and provide fairly high results in their field. However, they do not always have time to adapt to market changes or set modest goals.

Seers

There are no seers in this Magic Quadrant. Seers boldly look to the future and invest heavily in the development of unique technologies. Seers can be new market participants or existing suppliers who seek to offer the market something revolutionary. Seers demonstrate the ability to enhance the functionality of their offerings by offering the market a unique approach that distinguishes their products from competitors. Seers are characterized by innovation in one or more key areas of the data center, such as management, security, operational efficiency, and cost reduction. However, they are still developing their services, so many opportunities are not yet available to them. Even if they serve many customers, the scope of their services is still quite narrow.

Niche players

In the Magic Quadrant, niche players are all suppliers that consistently offer a certain type of service. However, the scope of their services, as well as the development strategy, is very limited. They can be new market participants or suppliers who do not have a large customer base. Niche players have a wide range of products, but do not have strong opportunities for their promotion. Niche players offer competitive products and in some these offers may be the best choice.