GoPro factory moves to guard against the threat of higher import duties

- Transfer

Despite the 90-day truce in the US-China trade war, and new defensive tariffs will not be introduced until March 2019, not all companies agree to wait until these countries try to agree among themselves. In a recent press release, action camera maker GoPro announced the decision to withdraw some of its production capacity from China in the face of potential tariff increases; Many analysts fear that this will be a result of the current stalemate. Yes, it is part of the capacity.

“We are warning about tariff problems, shifting most of the production to the US market from China,” says GoPro Chief Financial Officer Brian McGee. “We believe that the diversification of production can be beneficial for our business regardless of the results of the introduction of tariffs.” If you read carefully, the key phrase here will be "diversification of production." GoPro is not going to completely leave China, it only removes production aimed at importing into the United States. Camera models sold in other markets will continue to be made in China.

This move may seem extravagant if it is done only to avoid new tariffs, but since more than 40% of GoPro's profits in the third quarter of 2018 come from America, 25% taxes would have hit the company hard. Considering that last year the company closed its drones division, under the pretext of an “extremely competitive aircraft market,” and the appearance of a huge number of GoPro clones, which are several times cheaper, it becomes clear that the company, whose name was once synonymous with action -camera, with all his might, tightens his belt.

Bypass trade war

The current US administration has made it a priority to fight what it considers to be dishonest play and the theft of intellectual property from Chinese companies, and as a punitive measure it has seriously increased import duties on a variety of products. Also, these taxes are designed to help local manufacturers remain competitive compared to Chinese imports, which historically cost less for the end user. All this is done according to the theory that quite high import duties on goods made in China will lead to a revival of American production.

A side effect of this policy is the fact that since even individual components (LEDs, transistors, capacitors, etc.) are subject to an increase in import duties, even manufacturers located in the United States,suffer from it . US manufacturers can not just click the switch and stop buying imported parts - to establish local production of these components will take time and money. Even products whose production has never left America have inevitably used at least a few imported components.

GoPro decided to go its own way: take advantage of the loophole in the US-Chinese trade war. If the finished cameras suffer from high duties, and cameras assembled in the United States still require imported Chinese components, then it would be most logical to assemble cameras in other countries, not in China and not in the United States.

So far, the company has not announced which country the production of cameras intended for import into the USA is moving to, but you can bet on another Asian country, for example, Cambodia or Vietnam, where labor is still little paid. After deploying production in this non-conflict country, the company will import Chinese components without penalty taxes, and export the final product to the USA. The product will be exactly the same as before, it will be manufactured on the same machines, but the label will not say “made in China”.

Mobile factory of the future

This plan has only one problem: how to transfer production to another country inexpensively enough so that it is reasonable from a financial point of view? Even in view of the imminent threat of increasing import duties, it seems that building a new factory from scratch and recruiting staff is an extreme measure. But, according to Mackia, the GoPro is unusually well adapted to the redistribution of labor. “It is important to note that our production facilities belong to us, and our production partner provides the premises, so we expect that we will be able to arrange this move relatively inexpensively.”

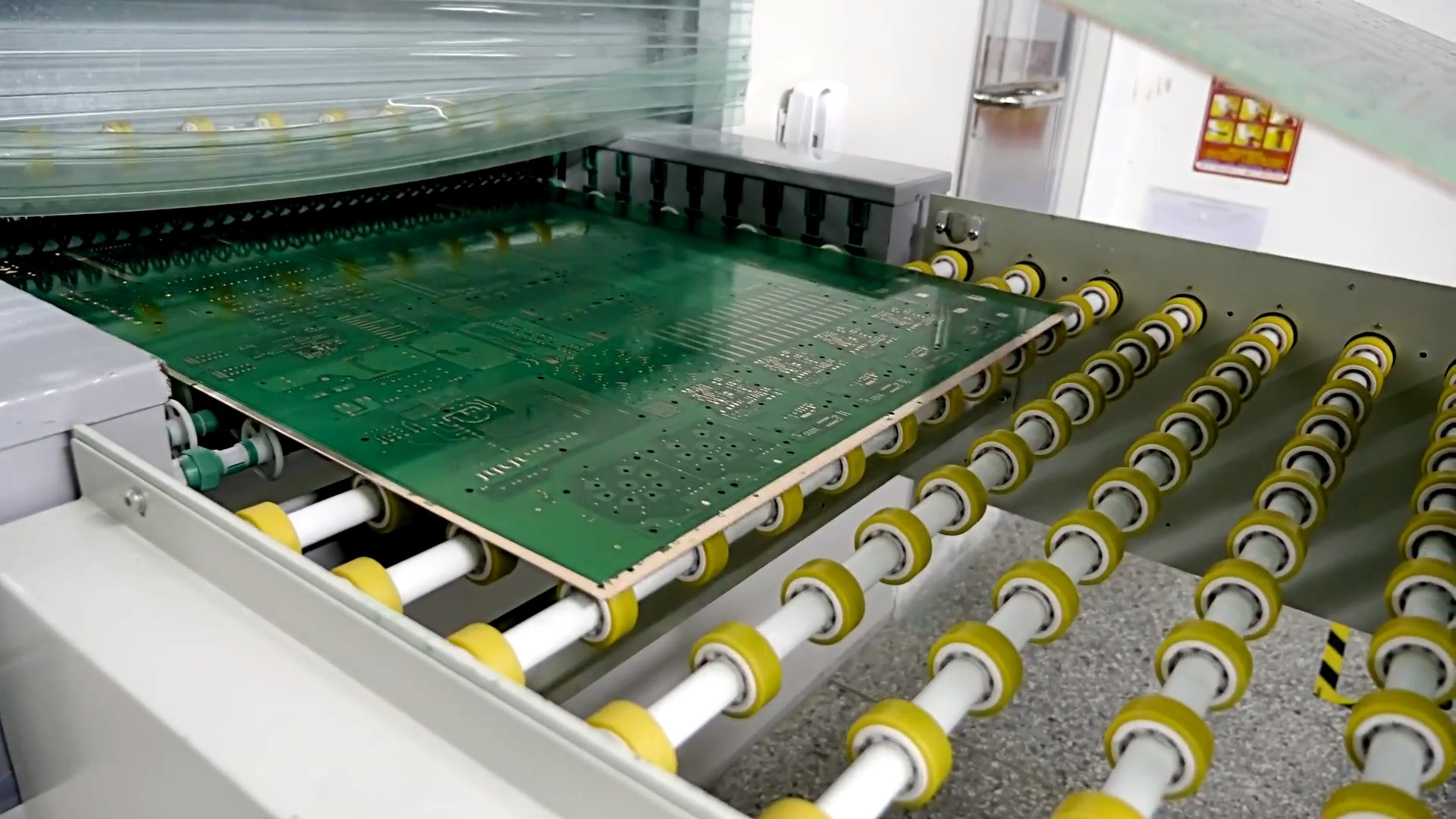

That is, GoPro needs to find a place in a foreign country, physically transport several production lines there, and then hire local workers. In the worst case, this will lead to a temporary decrease in production capacity.

Let's imagine that GoPro has ten assembly lines in their Chinese factory. Instead of transporting them all at the same time, they will pack and transport four lines responsible for 40% of their sales destined for the United States. Since all production equipment belongs to GoPro, moving the assembly line to a relatively near Asian country of necessity resulting from changes in the geopolitical climate remains a matter of logistics.

And in the face of the threat hanging over the producers in the form of a whole range of expanded tax tariffs, one involuntarily wonders if such “mobile” factories will not come across more often. Given the high automation in modern production and the level of uniformity of Asian factories , it is reasonable to assume that the manufacturer should be able to take their equipment and move it somewhere else to find the most advantageous offer not only for the premises, but also for the workforce. At the very least, the US-Chinese trade war may spawn a new trend, which can be called "itinerant production."

War on many fronts

Critics will most likely cite GoPro as an example of the futility of Chinese tariffs. Indeed, GoPro has no plans to transfer camera production to America, and in the end it will still use Chinese components. On the other hand, China may regard these new “mobile” factories as a threat to its economy, which will increase the likelihood of the country's capitulation in a trade war. For a country called the “World Factory”, anything that encourages companies to produce goods somewhere else will be a problem. At the same time, the US will benefit from a more diversified supply chain if the deterioration of relations with China continues.

GoPro has made it clear that moving their production from China to next year will be a precautionary measure to protect themselves, regardless of the results of current trade negotiations. If the situation improves and duties are reduced, GoPro will still benefit from the diversification of production capabilities. If tariffs tighten, they will save millions, not loss of profits. There is no end to the trade war, and GoPro is likely to become not the only company that has decided to restructure its operations in order to take advantage of this loophole in the near future.